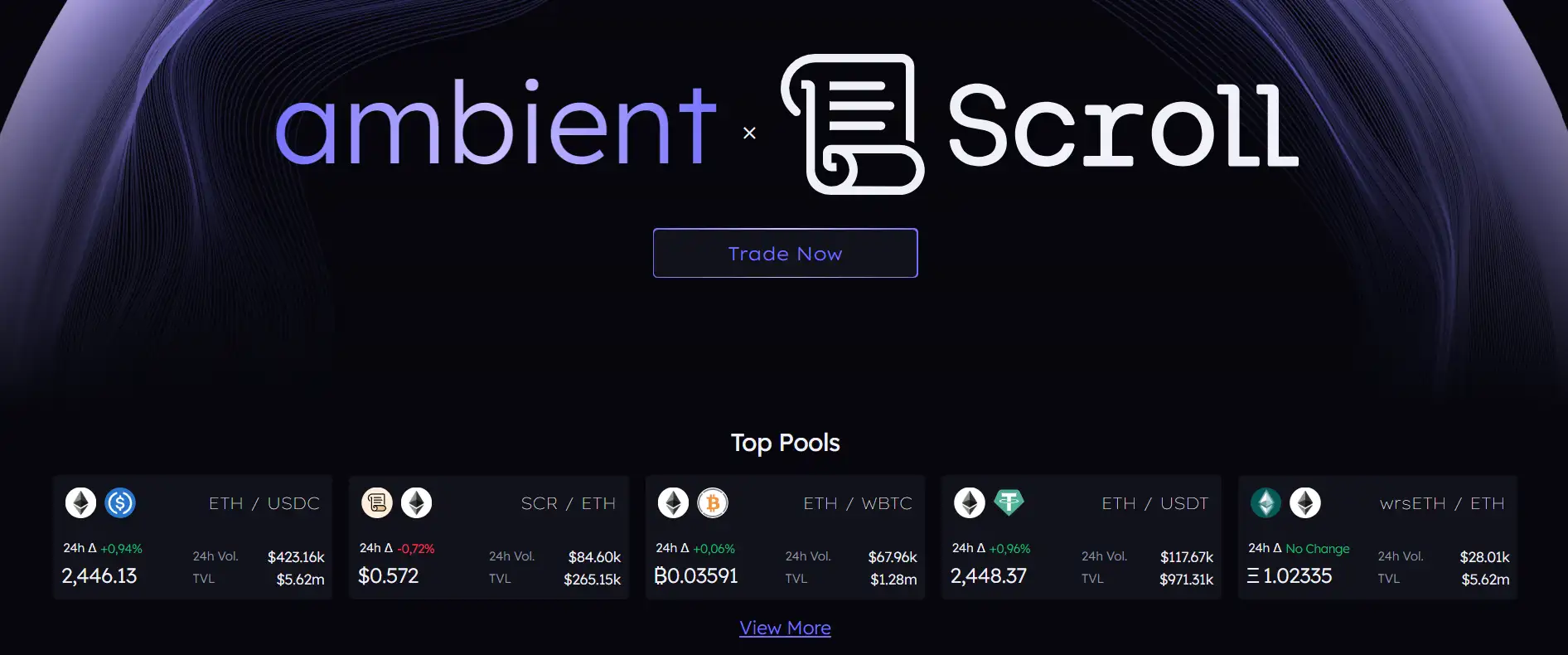

About Ambient Finance

Ambient Finance is a cutting-edge decentralized exchange (DEX) protocol that integrates concentrated and ambient constant-product liquidity into a single platform, delivering unmatched efficiency and functionality for the DeFi ecosystem. With its unique approach, Ambient Finance enables seamless trading across any pair of blockchain assets while significantly reducing gas costs by consolidating all operations into a single smart contract.

The DeFi space has witnessed explosive growth, making the demand for efficient, flexible, and secure trading platforms more important than ever. Ambient Finance addresses this by offering a feature-rich platform tailored to meet the needs of liquidity providers and traders. Through its integration of multiple liquidity types, dynamic fee adjustments, and advanced security mechanisms, it sets a new benchmark in the decentralized exchange sector.

