About Copper

Copper is an institutional-grade digital asset custody provider offering secure, compliant, and flexible infrastructure for crypto asset management. Built on a foundation of MPC (Multi-Party Computation) technology, Copper empowers institutions with advanced tools to store, manage, and move digital assets across 60+ blockchain networks. From segregated cold storage to hot wallet liquidity, Copper ensures maximum security without compromising speed or user control.

Used by hedge funds, exchanges, token issuers, and asset managers, Copper's platform stands out for its strong regulatory framework, advanced policy control engine, and SOC2 certification. The architecture eliminates single points of failure and supports customizable vault configurations that meet the diverse needs of institutions—from trading desks to tokenization platforms. Its goal: to bridge traditional finance with the decentralized world, securely.

Copper delivers a modular suite of custody, trading, and settlement solutions built specifically for the needs of institutional players in the digital asset space. Launched with the mission to bring secure, enterprise-grade infrastructure to crypto custody, Copper operates a globally trusted platform that safeguards billions in digital assets through its unique multi-party computation architecture.

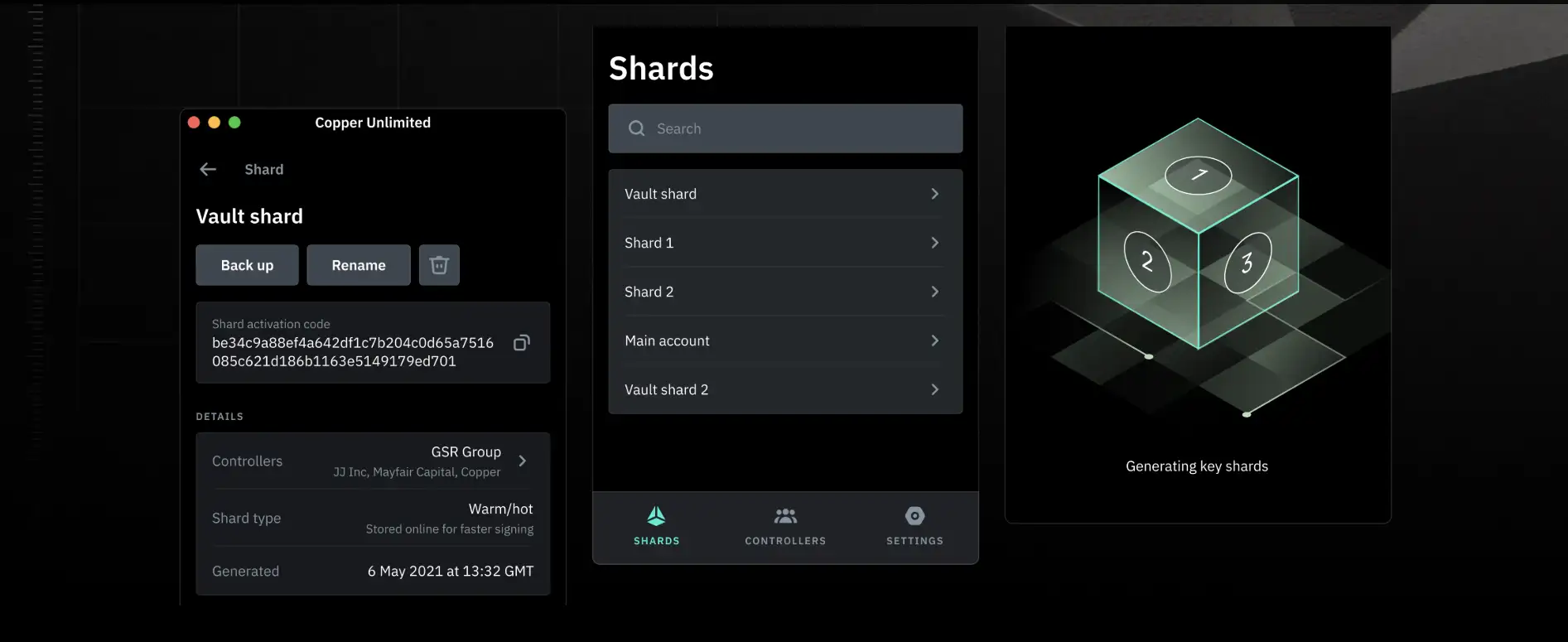

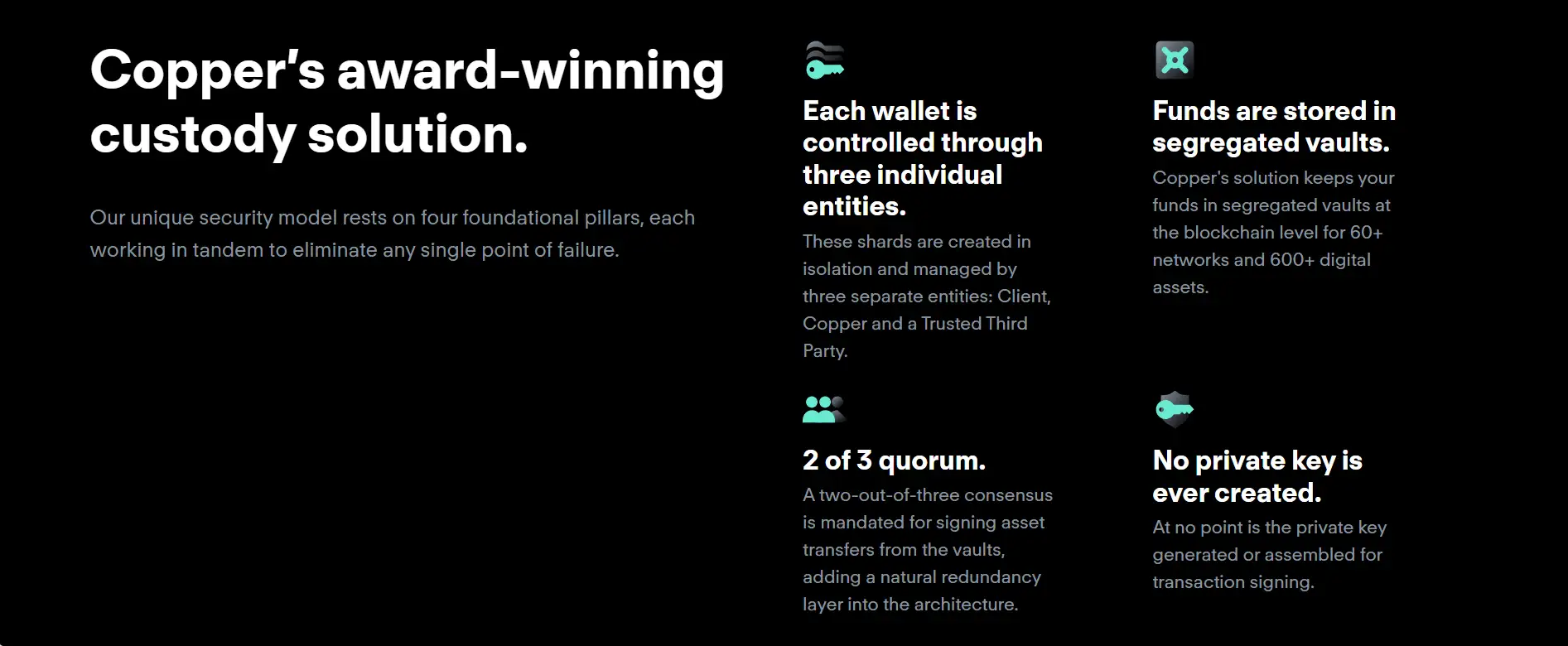

At the core of Copper's platform is a proprietary custody model based on four pillars: multi-entity key control, segregated vaults, quorum-based signing, and a “no private key ever created” guarantee. Each wallet is fragmented into three key shards—controlled separately by the client, Copper, and a trusted third party. Transactions require a two-out-of-three quorum, meaning no single entity has unilateral access, greatly reducing attack vectors.

The platform supports over 600 assets across more than 60 blockchain networks, and includes specialized custody support for money market fund tokens such as those issued by Ondo, Hashnote, and Securitize. Clients can customize custody setups with hot, warm, or cold vaults, all while using Copper's real-time settlement layer and automated transaction flows. The Policy Engine adds enterprise-grade operational controls with role-based access, time limits, transaction thresholds, and multi-approver workflows.

