About Ebisu Finance

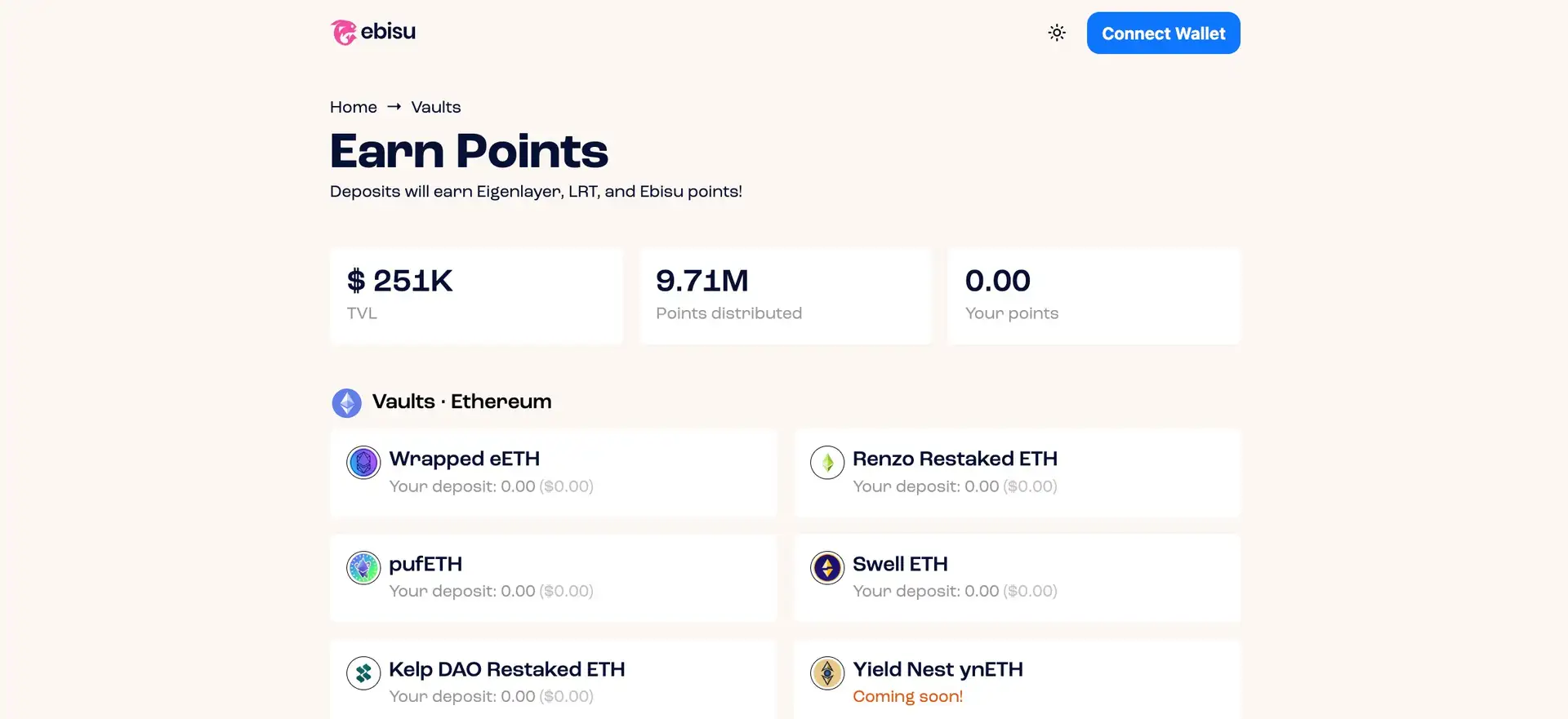

Ebisu Finance is a decentralized finance (DeFi) platform designed to optimize the utility of restaked assets within the blockchain ecosystem. Launched in 2023, Ebisu Finance offers users the ability to borrow stablecoins using Liquid Restaking Tokens (LRTs), which are generated through innovative restaking mechanisms on platforms like EigenLayer. The protocol enhances the capital efficiency of assets by integrating these tokens into various DeFi strategies, providing users with enhanced yield opportunities and improved liquidity management.

