About AugmentLabs

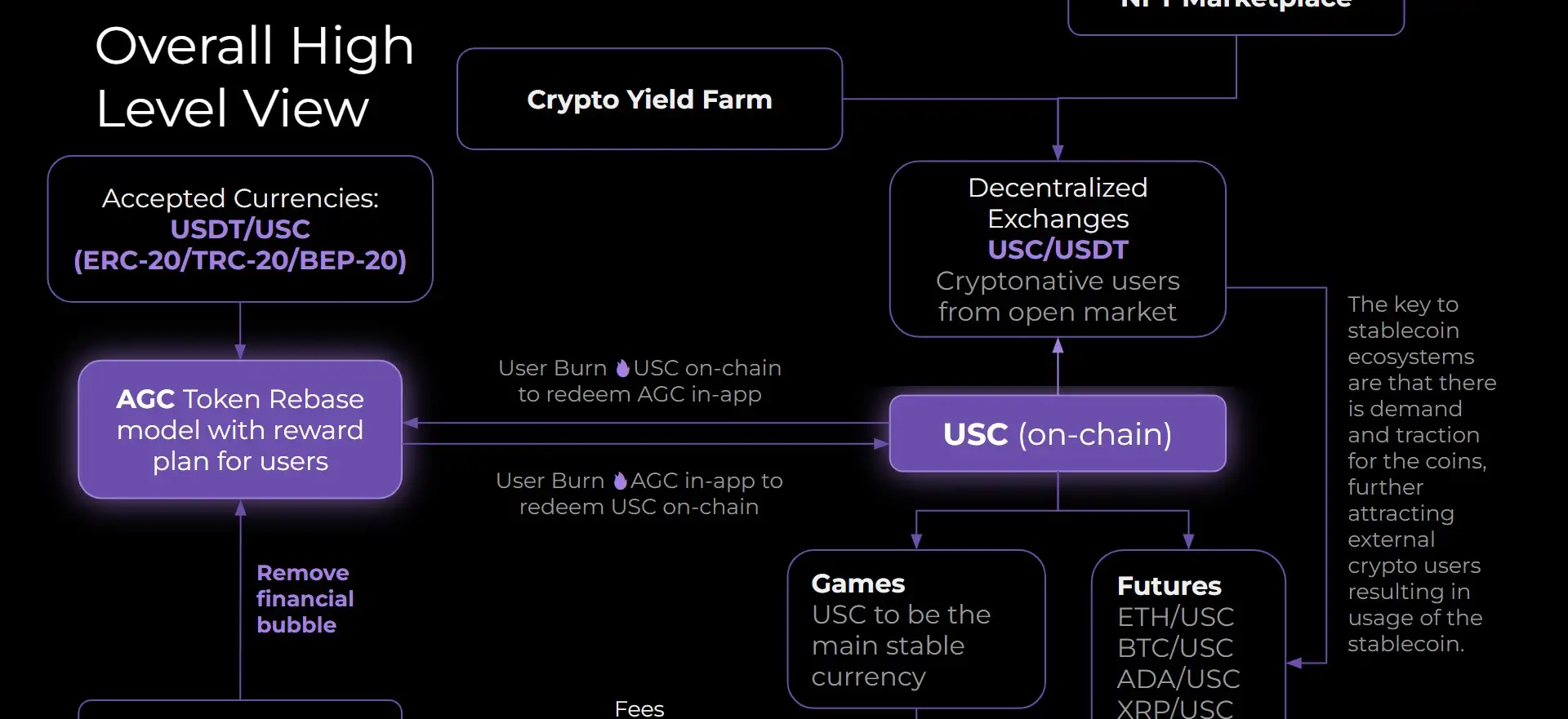

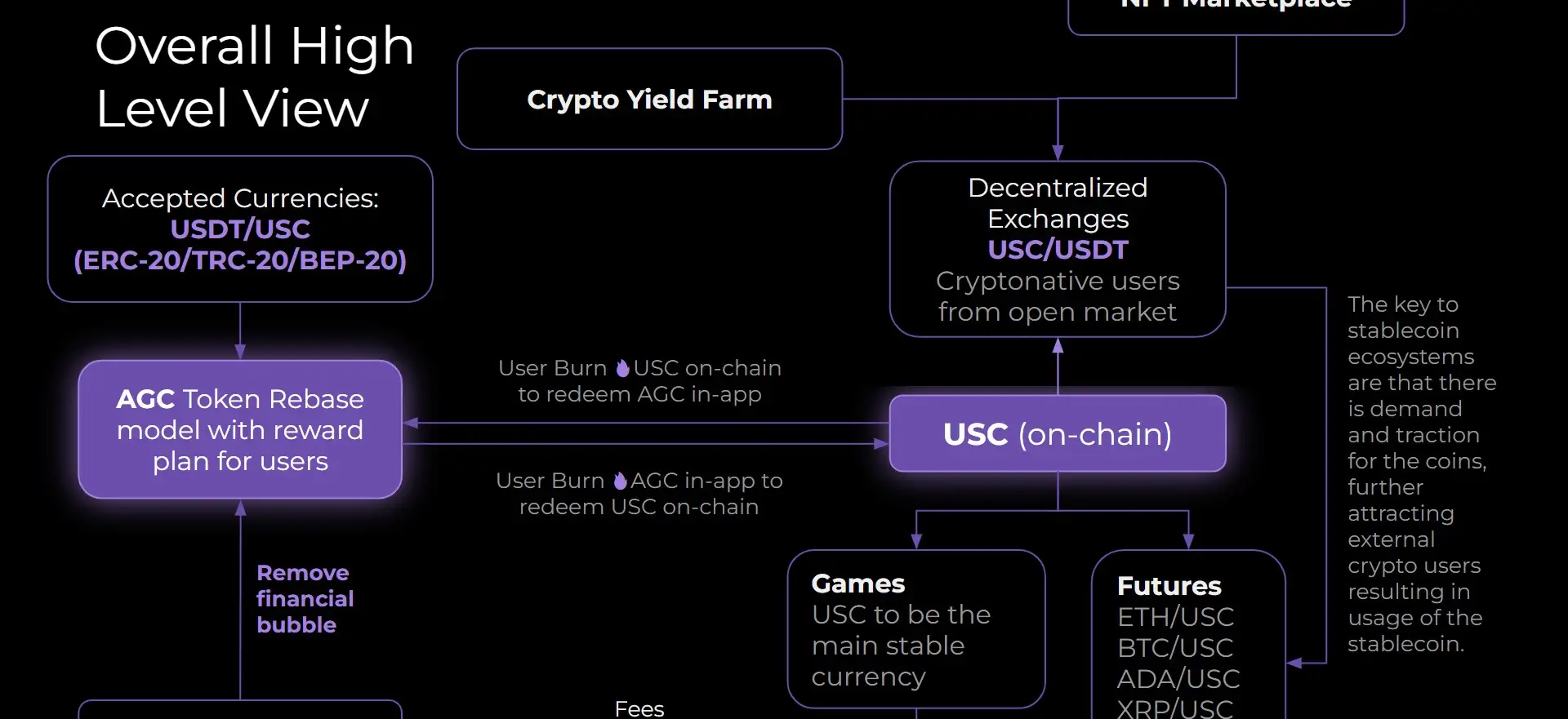

Augment Labs is a groundbreaking blockchain project designed to tackle the inherent challenges faced by previous algorithmic stablecoins. At the heart of this ecosystem are the AGC and USC tokens, which work together to provide stability, governance, and utility within the platform. The project's primary mission is to establish a sustainable and resilient ecosystem that can withstand market volatility and prevent manipulation by large token holders.

Unlike many other projects, Augment Labs employs a unique rebasement mechanism for the AGC token, which incentivizes long-term holders and discourages market manipulation. Additionally, the USC stablecoin operates under a proprietary Automated Market Cap Comparison Framework (AMCF) that dynamically adjusts supply and demand to ensure stability. This combination of innovative technologies makes Augment Labs a significant player in the decentralized finance (DeFi) space, offering a robust alternative to traditional stablecoins.

