About Aark Digital

Aark Digital is a cutting-edge decentralized exchange (DEX) operating on the Arbitrum network. It is designed specifically for professional traders and liquidity providers, merging the transparency and security of decentralized exchanges with the efficiency and advanced features of centralized exchanges. Aark Digital's mission is to enhance the self-custody trading experience while addressing the liquidity challenges faced by decentralized finance (DeFi). The platform caters to users who seek high-leverage opportunities, deep liquidity, and efficient trading mechanisms that are often unavailable on traditional centralized platforms.

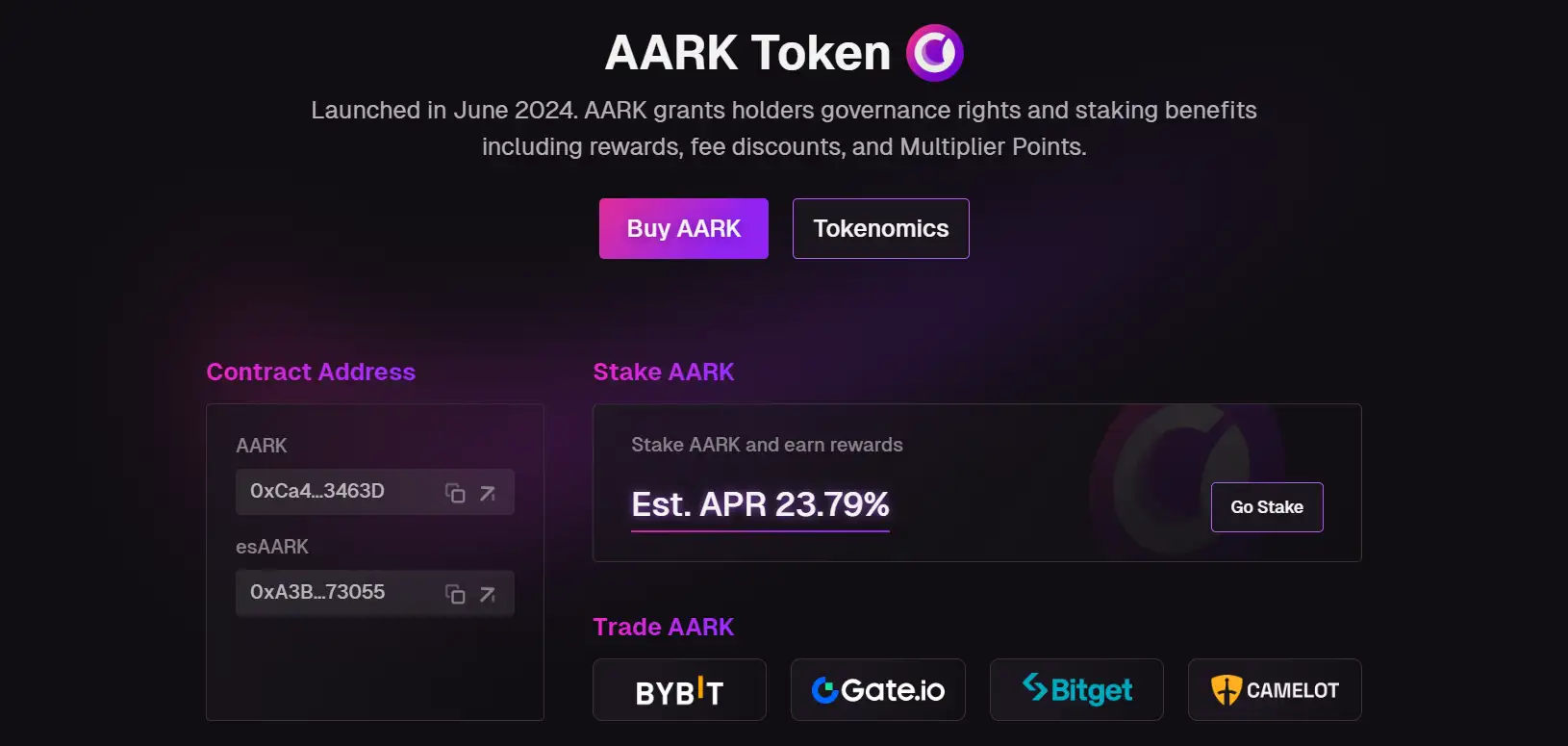

Aark Digital introduces unique features such as leveraged perpetual trading across a wide variety of assets, including long-tail assets often overlooked by competitors. The exchange operates using a novel architecture called Parallel Market Maker (PMM), which replicates liquidity dynamics from top centralized exchanges, resulting in reduced slippage and improved trading efficiency. Furthermore, the ecosystem is powered by the AARK token, which supports governance, staking, and reward distribution. By incorporating community-driven governance and incentivizing active participation, Aark Digital is setting new standards in the DeFi sector. Learn more about Aark Digital