The project aims to bridge the gap between restaking and DeFi by allowing users to leverage their restaked collateral for additional financial activities. Key products include Ebisu Money, a collateralized debt protocol, and Ebisu Earn, which offers automated strategies to maximize yield. For more details, visit the Ebisu Finance website.

Ebisu Finance envisions creating a more efficient and safer environment for decentralized financial interactions by commodifying cryptoeconomic security. The platform draws inspiration from Ebisu, a Japanese deity associated with luck, prosperity, and protection. This inspiration reflects the project’s commitment to safeguarding its users' financial assets while driving innovation in the DeFi space.

The project is focused on leveraging restaking as a tool to unlock new capital efficiencies, enabling protocols and networks to scale without compromising on security. By providing automated yield strategies and innovative lending solutions, Ebisu aims to redefine how restaked assets are used in DeFi, making it more accessible and beneficial for a broader audience. To learn more about the project’s vision, explore the official documentation.

Ebisu Finance has outlined a detailed development roadmap that includes several key milestones. The immediate focus is on launching Ebisu Money, a protocol that allows users to borrow US dollar or ETH-denominated stablecoins against LRTs. This product aims to provide enhanced liquidity for restaked assets while minimizing risk. Following this, Ebisu Earn will be introduced, enabling users to participate in high-yield restaking strategies that are automatically managed by the platform.

The ongoing development efforts also include expanding the integration of various restaking protocols and refining risk management tools to further enhance user experience and security. For updates on key milestones, you can visit Ebisu Finance.

Ethan Lippman is the co-founder of Ebisu Finance. He brings significant experience from his previous roles, including working at EthSign, a Sequoia-backed legal tech startup, and co-founding Unistart.io, a platform that supports early-stage ventures. Ethan’s background in venture capital and product development has been instrumental in guiding Ebisu Finance's vision and strategic direction source.

