About Amnis Finance

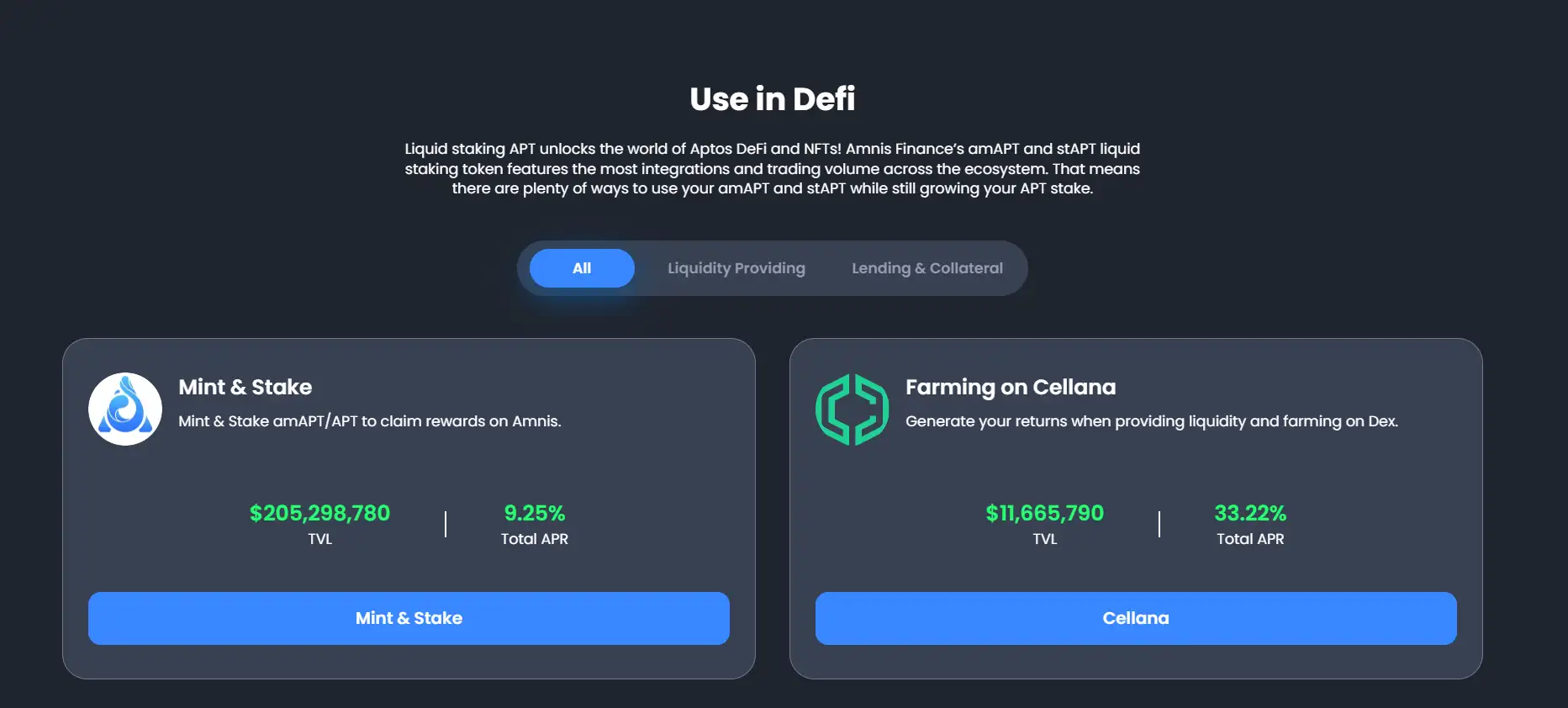

Amnis Finance is a groundbreaking liquid staking protocol designed to address the inefficiencies of traditional staking mechanisms on the Aptos blockchain. It empowers users to stake their APT tokens without sacrificing liquidity, offering a seamless way to maximize staking rewards. By providing a liquid staking mechanism, Amnis allows users to stake their APT tokens and receive equivalent representations in the form of amAPT and stAPT, which can be utilized across various DeFi applications. This innovative approach enhances the user experience by combining the benefits of staking and liquidity, effectively bridging the gap between security and flexibility.

With a strong focus on community governance, Amnis Finance integrates the AMI governance token, enabling users to influence the protocol’s future development and key decisions. Its zero-fee staking model, coupled with advanced features such as yield tokenization and composability, sets it apart from competitors. Amnis is committed to providing a secure, decentralized, and user-friendly platform. By leveraging its robust infrastructure and integration with the Aptos DeFi ecosystem, Amnis has positioned itself as a leader in the liquid staking space, aiming to redefine the way users interact with staking protocols.

Amnis Finance is a cutting-edge liquid staking protocol that offers an innovative approach to maximizing the utility and flexibility of staked tokens on the Aptos blockchain. Traditional Proof-of-Stake (PoS) mechanisms often lock staked assets, rendering them inaccessible for other financial activities. Amnis Finance addresses this limitation by introducing a two-token liquid staking model: amAPT, a token pegged 1:1 to staked APT, and stAPT, a yield-bearing token that accumulates staking rewards over time.

