About Aster

Aster is a next-generation decentralized perpetual exchange that merges powerful trading tools with a user-centric design, catering to both professional and beginner traders. Emerging from the 2024 merger between Astherus and APX Finance, Aster carries forward a legacy of yield innovation and trading infrastructure. Its mission is to deliver a high-leverage, ultra-secure, and seamless trading experience fully on-chain.

With support for spot and perpetual trading, hidden orders, and cross-chain transactions without bridging, Aster aims to become the leading hub for on-chain derivatives. Its architecture is built on performance, deep liquidity, and low latency, making Aster an ideal destination for users who value privacy, transparency, and execution speed. Whether you're trading with 100x leverage or managing portfolios, Aster provides everything in a frictionless, non-custodial interface.

Aster represents the convergence of two distinct strengths in DeFi: Astherus' pioneering yield products and APX Finance's robust perpetual trading engine. Following their merger in 2024, the new Aster identity signifies more than a branding shift—it's a recommitment to building a comprehensive and scalable platform for on-chain trading. The focus is squarely on developing the most reliable, high-performance, and user-friendly decentralized perpetual exchange in the market.

At the core of Aster is its diverse trading infrastructure. Users can access three primary trading modes:

- Perpetual Mode (Pro): Advanced perpetual trading using an order book interface and extremely low fees.

- 1001x Mode: On-chain perpetual trading with one-click execution, MEV resistance, and no UI complexity.

- Spot Mode: Traditional spot trading with deep liquidity and hidden order capabilities.

Each of these modes offers different levels of control, customization, and liquidity sources, giving users the flexibility to choose what best suits their strategy and experience level.

One of the most compelling aspects of Aster is its commitment to privacy and advanced execution. With tools like hidden orders, traders can conceal their size and direction from the public order book, protecting their strategies from front-running and market impact. Combined with deep liquidity aggregated across markets and a non-custodial execution model, Aster provides a serious alternative to centralized platforms.

From a growth perspective, perpetual contracts are a multi-billion-dollar market, and Aster is well-positioned to capture a significant share. Decentralized perpetual DEXs already process hundreds of billions in cumulative volume monthly (source: DeFiLlama), and Aster’s infrastructure is designed to scale. Future upgrades include a purpose-built Layer 1, zero-knowledge proof integrations, and an intent-based system for frictionless cross-chain execution.

In addition to trading, Aster continues to support its earning ecosystem under Aster Earn, retaining popular yield products like asBNB (a BNB liquid staking derivative) and USDF (a yield-bearing stablecoin). These offerings blend well with the platform's broader DeFi ambitions, enabling users to both trade and grow their portfolio in one place.

Competitor platforms include:

- dYdX – Known for advanced perpetuals and a dedicated Layer 1 chain.

- Perpetual Protocol – Offers on-chain trading via virtual AMMs.

- GMX – Leader in decentralized perpetuals with community-focused tokenomics.

While these are established platforms, Aster differentiates itself through its multi-mode approach, cross-chain architecture, and powerful execution privacy tools, all wrapped into a non-custodial user experience.

Aster provides numerous benefits and features that elevate the experience of on-chain perpetual trading:

- Multi-Mode Trading: Choose from Perpetual Pro, 1001x, or Spot mode to match your trading style and technical expertise.

- Hidden Orders: Place stealth limit orders that keep your size and trade direction fully concealed from public order books.

- Cross-Chain Execution: Trade directly across supported chains without bridging or switching wallets — just pick a chain and go.

- Non-Custodial Platform: Full control over your assets at all times — Aster never holds user funds.

- Advanced Yield Options: Use Aster Earn to stake assets in products like asBNB and earn with yield-bearing stablecoins like USDF.

- Future-Proof Roadmap: Upcoming features include zero-knowledge proofs, a proprietary L1, and an intent-based execution layer to automate cross-chain trading.

Aster is built for both new users and DeFi veterans. Here’s how to get started on Aster in just a few steps:

- Visit the Official Website: Head to the Aster homepage and click “Launch App” or “Download App” to access the platform on your preferred device.

- Connect Your Wallet: Use a Web3 wallet like MetaMask or WalletConnect. Ensure you’re on a supported chain to access cross-chain features.

- Choose a Trading Mode: Select from Spot, Perpetual (Pro), or 1001x mode depending on your experience and desired leverage.

- Start Trading: Access deep liquidity pools and place trades directly from your wallet. Use hidden orders if you want private execution.

- Explore Aster Earn: Grow your portfolio by staking assets in liquid products like asBNB or using yield-bearing assets such as USDF.

- Join the Community: Stay up-to-date on platform developments and liquidity incentives by joining Aster’s Telegram or Discord community.

- Check the Roadmap: Aster’s roadmap includes Layer 1 development, automation tools, and more. Stay tuned on the official website.

