About Bean Exchange

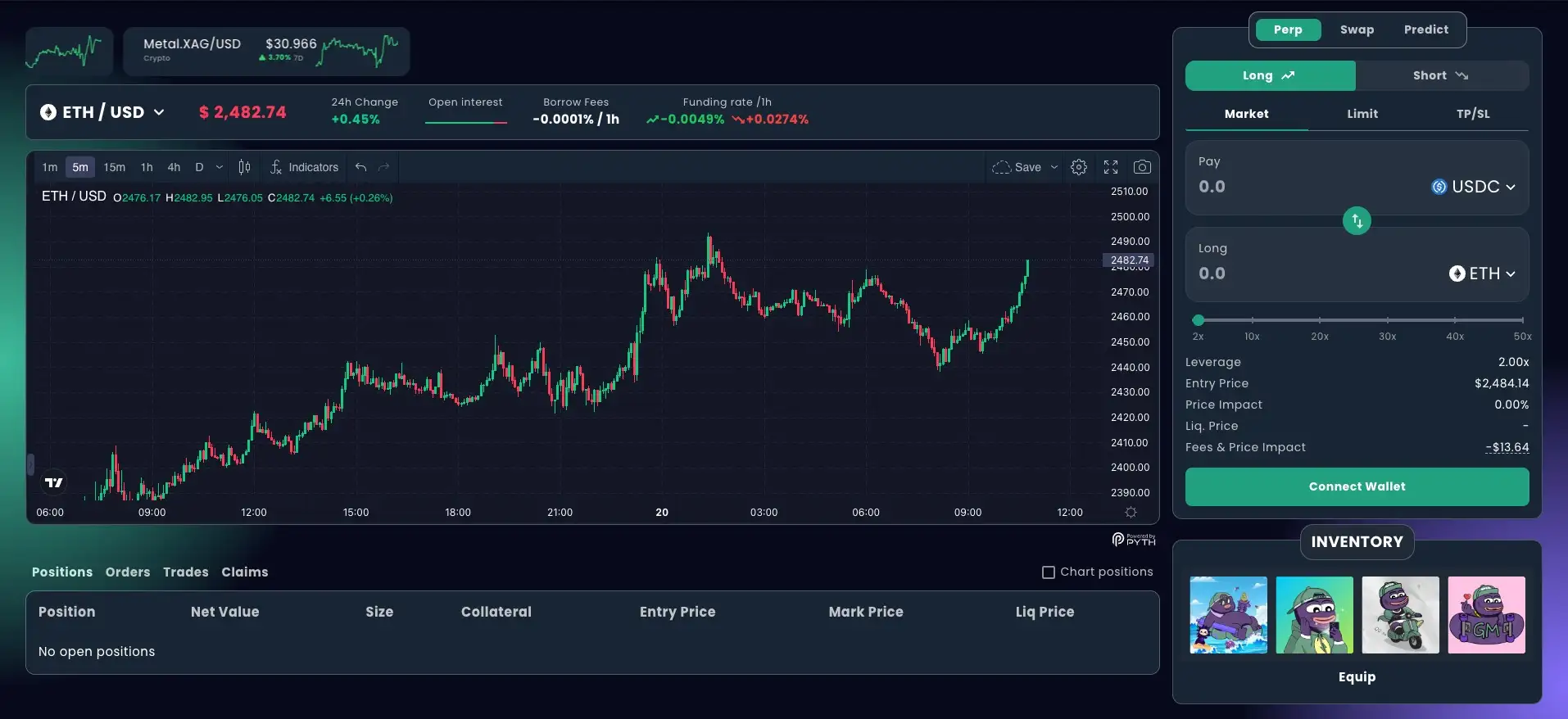

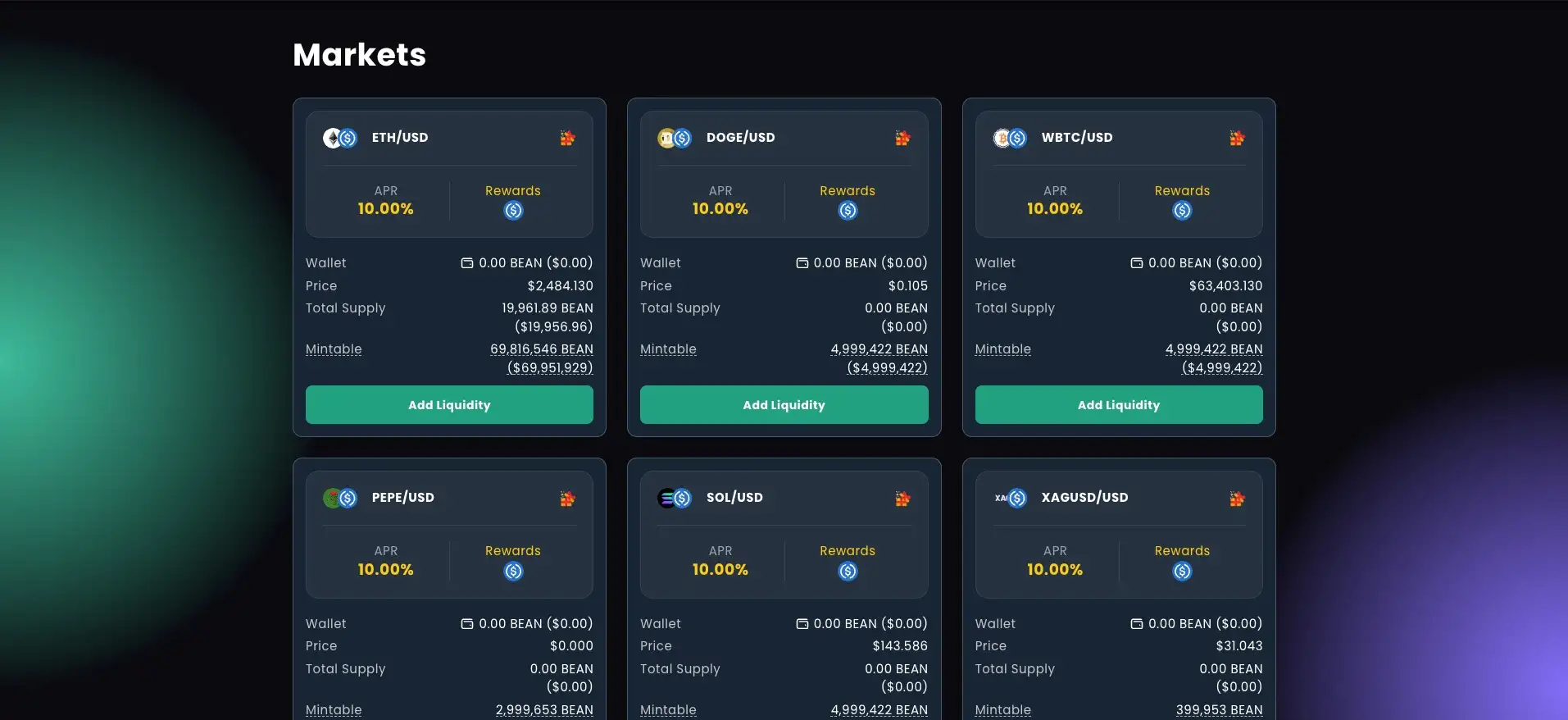

Bean Exchange is a decentralized trading platform designed to provide a seamless and highly efficient trading experience. Specializing in both spot and perpetual markets, Bean leverages advanced blockchain technologies to offer zero price impact trades and low swap fees. The platform’s unique approach centers around a multi-asset pool that benefits both traders and liquidity providers (LPs), enabling them to engage in spot trading, leverage trading, and market making activities while earning fees from these processes.

Additionally, Bean uses the Pyth Oracles for real-time and accurate pricing, ensuring that traders access up-to-date market data. This combination of precise pricing tools and a robust fee-earning model makes Bean Exchange an attractive option for traders and liquidity providers alike. Whether you are staking or redeeming tokens or contributing liquidity, the platform promises long-term growth opportunities, secured by on-chain governance and transparency.

The core vision of Bean Exchange is to revolutionize decentralized trading by making it more accessible and rewarding for users. The platform’s aim is to eliminate inefficiencies common in traditional trading systems, such as high fees and disruptive price fluctuations. By focusing on fully decentralized infrastructure, Bean empowers traders with the ability to trade freely, without intermediaries, while benefiting from low-cost swaps and seamless transaction flows.

Bean’s innovative use of multi-asset pools offers liquidity providers diverse earning options, allowing them to benefit from fees across various trading activities like leverage trading and swaps. This layered earning mechanism ensures that participants in the ecosystem have numerous ways to profit, thus driving sustainable growth.

Additionally, Bean’s integration with decentralized pricing oracles like Pyth ensures that users have access to real-time market data, fostering trust in price accuracy. This commitment to transparency and efficiency is central to Bean’s mission of transforming how decentralized exchanges function.

While specific details about the founders and team behind Bean Exchange are not readily available on the platform, the project is built on a foundation of decentralized principles, aiming to empower users with transparency and efficiency. Further information about key stakeholders or investors may become available as the project progresses, but for now, the focus remains on building a robust, community-driven exchange.

For more detailed information on how to get involved with Bean Exchange, visit their official website.

