About Kaspa Finance

Kaspa Finance is a powerful DeFi platform designed to redefine decentralized trading on the high-speed Kaspa blockchain. Built on Kasplex zkEVM (Kaspa’s Layer 2 smart contract execution layer), it combines lightning-fast performance with Ethereum-compatible tooling, allowing developers and traders to harness scalable, secure, and low-latency DeFi infrastructure.

More than just a DEX, Kaspa Finance introduces an integrated “DeFai” suite—short for Decentralized Finance + Artificial Intelligence. Through a combination of AI-powered bots, yield automation, staking, lending, and triple emission farming, it enables both retail and institutional users to trade, earn, and build with unprecedented flexibility and speed. The result is a full-service decentralized finance super app built natively for the Kaspa ecosystem.

Kaspa Finance is the first full-featured decentralized finance platform built for the Kaspa EVM (Kasplex L2). It brings together the essential building blocks of DeFi—swapping, staking, farming, and lending—while enhancing them with AI-driven automation, performance-focused design, and modular composability. Kaspa’s unique blockDAG architecture offers ultra-fast execution, near-zero finality delay, and high scalability, giving Kaspa Finance an advantage over traditional EVM-based protocols.

One of the standout aspects of Kaspa Finance is its use of concentrated liquidity in a V3 AMM DEX format, similar to Uniswap V3. Users can enjoy low-slippage trades, custom fee tiers, and programmable LP tokenomics. Meanwhile, liquidity providers benefit from dynamic emissions with dual and triple-reward farming pools. Staking mechanisms feature lockups and tiered APR models, and users can lend or borrow assets using an Aave-style lending system optimized for Kaspa’s high throughput.

Kaspa Finance’s architecture is inherently composable. Yield farms are NFT-based (ERC-721 LP tokens), which can be staked, loaned, or used as collateral in lending pools. AI bots—branded as KasBots—run off-chain ML models that interact with on-chain liquidity, executing trades or strategies based on predefined triggers. These bots are unlocked via KFC token staking tiers and are governed by community DAO proposals, giving users an intelligent and customizable trading experience.

Competitor platforms in the Ethereum and Layer 2 DeFi space include Uniswap, Aave, Balancer, and Curve. While these protocols pioneered much of what DeFi is today, Kaspa Finance differentiates itself by being fully native to the Kaspa Layer 1 blockDAG chain via Kasplex zkEVM—making it the first of its kind to blend high-speed PoW security with modern DeFi primitives.

With a modular protocol stack and smart contract compatibility, Kaspa Finance is also ideal for builders. Tools like the Token Creator allow anyone to launch KRC20 tokens, LP-enabled tokens, or buyback-style contracts within minutes. As the Kaspa ecosystem continues to expand, Kaspa Finance is positioned to become the liquidity and innovation hub for DeFi on Kaspa.

Kaspa Finance offers a robust set of features and benefits that cater to advanced DeFi users and newcomers alike:

- V3 AMM with Concentrated Liquidity: Trade with ultra-low slippage and custom fee tiers using a Uniswap V3–style AMM powered by Kasplex zkEVM.

- Multi-Emission Yield Farming: Earn dual or triple rewards across farms optimized for LP tokens with 721 NFT structures.

- AI-Powered Trading Bots (KasBot): Unlock automated trading, yield optimization, and strategy execution via AI logic linked to smart contracts.

- Secure Lending & Borrowing: Lend and borrow assets via an Aave-style module with dynamic collateralization and Kaspa-native speed.

- Token Creator Tool: Deploy your own KRC20 tokens or liquidity-enabled smart contracts directly on Kaspa Finance with just a few clicks.

