About ArtemisFinance

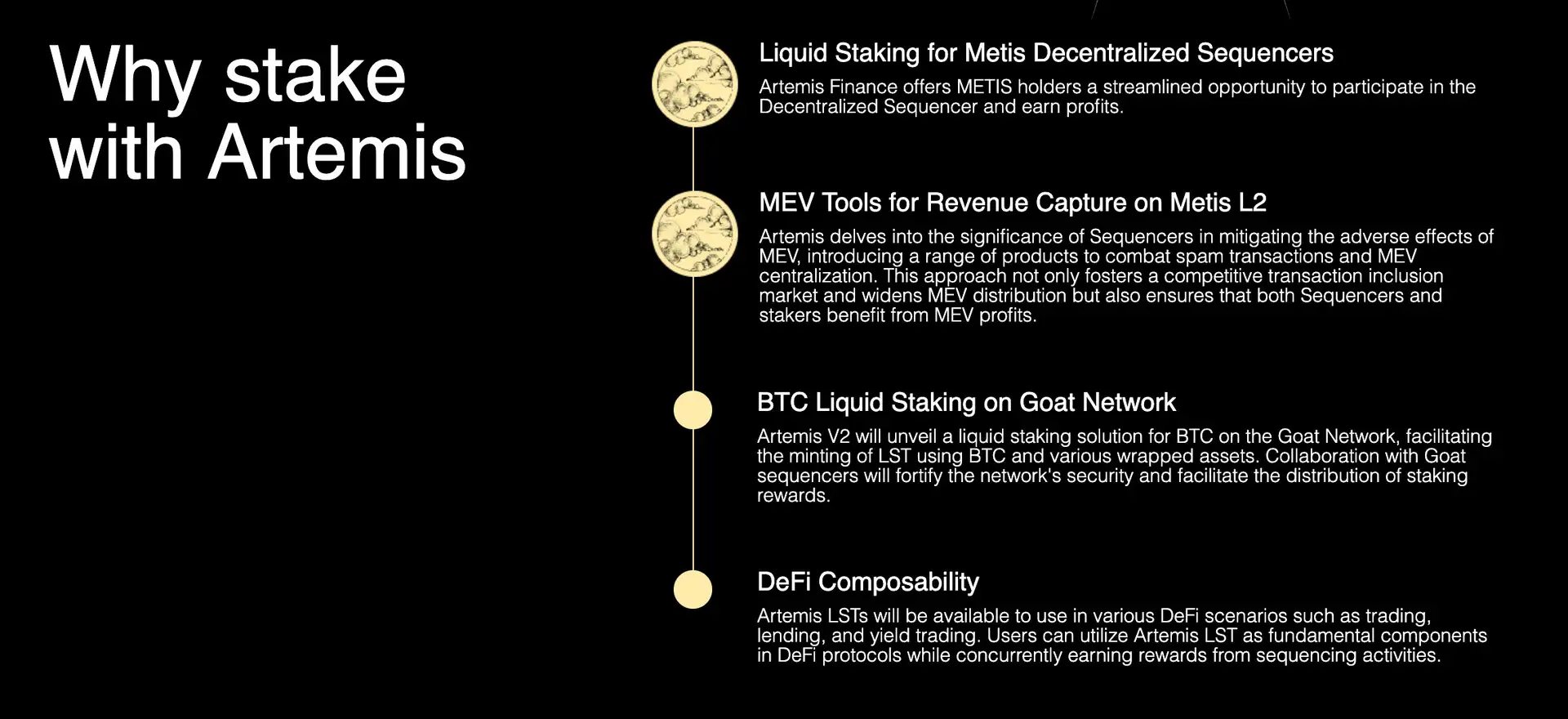

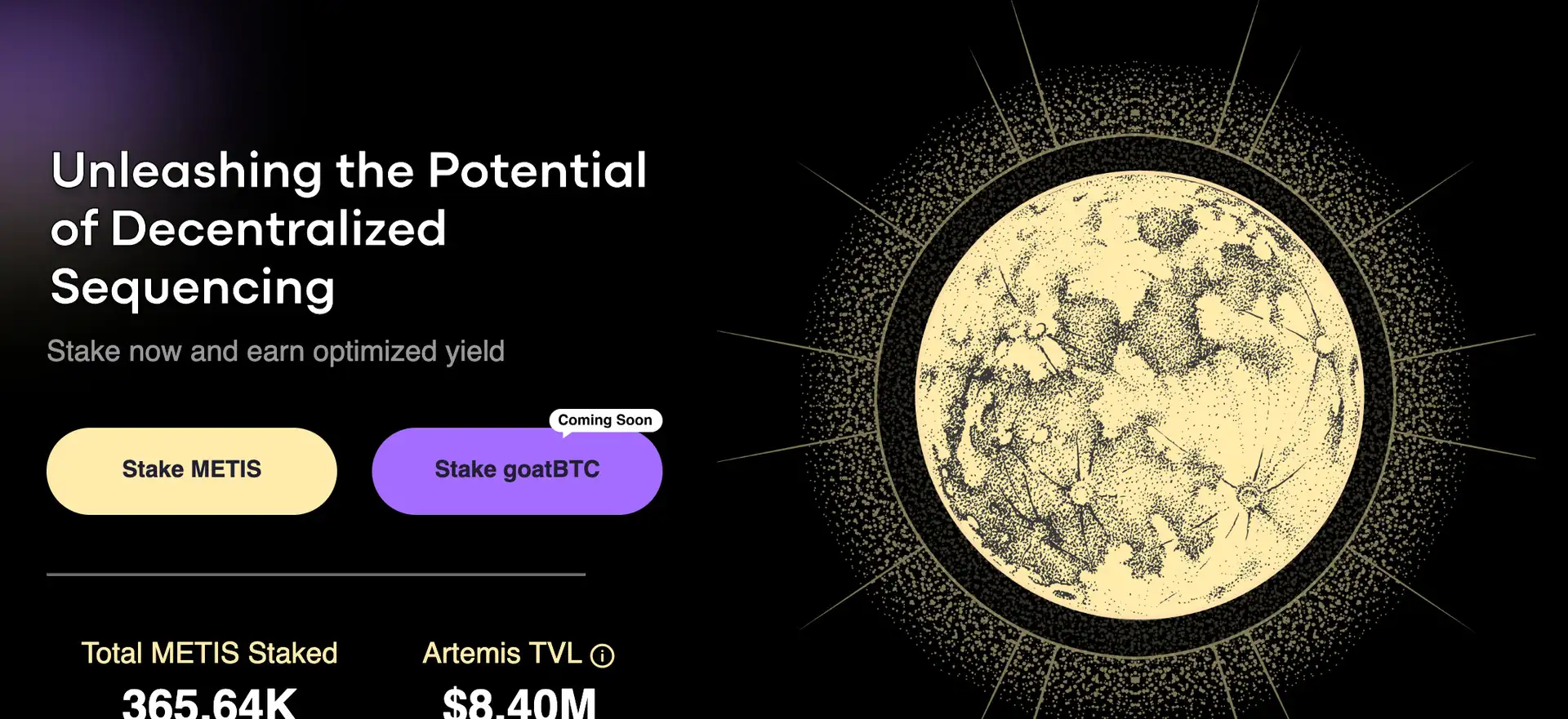

Artemis Finance is a liquid staking protocol built specifically for Metis Decentralized Sequencer Pools. The platform enables METIS holders to stake their tokens, participate in the Decentralized Sequencer, and earn profits. Unlike traditional staking methods, Artemis Finance provides a liquid staking token (artMETIS) that allows users to remain flexible while still earning rewards.

By leveraging sequencer nodes, MEV revenue capture tools, and DeFi composability, Artemis Finance enhances the staking experience by offering yield-optimized staking solutions. The platform also plans to introduce BTC liquid staking on Goat Network, further expanding its decentralized financial services. With a single liquid staking structure, users can maximize their yield while maintaining accessibility and interoperability within the Metis ecosystem.

Artemis Finance is designed to revolutionize staking on Metis L2 by introducing liquid staking solutions that simplify user participation in Decentralized Sequencer Pools. Traditionally, Ethereum Layer 2 (L2) scaling solutions have relied on centralized sequencers, leading to concerns about single points of failure and MEV (Maximal Extractable Value) centralization. Artemis Finance addresses these issues by enabling users to stake their METIS tokens and contribute to the network’s decentralization while earning staking rewards.

