About Velodrome

Velodrome Finance is a decentralized finance (DeFi) platform that aims to provide efficient, low-cost trading solutions on Ethereum's Layer 2 via Optimism. By leveraging Optimism's technology, Velodrome significantly reduces gas fees and enhances transaction speeds, offering a superior trading experience compared to traditional DeFi platforms on Ethereum. The platform's mission is to democratize access to DeFi by making it more accessible and cost-effective for users of all sizes. Velodrome achieves this by integrating advanced technologies, robust security measures, and a user-friendly interface.

Velodrome's innovative use of Layer 2 technology addresses the scalability issues that have plagued Ethereum, making DeFi more accessible to a broader audience. The platform's low transaction fees and fast confirmation times enhance the overall user experience, attracting both new and experienced DeFi participants.

Velodrome Finance App was developed to address the high gas fees and slow transaction speeds that have hindered the growth of DeFi on the Ethereum mainnet. By leveraging Optimism's Layer 2 scaling solution, Velodrome offers users a more efficient and cost-effective trading environment. Since its inception, Velodrome has achieved several key milestones, including the successful launch of its mainnet, integration with major liquidity pools, and the establishment of a robust governance framework.

The development of Velodrome Finance App is rooted in the desire to make DeFi more accessible and user-friendly. The platform's team comprises experienced developers and blockchain enthusiasts who are dedicated to creating a seamless and secure trading experience. Velodrome's integration with Optimism allows it to provide fast transaction speeds and low fees, addressing some of the most significant pain points for DeFi users.

Key milestones in Velodrome's history include its initial launch, which saw significant user adoption and liquidity provision. The platform quickly gained traction due to its innovative approach to liquidity incentives and governance. Velodrome's unique incentive mechanisms reward users for providing liquidity and participating in governance, fostering a vibrant and engaged community.

The project's roadmap includes plans for further development and expansion. Future updates will focus on enhancing the platform's functionality, integrating additional DeFi services, and expanding its user base. Velodrome also aims to establish partnerships with other leading DeFi projects to create a more interconnected and collaborative ecosystem.

In terms of competition, Velodrome faces other Layer 2 DEXs like Uniswap v3 on Optimism and Synthetix. These platforms also aim to provide efficient and cost-effective trading solutions on Ethereum's Layer 2. However, Velodrome differentiates itself through its unique incentive mechanisms, user-friendly interface, and strong community governance.

- Low Transaction Fees: Operating on Optimism, Velodrome significantly reduces gas fees, making it more cost-effective for traders.

- Fast Transactions: Optimism's Layer 2 technology ensures quick transaction confirmation times, enhancing user experience.

