About Aptin Finance

Aptin is a groundbreaking decentralized, non-custodial liquidity market protocol built on the innovative Aptos blockchain. The platform empowers users to act as depositors or borrowers in a secure, permissionless environment. By providing seamless and transparent access to decentralized lending and borrowing, Aptin enables participants to earn interest on deposits or acquire liquidity against collateralized assets. This is achieved without the need for intermediaries, ensuring a fully decentralized financial ecosystem.

The mission of Aptin is to revolutionize the decentralized finance (DeFi) space by leveraging the unique capabilities of the Aptos network. With enhanced scalability, reduced transaction fees, and a strong focus on user security, Aptin is set to redefine how lending and borrowing are conducted in the blockchain industry. By focusing on innovation and inclusivity, Aptin contributes significantly to expanding the DeFi ecosystem, providing financial tools to a broader audience worldwide.

Aptin Finance, developed by the AptinLabs Foundation, is an advanced lending and borrowing protocol designed to thrive on the scalable and efficient Aptos blockchain. Since its inception, Aptin has positioned itself as a leader within the DeFi ecosystem by combining algorithmic mechanisms with user-friendly functionality. This enables users to lend assets to earn interest and borrow funds against supplied collateral in a decentralized manner.

One of the key highlights of Aptin is its integration with the robust Aptos ecosystem, leveraging its cutting-edge technology to ensure lightning-fast transactions, low fees, and a seamless user experience. This level of optimization makes Aptin stand out compared to platforms like Aave and Compound, which primarily operate on Ethereum and other blockchains. With the flexibility to support a wide range of assets, Aptin appeals to both retail and institutional participants in the DeFi sector. The platform also integrates extensive risk management features, including liquidation thresholds, health factors, and interest rate models, ensuring user funds are secure while the protocol remains resilient.

Moreover, Aptin plays a pivotal role in enabling liquidity across multiple decentralized ecosystems. Its advanced tokenomics and rewards mechanisms, such as the Points Program, incentivize active participation and loyalty within the network. The inclusion of comprehensive documentation, tutorials, and support ensures accessibility for all users, whether seasoned DeFi veterans or newcomers. While platforms like Aave, Compound, and Venus offer competitive features, Aptin's focus on speed, cost-efficiency, and user-centric design uniquely positions it as a transformative solution in the DeFi space.

Aptin offers a comprehensive suite of features that make it a standout platform in the DeFi industry:

- Decentralized & Non-Custodial: Users retain full control of their funds, ensuring complete ownership and minimizing counterparty risks.

- Algorithmic Interest Rates: Automatically adjusts based on supply and demand to provide fair and efficient rates for both lenders and borrowers.

