Hello Magicians,

Markets are swinging, builders are shipping, and yield is back on the menu. If you’re providing liquidity, the 970,000 $SQR Liquidity Mining campaign on Merkl is still live.

👉 Join on Merkl: https://app.merkl.xyz/opportunities/bsc/CLAMM/0xd5a79aB649E0a5F20e995026d034a0bF28B8aACa

This week: Bhutan moves its national ID to Ethereum, gold shatters records, Citi targets crypto custody, and the market rebounds after a $450B wipeout. Let’s go.

Crypto Market Recap

Bhutan Migrates National ID to Ethereum

Bhutan is moving its self-sovereign ID system from Polygon to Ethereum, enabling ~800K citizens to verify identity and access services on open infrastructure. The integration is done, with full credential migration slated by early 2026. It’s Bhutan’s third blockchain stack for NDI (after Hyperledger Indy and Polygon) and a big real-world nod to public chains.

Gold Rockets Past $4,100 on Rate-Cut Bets & Trade Jitters

Gold ripped to fresh all-time highs above $4,179/oz as market price in Fed cuts and brace for U.S.–China trade friction and a government shutdown. Silver tagged a record too. Some technicians warn of near-term cool-offs after overbought readings, but macro flows (de-dollarization, central bank buying) remain a powerful tailwind.

Citi Targets 2026 for Crypto Custody

Citigroup plans to roll out institutional crypto custody by 2026, blending in-house rails with third-party tech. The bank is also eyeing custody around ETF collateral and stablecoin reserves, another sign that Wall Street is normalizing digital assets under clearer U.S. rules.

After “Black Wednesday,” Crypto Snaps Back

Following an Oct 1 “$450B crash,” crypto staged a V-shaped rebound: BTC reclaimed ~$115K, ETH ~$4K, and flows returned to ETFs (BlackRock, GBTC) and corporates (MicroStrategy). Optimism is back, though traders joke that Jim Cramer’s “We’re back!” could mark a local top, so keep risk tight.

Web3 Apps You Should Know About

- Omni Labs (Data Analysis): Low-code dev kits for seamless AI-Web3 integration

https://magicsquare.io/store/app/omni-labs - APEPE (Memes): A meme coin that combines "APE" and "PEPE"

https://magicsquare.io/store/app/apepe

Magic Board

New week, fresh ways to stack Karma. From Claim Hallows VIP, Karma Speedrun, and 20 App Reviews to Consistency Magician on X and Halloween Challenges, there’s something for every grind.

Knock out tasks, climb the leaderboard, and keep the momentum rolling.

👉 https://magicsquare.io/store/magic-board

What’s New at Magic Square?