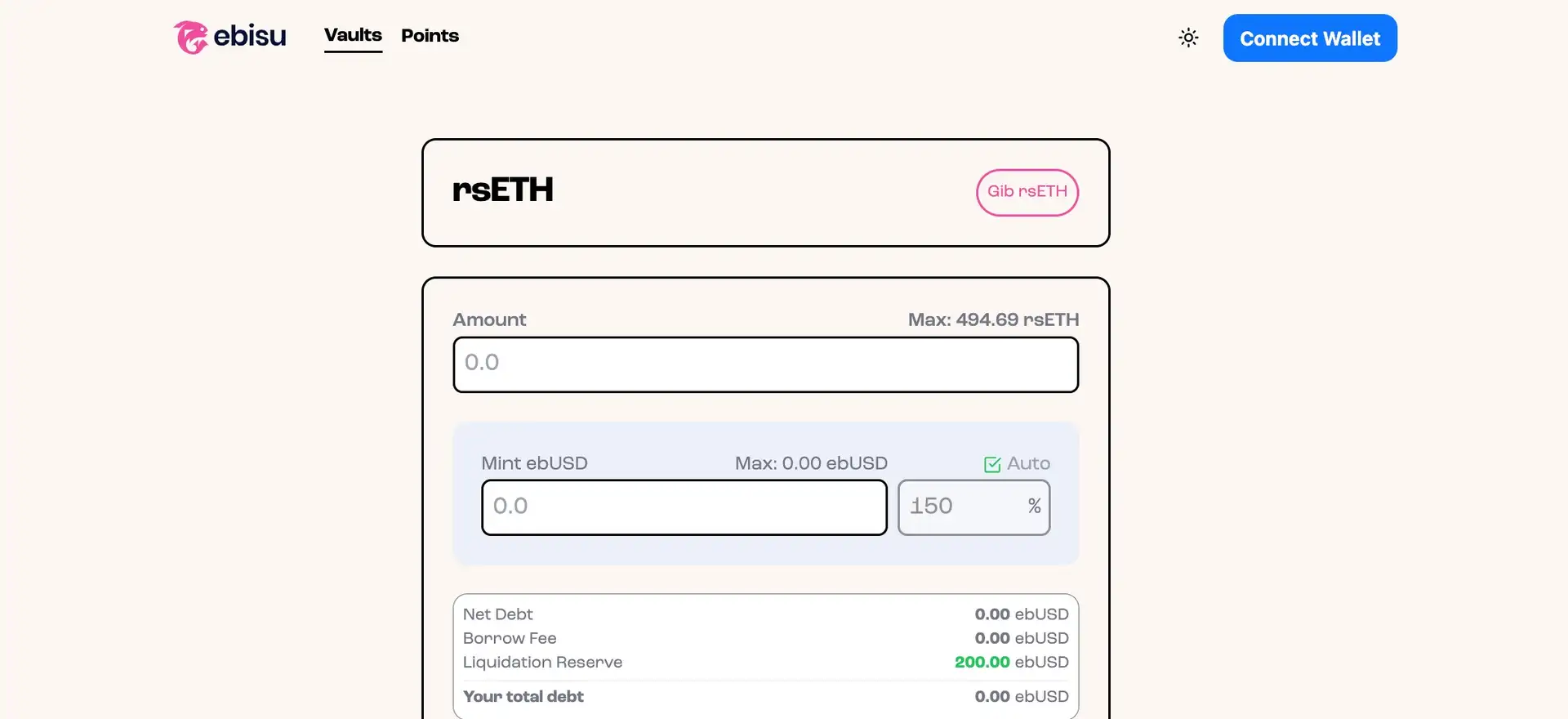

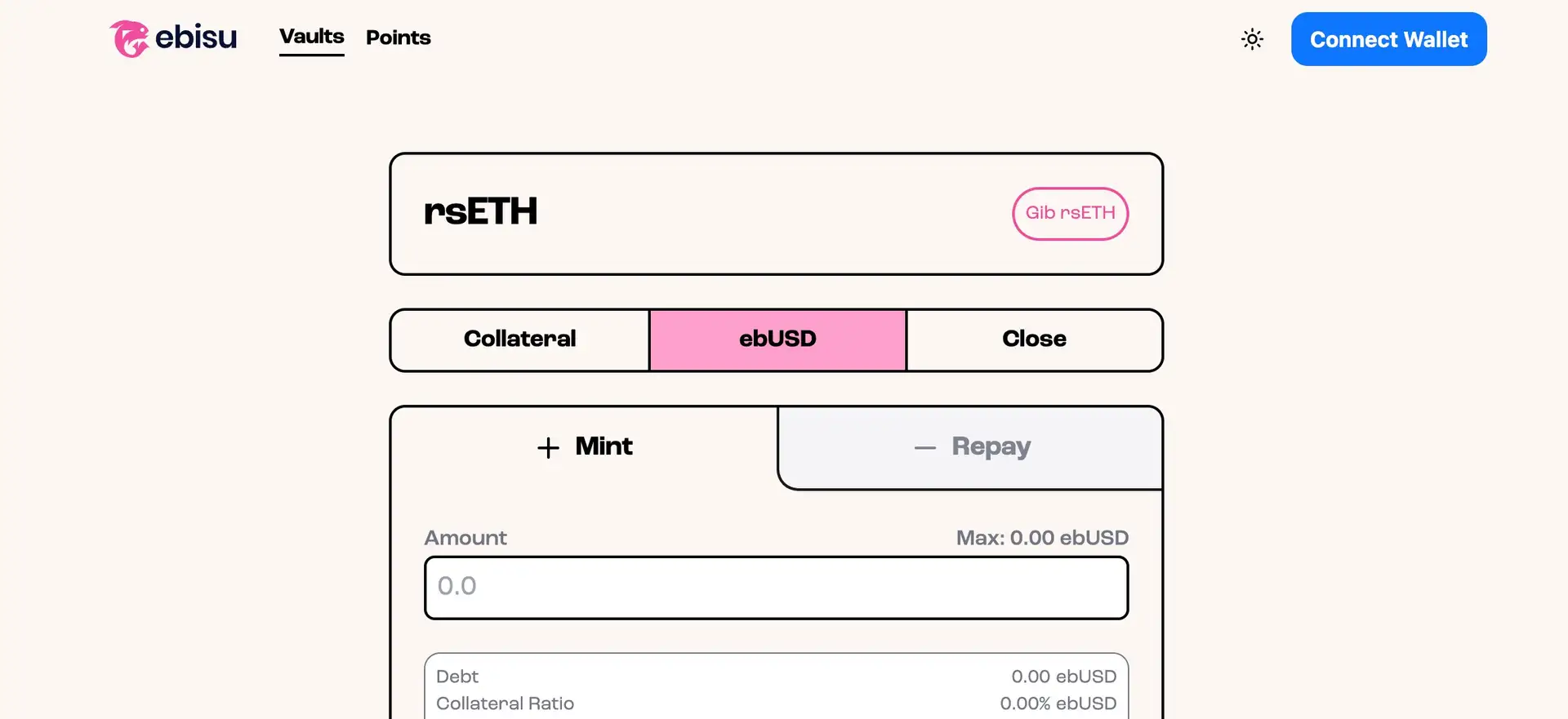

The Ebisu Finance public testnet is currently live, offering users the opportunity to explore the platform’s key features, particularly Ebisu Money. Accessible through the Omni Ebisu Finance platform, the testnet allows users to mint stablecoins by using Liquid Restaking Tokens (LRTs) as collateral. Participants can simulate borrowing, manage collateral ratios, and earn yield through various DeFi strategies, gaining valuable insights into the platform’s mechanics.

During the testnet phase, users can interact with the system in a real-time environment, helping the development team identify areas for refinement before the mainnet launch. The testnet experience not only provides early access to the platform's features but also empowers users to directly influence its final design through their feedback. To start using Ebisu Money and learn more about the testnet functionalities, visit the Ebisu Money documentation.

Ebisu Finance Suggestions by Real Users

Ebisu Finance FAQ

Ebisu Finance leverages Liquid Restaking Tokens (LRTs) to maximize capital efficiency by allowing users to borrow stablecoins and participate in yield-generating activities simultaneously. By utilizing LRTs, users can engage in DeFi strategies that enhance yield without compromising on security or liquidity. For more insights on LRTs, visit the official documentation.

