About Amped Finance

Amped Finance is a next-generation decentralized trading platform designed to reshape the landscape of on-chain finance. By combining the power of AI-driven agents with highly efficient decentralized infrastructure, it enables users to experience lightning-fast perpetual and spot trading with integrated liquidity rewards. Focused on creating an inclusive and permissionless trading ecosystem, Amped Finance leverages advanced mechanisms like zero gas fees, multi-token economics, and omnichain accessibility.

The project is aligned with the evolving concept of the Agentic Economy, where AI agents autonomously interact with DeFi systems. By integrating key partners like LayerZero, LightLink, and Berachain, Amped Finance positions itself at the intersection of cutting-edge DeFi and automated smart trading. It aims to empower both seasoned traders and liquidity providers through an open, transparent, and community-governed platform.

Amped Finance was conceived as a response to the increasing complexity and inefficiencies in existing decentralized exchanges. With its core focus on perpetuals and spot trading, Amped Finance introduces a platform that is gasless, fast, and capable of offering up to 100x leverage on major crypto assets like ETH and BTC. Operating on EVM-compatible chains such as LightLink, Sonic, and Berachain, the project ensures cross-chain operability with deep liquidity pools and a high-yield staking ecosystem.

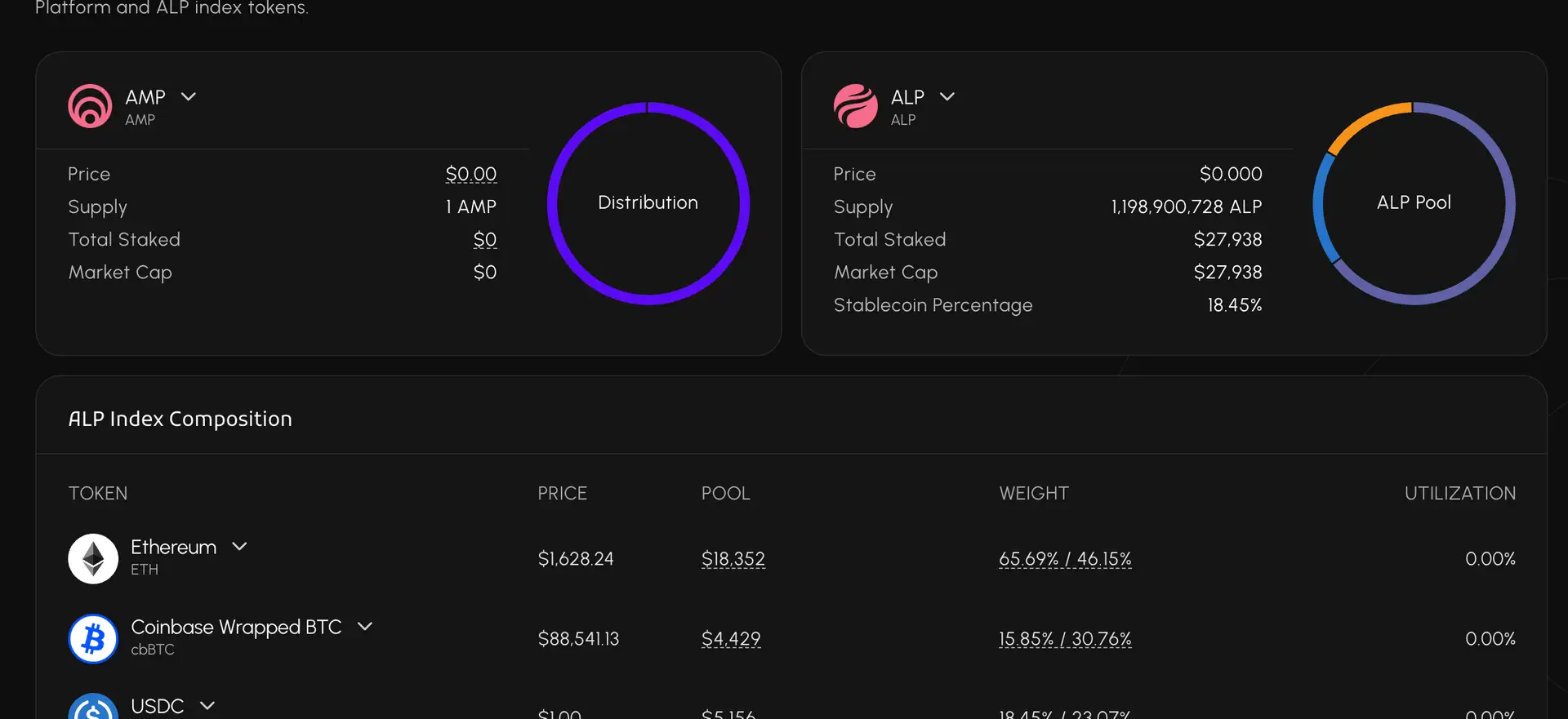

The platform’s architecture is powered by three major tokens: AMP, esAMP, and ALP. These tokens interact through a cyclical model of staking, vesting, and liquidity provision. Traders pay platform fees in ETH, which are distributed to AMP and ALP stakers. Staking AMP and ALP earns esAMP, which is then either vested or re-staked, creating a sustainable ecosystem for yield farming and governance.

