About ApeX Protocol

ApeX Protocol is a cutting-edge decentralized trading platform that offers a high-performance, self-custody trading experience. The platform is designed to cater to both novice and experienced traders by providing a user-friendly interface combined with the robust security and transparency features inherent in decentralized exchanges (DEXs). ApeX aims to bridge the gap between centralized exchanges (CEXs) and DEXs by delivering an experience that rivals traditional trading platforms while preserving the principles of decentralization.

The mission of ApeX Protocol is to empower traders by offering them full control over their assets without compromising on speed or functionality. The platform’s architecture is designed to be highly scalable, accommodating a wide range of trading pairs and markets, including perpetual contracts, which are a cornerstone of its offering. Through its unique modular design, ApeX ensures that it remains adaptable to the evolving needs of its users and the broader market.

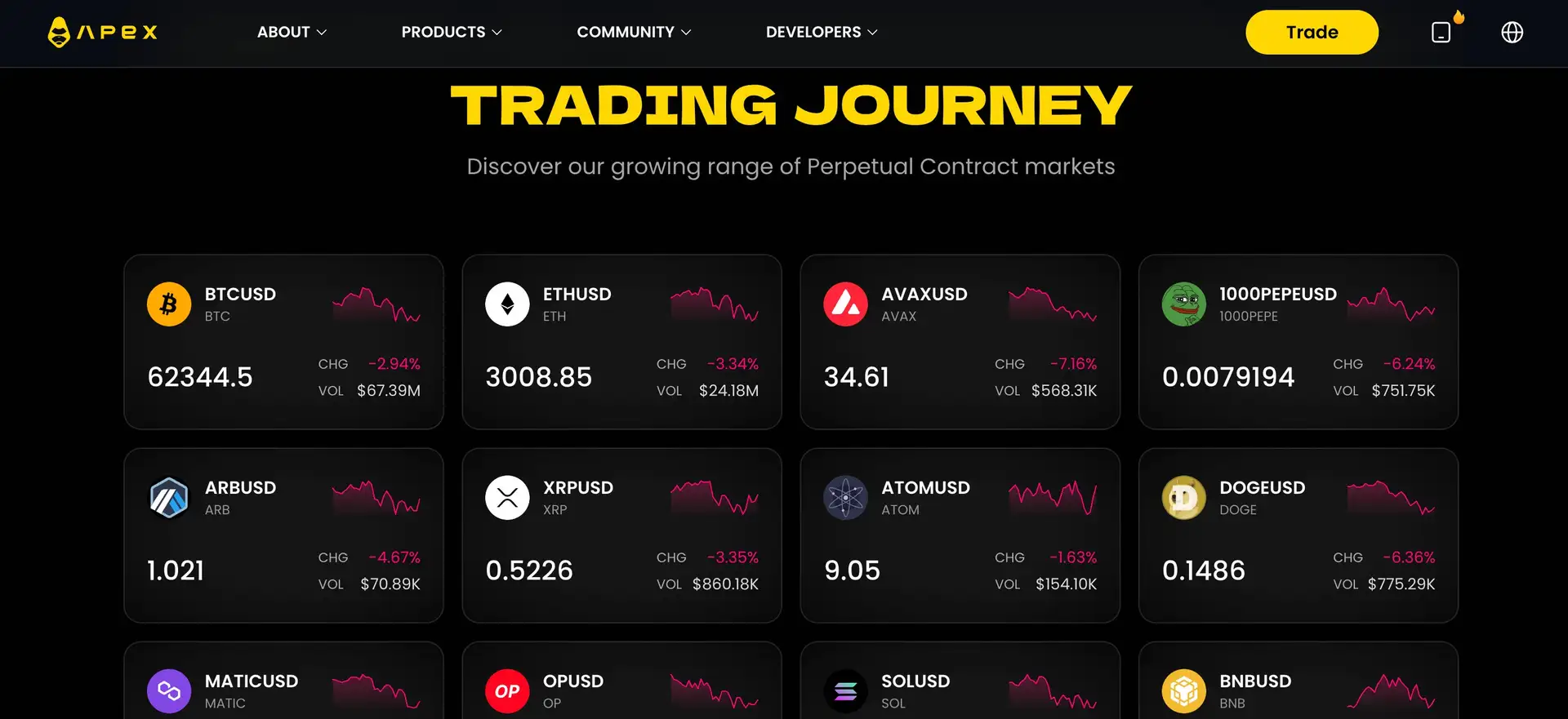

ApeX Protocol is a comprehensive decentralized exchange (DEX) platform offering both spot and derivatives trading. Since its inception, ApeX has undergone significant evolution, leading to the development of ApeX Omni, the latest version that aggregates multichain liquidity to provide a seamless trading experience across various blockchain networks. This approach allows the platform to offer low fees, minimal slippage, and a broad range of trading products, making it a versatile option for traders of all levels.

The ApeX Protocol operates with a modular architecture that enhances its flexibility and allows for quick adaptation to market demands and technological advancements. This modularity also supports cross-chain trading, enabling users to trade assets across different blockchains without the need for complex bridging processes. The platform’s architecture is designed to support high-frequency trading with minimal latency, ensuring that users can execute trades with precision and efficiency.

One of the key features of ApeX is its focus on security and user control. The platform employs zk-proofs to ensure that users retain full control over their assets, even as they engage in complex trading activities. This level of security, combined with the platform’s decentralized nature, provides a strong alternative to traditional centralized exchanges, which are often vulnerable to hacks and other security breaches.