The journey of Amnis Finance began with a mission to revolutionize staking by removing barriers such as asset illiquidity and inefficiency. Users staking APT through Amnis receive amAPT, which can be further staked to generate stAPT. This system provides unparalleled flexibility, allowing users to earn staking rewards while actively participating in Aptos DeFi applications. With an estimated annual return of 7%, stAPT not only accrues rewards but also serves as a gateway for users to explore various DeFi opportunities.

One of the defining features of Amnis Finance is its zero-protocol-fee structure. Unlike competitors such as Pontem Network and LiquidSwap, Amnis ensures that users retain the full benefits of staking without any deductions. Additionally, Amnis Finance emphasizes security, having undergone extensive audits by trusted firms like Movebit and Verichains. This commitment to safety builds trust among its users and solidifies its position as a reliable platform for liquid staking.

Amnis Finance has also introduced innovative features like yield tokenization, which provides users with greater control over their assets. Through yield tokenization, stAPT can be split into principal tokens (PT) and yield tokens (YT), enabling users to customize their staking strategies to suit their financial goals. Furthermore, the protocol’s emphasis on decentralization is reflected in the governance capabilities provided by the AMI token. Holders of AMI can vote on critical protocol decisions, ensuring that the community remains at the core of Amnis’s development.

Since its launch, Amnis Finance has rolled out initiatives such as the Amnis Retroactive Airdrop to reward early adopters and encourage ecosystem growth. Its integration with Aptos DeFi platforms and partnerships with other protocols demonstrate its commitment to creating a comprehensive and accessible liquid staking solution. By eliminating the traditional constraints of staking and offering advanced features, Amnis Finance is positioned as a leader in the liquid staking space.

- Liquid Staking: Stake your APT tokens and receive amAPT, maintaining liquidity to engage in other DeFi applications.

- Yield-Bearing Tokens: stAPT allows users to earn approximately 7% APR, with rewards accruing automatically over time.

- Zero Protocol Fees: Amnis Finance ensures users receive maximum staking returns without any deductions.

- Yield Tokenization: Split stAPT into principal tokens (PT) and yield tokens (YT) for customized investment strategies.

- Governance Participation: AMI token holders can influence protocol decisions, ensuring a decentralized and community-driven development process.

- Security Audits: Thoroughly audited by trusted firms, ensuring a safe and reliable staking experience.

Getting started with Amnis Finance is simple and straightforward. Here’s a step-by-step guide:

- Visit the official Amnis Finance platform and connect your wallet. Ensure you have an Aptos-compatible wallet such as Martian Wallet or Pontem Wallet.

- Deposit your APT tokens into the platform's staking pool. Once deposited, you will receive amAPT, representing your staked tokens.

- Optionally, stake your amAPT to earn stAPT, which accrues staking rewards automatically over time.

- Use your amAPT or stAPT across various Aptos DeFi protocols to maximize returns while retaining liquidity.

- For governance participation, acquire and hold AMI tokens to vote on protocol decisions.

For detailed guides and tutorials, visit the Amnis Finance documentation.

Amnis Finance FAQ

Amnis Finance stands out due to its innovative dual-token model, offering amAPT and stAPT to users for greater flexibility and liquidity. Unlike other platforms, Amnis provides a zero-protocol-fee structure, ensuring users maximize their staking rewards. Additionally, its focus on yield tokenization, where stAPT can be split into Principal Tokens (PT) and Yield Tokens (YT), provides users with advanced control over their financial strategies. Amnis also emphasizes decentralization through its AMI governance token, allowing community-driven development and decisions. Learn more at Amnis Finance.

Yield tokenization is a unique feature of Amnis Finance that allows users to split stAPT into Principal Tokens (PT) and Yield Tokens (YT). This process offers users greater flexibility in managing their staking rewards and investments. For instance, users can trade PTs or YTs separately in DeFi markets, unlocking liquidity while retaining the ability to earn staking rewards. It’s a groundbreaking innovation that sets Amnis apart from competitors. More details are available in the documentation.

The AMI governance token is central to the decentralized governance of Amnis Finance. It empowers the community to propose and vote on protocol upgrades, development initiatives, and other critical decisions. This ensures that the platform remains community-driven and adaptable to user needs. AMI holders also benefit from alignment with the platform’s growth and long-term vision. For more details, check out the AMI token page.

Amnis Finance prioritizes security by undergoing rigorous audits conducted by reputable firms such as Movebit and Verichains. These audits ensure that the protocol’s smart contracts are free from vulnerabilities and provide a secure staking environment for users. Additionally, the platform adheres to best practices in blockchain security, making it one of the safest choices for APT staking on the Aptos blockchain. You can review the full audit reports in the security section.

amAPT and stAPT are core components of the Amnis Finance ecosystem. amAPT is a liquid staking token pegged 1:1 to staked APT, enabling users to retain liquidity while staking. On the other hand, stAPT is a yield-bearing token that accrues staking rewards over time, with an approximate annual return of 7%. Users can utilize both tokens across Aptos DeFi platforms, enhancing their financial flexibility and earning potential. Find out more in the protocol documentation.

You Might Also Like