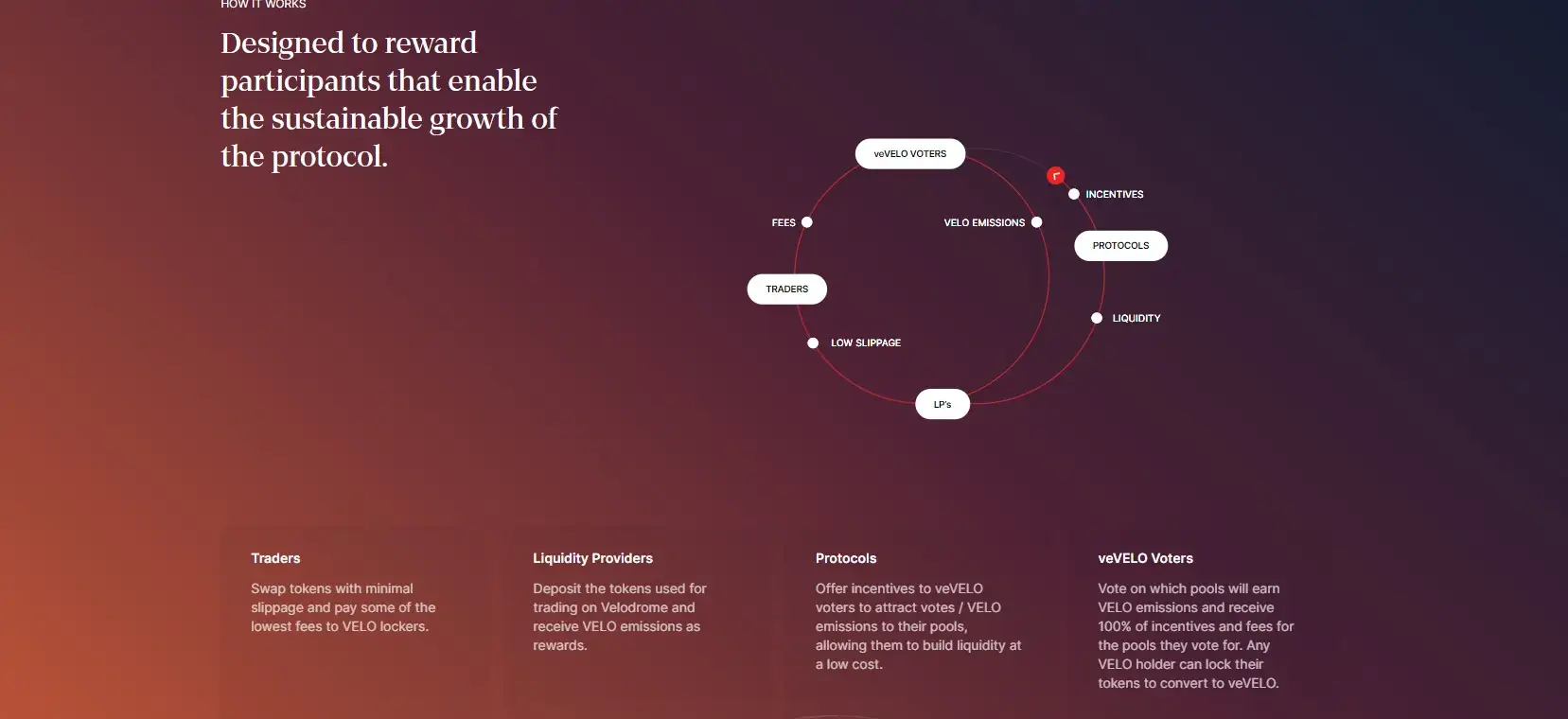

- Liquidity Incentives: Velodrome offers attractive rewards for liquidity providers, ensuring deep liquidity and better trading conditions.

- Governance Participation: VELO token holders can participate in governance, influencing the platform's future direction.

- Security: Leveraging Ethereum's security model, Velodrome ensures a secure trading environment.

- User-Friendly Interface: Velodrome's platform is designed to be intuitive and easy to navigate, making it accessible to both new and experienced DeFi users.

- Community-Driven Development: Velodrome's decentralized governance model ensures that the platform evolves in line with the needs and preferences of its users.

- Scalability: By leveraging Layer 2 technology, Velodrome can handle a high volume of transactions without compromising on speed or cost.