Aark Digital was established to address critical inefficiencies in existing decentralized exchanges (DEXs), particularly around liquidity depth, scalability, and user experience. The platform launched its testnet in April 2023, followed by an open beta in July 2023. Since then, it has rapidly evolved, earning recognition as a promising solution for professional traders seeking advanced trading capabilities in the decentralized ecosystem.

The standout feature of Aark Digital is its innovative Automated Market Maker (AMM) architecture, known as Parallel Market Maker (PMM). Unlike traditional AMM models, which can suffer from inefficiencies and poor liquidity for less-traded assets, PMM replicates real-world liquidity patterns from top centralized exchanges. This ensures tighter spreads and lower price impacts for traders. The PMM design also facilitates arbitrage opportunities, enabling traders to profit from price inefficiencies across over 300 asset pairs, including long-tail assets that other exchanges often ignore.

Aark Digital caters not only to traders but also to liquidity providers (LPs). The platform allows LPs to deposit a single asset—such as stETH, BTC, or USDC—into the Aark Liquidity Pool (ALP), eliminating the need for multi-asset exposure. Additionally, the platform offers leveraged LP options, enabling users to amplify their positions by up to 5x, significantly enhancing potential returns. This single-sided liquidity provision and leveraged LP design ensure that LPs can maximize their capital efficiency while minimizing directional risks.