In addition to its trading features, ApeX offers a robust staking program. Users can stake APEX and esAPEX tokens to participate in revenue sharing, earning yield in USDC. This staking mechanism is designed to reward long-term participants and align their interests with the overall success of the platform. The revenue-sharing model ensures that those who contribute to the platform's liquidity and stability are fairly compensated.

The ApeX Protocol has a clear and ambitious roadmap. Future developments include the introduction of new staking options, the deployment of grid trading bots, and a token supply reduction plan aimed at increasing the scarcity and value of the APEX token. These initiatives are designed to keep the platform at the forefront of the DeFi space.

In the competitive landscape, ApeX stands out by focusing heavily on derivatives and perpetual contracts. Competing platforms include Uniswap and SushiSwap, which also offer decentralized trading solutions, though they primarily focus on spot trading and do not offer the same depth in derivatives trading as ApeX.

- Decentralized and Self-Custody: Users maintain full control over their assets, ensuring security and transparency.

- High-Performance Trading: Designed for precision trades with minimal latency and high liquidity.

- Multichain Liquidity: Supports seamless trading across multiple blockchain networks with zero gas fees.

- Modular Architecture: Offers flexibility and agility, enabling the platform to quickly adapt to market changes and user needs.

- Staking and Revenue Sharing: Users can stake APEX tokens to earn a share of the platform's revenue, paid in USDC.

- Governance: APEX token holders have voting rights to influence the protocol's future developments and governance.

To begin using the ApeX Protocol, follow these steps:

- Visit the ApeX Exchange Website: Go to ApeX Exchange and connect your crypto wallet (e.g., MetaMask).

- Create an Account: Register for an account on ApeX Pro or ApeX Omni, depending on your trading preference.

- Deposit Funds: Transfer USDC or USDT to your connected wallet to start trading. You can also add liquidity by joining the APEX-ETH liquidity pool.

