About Cygnus Finance

Cygnus Finance is an innovative decentralized finance (DeFi) platform that aims to redefine how stablecoins operate by merging traditional financial instruments with blockchain technology. It specializes in real-world asset (RWA) tokenization and has introduced cgUSD, an interest-bearing stablecoin collateralized by U.S. Treasury bills. Built on the Base blockchain, Cygnus offers users a secure, decentralized, and transparent method of generating yield on stable assets, setting itself apart from other DeFi platforms by focusing on low-risk, real-world assets. Unlike most stablecoins that depend purely on cryptocurrency reserves, Cygnus’ cgUSD leverages the stability of U.S. Treasuries to provide a more reliable and consistent yield, making it an attractive option for risk-averse investors in the DeFi space.

The mission of Cygnus Finance is to provide users with access to a stable, yield-generating asset that is fully decentralized and supported by real-world financial instruments. By focusing on short-term U.S. Treasury bills as collateral, Cygnus minimizes risk exposure while offering the benefits of decentralization. Its real-world asset-backed stablecoin concept bridges the gap between traditional finance (TradFi) and decentralized finance, opening new avenues for yield generation. This not only helps to bring institutional-level financial instruments to the DeFi market but also democratizes access to these tools for all users, regardless of their background or geographical location.

Cygnus Finance is a groundbreaking DeFi protocol that offers a new approach to stablecoin issuance and liquidity by utilizing real-world assets like U.S. Treasuries. This Base blockchain-based project has built a robust infrastructure that integrates both on-chain and off-chain assets to ensure liquidity, transparency, and stability for its users. The core innovation of Cygnus is cgUSD, a stablecoin collateralized by U.S. Treasury bills, a widely regarded low-risk asset in traditional finance. The value proposition of cgUSD lies in its ability to generate yield directly from these low-risk assets, providing users with stable and predictable returns.

The development of Cygnus is centered around its Cygnus Omnichain Liquidity Validation System (LVS), which allows it to connect and manage liquidity across multiple blockchains. This omnichain capability expands the reach and utility of cgUSD, ensuring that users can access liquidity pools and DeFi services across different networks. Users can mint cgUSD by depositing USDC and other stable assets, with the value of cgUSD being pegged to USDC at a 1:1 ratio. However, what differentiates cgUSD from other stablecoins like USDC is its rebase mechanism, which automatically increases users' balances as yield from U.S. Treasuries is distributed. This passive earning mechanism allows users to benefit from the yield generated by U.S. Treasury bills without needing to actively manage their holdings.

Cygnus Finance’s focus on integrating real-world assets (RWAs) into the DeFi ecosystem gives it an edge over other DeFi projects. While competitors like Frax Finance and SkyMoney also offer stablecoins, they rely more heavily on crypto assets for collateralization. Cygnus takes a different route by anchoring cgUSD to U.S. Treasuries, offering a safer and more predictable return. This makes it particularly attractive to institutional investors and risk-averse DeFi users who are looking for exposure to stable yield without the volatility commonly associated with cryptocurrencies.

