About Request Finance

Request Finance is a cutting-edge platform designed to meet the needs of modern businesses that operate at the intersection of traditional finance and the emerging world of cryptocurrencies. As more companies embrace digital assets, there is an increasing demand for robust tools that can manage both fiat and crypto transactions seamlessly. Request Finance emerges as a solution to this challenge, providing an all-in-one financial management platform tailored for businesses that need to handle a wide array of financial activities, including invoicing, payroll, expenses, and accounting, across different currencies.

Founded on the vision of simplifying financial processes, Request Finance is especially significant for businesses operating in the Web3 space, where decentralized finance (DeFi) and blockchain technologies are becoming the norm. However, it is also incredibly useful for traditional businesses that are looking to integrate cryptocurrency payments into their operations. By offering tools that bridge the gap between fiat and crypto, Request Finance helps companies manage their finances more efficiently, reduce operational risks, and ensure compliance with evolving regulatory standards.

Request Finance was born out of the growing need for a sophisticated financial management platform that could address the complexities of handling both cryptocurrency and fiat transactions. The platform was designed to serve the unique needs of businesses in the Web3 ecosystem, where digital assets and decentralized finance are integral components of daily operations. However, its utility extends beyond the crypto space, offering value to any business that needs to manage a diverse portfolio of payments and financial transactions.

