Stabull Project Overview and Campaign Details

Meet Stabull

An AMM optimized for stablecoins and RWAs. Swap, provide liquidity & earn.

Introduction

As the global financial landscape evolves, stablecoins and Real World Assets (RWAs) are quickly becoming a central focus in the cryptocurrency sector. Over the next 3-9 months, hundreds of millions of investments will transition from development to deployment, tokenizing assets such as gold, oil, stocks, commodities, bonds, and more. Stabull is uniquely positioned to meet this emerging demand, providing a decentralized exchange specifically built for FX and commodities, designed to handle the unique requirements of these markets.

Problem and Solution

- Problem: Current decentralized exchanges fail to address the growing need for stablecoin and RWA markets. Users face high trading costs, poor capital efficiency, and a lack of tailored features for FX swaps.

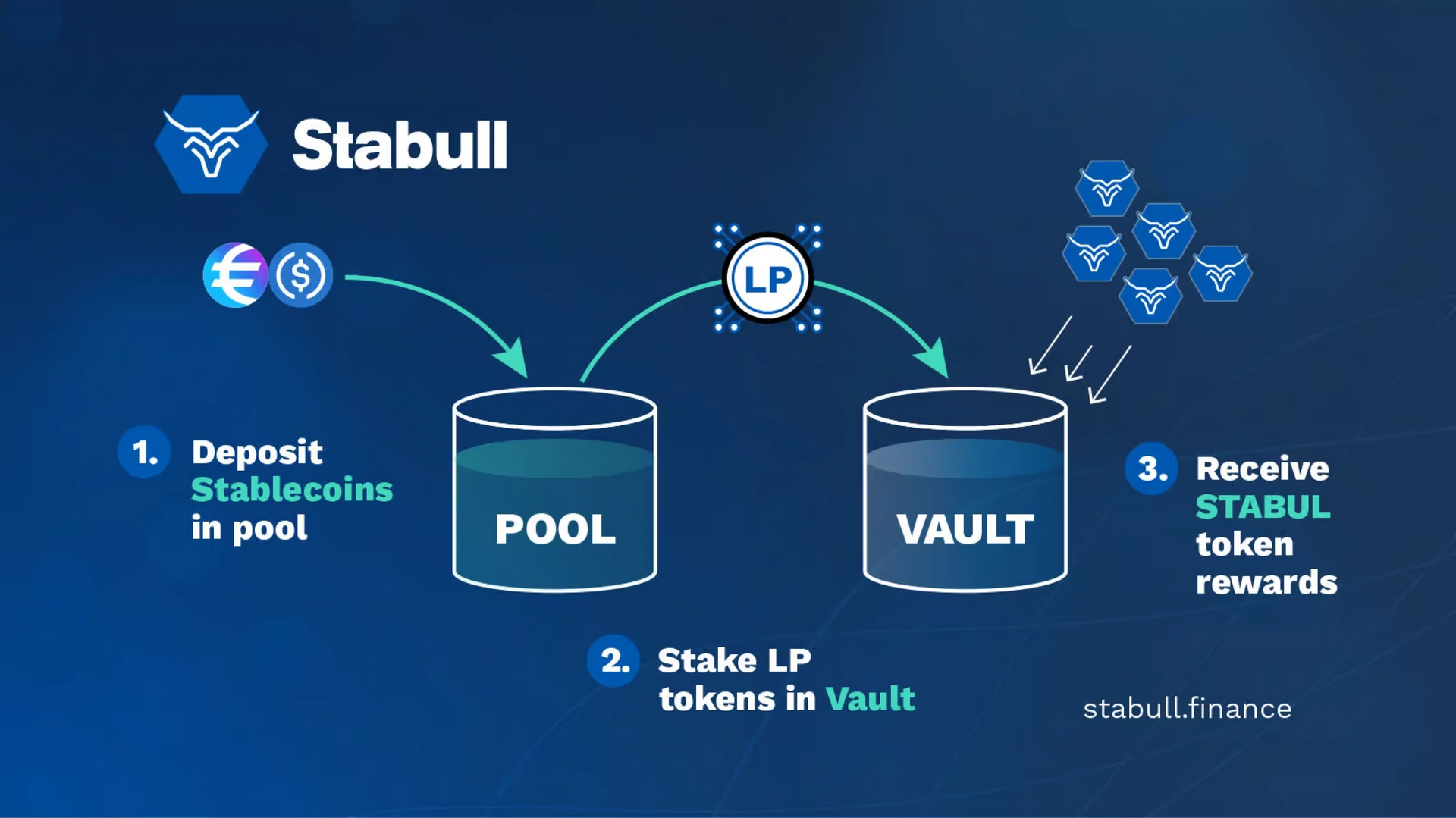

- Solution: Stabull offers a specialized Automated Market Maker (AMM) optimized for stablecoins and RWAs, using oracle-informed liquidity to dynamically adjust around key FX pairs, like EUR/USD. This allows for low-slippage swaps and capital-efficient liquidity provision.

Key Features

- 24/7 permissionless access

- Instant transaction finality and settlement

- Trustless and transparent operations

- Low execution costs

Unique Value Proposition

Stabull operates as a 4th-generation AMM/DEX, generating revenue through transaction fees on swaps and liquidity provision. The business model is centered around a self-balancing ecosystem where more liquidity attracts larger swaps, which generates more fees, leading to higher APY for liquidity providers.

Stabull's live dApp is simple but highly scalable to the Trillion Dollar Stable/RWA sector, which is currently on an exponential growth trajectory. Competitors are not designed to cater to FX and commodities markets. Stabull's unique advantage lies in its capital efficiency and its specialization for Stablecoins and RWAs, setting it apart from other platforms.