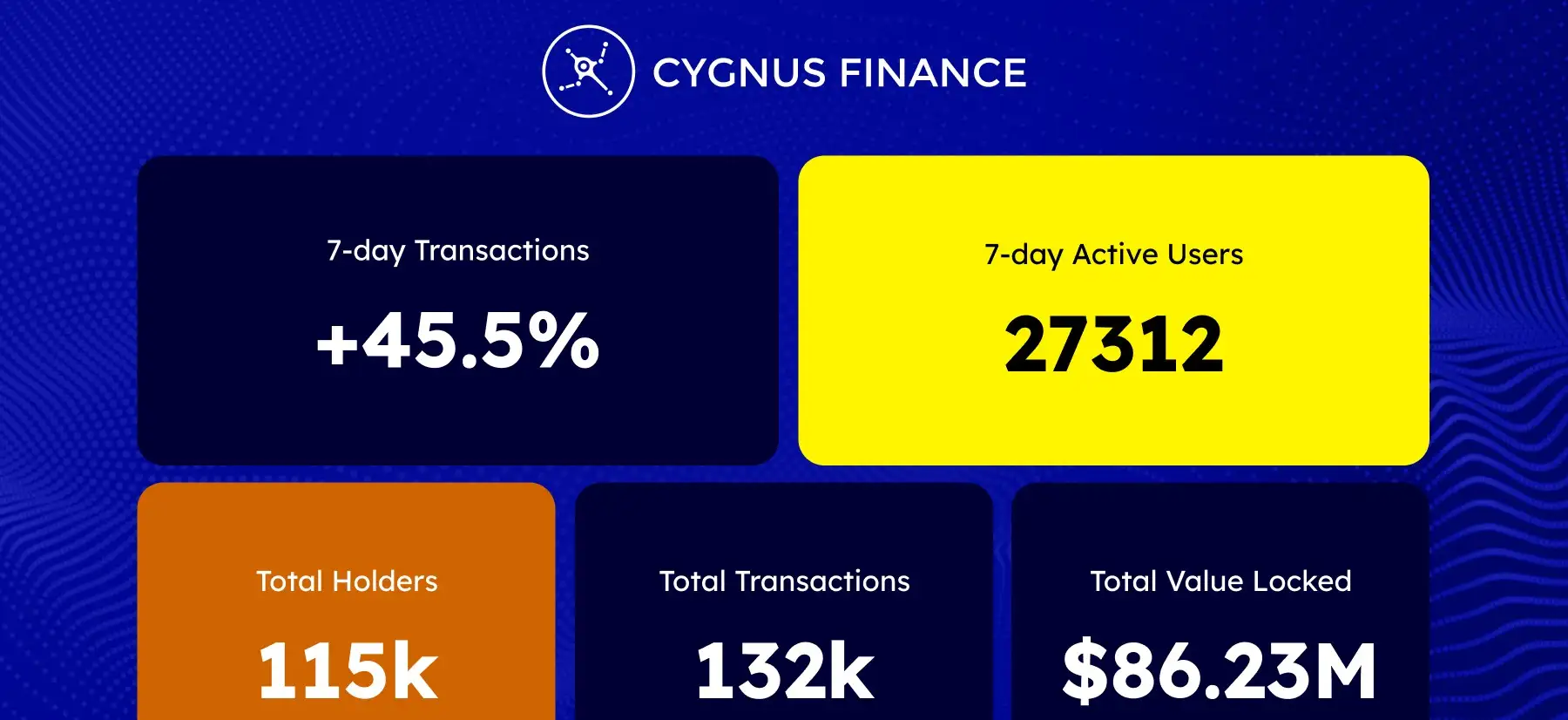

The platform’s roadmap highlights key milestones, including the successful launch of cgUSD, further omnichain integrations, and partnerships with major liquidity providers. Cygnus is also exploring new use cases for its technology, particularly in decentralized lending and borrowing markets, which could further increase the demand for cgUSD.

In summary, Cygnus Finance has positioned itself as a leader in the RWA-backed stablecoin sector by offering cgUSD, an interest-bearing stablecoin backed by U.S. Treasury bills. Its seamless integration across multiple blockchains and focus on yield generation through low-risk assets provide it with a competitive edge in the DeFi ecosystem.

- Interest-bearing Stablecoin: Cygnus’ cgUSD stands out as a stablecoin that generates yield through U.S. Treasury bills. By holding cgUSD, users passively earn interest as their holdings automatically rebase to reflect income generated by the Treasury-backed assets.

- Decentralized Collateralization: Unlike other stablecoins that rely solely on crypto-based reserves, cgUSD is backed by both off-chain assets like U.S. Treasuries and on-chain reserves. This hybrid collateralization model enhances the stability and security of cgUSD, offering users peace of mind in volatile markets.

- Omnichain Liquidity Access: The Cygnus Liquidity Validation System (LVS) supports seamless liquidity across multiple blockchains. This cross-chain functionality ensures users have access to liquidity pools and services on various networks, enhancing the utility of cgUSD.