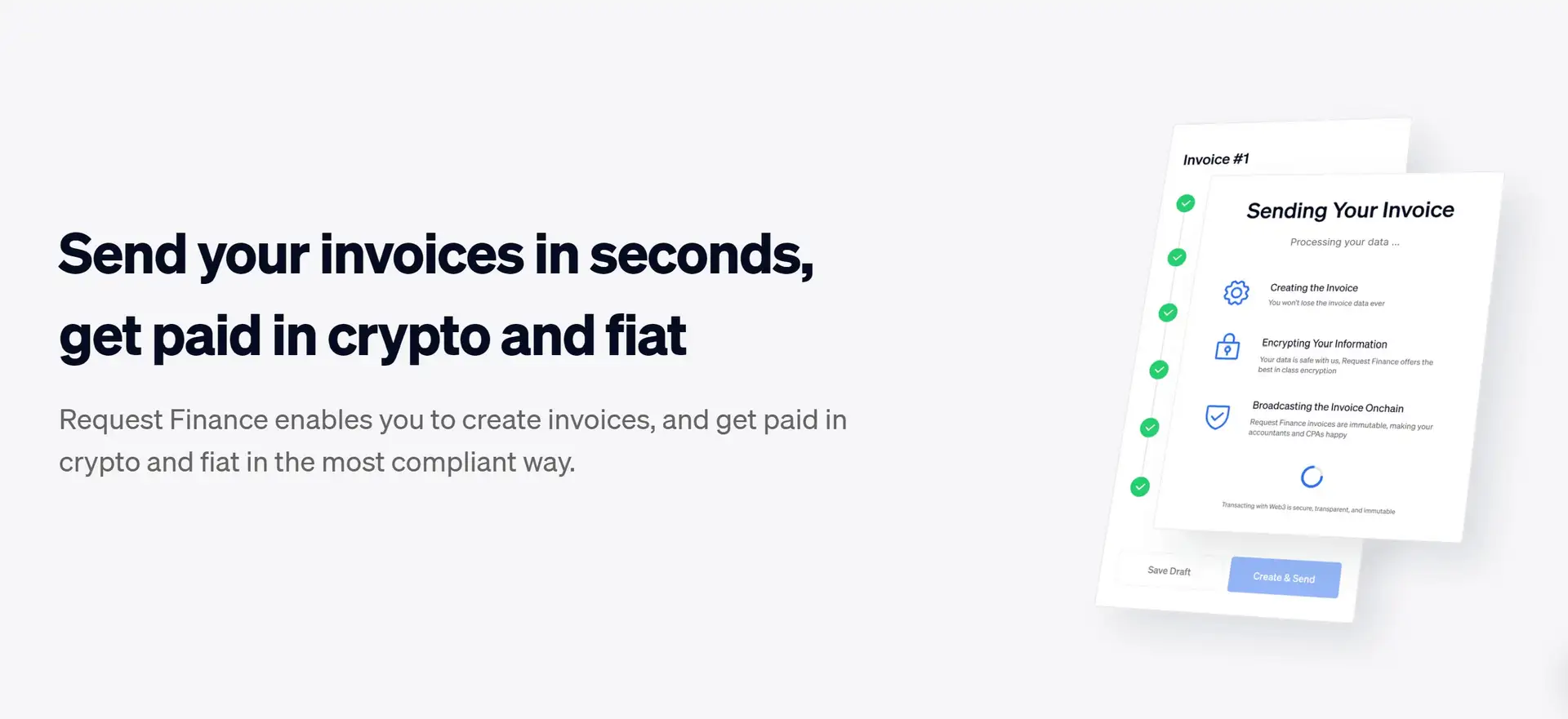

The platform's development has been marked by a commitment to innovation and user-centric design. Request Finance simplifies the financial operations of businesses by providing a suite of tools that include invoicing, payroll, expense management, and accounting. These tools are designed to work in harmony, allowing businesses to streamline their financial workflows and reduce the administrative burden associated with managing multiple currencies and payment methods.

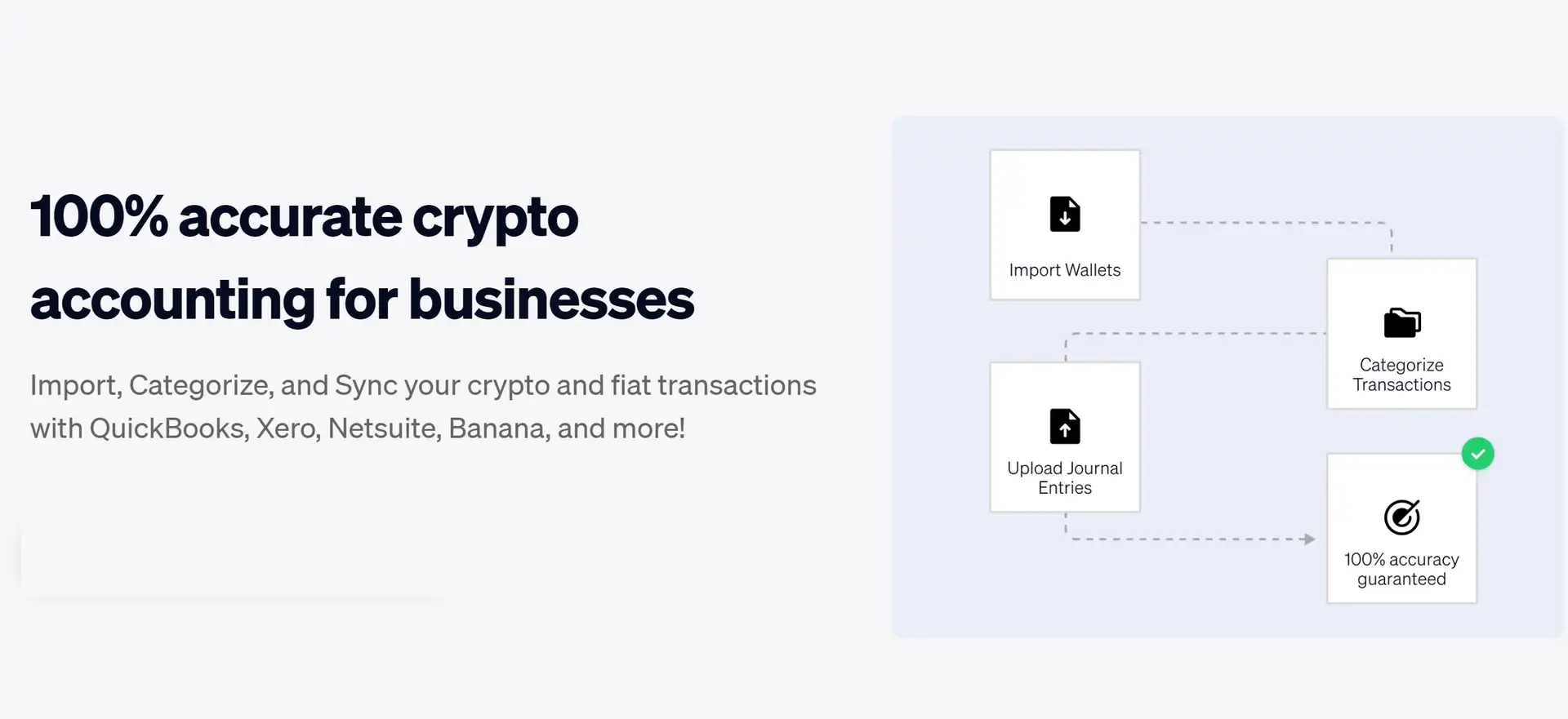

One of the key milestones in the evolution of Request Finance was the integration with popular accounting software like QuickBooks and Xero. This integration allows businesses to synchronize their financial data seamlessly, reducing the risk of errors and ensuring that their financial records are always up to date. Moreover, Request Finance supports batch payments, a feature that is particularly useful for businesses that need to process multiple transactions simultaneously, such as payroll for large teams or mass invoicing for service providers.

