About Awaken Tax

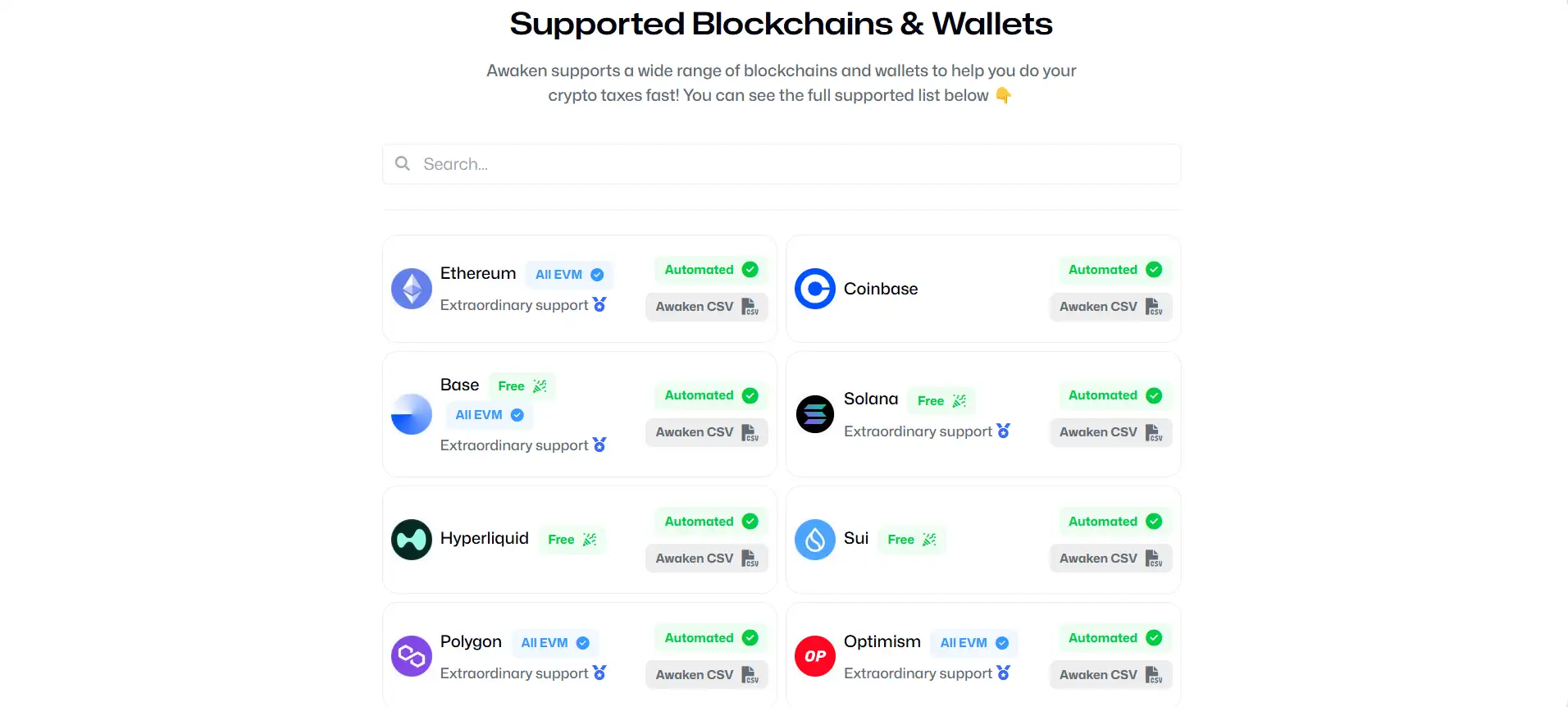

Awaken Tax is a next-generation crypto tax software built specifically for Web3 natives, enabling fast, secure, and accurate tax reporting across hundreds of blockchains and exchanges. With support for top protocols like Ethereum, Solana, Bitcoin, Base, and Polygon, Awaken helps users reclaim control over their crypto tax processes.