- Rebase Mechanism: Cygnus employs a rebase mechanism that automatically distributes yield from U.S. Treasuries into users' cgUSD holdings. This allows users to benefit from passive income without needing to manually stake or manage their assets.

- 1:1 Redemption for USDC: Users can redeem cgUSD for USDC at any time at a 1:1 ratio, ensuring liquidity and ease of conversion. This stability makes cgUSD a reliable asset in uncertain market conditions.

- Real-world Asset (RWA) Integration: The use of real-world assets, specifically U.S. Treasuries, sets Cygnus apart from other DeFi protocols. This integration provides cgUSD with a more secure and stable foundation, appealing to risk-averse users seeking consistent returns.

To start using Cygnus Finance, follow these detailed steps:

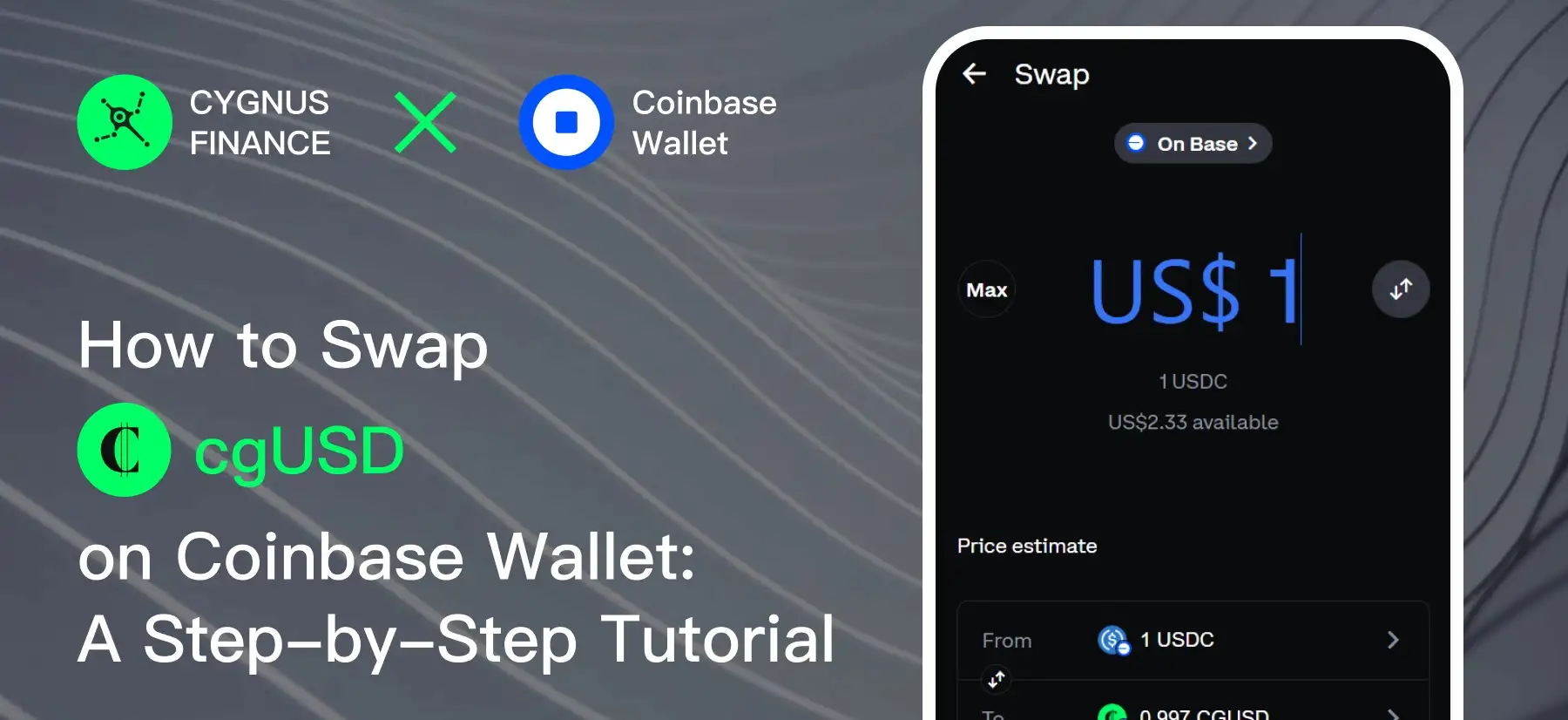

- Create a DeFi Wallet: Begin by setting up a decentralized wallet like MetaMask or WalletConnect that is compatible with the Base blockchain. Ensure your wallet is secure and backed up with your recovery phrase.

- Connect Your Wallet to Base: After setting up your wallet, configure it to support the Base blockchain. This may involve manually adding Base as a custom network. Detailed instructions for adding Base can be found on the Cygnus website or via official resources.

- Deposit USDC: To mint cgUSD, deposit USDC into your wallet. Ensure you have enough USDC for the minting process and to cover any necessary transaction fees on the Base network. Once USDC is deposited in your wallet, you are ready to proceed to the next steps on Cygnus Finance.

- Mint cgUSD: Visit the official Cygnus platform and connect your wallet. Navigate to the minting section, input the amount of USDC you wish to convert into cgUSD, and complete the transaction. Your cgUSD will then be credited to your wallet at a 1:1 ratio.

- Earn Interest Automatically: Once you hold cgUSD in your wallet, it will begin generating interest via the rebase mechanism, which automatically distributes yield earned from U.S. Treasury bills. This process happens daily, increasing your cgUSD balance to reflect the earned interest.

- Wrap cgUSD for Cross-chain Use (Optional): If you intend to use cgUSD on other blockchain networks, you can wrap it into wcgUSD for cross-chain compatibility. This step is only necessary for users who wish to participate in cross-chain DeFi services, liquidity pools, or lending platforms on different networks supported by Cygnus.