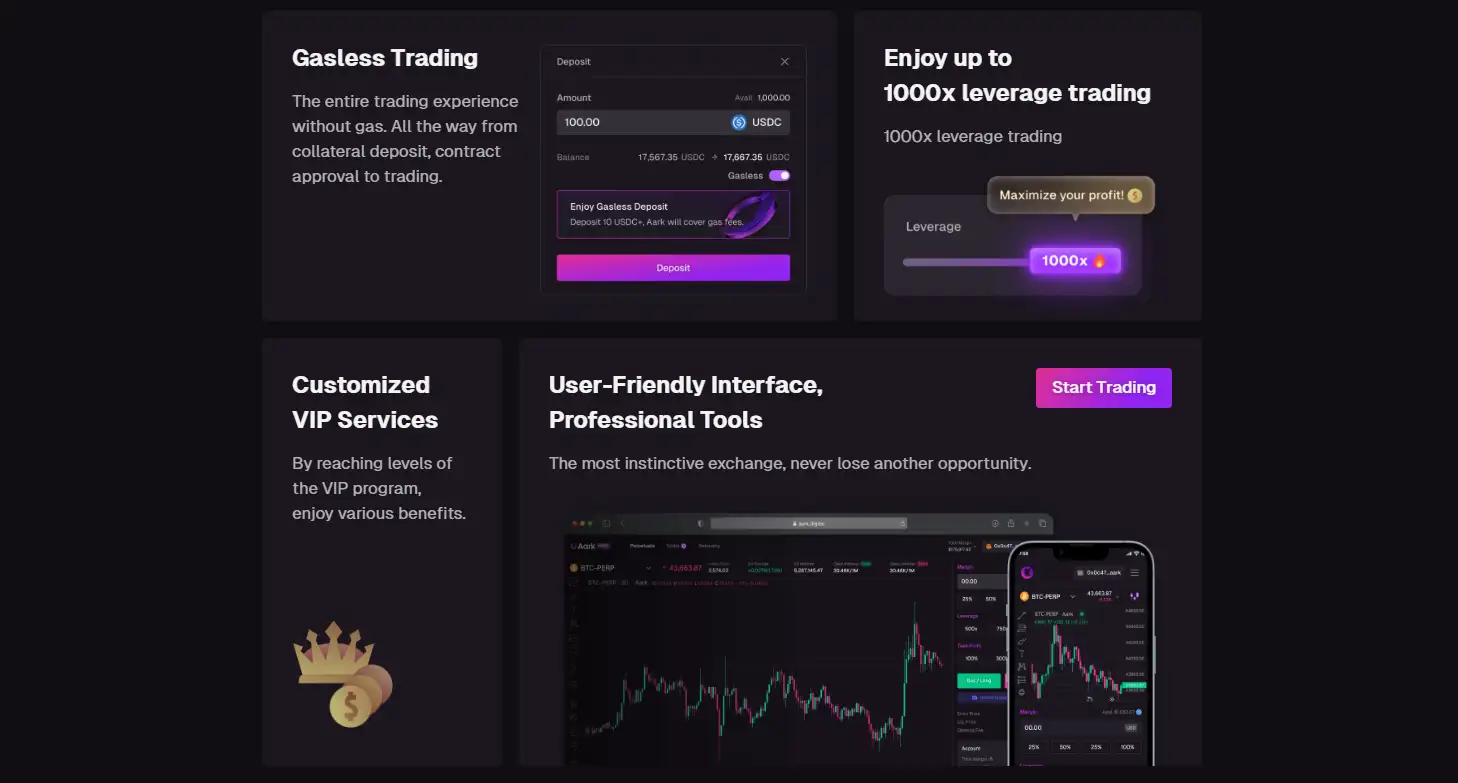

The platform’s trading infrastructure is built to support highly leveraged perpetual trading, offering leverage of up to 1000x for certain long-tail assets. This appeals to professional traders who require access to high-risk, high-reward trading opportunities in an efficient and scalable manner. Aark Digital’s advanced technology ensures low latency and a seamless trading experience, rivaling the performance of centralized platforms.

Competitors in this space include:

- GMX - A decentralized platform offering perpetual swaps and spot trading.

- dYdX - A popular DEX specializing in perpetual contracts and derivatives.

However, Aark Digital differentiates itself through its PMM architecture, superior liquidity depth, and support for an extensive range of asset pairs. Read about Aark Digital's innovations.

- Leveraged Perpetual Trading: Access up to 1000x leverage across a broad range of assets, including long-tail pairs. This feature is designed for professional traders seeking high-risk, high-reward opportunities.

- Parallel Market Maker (PMM): A unique AMM architecture that replicates liquidity from centralized exchanges, reducing slippage and enabling arbitrage.

- Single-Sided Liquidity Provision: Liquidity providers can deposit stETH, BTC, or USDC without requiring multi-asset exposure.

- Leveraged Liquidity Provision: Amplify liquidity positions up to 5x for higher APRs. Learn more.

- Community Governance: AARK token holders can propose and vote on protocol changes.

Getting started with Aark Digital is simple. Follow these steps to begin:

- Create a Wallet: Set up a cryptocurrency wallet such as MetaMask or Trust Wallet. Ensure it supports the Arbitrum network.

- Connect to Arbitrum: Add the Arbitrum network to your wallet either manually or through tools like Chainlist.

- Fund Your Wallet: Deposit assets like ETH or USDC. Ensure you have ETH for gas fees.

- Visit Aark Digital: Go to Aark Digital's official site and connect your wallet.

- Start Trading: Access leveraged perpetual contracts or provide liquidity in the ALP.

- Stake AARK Tokens: Stake AARK to earn rewards, fee discounts, and governance rights.

For detailed guides, visit the official Aark Digital documentation.

Aark Digital FAQ

Aark Digital’s Parallel Market Maker (PMM) is an innovative architecture designed to replicate real-world liquidity from centralized exchanges. Unlike traditional AMMs that rely solely on constant product formulas, PMM ensures tighter spreads and reduced slippage for traders by mirroring centralized liquidity dynamics. This approach also facilitates arbitrage opportunities across 300+ asset pairs, including long-tail assets.

Single-sided liquidity provision allows users to deposit one asset, such as stETH, BTC, or USDC, without needing to pair it with another. This reduces exposure to impermanent loss and simplifies the process for liquidity providers. By leveraging Aark Digital’s Liquidity Pool (ALP), providers can earn rewards while maintaining capital efficiency.

Aark Digital utilizes its unique PMM architecture to aggregate liquidity across a broad range of assets, including long-tail pairs. The PMM system mirrors liquidity from top centralized exchanges, ensuring reduced price impact and more trading opportunities. This approach addresses the challenges of illiquid markets and opens up possibilities for traders and arbitrageurs.

The AARK token is central to Aark Digital’s community-driven governance model. Token holders can propose and vote on protocol changes, ensuring the platform evolves based on user needs. Additionally, staking AARK offers benefits like rewards and fee discounts, incentivizing active participation.

Liquidity providers on Aark Digital can utilize leveraged liquidity options to amplify their positions by up to 5x. This feature increases potential annual percentage rates (APRs) while maintaining flexibility. By depositing into the ALP, providers can balance risk and reward efficiently.

You Might Also Like