The platform aggregates user-staked METIS and directs these assets to Metis Sequencer Nodes, allowing stakers to earn rewards from sequencing activities. To enhance accessibility and composability, Artemis Finance introduces artMETIS, a liquid staking token that represents staked METIS. Holders of artMETIS can use their tokens within DeFi applications, such as DEX trading, lending, borrowing, and yield farming, while still accruing staking rewards.

A key feature of Artemis Finance is its integration with MEV revenue capture tools. MEV refers to the additional value extractable by network participants from transaction reordering, a common issue in decentralized networks. By optimizing MEV capture and redistributing profits among sequencers and stakers, Artemis Finance ensures a more equitable and decentralized financial system.

In addition to METIS staking, Artemis Finance V2 will introduce BTC Liquid Staking on Goat Network. This feature will allow users to mint liquid staking tokens using BTC and wrapped Bitcoin assets. By partnering with Goat Sequencers, Artemis Finance enhances the security and decentralization of Bitcoin staking within the Metis ecosystem.

Several projects offer liquid staking solutions, but Artemis Finance stands out by focusing on Decentralized Sequencer Staking within the Metis Layer 2 ecosystem. Other liquid staking protocols like Lido and Rocket Pool specialize in Ethereum staking, while Stader and Ankr focus on multi-chain staking. Artemis Finance differentiates itself by targeting Metis L2 sequencer staking, optimizing MEV revenue distribution, and integrating deep DeFi composability.

Artemis Finance provides numerous benefits and features that set it apart in the liquid staking and DeFi ecosystem:

- Liquid Staking for METIS: Users can stake METIS and receive artMETIS, a liquid staking token that can be used in DeFi applications while still earning staking rewards.

- Decentralized Sequencer Participation: Staking through Artemis Finance helps decentralize Metis L2 and ensures a more secure and distributed sequencer network.

- MEV Profit Redistribution: Artemis Finance optimizes MEV revenue capture and distributes profits among sequencers and stakers, reducing MEV centralization.

- DeFi Composability: artMETIS can be used in various DeFi scenarios such as trading, lending, and yield farming, allowing users to maximize their capital efficiency.

- BTC Liquid Staking on Goat Network: Future versions will introduce BTC liquid staking, allowing users to mint LSTs using BTC and participate in DeFi while earning staking rewards.

- Community Governance: Artemis Finance is governed by its community, ensuring that ART token holders can vote on protocol upgrades and changes.