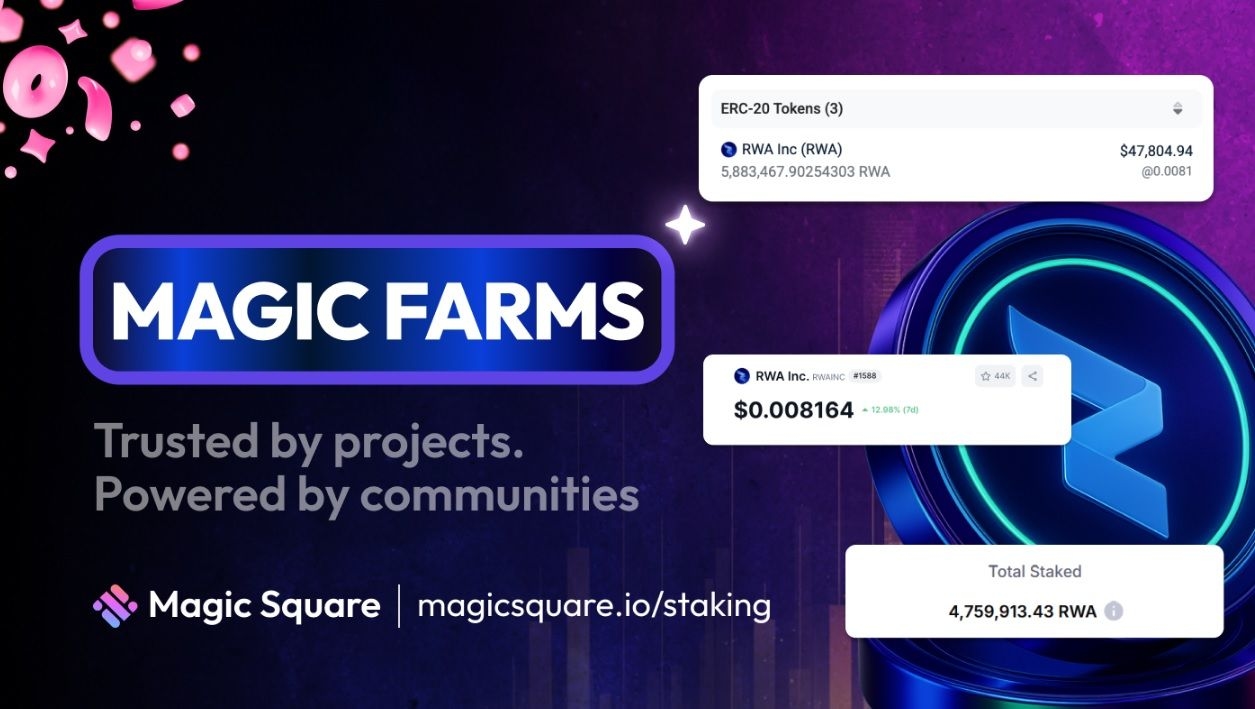

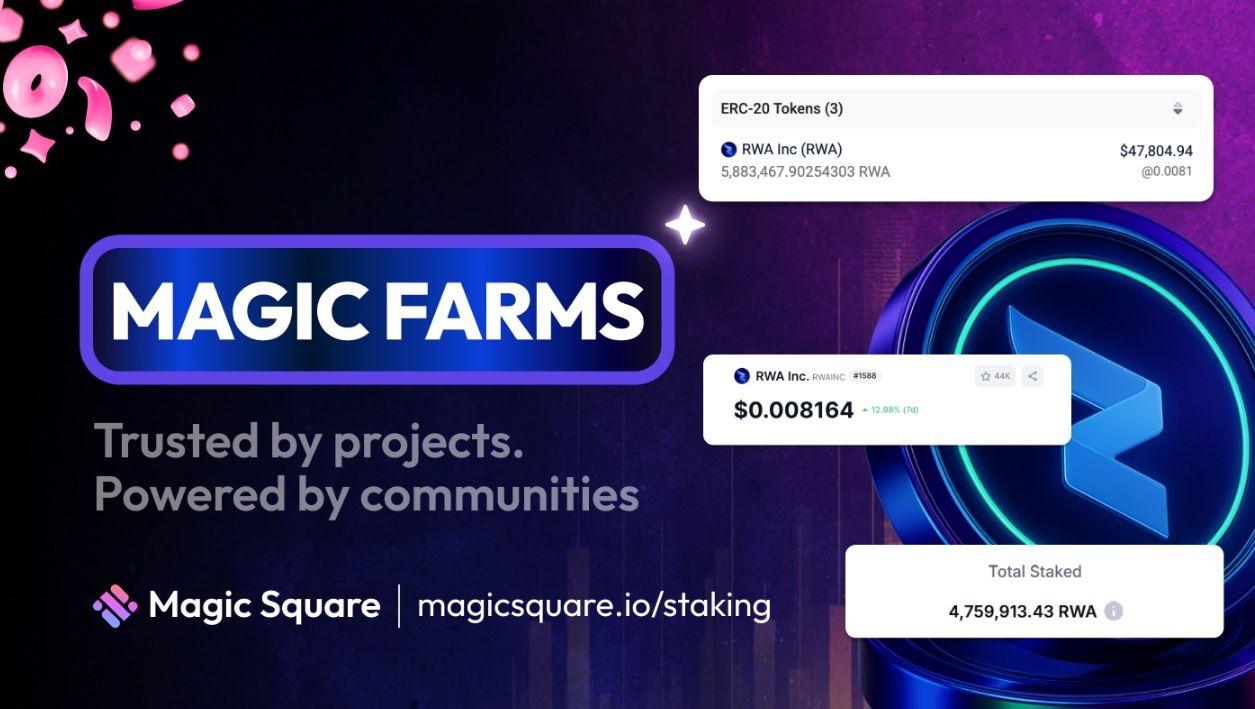

When builders and communities align, growth follows. The RWA Inc. Magic Farm wrapped with standout metrics:

- 9.5M RWA staked (~$95K TVS)

- 7× staked-to-reward ratio

- +25% token price

- +343% daily volume

Explore all active farms and stake in real time 👉 https://magicsquare.io/staking/farms

Tip of the Week

How to Spot Strong Farming Projects

Before joining a farm, look for:

- Real utility: Is the token tied to an actual product?

- Liquidity depth: TVL > reward pool = long-term stability.

- Community traction: Active holders and social proof drive sustained growth.

At Magic Square, we carefully evaluate and onboard projects for Magic Farms, making sure our community gets access to high-quality campaigns that bring real value 🌾.

Meme Break

“Macro bosses fighting while I wait for altseason like it’s a side quest.”

That’s a wrap for this week.

Questions or alpha to share? Ask Mystic AI or chat in: Discord | Telegram

Stay safe, stay curious, and stay magical.

— The Magic Square Team