The team behind Augment Labs brings a wealth of experience in blockchain technology, market making, and cryptocurrency exchange operations, ensuring the project's success in an ever-evolving industry. With a clear focus on sustainability and innovation, Augment Labs aims to create a lasting impact in the world of decentralized finance.

Augment Labs was developed in response to the numerous challenges and failures observed in earlier algorithmic stablecoin projects. The project's foundation is built on extensive research and a deep understanding of the pitfalls that have plagued the industry. By combining a unique rebasement mechanism for the AGC token and the Automated Market Cap Comparison Framework (AMCF) for the USC stablecoin, Augment Labs offers a resilient and sustainable solution that sets it apart from its competitors.

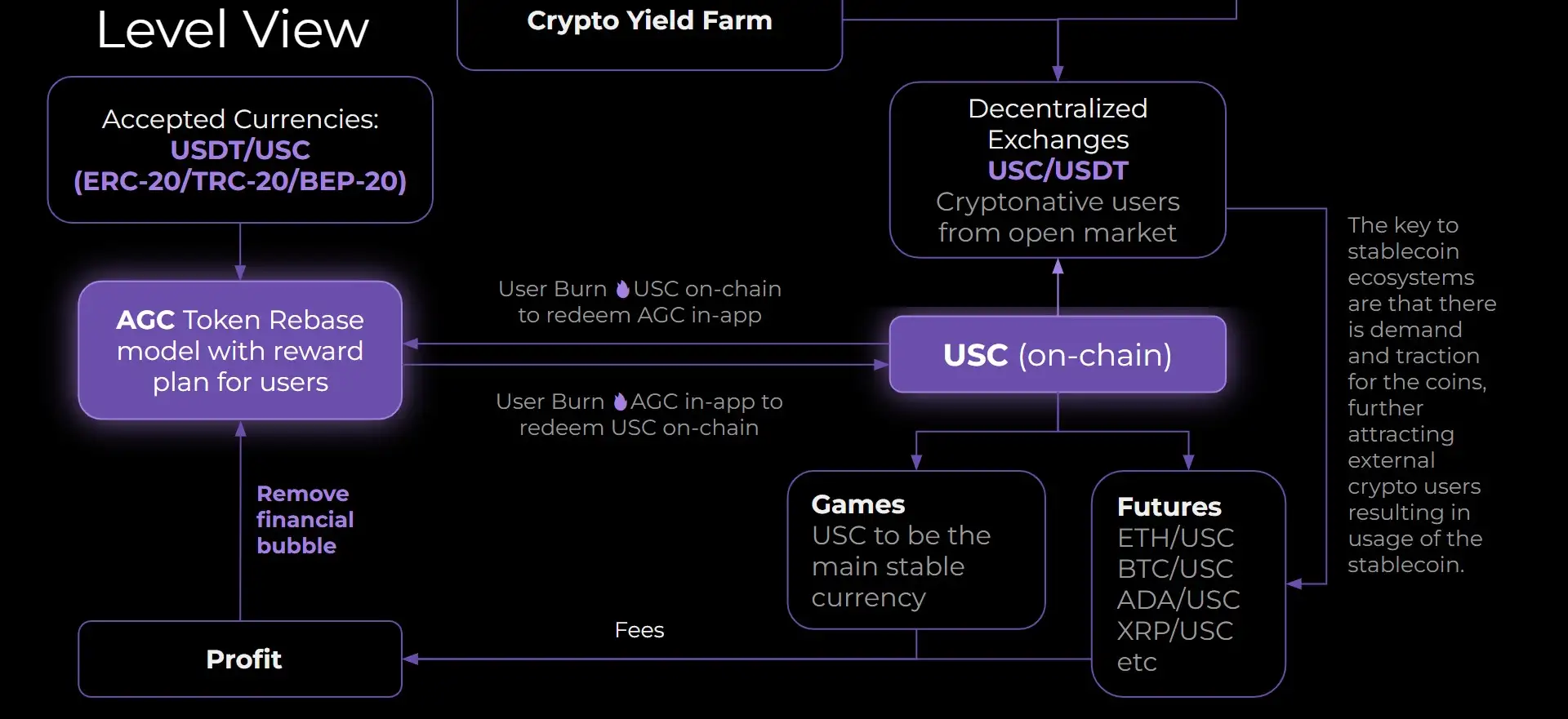

The AGC token plays a critical role in the Augment Labs ecosystem. As the native token, it serves multiple functions, including governance within the Decentralized Autonomous Organization (DAO) and collateralization of the USC stablecoin. The rebasement mechanism employed by AGC ensures that the token supply is adjusted algorithmically to stabilize its value, thereby preventing market manipulation. This mechanism is particularly effective in deterring large token holders from hoarding AGC and disrupting the market. Instead, it encourages participation from a broad range of users, fostering a more equitable and decentralized ecosystem.