Security is another critical aspect of Request Finance. The platform employs advanced security measures, including double payment detection, to protect businesses from common financial risks. In addition, Request Finance has established partnerships with leading cybersecurity firms to ensure that all transactions are secure and compliant with regulatory standards. This focus on security, coupled with its user-friendly interface and extensive integration capabilities, positions Request Finance as a leader in the financial management space, particularly for businesses that need to navigate the complexities of both fiat and cryptocurrency transactions.

Among the competitors in this space are platforms like BitPay and CoinPayments, which also offer cryptocurrency payment solutions. However, Request Finance differentiates itself with its comprehensive set of tools, including its advanced invoicing, payroll, and expense management features, as well as its deep integration with existing financial systems.

The key benefits and features of Request Finance include:

- Comprehensive Payment Solutions: Manage both crypto and fiat payments through a single platform, supporting global transactions across 190+ countries.

- Seamless Integrations: Integrates with popular accounting software like QuickBooks and Xero, streamlining financial management.

- Enhanced Security: Features like double payment detection and partnerships with cybersecurity firms ensure that transactions are secure and compliant.

- User-Friendly Interface: Simplifies complex financial operations with an intuitive design, making it easy to track, manage, and optimize financial workflows.

- Flexible Invoicing & Payroll: Supports batch payments and automated invoicing, which are crucial for businesses with high transaction volumes.

- Multi-Currency Support: Handles both crypto and fiat currencies, facilitating smooth cross-border transactions.

- Regulatory Compliance: Ensures that all transactions adhere to global regulatory standards, reducing the risk of non-compliance.

- Scalability: Designed to grow with your business, whether you're managing a small team or a large organization with complex financial needs.

- Customer Support: Offers comprehensive support through its Help Center and dedicated customer service, ensuring that users can resolve issues quickly and efficiently.

To get started with Request Finance, follow these steps:

- Create an Account: Visit the Request Finance website and sign up for a free account.

- Initial Setup: Set up your business profile by providing the necessary information, including payment preferences and supported currencies.

- Integrate Tools: Link your Request Finance account with your existing accounting software like QuickBooks or Xero to streamline financial management.

- Start Using Features: Begin by creating invoices, setting up payroll, and managing expenses through the platform’s intuitive dashboard.

- Security Measures: Take advantage of security features like double payment detection and ensure your business is protected.

- Access Resources: Utilize the platform’s educational resources, such as the Crypto Treasury Guide, to fully leverage the capabilities of Request Finance.

- Explore Advanced Features: Dive deeper into the platform by exploring advanced features like batch payments, multi-currency management, and automated invoicing to optimize your financial workflows.

- Customer Support: If you encounter any issues or need assistance, the Request Finance Help Center offers detailed guides and customer support to help you navigate the platform.

By following these steps, you'll be well on your way to managing your business's finances with ease and efficiency using Request Finance.

Request Finance Reviews by Real Users

Request Finance FAQ

Request Finance employs advanced security measures, including double payment detection, encryption, and partnerships with leading cybersecurity firms. These measures are designed to protect your crypto transactions from fraud and unauthorized access, ensuring compliance with global regulatory standards. Additionally, all user data is stored securely, and the platform regularly undergoes security audits to maintain its integrity.

Yes, Request Finance is designed to handle both crypto and fiat payments simultaneously. The platform supports multiple currencies and integrates with popular accounting software like QuickBooks and Xero, allowing you to manage all your financial transactions in one place, regardless of currency type.

Request Finance integrates seamlessly with popular accounting software like QuickBooks and Xero. This integration allows for automatic synchronization of financial data, reducing manual entry errors and ensuring that your accounts are always up to date. The integration also helps streamline your financial workflows, making it easier to manage invoices, payroll, and expenses.

Request Finance is particularly beneficial for businesses operating in the Web3 space, such as those involved in DeFi, blockchain development, and digital asset management. However, it is also suitable for traditional businesses looking to integrate crypto payments into their operations. The platform’s versatility and extensive feature set make it ideal for any business that needs to manage complex financial transactions across multiple currencies.

Request Finance helps businesses maintain regulatory compliance by offering tools that ensure all crypto transactions adhere to global standards. The platform includes features like automated invoicing, detailed transaction records, and compliance checks that help businesses stay within the legal frameworks of their respective jurisdictions. This reduces the risk of non-compliance and helps businesses operate more securely and efficiently.

You Might Also Like