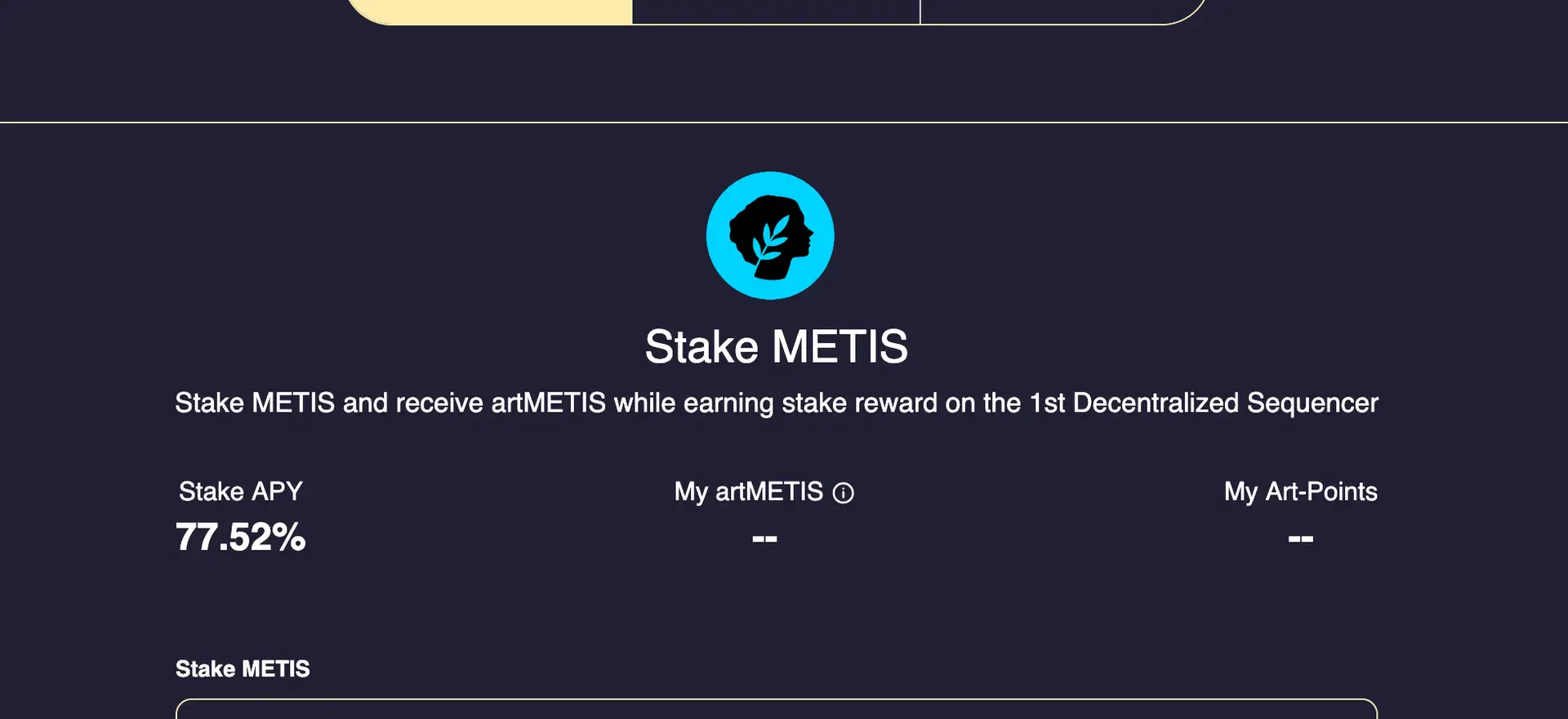

Getting started with Artemis Finance is simple, allowing users to begin staking and earning rewards in a few easy steps:

- Visit the Artemis Finance Website: Go to Artemis Finance.

- Connect Your Wallet: Ensure you have a Metamask or another compatible wallet connected to the Metis network.

- Deposit METIS Tokens: Transfer METIS to your wallet and navigate to the staking section.

- Stake METIS: Select the amount of METIS you wish to stake and confirm the transaction.

- Receive artMETIS: Once staking is complete, you will receive artMETIS, which can be used for additional DeFi activities.

- Monitor and Withdraw: Track your staking rewards and initiate unstaking when desired. Note that unstaking follows a 21-day withdrawal period.

ArtemisFinance Reviews by Real Users

ArtemisFinance FAQ

Artemis Finance leverages advanced MEV (Maximal Extractable Value) optimization strategies to ensure that both sequencers and stakers benefit from MEV revenue. The platform introduces tools that combat MEV centralization and reduce spam transactions, leading to a more equitable distribution of profits. By participating in the Decentralized Sequencer through Artemis Finance, stakers automatically receive a share of these MEV rewards, enhancing their overall staking yield.

Unlike traditional staking models, Artemis Finance allows users to maintain liquidity even while staked. If you wish to exit early, you can sell your artMETIS tokens on supported DEX platforms such as Hercules Exchange. This provides an alternative to waiting for the 21-day unstaking period. Additionally, DeFi lending platforms like Shoebill Finance allow users to borrow against their artMETIS, offering another liquidity solution.

Artemis Finance V2 will introduce a unique BTC liquid staking solution on the Goat Network. Users will be able to stake Bitcoin (BTC) and wrapped BTC assets to mint a new liquid staking token. This token can be used within DeFi applications while still accruing staking rewards. By collaborating with Goat Sequencers, Artemis Finance ensures that BTC staking is secure, decentralized, and seamlessly integrated into the Metis ecosystem.

Artemis Finance simplifies the liquid staking experience by using a single yield-bearing token, artMETIS. Unlike platforms that require multiple wrappers, this approach eliminates the need for extra incentives to provide liquidity across different staking derivatives. By maintaining a single liquid staking asset, Artemis Finance enhances capital efficiency, increases adoption within DeFi protocols, and reduces complexity for users.

In the Metis Layer 2 ecosystem, sequencers are responsible for ordering and processing transactions before they are finalized on Ethereum. A centralized sequencer poses a single point of failure and risks network manipulation. Artemis Finance tackles this issue by supporting a Decentralized Sequencer Pool, where users stake METIS to participate in sequencer operations. This not only enhances network security but also distributes rewards more fairly among participants.

You Might Also Like