The USC stablecoin is designed to be the cornerstone of liquidity within the Augment Labs ecosystem. It is the world's first algorithmic stablecoin that operates under the AMCF, a proprietary oracle system that continuously monitors and adjusts the supply-demand dynamics between AGC and USC. This framework ensures that USC remains stable and antifragile, even in the face of market fluctuations. The AMCF is designed to trigger corrective actions automatically if any unusual discrepancies arise, thereby maintaining the peg and ensuring the long-term viability of the stablecoin.

The development of Augment Labs has been methodical and strategic. The initial phases involve a closed-loop system where AGC tokens are kept off-chain to prevent premature market influence and ensure controlled growth. During this period, participation is limited to whitelisted users who are aligned with the project's long-term goals. This approach prevents large holders from manipulating the market and ensures that the ecosystem remains stable and resilient during its early stages. As the project progresses, it will transition to a more open structure, allowing broader participation and increasing liquidity across various decentralized finance (DeFi) applications.

In terms of competition, Augment Labs faces rivals such as Terra Luna, which also employs an algorithmic approach to stablecoins. However, Augment Labs differentiates itself through its unique governance model, where the DAO-managed treasury and whitelisted approach to minting and burning tokens provide an additional layer of security and stability. Moreover, Augment Labs' use of the AMCF oracle system ensures that the ecosystem can adapt and respond to market changes more effectively than its competitors.

Another competitor is MakerDAO, which is known for its DAI stablecoin. While both projects share a focus on decentralized governance, Augment Labs offers a more innovative approach to stability through its rebasement mechanism and AMCF framework. This combination of technologies allows Augment Labs to maintain a stable and resilient ecosystem that can withstand market shocks and prevent the kind of catastrophic failures that have affected other algorithmic stablecoins.

As Augment Labs continues to evolve, it will expand its ecosystem through various DeFi applications, GameFi, and point-of-sales systems. These developments will further enhance the utility and adoption of USC, making it a critical player in the decentralized finance space. The project is committed to building a sustainable and robust ecosystem that can support a wide range of financial activities, from trading and staking to gaming and real-world transactions.

The Augment Labs ecosystem offers several key benefits and features that set it apart from other projects in the decentralized finance (DeFi) space:

- Rebasement Mechanism: The innovative rebasement mechanism of the AGC token adjusts its supply algorithmically to stabilize its value. This mechanism prevents market manipulation by large holders and ensures fair distribution, encouraging long-term participation in the ecosystem.

- Automated Market Cap Comparison Framework (AMCF): The AMCF is a proprietary oracle system that monitors and balances the supply-demand dynamics between AGC and USC. It automatically triggers corrective actions to maintain stability, making the system antifragile and resilient to market shocks.

- DAO Governance: The Decentralized Autonomous Organization (DAO) governs the entire ecosystem, including the management of the treasury and algorithmic parameters. This ensures that all decisions are made in the best interest of the community and the long-term success of the project.

- Closed-Loop System: During the initial phases, the AGC token operates within a closed-loop system, preventing premature market influence and ensuring controlled growth. This approach helps to build a stable foundation for the ecosystem before opening up to a broader audience.

- ERC20 Compatibility: Both AGC and USC are ERC20 tokens, which means they can be stored in standard Ethereum wallets like Metamask, Imtoken, and hardware wallets such as Trezor and Ledger.

- High Liquidity and Utility: The USC stablecoin is designed to be a cornerstone of liquidity within the ecosystem. It will be used in various DeFi applications, including decentralized exchanges, GameFi, and point-of-sales systems, ensuring broad utility and adoption.