Stabull Investors

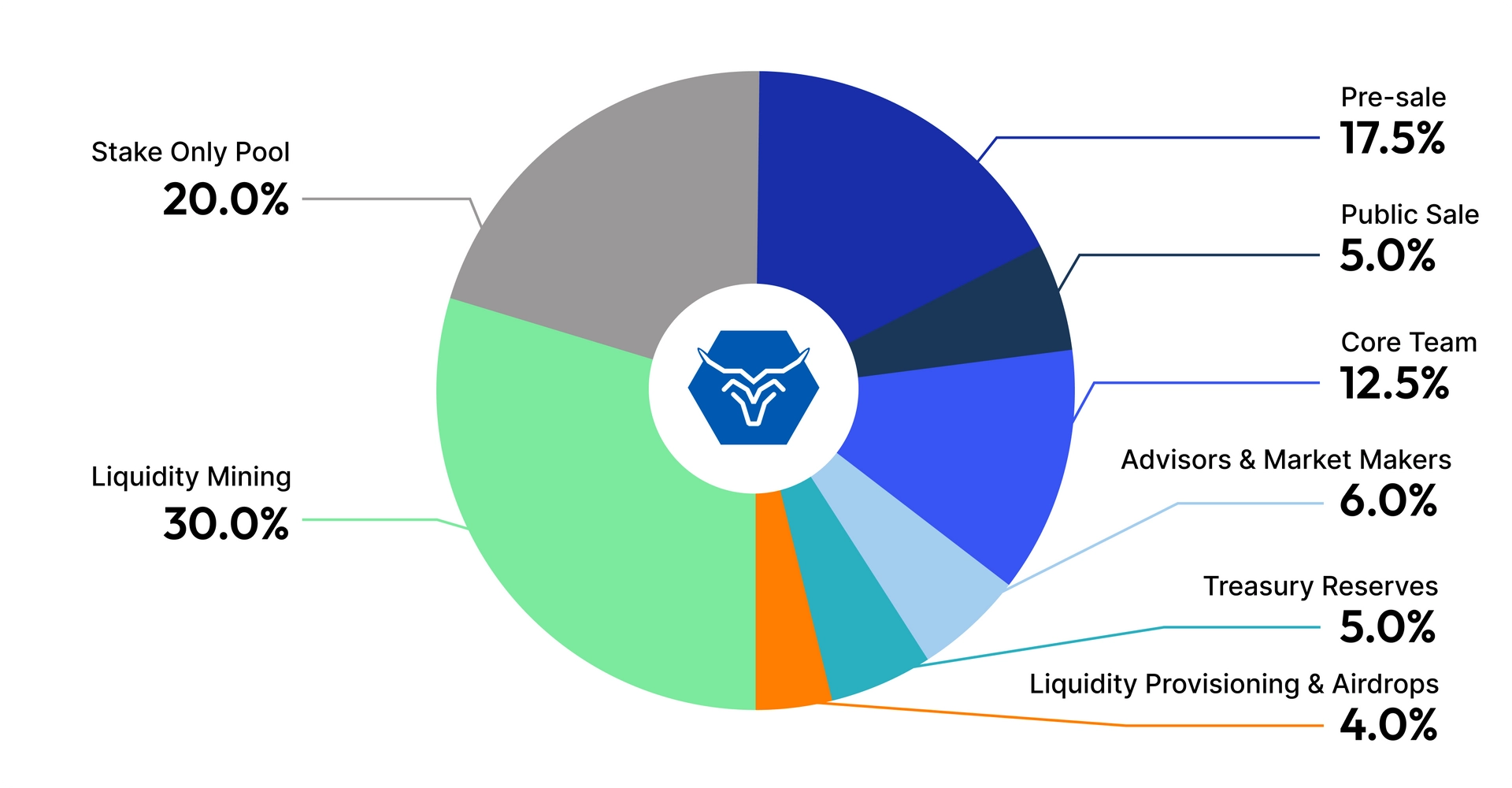

Token Utility / Tokenomics

- Liquidity Mining: 30% of the token supply and 70% of swap fees are distributed to liquidity providers as $STABUL tokens.

- Governance: $STABUL token holders have voting rights, allowing them to influence the allocation of liquidity mining rewards, pool APY, and protocol upgrades.

Deflationary Mechanism

The $STABUL token has a fixed supply of 10M, ensuring its value accrues rather than dilutes. Stabull's protocol fees are designed to buy $STABUL off the market and split revenues in a deflationary model. The starting composition allocates 5% of all fees to the Insurance Fund, while 95% of the fees are used to buy back $STABUL and distribute it as follows:

- 5% to the Treasury, which buys $STABUL and converts it to non-sellable POL tokens (stake-only).

- 20% towards POL stake-only pools.

- 70% towards topping up the long-term liquidity mining program.

This liquidity mining program is structured to encourage early participation and drive market share, similar to how early tech companies offer incentives for market penetration. In 2025, when the Voting Portal / DAO is launched, $STABUL holders will be able to vote quarterly on the fee distribution and APY emission across pools. For example, token holders can vote to allocate a larger percentage of fees to the Insurance Fund or boost APY for specific liquidity pools for a set period. This introduces competition among token holders for governance and staking rewards.

