About 8LENDS

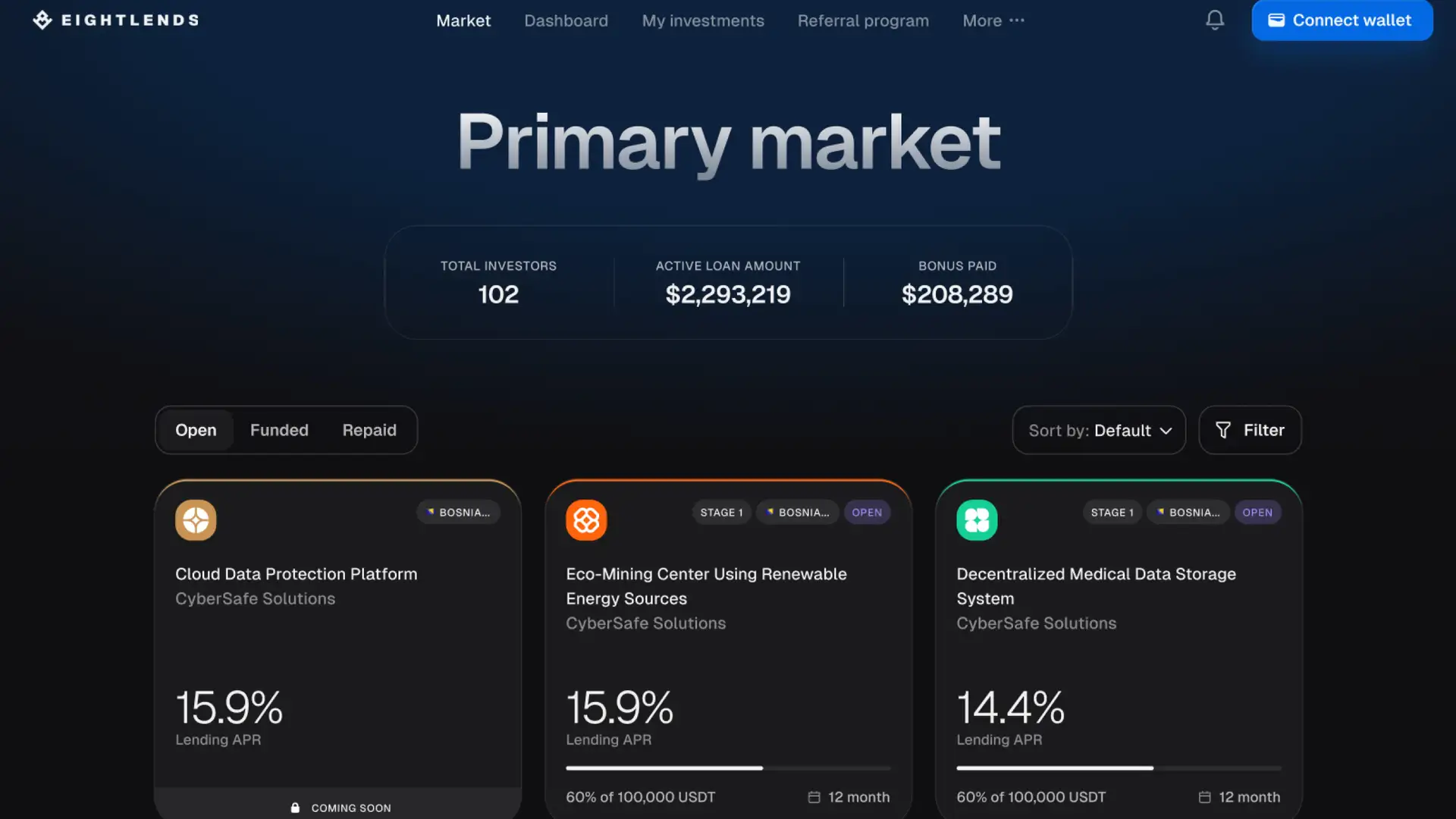

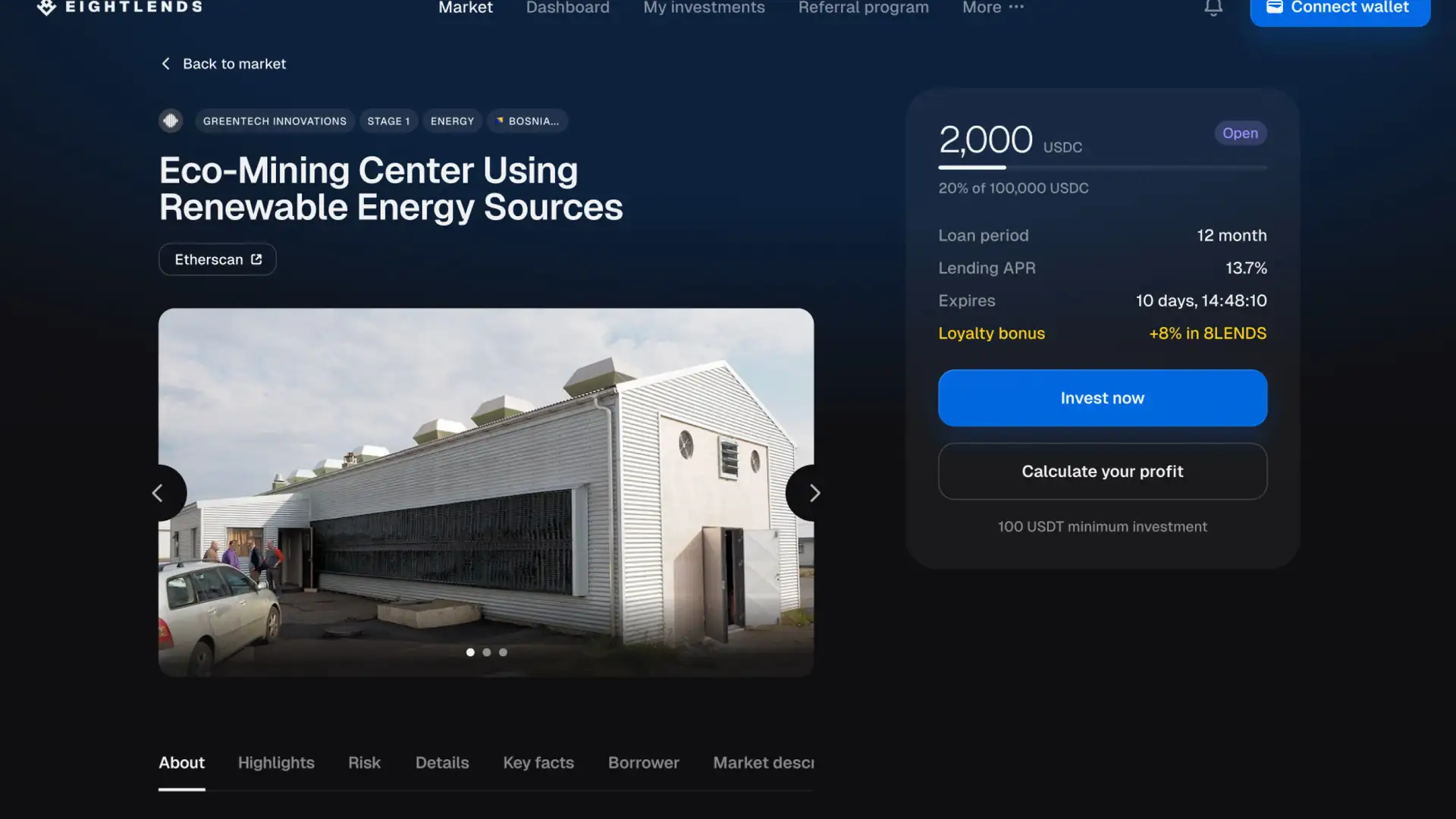

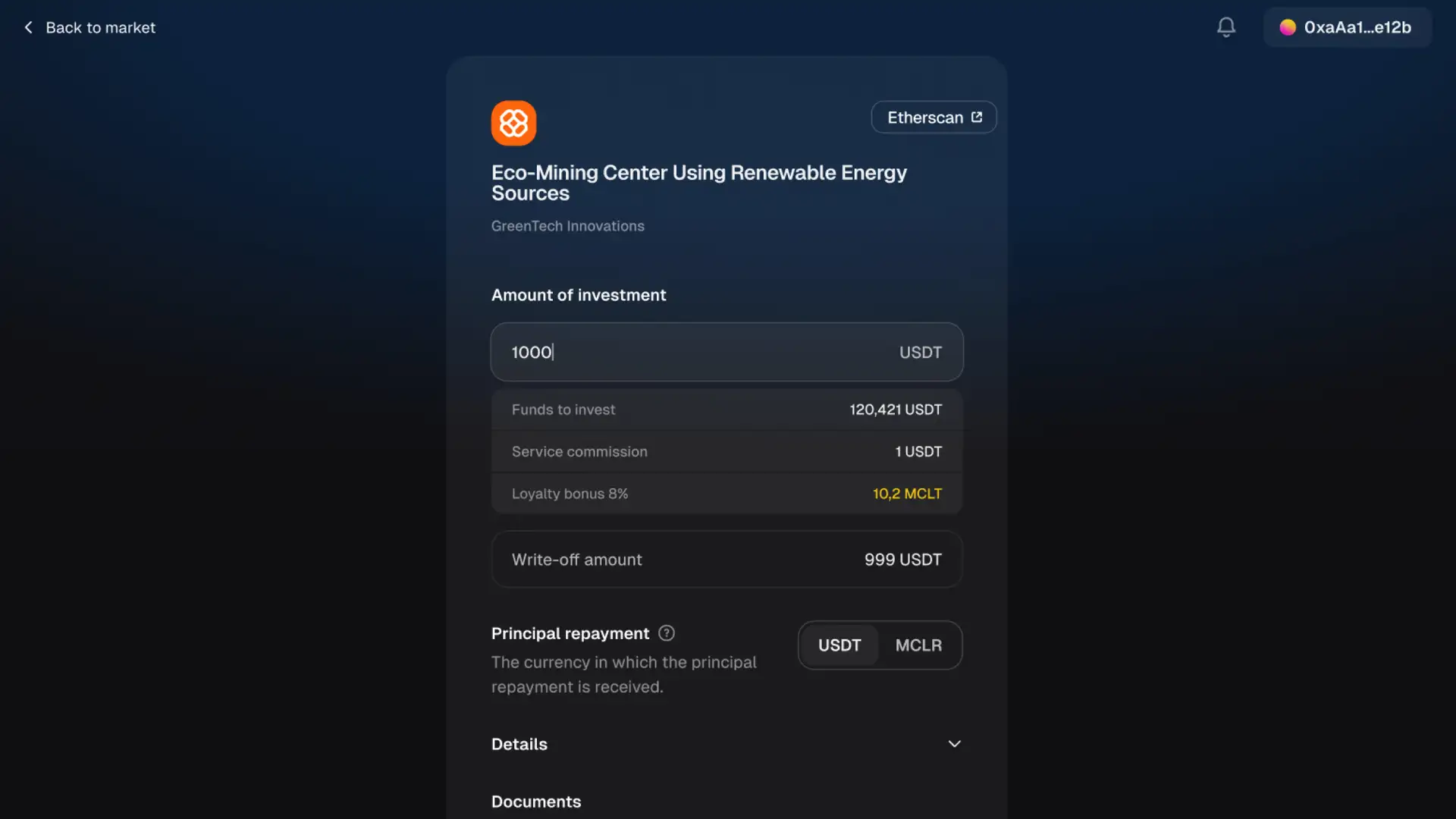

8Lends is a cutting-edge decentralized finance (DeFi) platform that bridges the gap between traditional finance and blockchain technology. It empowers borrowers to utilize real-world assets, such as property, invoices, or commodities, as collateral to access decentralized lending opportunities. The platform’s integration of blockchain and smart contracts ensures secure, transparent, and tamper-proof lending agreements, making DeFi lending accessible to a broader audience.