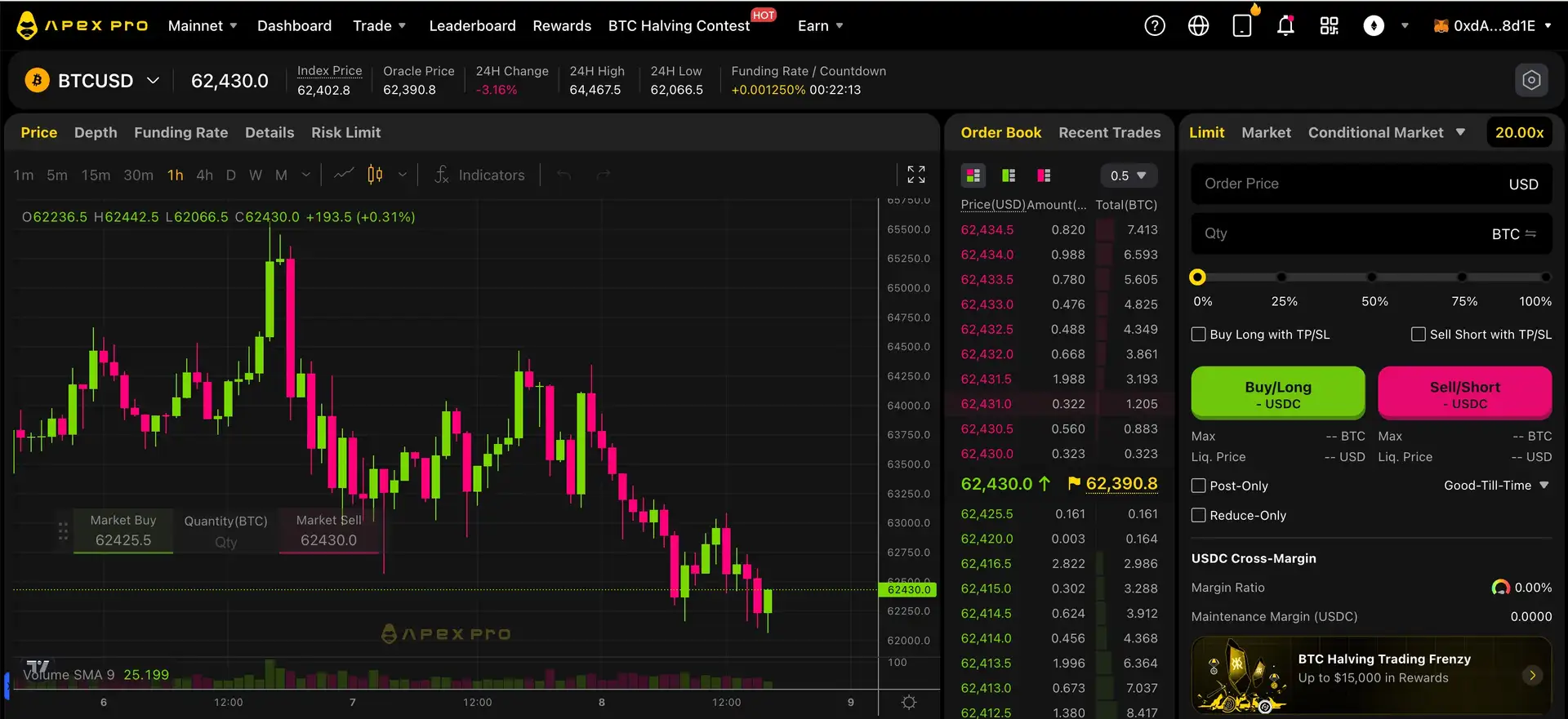

- Start Trading: Explore the various trading markets available, including perpetual contracts for different assets like BTC, ETH, and more.

- Stake APEX: Participate in the staking program by staking APEX or esAPEX tokens to earn rewards in USDC.

- Engage with the Community: Join the ApeX Discord or follow their social channels to stay updated with the latest developments and participate in governance decisions.

For detailed guides and documentation, visit the ApeX Pro Gitbook.

ApeX Protocol Token

ApeX Protocol Reviews by Real Users

ApeX Protocol FAQ

The BANANA token serves as a trade-to-earn reward on ApeX Pro. Users earn BANANA tokens by engaging in trading activities, which can then be used within the platform or traded on various exchanges, thus incentivizing active participation.

To maximize earnings on the ApeX Protocol, users can stake their APEX tokens to participate in the platform's revenue-sharing model, earning yields in USDC. Additionally, providing liquidity to pools and actively trading to earn BANANA tokens are other effective strategies.

Yes, ApeX is designed with a high-performance architecture that supports high-frequency trading. The platform's low-latency environment and deep liquidity pools ensure that trades are executed with precision and minimal slippage.

The ApeX Protocol has an ambitious roadmap that includes the introduction of new staking options, deployment of grid trading bots, and a strategic token supply reduction plan aimed at increasing the value of the APEX token. Stay updated by following their announcements.

The multichain liquidity feature on the ApeX Protocol allows traders to access liquidity from multiple blockchain networks, ensuring low fees and minimal slippage. This makes trading more efficient and flexible compared to single-chain platforms.

You Might Also Like