About Argo Finance

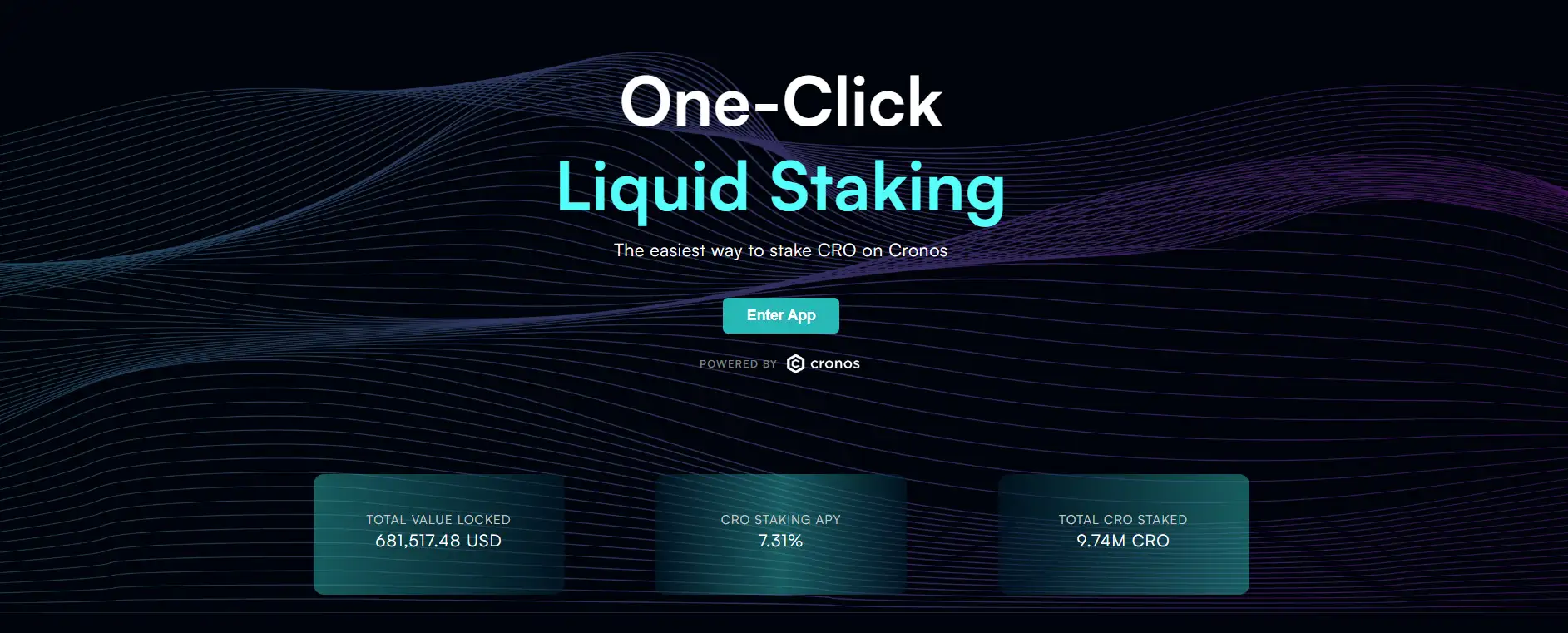

Argo Finance is an innovative liquid staking platform built on the Cronos blockchain. It empowers users to maximize the potential of their CRO tokens by offering a seamless staking mechanism that eliminates the traditional lockup periods associated with staking. By staking CRO tokens on Argo, users receive bonded CRO (bCRO) tokens, which act as liquid derivatives that can be utilized in decentralized finance (DeFi) protocols. This allows users to earn dual rewards—staking yields and additional income from DeFi activities—all while maintaining liquidity.

The mission of Argo Finance is to enhance the capital efficiency of the Cronos ecosystem and to provide users with greater flexibility and profitability. Whether you're a seasoned DeFi participant or a newcomer, Argo's intuitive interface and advanced features make staking accessible to all. By addressing the key challenges of traditional staking—such as locked funds and limited utility—Argo is paving the way for a more dynamic and user-centric staking experience. For further details, visit the official Argo Finance website.

Argo Finance is a revolutionary liquid staking platform in the Cronos ecosystem, offering a robust and efficient solution for unlocking the liquidity of staked CRO tokens. Unlike traditional staking methods that require a 28-day unbonding period, Argo allows users to stake their CRO and receive bonded CRO (bCRO) tokens. These bCRO tokens act as liquid derivatives, preserving the value of the staked CRO while enabling users to access and deploy their liquidity across various DeFi applications.

One of Argo's standout features is its commitment to maximizing capital efficiency. Through its innovative validator delegation strategy, the platform ensures that staked CRO is distributed across a diversified pool of high-quality validators. This approach enhances security, reduces risks, and optimizes staking rewards for its users. The addition of Argo DeFi Vaults further underscores its innovation, providing automated yield optimization strategies such as auto-compounding and yield harvesting, which are essential for users aiming to maximize returns with minimal effort.