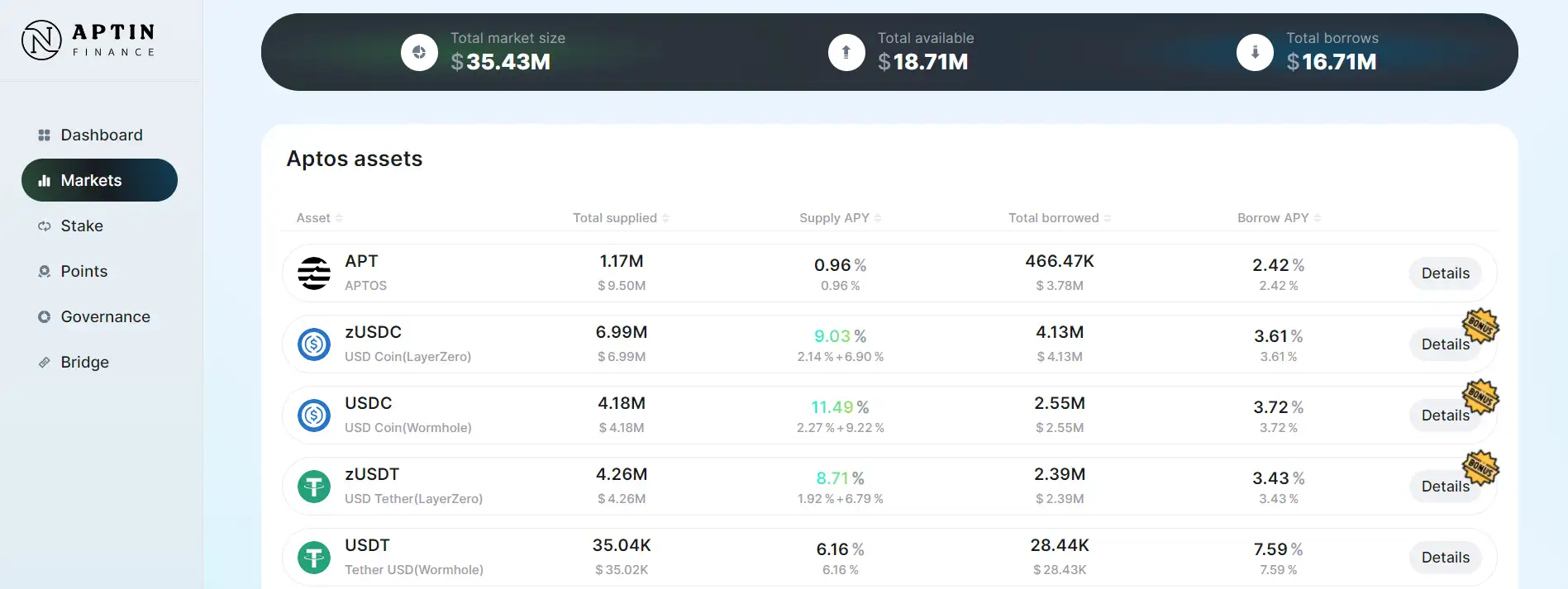

- Multi-Asset Support: Enables lending and borrowing of various assets, including stablecoins, governance tokens, and more.

- Aptos Network Integration: Enhanced transaction speeds and reduced fees make it a preferred choice for efficient DeFi operations.

- Advanced Risk Management: Incorporates liquidation thresholds, health factors, and detailed analytics to ensure user funds are secure.