The name Ebisu Finance is inspired by the Japanese deity Ebisu, known for protection, prosperity, and safeguarding the sea. This symbolic inspiration reflects the project’s commitment to protecting users' assets and driving innovation in the DeFi ecosystem, aligning closely with the mission of creating a secure and efficient environment for decentralized finance. Learn more about the vision and inspiration behind the project at Ebisu Finance GitBook.

Ebisu Finance sets itself apart by offering automated strategies specifically tailored for restaked assets, allowing users to earn yield without the need for active management. The integration of LRTs and restaking technologies creates a unique synergy, unlocking new levels of capital efficiency and enhancing returns for users. Explore more about these unique strategies at the Ebisu Finance website.

Users can participate in the Ebisu Finance public testnet by exploring the functionalities of Ebisu Money and providing feedback that directly influences the platform’s final features. The testnet offers a hands-on experience with borrowing and yield strategies, allowing participants to shape the future of the protocol. For details on how to join, visit the GitBook documentation.

Ethan Lippman is the co-founder of Ebisu Finance, bringing a rich background in blockchain application development and venture capital. His experience includes working at Sequoia-backed EthSign and co-founding Unistart.io, a platform that supports early-stage ventures. Ethan’s strategic guidance is central to Ebisu Finance’s development and direction. Discover more about the team at the Ebisu Finance website and Ethan’s profile.

You Might Also Like