Ambient Finance is an innovative DEX protocol designed to elevate the standards of decentralized trading within the DeFi space. Formerly known as CrocSwap, Ambient Finance stands out due to its unified smart contract architecture, which supports multiple liquidity strategies—concentrated, ambient, and knockout—on a single platform. This unique approach enhances efficiency and reduces operational costs, making it one of the most innovative DeFi platforms.

The platform consolidates all trading and liquidity functions into a single smart contract, reducing gas fees and streamlining operations. This is a stark contrast to traditional DEXs like Uniswap, which require separate smart contracts for individual pools. By enabling multiple liquidity types on a single curve, Ambient Finance maximizes capital efficiency and ensures users can benefit from cost-effective trading and liquidity provision.

Key competitors in the market include SushiSwap and Balancer. However, Ambient Finance differentiates itself through its dynamic fee adjustments, unique liquidity provision methods, and robust security measures. These features position it as a leader in innovation and efficiency in the competitive DeFi space.

Additionally, the platform offers unique functionalities like automatic reinvestment of fees into ambient liquidity, surplus collateral for pre-funding trades, and gasless transactions. Together, these features contribute to a seamless user experience while ensuring the profitability and security of liquidity providers.

Ambient Finance provides several distinct benefits and features that set it apart from other DEX platforms:

- Unified Smart Contract Architecture: Operating within a single smart contract reduces gas fees and improves transaction speed.