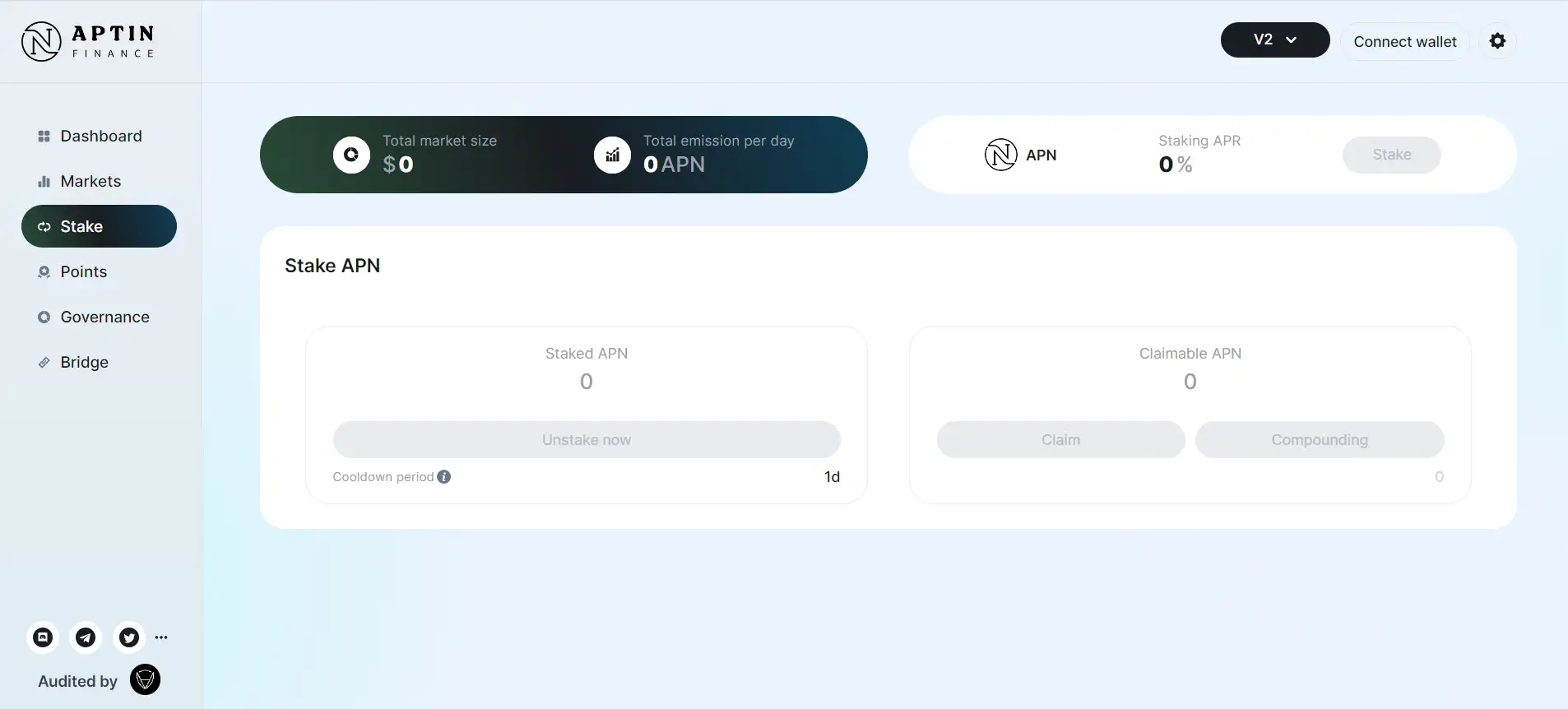

- Points Program: Rewards active users with points that can be used to access additional benefits and incentives within the platform.

Getting started with Aptin is straightforward, even for new users in the DeFi space:

- Set Up an Aptos Wallet: Install a wallet that supports the Aptos blockchain, such as Martian Wallet or Pontem Wallet. Ensure the wallet is properly secured and backed up.

- Fund Your Wallet with APT Tokens: Obtain APT tokens for transaction fees by purchasing them on exchanges or using testnet faucets if you’re exploring the platform in a test environment.

- Visit the Aptin Platform: Head to https://app.aptin.io and connect your wallet.

- Deposit Assets: Select from the available assets in your wallet and deposit them into the Aptin protocol to earn interest on your funds.

- Borrow Assets: Once you’ve provided collateral, borrow other assets based on your loan-to-value ratio. Manage your borrowed funds wisely to avoid liquidation.

- Track and Optimize: Regularly monitor your positions, including supplied and borrowed assets, to maintain a healthy status. Withdraw your funds or repay loans as needed.

For a detailed step-by-step guide, check the official documentation at Aptin Documentation.

Aptin Finance FAQ

Aptin distinguishes itself by operating on the highly scalable and efficient Aptos blockchain, enabling faster transactions and lower fees compared to platforms on Ethereum. Additionally, it offers advanced risk management tools, an innovative Points Program for rewarding users, and extensive support for diverse assets. The algorithmic interest rate model ensures a fair balance between supply and demand, making Aptin a cutting-edge solution in the decentralized finance space. Learn more here.

The Points Program on Aptin rewards users for active participation on the platform. By supplying assets, borrowing, or interacting with the protocol, users earn points that can be redeemed for exclusive benefits and incentives within the Aptos ecosystem. This feature not only encourages user engagement but also enhances loyalty within the platform. For details on how to maximize your rewards, visit Aptin Points Program.

Yes, Aptin is designed to be beginner-friendly. With comprehensive guides, tutorials, and an intuitive interface, users with little or no experience in DeFi can easily get started. By following a step-by-step process to set up a wallet, fund it with APT tokens, and interact with the protocol, new users can participate confidently. Learn more from the official documentation: Getting Started with Aptin.

Aptin prioritizes user security through robust risk management mechanisms, including health factors, liquidation thresholds, and advanced smart contract auditing. These measures minimize risks such as liquidation and ensure that the protocol operates securely and reliably. Moreover, the non-custodial design ensures that users maintain full control over their assets at all times. Visit Aptin's official site for more details on security protocols.

If your collateral’s value falls below the required liquidation threshold on Aptin, your position becomes at risk of liquidation. In such cases, a portion of your collateral may be sold to cover the outstanding loan balance, ensuring that the protocol remains solvent. Users are encouraged to monitor their health factor and supply additional collateral if needed to avoid liquidation. Detailed risk management guidelines are available at Aptin Liquidation Policies.

You Might Also Like