At present, Bean Exchange offers an accessible version for early adopters through their Devnet. This environment allows users to test the platform's functionalities, providing valuable feedback on trading, liquidity provision, and staking processes. Users can also explore features like staking BEAN and BLP tokens, and participating in reward programs before the full launch.

Bean Exchange Suggestions by Real Users

Bean Exchange FAQ

At Bean Exchange, the liquidity pools are powered by multi-asset pools, offering more than just traditional liquidity provision. Liquidity providers (LPs) earn not only from spot trading but also from leveraged trading and market making activities. This is made possible by our unique BLP Tokens, which automatically adjust in value based on fees earned, ensuring sustainable growth. Plus, the platform offers a clear distinction between long and short market positions, allowing LPs to tailor their strategies based on risk and reward.

Unlike traditional exchanges that suffer from price fluctuations during large trades, Bean Exchange utilizes a multi-asset liquidity pool model that absorbs the pressure of high-volume trades. By integrating Pyth Oracles, which provide accurate and real-time price data, Bean ensures that even large trades are executed without disrupting the market price, resulting in zero price impact for all users.

Yes! Bean Exchange offers an open Devnet environment for early adopters to explore. In this early access version, users can test the platform’s core functionalities, such as spot and perpetual trading, liquidity provision, staking of BEAN and BLP tokens, and participating in gamified reward systems. Feedback from early users will directly influence future platform updates and enhancements.

Bean Exchange goes beyond traditional fee structures. LPs on Bean not only earn from swap and leverage fees, but they can also stake their BLP Tokens for additional rewards via our Real Yield Platform. This staking mechanism allows for multi-layered rewards, with LPs earning based on their risk profile and trading volume, making liquidity provision highly profitable even in volatile markets.

Bean Exchange offers a gamified experience through features like trading seasons, XP points, and reward missions. These elements turn everyday trading into a competitive and rewarding activity. Users can earn loot boxes and NFTs by participating in different activities and hitting specific trading milestones, creating an engaging and entertaining way to interact with decentralized finance. This gamification system not only increases user engagement but also provides opportunities for additional earnings.

You Might Also Like