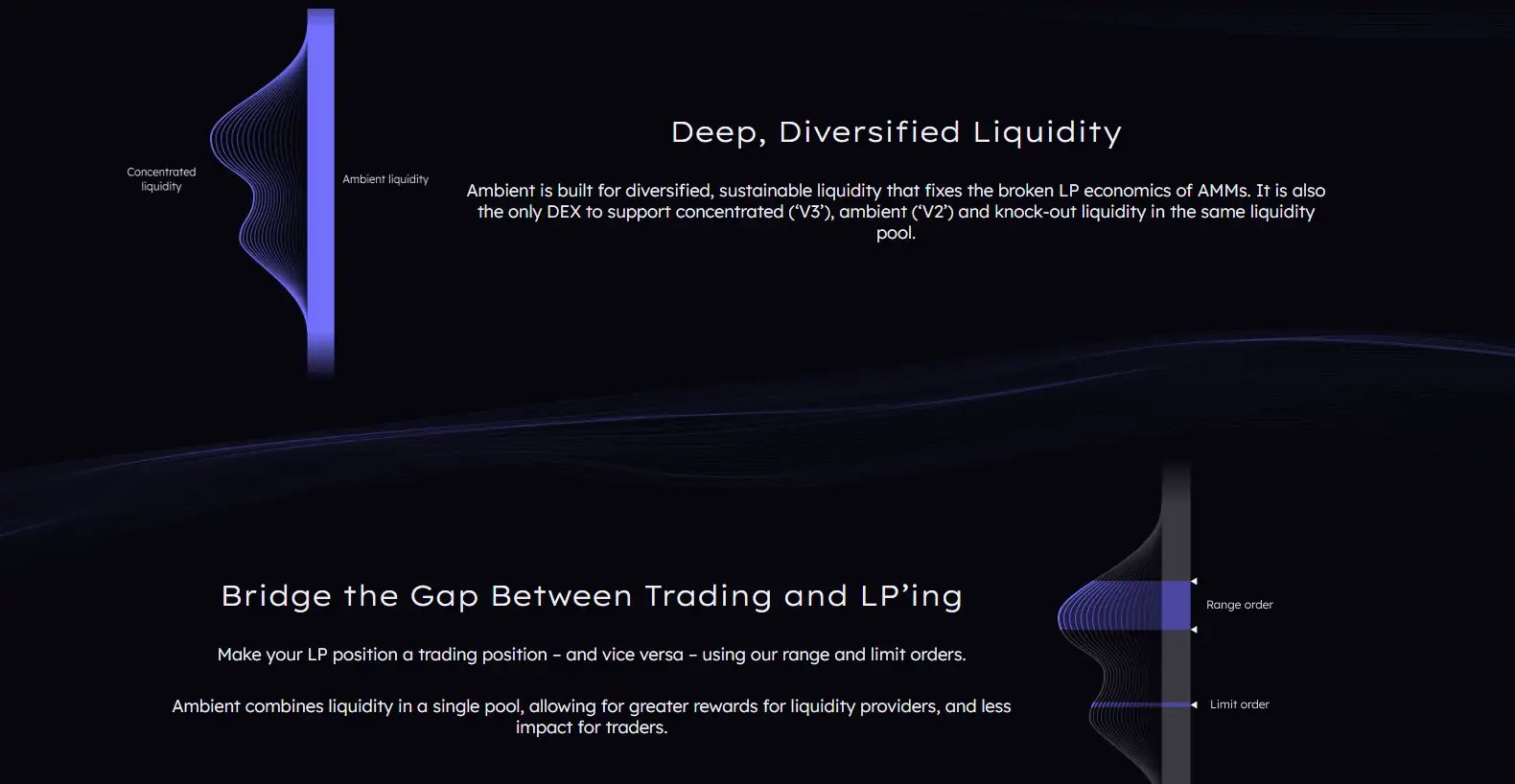

- Multiple Liquidity Types: Supports concentrated, ambient, and knockout liquidity, catering to both advanced and passive users.

- Dynamic Fee Adjustments: Real-time fee adjustments based on market conditions maximize profits for liquidity providers.

- Automatic Reinvestment: Fees from concentrated liquidity are automatically converted into ambient liquidity for compounded returns.

- Surplus Collateral: Allows users to pre-fund trades, reducing on-chain costs and enhancing trading efficiency.

- Gasless Transactions: Supports EIP-712 standard for gasless transactions, enabling fees to be paid in swapped tokens.

Getting started with Ambient Finance is simple and user-friendly. Follow these steps:

- Visit the Website: Go to the official Ambient Finance website.

- Connect Your Wallet: Click on the "Connect Wallet" button and link your preferred Web3 wallet, such as MetaMask.

- Choose a Trading Pair: Browse available trading pairs and select the one you wish to trade.

- Add Liquidity: If you’re a liquidity provider, choose the type of liquidity you want to add (concentrated, ambient, or knockout) and deposit funds into the pool.

- Start Trading: Execute your trades directly through the user-friendly interface.

- Monitor Your Positions: Use the dashboard to track your positions, earnings, and liquidity performance.

For detailed guides and tutorials, visit the Ambient Finance documentation. With its streamlined setup process, Ambient Finance is accessible to both experienced traders and newcomers in the DeFi ecosystem.

Ambient Finance FAQ

Ambient Finance utilizes a unified smart contract architecture that operates entirely within a single contract. This reduces gas fees and improves transaction speeds by eliminating the need for separate contracts for individual pools. Unlike competitors like Uniswap or SushiSwap, this approach minimizes on-chain interactions, making Ambient Finance one of the most efficient platforms in the DeFi ecosystem.

Ambient Finance uniquely supports concentrated, ambient, and knockout liquidity in a single pool, providing flexibility and maximizing capital efficiency. Concentrated liquidity allows targeting specific price ranges, ambient liquidity ensures broad market coverage, and knockout liquidity acts like limit orders. This diversity empowers users to tailor their strategies while maintaining continuous liquidity. Learn more at Ambient Finance.

Ambient Finance implements robust security measures to counter just-in-time liquidity attacks. By enforcing minimum time-to-live (TTL) parameters on concentrated liquidity, it ensures that liquidity providers earn fair fees without being undercut by opportunistic actors. This enhances trust and profitability for liquidity providers on Ambient Finance.

Ambient Finance employs real-time fee adjustments through external policy oracles. This dynamic fee structure ensures that fees adapt to market conditions, optimizing returns for liquidity providers while maintaining competitive trading costs for users. This approach differentiates Ambient Finance from platforms with static fee structures, like Balancer.

Yes, Ambient Finance supports gasless transactions using the EIP-712 off-chain standard. This enables users to pay transaction fees in the swapped token instead of native blockchain tokens, significantly enhancing accessibility. For more details, visit Ambient Finance.

You Might Also Like