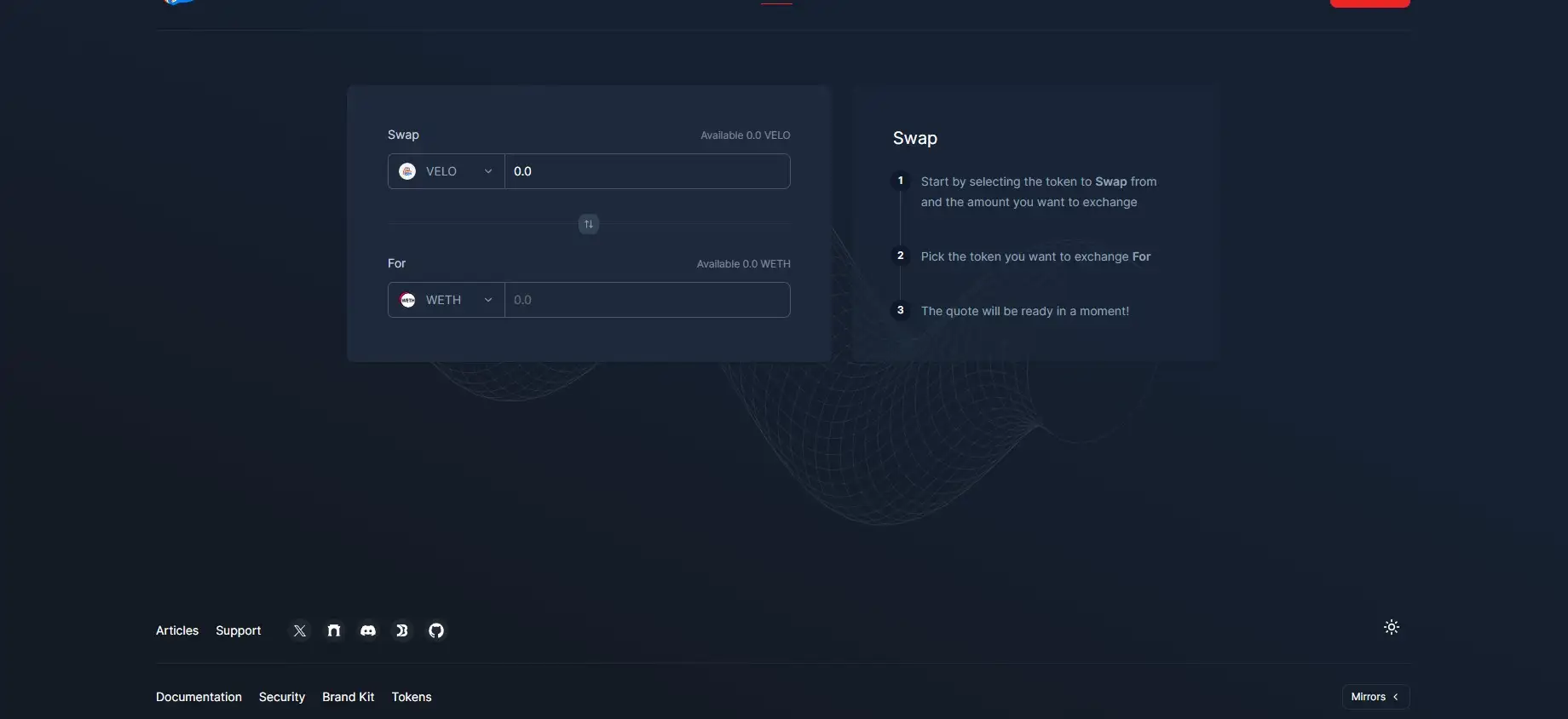

- Create an Optimism-Compatible Wallet: Use wallets like MetaMask and configure it for the Optimism network.

- Acquire VELO Tokens: Purchase VELO from supported exchanges such as Uniswap or Sushiswap.

- Connect Your Wallet: Visit the Velodrome Finance website and connect your wallet.

- Start Trading: Utilize the platform to trade various tokens with reduced fees.

- Stake VELO: Participate in governance and earn rewards by staking your VELO tokens.

- Explore Liquidity Pools: Provide liquidity to earn incentives and contribute to the platform's growth.

- Access Tutorials and Guides: Visit the Velodrome Finance App's documentation for detailed guides on using the platform effectively.

- Join the Community: Engage with the Velodrome community through forums, social media, and governance proposals to stay updated and involved.

Velodrome Token

Velodrome Reviews by Real Users

Velodrome FAQ

Velodrome Finance App operates on the Optimism Layer 2 solution, which significantly lowers gas fees compared to the Ethereum mainnet. This makes transactions more cost-effective for users.

Users can earn rewards by staking VELO tokens and providing liquidity to various pools on the Velodrome Finance platform.

Liquidity providers are essential to the Velodrome Finance ecosystem. They supply liquidity to pools, enabling smooth and efficient trading, and are rewarded with VELO tokens.

Key milestones include the successful mainnet launch, integration with major liquidity pools, and the establishment of a robust governance framework within the Velodrome Finance ecosystem.

Velodrome Finance supports scalability by utilizing Layer 2 technology, allowing it to handle a high volume of transactions without compromising speed or cost.

You Might Also Like