Unlike traditional tax platforms, Awaken offers automated transaction recognition, AI-powered smart labeling, and seamless wallet syncing—designed to save both time and money. Trusted by users from Coinbase, Kraken, MetaMask, and Phantom, it supports over 25,000 dApps and offers ready-to-use reports for TurboTax, CPAs, and the IRS. Whether you're a casual trader or deep in DeFi, Awaken simplifies your crypto taxes with unmatched efficiency.

Awaken Tax began as a response to the frustration crypto users face when dealing with inefficient or broken tax software. Founded by blockchain veterans, the platform was built from the ground up for users engaging daily in on-chain activities like staking, liquidity provision, bridging, swapping, and NFT trading. What sets Awaken apart is its obsessive focus on delivering smart, quality automation rather than an overwhelming number of poorly supported integrations.

Users can connect wallets like MetaMask, Phantom, or Coinbase and receive real-time tax summaries at no cost. Awaken’s AI models accurately auto-label over 80% of a user’s transactions and continue to learn over time. The platform also prioritizes financial savings—deducting token approvals, gas fees, and other applicable expenses in line with the latest IRS guidelines.

Security is a cornerstone of the platform. Awaken is SOC 2 compliant, employs AES-256 encryption for all data at rest, and TLS 1.2 for all data in transit. It partners with Doppel to fight phishing threats and is committed to protecting user privacy. With transparent pricing plans (starting at $0 for 100 transactions) and full support for all major chains, the platform is widely regarded as the most practical, polished, and performant crypto tax tool for the Web3 community.