As a subsidiary of Maclear AG, a Switzerland-based financial entity, 8Lends inherits a legacy of trust and expertise in traditional finance. Maclear AG has successfully facilitated over €7 million in investments, funding 66 projects across Europe. This extensive experience serves as the foundation for 8Lends’ mission to democratize access to investment opportunities backed by tangible assets with significant growth potential.

The core vision of 8Lends is to make investment opportunities more inclusive and accessible on a global scale. By integrating physical assets with blockchain technology, the platform enables a seamless and borderless lending ecosystem. This innovative approach redefines traditional lending paradigms, aligning them with the decentralized and trustless ethos of blockchain.

8Lends uniquely combines traditional financial frameworks with the automated, secure functionality of decentralized finance (DeFi). Borrowers can stake their real-world assets, such as property or invoices, while the platform handles crucial processes including due diligence, compliance, and tokenization. This ensures adherence to legal standards while maintaining the operational efficiency of blockchain systems.

Drawing inspiration from its parent company, Maclear AG, 8Lends emphasizes the importance of real-world asset-backed investments in driving global economic growth. The platform leverages blockchain technology to ensure all transactions are secure, immutable, and transparent. By fostering trust and innovation, 8Lends lays the foundation for a financial system that works for everyone.

8Lends has a robust roadmap detailing its growth and development from late 2024 through 2025. Here are the key highlights:

- Q4 2024: Launch of the platform's MVP with core functionalities, including investment pools, basic tokenomics, smart contracts for loans, and test loan issuance.

- Q1 2025: Introduction of new products like Launchpad, Launchpool, and exclusive NFTs; deployment of loans backed by 8LENDS tokens and enhanced investor protection measures.

- Q2 2025: Integration of real-world assets (RWAs) as collateral, creation of a secondary market for tokenized investments, and geographic expansion to Central Asia, the US, and Latin America.

- Q3 2025: Launch of advanced features like cross-network liquidity pools, co-branded credit cards, and leverage options for investors.

- Q4 2025: Global scaling with TradeFi integration, advanced RWA applications, and AI-driven automation for risk assessment and lending processes.

For the full roadmap details, visit the 8Lends Roadmap page.

8Lends operates as a subsidiary of Maclear AG, a Swiss-based financial entity. The leadership team at Maclear combines global expertise to ensure that projects are thoroughly vetted, safeguarding investments through rigorous due diligence, compliance with legal and regulatory requirements, and the securing and tokenization of assets for blockchain use.

8Lends is actively engaging its community through a waitlist for early access to its platform. By joining the waitlist, users can secure exclusive rewards and be among the first to experience the platform's features. This initiative allows participants to explore the integration of real-world assets with decentralized finance, providing valuable feedback to shape the platform's development.

8LENDS Suggestions by Real Users

8LENDS FAQ

8Lends bridges traditional finance and blockchain by tokenizing real-world assets like property and invoices. These tokenized assets are then used as collateral in lending pools, providing a secure and innovative way to access liquidity. Learn more about this unique approach on the 8Lends official website.

Joining the 8Lends waitlist provides exclusive rewards such as early access to the platform and unique bonuses that enhance the user experience.

Maclear AG, the parent company of 8Lends, ensures platform reliability through its extensive financial expertise, rigorous due diligence, and secure asset tokenization processes.

8Lends implements advanced measures like insurance pools in 8LENDS tokens and USDC, rigorous due diligence, and smart contract-based loan processes to ensure transparency and minimize risks. Explore these features further on the official website.

The 8Lends secondary market enables users to trade CP tokens earned from investments, offering liquidity and flexibility for investors. This feature promotes a dynamic ecosystem by allowing participants to adapt their investment strategies efficiently. Learn more about the secondary market on the 8Lends Roadmap page.

You Might Also Like