- Incentives for Participation: Users can stake USC on the Augment Labs staking platform to earn a return of 10-18% per year. This provides significant incentives for users to participate in the ecosystem and contribute to its growth.

To get started with Augment Labs, follow these detailed steps:

- Whitelisting: Initially, participation in the AGC token sale is limited to whitelisted users. To become whitelisted, visit invest.augmentlabs.io and submit your application. This process is crucial to ensure that participants are aligned with the project's long-term goals and to prevent market manipulation during the early stages.

- Create a Wallet: Set up an Ethereum-compatible wallet to store your AGC and USC tokens. Popular options include Metamask, Imtoken, and hardware wallets such as Trezor and Ledger. Make sure your wallet is set up and funded with ETH for transaction fees.

- Participate in the Token Sale: Once you are whitelisted, you can participate in the AGC token sale through the official Augment Labs web app. Visit the web app at app.augmentlabs.io, connect your wallet, and follow the instructions to purchase AGC tokens. Note that during the initial phase, there is a maximum investment limit to prevent market manipulation by large holders.

- Manage Your Tokens: After purchasing AGC tokens, you can manage them through your Ethereum wallet. Ensure that you store your private keys securely and consider using a hardware wallet for added security. You can also track the value of your AGC and USC tokens through various portfolio management tools compatible with Ethereum.

- Staking and Earning Rewards: To earn additional rewards, you can stake your USC stablecoins on the Augment Labs staking platform. Staking USC allows you to earn an annual return of 10-18%, generated from the ecosystem’s treasury. This staking process is designed to incentivize participation and contribute to the stability and growth of the USC stablecoin.

- Explore the Ecosystem: As the Augment Labs project develops, additional features and applications will be rolled out. These include a decentralized exchange (AugmentDex), GameFi platforms, and point-of-sales systems. Stay engaged with the community through the official Augment Labs communication channels and participate in DAO governance to influence the future direction of the project.

- Stay Informed: Regularly visit the official website and join the Augment Labs community on platforms like Discord, Telegram, and Twitter to stay updated on the latest developments, announcements, and opportunities within the ecosystem.

AugmentLabs Reviews by Real Users

AugmentLabs FAQ

The rebasement mechanism of Augment Labs is uniquely designed to prevent market manipulation by dynamically adjusting the supply of AGC tokens. Unlike traditional rebase tokens that can lead to extreme volatility, Augment Labs employs a controlled approach where supply adjustments are made to maintain stability, ensuring that both long-term holders and the ecosystem benefit. This approach prevents large token holders from dominating the market and encourages widespread participation.

The Automated Market Cap Comparison Framework (AMCF) is a proprietary system developed by Augment Labs to continuously monitor and adjust the supply-demand balance between AGC and USC. The AMCF system automatically triggers corrective actions if it detects unusual discrepancies, such as rapid changes in market cap or price deviations. This ensures that USC remains stable and antifragile, even during periods of market turbulence, making it a reliable stablecoin for various DeFi applications.

Augment Labs addresses the potential risks of early whale investors through a combination of whitelisting and a closed-loop system during the initial phases. By requiring whitelisting for early participation, Augment Labs ensures that only those aligned with the project’s long-term goals can participate. Additionally, the closed-loop system prevents large holders from influencing the market too early, allowing the ecosystem to grow in a controlled and stable manner before opening up to a broader audience.

The DAO governance model of Augment Labs places decision-making power directly in the hands of its community. As a DAO member, you have the ability to vote on key decisions, such as treasury management, minting and burning mechanisms, and other protocol changes. This decentralized approach ensures that the ecosystem evolves in a way that reflects the collective interests of its users, promoting transparency and alignment with the project's long-term vision.

USC is not only designed to be a stablecoin but also a foundational currency for a wide range of applications within the Augment Labs ecosystem. Beyond initial DeFi applications, the team plans to integrate USC into GameFi platforms, point-of-sales systems, and even NFT marketplaces. This expansion strategy aims to increase the adoption and utility of USC across various industries, creating a robust and versatile ecosystem where USC serves as the backbone of financial interactions.

You Might Also Like