- Redeem cgUSD: At any point, you can redeem your cgUSD back into USDC. Simply navigate to the redemption section on the platform, input the amount of cgUSD you wish to redeem, and confirm the transaction. The corresponding amount of USDC will be transferred back to your wallet at a 1:1 ratio.

For further detailed instructions, you can explore the official Cygnus documentation.

Cygnus Finance Token

Cygnus Finance Reviews by Real Users

Cygnus Finance FAQ

Cygnus Finance achieves stability for cgUSD by backing it with low-risk assets like U.S. Treasury bills, which provide stable collateral. The platform utilizes a rebase mechanism that distributes yield daily without affecting the core value of cgUSD. This approach ensures that cgUSD maintains a 1:1 ratio with USDC while simultaneously earning interest. For more details, visit Cygnus Finance.

cgUSD is unique because it is an interest-bearing stablecoin backed by U.S. Treasury bills, offering stable, low-risk returns. Unlike USDC and DAI, which are collateralized by cryptocurrencies or fiat, cgUSD generates daily yield through its rebase mechanism, providing passive income while maintaining its peg. Learn more about cgUSD at Cygnus Finance.

Cygnus Omnichain Liquidity Validation System (LVS) enables liquidity management across various blockchains. This integration means users can seamlessly interact with different DeFi protocols without being confined to a single network. It enhances cgUSD's utility by allowing cross-chain liquidity and asset transfers. Explore the omnichain system on Cygnus Finance.

The rebase mechanism in cgUSD ensures that users automatically receive daily interest from the yield generated by U.S. Treasury bills. Instead of requiring active participation like staking, the mechanism increases cgUSD balances passively, directly in users' wallets. This feature allows cgUSD holders to earn without additional steps. Find more on how rebase works at Cygnus Finance.

Cygnus Finance guarantees a 1:1 redemption for cgUSD to USDC. There is no risk of value loss during this process because cgUSD is fully backed by U.S. Treasuries and other assets, ensuring stability. Users can easily redeem their cgUSD anytime for USDC through the platform. Learn more about the redemption process at Cygnus Finance.

You Might Also Like