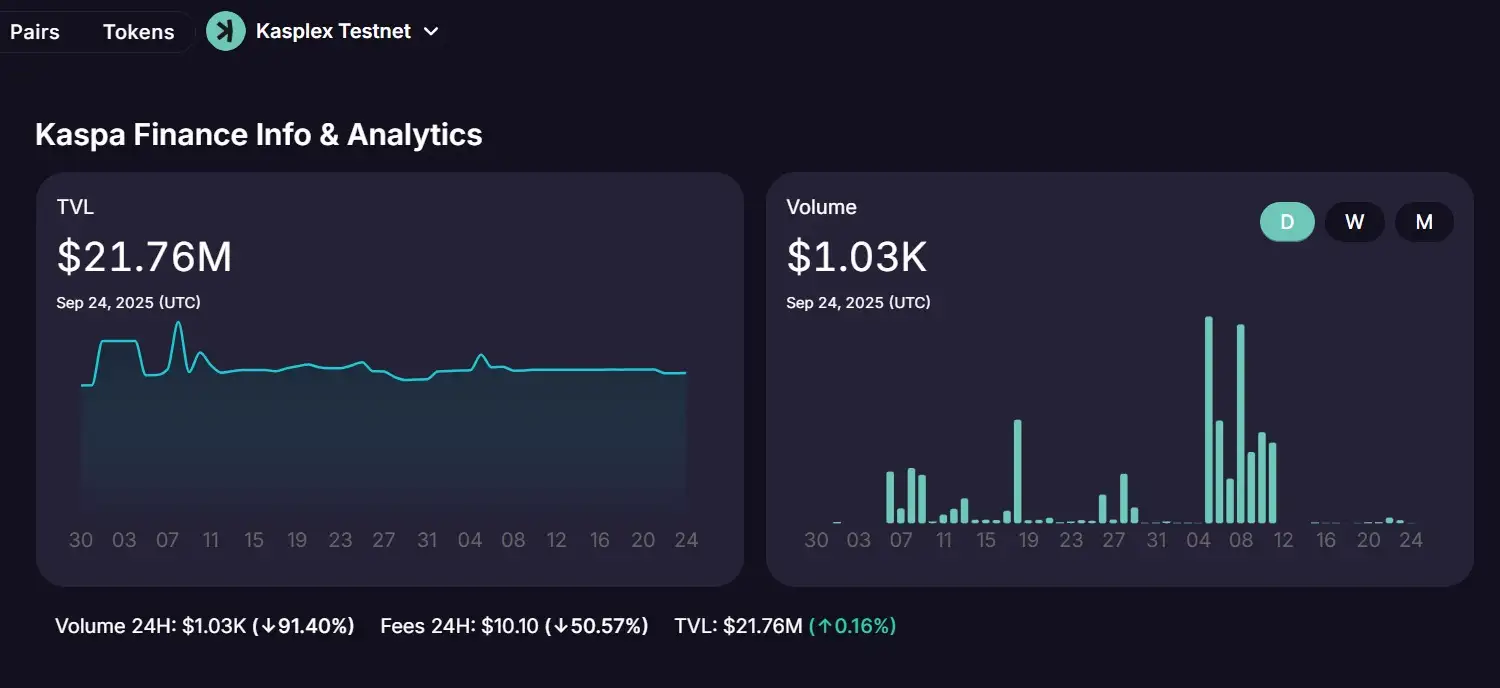

- Real-Time Analytics: Monitor your DeFi performance and portfolio metrics across swaps, farms, and staking in one dashboard.

- Composable Ecosystem: LP tokens, staked assets, and lending collateral interact seamlessly across modules, enabling flexible DeFi strategies.

- Kaspa-Native Performance: Built on Kaspa’s DAG, Kaspa Finance offers high-speed, low-latency DeFi with real finality and no orphan blocks.

Kaspa Finance offers a fast and seamless onboarding process for users ready to experience next-gen DeFi on the Kaspa blockchain:

- Step 1 – Visit the Official Website: Go to https://kaspafinance.io and click “Launch App” in the top menu to access the Kaspa Finance dashboard.

- Step 2 – Connect Your Wallet: Use MetaMask or any Web3-compatible wallet to connect to the Kasplex L2 (Kaspa EVM) network.

- Step 3 – Start Swapping: Use the V3 DEX to trade tokens with advanced liquidity controls and optimized slippage.

- Step 4 – Provide Liquidity: Add assets to concentrated liquidity pools to start earning trading fees and emission rewards.

- Step 5 – Farm & Stake: Participate in dual and triple yield farms or stake assets for escalating APR and protocol rewards.

- Step 6 – Explore DeFai: Activate KasBot automation (once available) by staking KFC tokens and customizing bot logic through the UI.

- Step 7 – Launch Your Token: Use the Token Creator Tool to mint a KRC20 token or liquidity-enabled contract.

Kaspa Finance Reviews by Real Users

Kaspa Finance FAQ

Kaspa Finance is the first full-suite DeFi super app built natively on the Kasplex zkEVM, the Layer 2 smart contract environment of the Kaspa blockchain. Unlike traditional DeFi platforms, it unites swapping, staking, farming, and lending into one composable ecosystem. By combining Kaspa’s blockDAG speed with EVM compatibility, Kaspa Finance delivers instant finality, ultra-low fees, and seamless DeFi automation—all within a single interface.

KasBot is an AI-powered trading engine integrated into Kaspa Finance’s DeFai Suite. It automates yield strategies, manages portfolio risk, and executes trades based on real-time market analytics. Each KasBot operates as an off-chain machine learning model that sends signed trade triggers to on-chain contracts. Users can unlock advanced KasBot tiers by staking KFC tokens, enabling features like automated arbitrage, liquidity balancing, and AI-driven treasury management. Learn more at kaspafinance.io.

The Kasplex zkEVM serves as the execution layer for Kaspa Finance, enabling parallel transaction processing through Kaspa’s blockDAG architecture. Unlike traditional blockchains that process blocks sequentially, Kaspa’s DAG structure allows multiple blocks to be created and confirmed simultaneously. This results in sub-second transaction finality, scalability, and reduced congestion. This high-throughput model allows Kaspa Finance users to swap, farm, or stake assets with almost no delay, all while maintaining full decentralization.

Kaspa Finance differentiates itself from competitors such as Uniswap and Aave through its AI integration, triple emission farming, and Kaspa-native infrastructure. While most DeFi protocols rely on Ethereum or Layer 2 rollups, Kaspa Finance leverages blockDAG consensus for unmatched speed and scalability. Its “DeFai” model (DeFi + AI) introduces features like KasBot automation and programmable yield optimization, setting a new benchmark for intelligent, high-performance decentralized finance.

Yes, Kaspa Finance features a built-in Token Creator Tool that allows developers and communities to deploy KRC20 tokens directly on the Kasplex zkEVM. Users can choose from multiple templates, including Standard Tokens, Liquidity Generator Tokens, and Buyback Tokens. These options simplify token deployment for both DeFi and experimental projects while ensuring full compatibility with Kaspa’s high-speed environment.

You Might Also Like