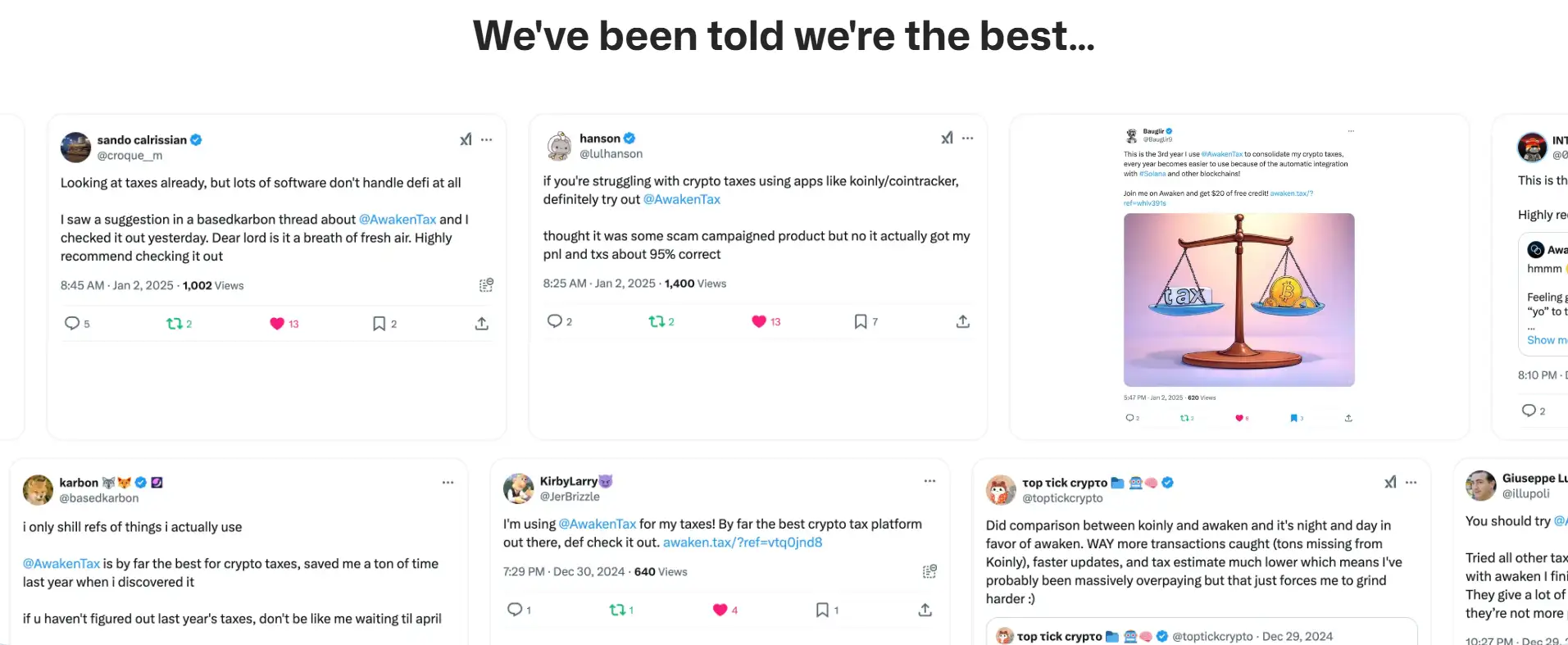

Competitors such as Koinly, CoinTracker, and CryptoTaxCalculator offer similar services, but Awaken stands out by focusing on the crypto-native user experience, offering better automation, faster support, and more accurate analytics for advanced use cases like DeFi, NFTs, and on-chain derivatives.

Awaken Tax provides an unmatched suite of crypto tax features for both casual users and DeFi power users:

- 25,000+ dApps supported: Automatically processes activity from major apps like OpenSea, Uniswap, Magic Eden, Kraken, and more.

- AI Smart Labeling: The platform intelligently labels over 80% of your transactions using machine learning—saving you countless hours of manual work.

- TurboTax & IRS Ready: Generate Forms 8949, 1099B, and other official crypto tax documents for easy submission to the IRS or your CPA.

- Free Wallet Upload & Preview: View your complete tax summary before paying. Only pay when you're ready to download reports.

- Real-Time Portfolio Tracking: Track your DeFi positions, NFTs, and token holdings year-round with Awaken Portfolio.

- Multi-Country Support: Tailored solutions for the United States, Canada, UK, Germany, and Australia, with growing international coverage.

- SOC 2 Certified Security: End-to-end encryption and phishing protection in collaboration with Doppel safeguard your sensitive data.

- Community-Driven Development: Feedback-driven updates from real crypto users and founders actively using the product.

Awaken Tax makes starting your crypto tax journey effortless. Here’s how to get started in just a few minutes:

- Step 1 – Visit the Website: Head over to awaken.tax to begin your free trial—no credit card required.

- Step 2 – Connect Your Wallets: Import from supported wallets and exchanges like MetaMask, Coinbase, Phantom, Kraken, and many more.

- Step 3 – Auto-Label Transactions: Let Awaken's AI identify and categorize over 80% of your activity across 25,000+ dApps.

- Step 4 – Review Your Tax Summary: Check your annual gain/loss reports, taxable events, and export-ready IRS documents.

- Step 5 – Download Reports: Purchase the appropriate plan only when you're ready to download your tax reports (starting at $69).

- Step 6 – Track Year-Round: Activate Awaken Portfolio to monitor your assets, gas fees, staking returns, and trading history in real time.

- Step 7 – Contact Support: Reach out via the Help Center or join the community for instant support and product updates.

Awaken Tax FAQ

Awaken Tax uses advanced AI to automatically label over 80% of your DeFi, NFT, and swap transactions across 25,000+ dApps. From bridging and staking to liquidity provision, it supports the entire crypto stack—saving you hours of manual work. Simply connect your wallets, and Awaken will handle the heavy lifting.

Yes. With Awaken, you can connect unlimited wallets and exchanges, and view your full tax summary for free. You only pay when you're ready to download official tax forms. This makes Awaken one of the most transparent tools in the market.

Awaken prioritizes data integrity over quantity. Unlike tools that support more chains but deliver inaccurate reports, Awaken fine-tunes each integration and uses machine learning to auto-label future transactions based on your past inputs. The result is cleaner data, fewer duplicates, and better IRS-compliant tax reports.

Security is a core feature of Awaken. The platform is SOC 2 compliant, encrypts data with AES-256, and uses TLS 1.2 for in-transit transfers. It also partners with Doppel to defend against phishing threats—ensuring your sensitive data is fully protected.

Absolutely. Awaken supports complex workflows across Ethereum, Solana, Base, Polygon, and 100+ others. Whether you're into NFT flipping, yield farming, or bridging tokens, Awaken tracks it all—giving you accurate reporting and year-round insights on awaken.tax.

You Might Also Like