Beyond custody, Copper’s ClearLoop network connects top exchanges and trading venues, enabling off-exchange settlement to reduce counterparty risk and unlock greater liquidity. Paired with robust $500M+ specie insurance coverage placed via Lloyd’s of London and managed by AON, Copper delivers both peace of mind and performance. In an industry where trust and compliance are paramount, Copper is a top-tier choice.

Comparable services include Fireblocks, Anchorage Digital, and BitGo. However, Copper’s unique MPC architecture, flexible vault configuration, and ClearLoop settlement set it apart as a market leader in institutional crypto custody.

Copper delivers a robust array of security features and institutional tools to meet the growing demands of digital asset managers:

- MPC-Based Custody: Private keys are never created. Wallet control is split across three entities with 2-of-3 consensus, minimizing risk.

- Segregated Vaults: Each client’s funds are stored separately at the blockchain level for enhanced transparency and security.

- Cold, Warm, Hot Vault Flexibility: Choose the custody method per asset—cold for long-term, warm for compliance-ready, or hot for instant transactions.

- ClearLoop Settlement Layer: Instantly settle trades off-exchange while maintaining full custody, reducing counterparty exposure.

- Policy Engine: Assign user roles, set transaction limits, define approval workflows, and enforce team-based controls.

- Insurance Coverage: Backed by AON and Lloyd’s of London, Copper offers $500M+ in bespoke crypto crime and specie coverage.

- 24/7 Transaction Execution: Cold vault operations can be processed within minutes, anytime, supported by Copper’s global team.

- Regulatory Alignment: SOC2 certified and fully compliant, Copper helps institutions meet evolving regulatory obligations.

Getting started with Copper is a high-touch, institution-focused process designed to ensure security and operational fit:

- Visit the Website: Go to copper.co and select “Book a demo” to schedule a call with the Copper onboarding team.

- Custody Planning: Work with Copper’s experts to design your custody architecture: choose cold, warm, or hot setups per asset class.

- Integrate Vault Access: Configure your MPC wallet shards. Assign control to your team, Copper, and your selected trusted third party.

- Set Up Policy Engine: Define internal rules, approval thresholds, and access controls via Copper’s customizable role system.

- Connect to Exchanges: Use ClearLoop to link custody directly with top trading platforms—no need to pre-fund exchanges.

- Enable Operations: Start transferring, securing, and managing your digital assets with 24/7 global support and insurance coverage.

Copper FAQ

Copper uses MPC (Multi-Party Computation) to secure wallets without ever creating or assembling a private key. Instead, wallet control is split across three shards—managed by the client, Copper, and a trusted third party. This means the full key never exists in one place at any time, eliminating single points of failure and dramatically reducing attack surfaces. It’s one of the most advanced methods for protecting digital assets. Learn more at copper.co.

Copper’s custody architecture is built for flexibility. Each wallet shard can be stored online or offline, allowing clients to choose cold, warm, or hot vaults depending on asset sensitivity and liquidity needs. This per-asset configuration enables maximum control over transaction speed, compliance policies, and operational security—all managed through Copper’s secure infrastructure. Explore options at copper.co.

ClearLoop is Copper’s off-exchange settlement layer that connects clients directly with leading crypto exchanges. It enables institutions to trade while their assets remain securely in custody—eliminating the need to pre-fund exchanges and mitigating the risk of exchange default or compromise. ClearLoop helps unlock liquidity and improve capital efficiency without sacrificing security. Discover how it works at copper.co.

Even for cold vaults, Copper provides near-instant execution. Transactions require approval from both the client and a Copper account manager but can be completed 24/7 within minutes, thanks to Copper’s always-on client services team. This hybrid approach offers the security of cold storage with the responsiveness of modern finance. For more, visit copper.co.

Copper’s Policy Engine is a role-based access and control system designed for enterprise-grade governance. Institutions can assign permissions, set transaction limits, define approval workflows, and apply custom rules per team member or vault. It ensures secure operations while maintaining internal compliance and auditability, all within a single platform. See its features on copper.co.

You Might Also Like