Aster FAQ

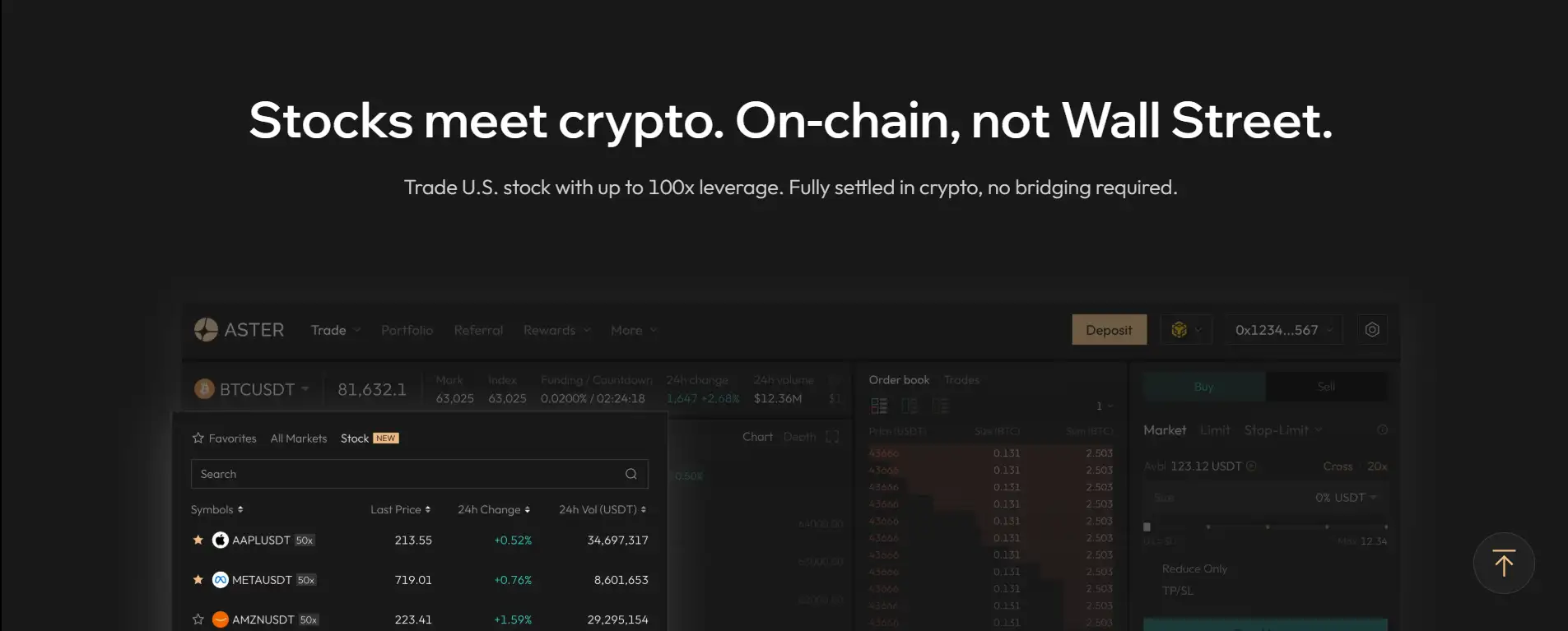

Aster offers on-chain access to U.S. stock perpetual contracts using its 1001x mode. This feature allows users to open leveraged positions—up to 100x—that are fully collateralized and settled in crypto, eliminating the need for bridging traditional assets. Users can interact directly from their wallet, enjoying high-speed execution and full control, all within the Aster app.

Hidden orders on Aster allow traders to place limit orders that remain invisible to the public order book. These orders conceal both trade size and direction, giving users an edge in execution and minimizing the risk of front-running or market impact. It’s a professional-grade feature designed to provide privacy, strategy protection, and a competitive advantage in fast-moving markets.

Aster’s 1001x mode is specifically engineered to be MEV-resistant. Unlike traditional DeFi platforms where miners or validators can front-run trades, Aster's on-chain liquidity design, combined with intent-based execution (coming soon), protects traders by reducing slippage risks and execution delays. The Aster architecture prioritizes fairness and efficiency, making it suitable for high-frequency and high-leverage users.

Aster aggregates liquidity from multiple sources across chains, ensuring each mode—Spot, Perpetual Pro, and 1001x—operates with deep, stable liquidity. This enables users to place large trades with minimal slippage. By building a unified cross-chain liquidity layer, Aster empowers confident trading, even under volatile conditions.

While Aster is primarily known for its on-chain trading infrastructure, it also offers passive earning opportunities through Aster Earn. Users can stake assets in yield-generating products like asBNB (a liquid BNB staking token) or use USDF, a stablecoin designed for consistent yield. These tools are seamlessly integrated into the Aster platform, allowing users to grow their assets while trading or holding.

You Might Also Like