Amped Finance’s strength lies in its robust reward mechanisms. Liquidity providers earn 70% of all trading and swap fees through ALP tokens, which are automatically staked. AMP holders enjoy a share of protocol earnings and multiplier points that increase APR without introducing inflation. This structured reward economy has been crafted to benefit long-term users and enhance platform stability.

One of the major innovations of Amped Finance is its emphasis on the agentic economy, enabling AI trading agents to interact with the platform autonomously. Combined with omnichain integration via LayerZero and interoperability with other DeFi systems, Amped enables seamless trading across multiple networks without compromising on performance or user experience.

Security is also a core component. The smart contracts are audited and derived from GMX’s trusted codebase with additional improvements. Transparent governance mechanisms backed by AMP allow users to vote on protocol changes and treasury decisions. Community is central, with active participation via Discord, Telegram, and governance proposals.

Competitor platforms include GMX, dYdX, and Perpetual Protocol. However, Amped Finance differentiates itself through its gasless trading model, AI integration, and multi-token staking incentives.

Amped Finance offers numerous features and advantages that distinguish it in the decentralized trading space:

- Gasless Trading Experience: Users can trade without incurring gas fees, significantly reducing friction and making frequent trading economically viable.

- AI-Powered Automation: Designed for the agentic economy, Amped allows integration with AI trading bots that execute transactions autonomously.

- Multi-Token Reward Ecosystem: The combination of AMP, esAMP, and ALP creates a reward loop that incentivizes long-term staking and liquidity provision.

- Omnichain Liquidity Pools: Users can provide liquidity across multiple networks, including LightLink, Sonic, and Berachain, with risk-adjusted rewards and no impermanent loss.

- Transparent and Secure: Built from a GMX-forked codebase and audited by Block Apex, ensuring a reliable and secure smart contract infrastructure.

- Mobile-Friendly UI: The responsive platform allows trading on the go, making it accessible from any device.

Amped Finance makes it simple for users to start trading or providing liquidity with the following steps:

- Connect Your Wallet: Visit Amped Finance and click “Connect Wallet.” Supported wallets include MetaMask, Trust Wallet, WalletConnect, and Coinbase Wallet.

- Start Spot or Perpetual Trading: Use the “Trade” tab to open spot trades between ETH, WBTC, USDT, and USDC, or leverage positions with up to 100x on perpetual contracts.

- Provide Liquidity: Head to the “Earn” section. Select your network and deposit supported tokens (ETH, USDC, WETH, etc.) to receive ALP tokens.

- Stake AMP: Stake your AMP tokens to earn esAMP, a share of protocol fees, and multiplier points. These boost your yield and enhance governance power.

- Claim Rewards: Rewards are distributed weekly. Access your “Rewards” tab to claim or compound into additional ALP or stake them for more esAMP.

- Stay Informed: Monitor your positions and rewards through the dashboard. Follow community updates via Twitter, Discord, and Telegram.

Amped Finance Token

Amped Finance Reviews by Real Users

Amped Finance FAQ

Amped Finance is designed for the emerging agentic economy, where users can deploy AI-powered trading bots to execute strategies autonomously. The platform’s smart contracts and UI are bot-compatible, making it possible for agents to trade both perpetual and spot assets with zero gas fees across supported chains. Thanks to integrations with protocols like LayerZero and responsive infrastructure, Amped Finance is one of the few DeFi platforms natively built for AI interaction.

Gasless trading on Amped Finance is possible through its integration with chains like LightLink, which absorb transaction fees for end users. This experience extends to perpetuals and spot trading, allowing users to transact without worrying about fluctuating gas costs. Transactions are routed seamlessly using omnichain technology like LayerZero, enabling cross-network efficiency and a smoother experience for both casual traders and AI agents.

ALP tokens are tied to specific networks, so staking on one chain (e.g., Berachain) means you only earn a share of protocol rewards generated on that chain. If you trade on a different network, such as LightLink, those actions don’t contribute to your ALP-based earnings unless you also stake on that chain. To optimize your yield, Amped Finance recommends diversifying your ALP provision across the networks where you expect the most activity and trading volume.

Multiplier Points increase your staking yields by enhancing ETH rewards without inflating the supply of AMP. They accumulate every second during AMP or esAMP staking, offering compounding effects on your total yield. The more points you have, the higher your effective APR, especially when staking for longer periods. On Amped Finance, these points remain until AMP is withdrawn, at which point a proportional burn occurs to maintain economic balance.

Yes, token weights directly influence deposit fees and rewards on Amped Finance. Assets that are underweight in the liquidity pool have lower deposit fees and generate more favorable minting conditions for ALP, while dominant assets may incur higher fees. The system adjusts dynamically to hedge ALP holders based on open positions. By monitoring the Dashboard and ALP Buy Page, users can maximize returns and avoid unnecessary penalties during liquidity provision.

You Might Also Like