Argo is tightly integrated with the expanding Cronos blockchain, which is part of the Crypto.com ecosystem. This synergy enhances the platform’s utility and makes it a critical component of the broader DeFi landscape. By enabling CRO holders to unlock liquidity and earn additional yields, Argo positions itself as a leader in liquid staking solutions, competing with established platforms like Lido Finance and Stader Labs, which offer similar services on other blockchains.

Accessibility and ease of use are key pillars of Argo Finance. The platform is designed with a user-friendly, one-click staking mechanism, making it easy for both new and experienced users to participate in liquid staking and DeFi opportunities. In addition, Argo offers extensive documentation and support to help users navigate the platform effectively. This ensures that even those with minimal technical knowledge can take full advantage of its features.

As the demand for liquid staking solutions grows, Argo Finance is uniquely positioned to meet the needs of CRO holders by providing a seamless and efficient way to stake, unlock liquidity, and maximize rewards. For more details, visit the official Argo Finance website.

Argo Finance offers several significant benefits and features that make it a leading liquid staking platform:

- Liquid Staking: Users can stake their CRO tokens and immediately receive bCRO, eliminating the traditional 28-day unbonding period.

- Enhanced Capital Efficiency: By issuing bCRO, Argo allows users to maintain liquidity and participate in other DeFi activities without losing access to staking rewards.

- Automated Yield Optimization: Argo DeFi Vaults provide automated strategies such as compounding and yield harvesting, simplifying yield farming for users.

- Diversified Validator Delegation: Argo ensures security and optimized returns by delegating staked CRO across a pool of trusted and high-performing validators.

- User-Friendly Interface: The platform is designed to make staking accessible to all users, with a seamless one-click process and detailed guides for setup and usage.

- Integration with DeFi: Argo’s bCRO tokens can be utilized across various DeFi protocols, enabling users to earn additional yields.

Getting started with Argo Finance is simple and designed for both beginners and experienced DeFi users. Follow these steps:

- Set Up a Wallet: Download and configure a wallet that supports the Cronos network, such as MetaMask. Ensure that Cronos is added as a network in your wallet settings.

- Acquire CRO Tokens: Purchase CRO tokens on popular exchanges such as Crypto.com, Binance, or Coinbase, and transfer them to your configured wallet.

- Visit the Argo Finance Website: Navigate to the official Argo Finance platform and click on "Enter App."

- Connect Your Wallet: Use the wallet connect feature on the platform to link your wallet securely. Ensure you approve the connection request.

- Stake CRO: In the staking interface, select the amount of CRO you want to stake. Confirm the transaction in your wallet to receive bCRO tokens.

- Utilize bCRO Tokens: Explore DeFi applications to leverage your bCRO tokens for additional yields, including lending, borrowing, and yield farming opportunities.

For detailed guides and troubleshooting support, refer to the official Argo Finance documentation.

Argo Finance FAQ

Argo Finance offers a liquid staking mechanism that eliminates the 28-day lockup period found in traditional CRO staking. Users receive bCRO tokens, which represent their staked CRO while maintaining liquidity. These tokens can be used in various DeFi protocols for earning additional rewards. This ensures that users no longer have to choose between liquidity and staking rewards, offering a flexible and efficient way to utilize their assets. For details, visit the official Argo documentation.

bCRO is a liquid staking token issued by Argo Finance. It represents staked CRO while allowing liquidity, enabling users to earn staking rewards and use their tokens in DeFi platforms for lending, borrowing, or yield farming. This dual utility combines the benefits of staking with the flexibility of active DeFi participation. Learn more about bCRO and its applications in the Argo documentation.

Argo Finance carefully selects validators based on performance, uptime, and adherence to security best practices. By delegating staked CRO across a diversified pool of trusted validators, Argo minimizes risks and maximizes returns for users. This decentralized and secure approach ensures the safety and profitability of your staked CRO tokens. More details can be found in the official documentation.

Argo Finance’s DeFi Vaults are automated tools that maximize earnings from liquid staking. They utilize strategies like auto-compounding, reinvesting rewards to grow holdings exponentially, and yield harvesting, identifying and leveraging the best earning opportunities. This hands-free approach simplifies the process, allowing users to focus on earning while the system handles optimization. Learn more about DeFi Vaults in the Argo documentation.

Yes, Argo Finance allows a seamless transition between staking and participating in DeFi activities. After staking CRO and receiving bCRO tokens, these tokens can be deployed in lending platforms, liquidity pools, or other DeFi opportunities without waiting for an unbonding period. This flexibility allows users to simultaneously earn staking rewards and participate in dynamic DeFi markets. Check out the Argo documentation for more guidance.

You Might Also Like