Tokenomics

By continuously buying $STABUL tokens off the market and offering governance rights to holders, the system fosters ongoing demand. As the Stabull Finance platform scales, it can handle billions in daily volume without encountering the scaling challenges faced by legacy services.

Campaign Details

The Stabull Road-to-IDO campaign offers a prize pool of $200,000 worth of $STABUL tokens. Users will be rewarded based on XP collected during the campaign, with rewards distributed proportionally according to their participation and activity on the Stabull platform.

- Prize Pool$200,000 worth of $STABUL tokens

- Campaign Start1st of October

- Reward Vesting30% at TGE, 2-month cliff, and 9-month vesting thereafter

Disclaimer

All information provided above has been supplied by Stabull. Magic Square encourages users to conduct their own research. This information should not be construed as financial advice.

- 1

Register for a Magic Store Account

- 2

Add an EVM Wallet to your MagicID

- 3

Create a username and verify your email

- 4

Complete Proof-of-Humanity verification

- 5

Visit the Campaign Page to complete tasks

- 6

Monitor your standing on the Leaderboard to track your progress.

Rewards will be distributed based on your campaign XP proportionally - 7

Rewards will be claimed through the Magic Launchpad / Presail

Only one account per user is permitted. Duplicate accounts will be blocked from the campaign.