About Bedrock uniETH

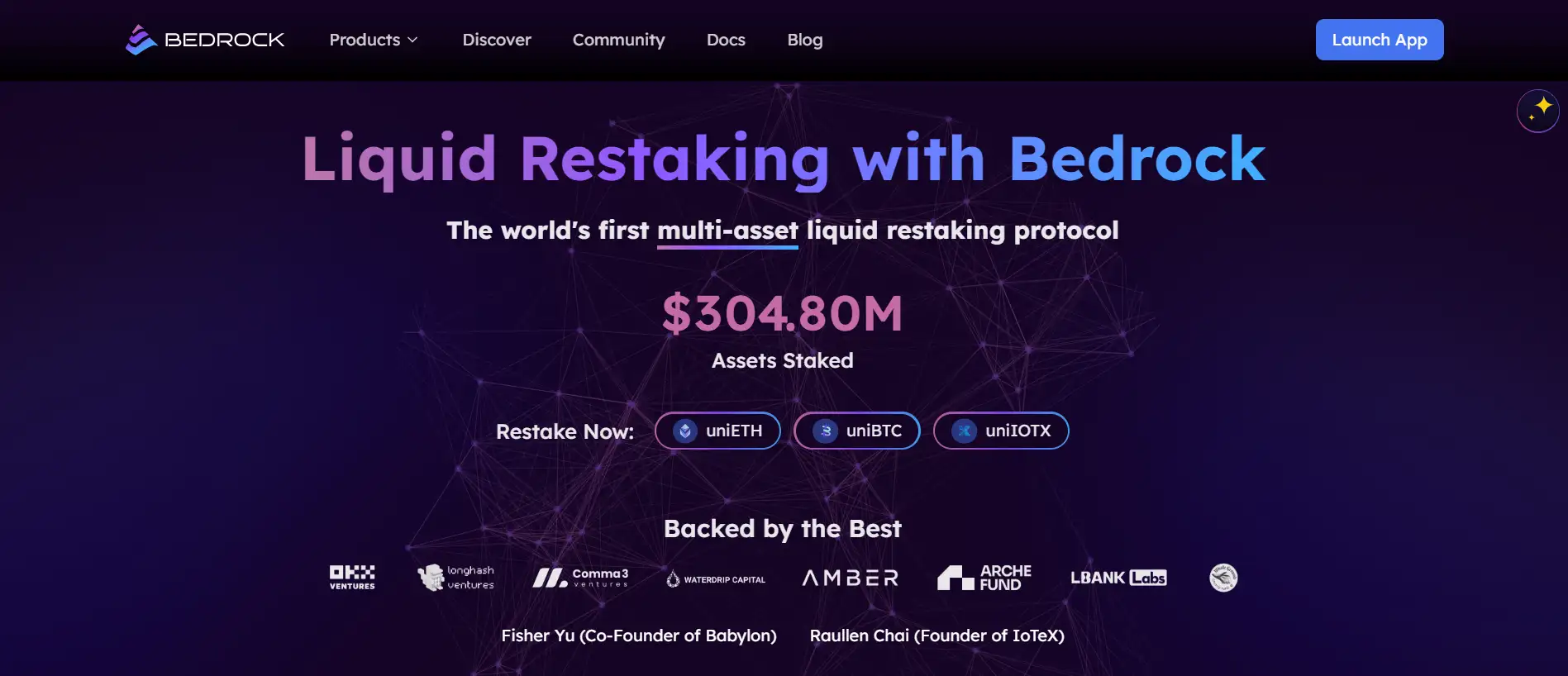

Bedrock is a cutting-edge liquid restaking protocol developed by RockX, a prominent blockchain infrastructure company. This protocol is designed to bridge the gap between centralized finance (CeFi) and decentralized finance (DeFi), offering a secure, transparent, and compliant staking experience for both institutional and retail users. By leveraging Bedrock, users can stake their digital assets, such as Ethereum (ETH), and receive liquid staking tokens like uniETH, which represent their staked assets plus accrued rewards. This approach unlocks liquidity, allowing users to participate in DeFi activities while earning staking rewards.

Bedrock's architecture emphasizes security, transparency, and compliance. It employs advanced technologies, including secret shared validator (SSV) technology, to enhance decentralization and fault tolerance. The protocol's smart contracts are open-source and have undergone thorough audits by industry-leading firms like Peckshield, ensuring robustness and reliability. Additionally, Bedrock is designed to be compatible with emerging restaking solutions, such as EigenLayer, enabling users to earn additional rewards by extending cryptoeconomic security to new applications.

Bedrock is a multi-asset liquid restaking protocol that enables users to stake various digital assets and receive corresponding liquid staking tokens, enhancing liquidity and capital efficiency in the DeFi ecosystem. Developed by RockX, Bedrock supports assets including ETH, wrapped BTC (uniBTC), and IoTeX (uniIOTX), providing a versatile platform for staking diverse cryptocurrencies.

One of Bedrock's key innovations is its integration with EigenLayer, a protocol that introduces the concept of restaking. This allows users to stake their ETH or liquid staking tokens and opt-in to EigenLayer smart contracts, extending cryptoeconomic security to additional applications on the network and earning extra rewards. By leveraging EigenLayer, Bedrock enhances the utility and yield potential of staked assets, offering users opportunities to maximize their returns.

Security is a paramount focus for Bedrock. The protocol is designed to be compatible with secret shared validator (SSV) technology, which splits validator keys among several non-trusting nodes, increasing decentralization, fault tolerance, and security. Additionally, Bedrock employs a hybrid cloud architecture with backup nodes and 24/7 monitoring systems to prevent single points of failure and ensure continuous operation. The protocol's smart contracts have been audited by leading firms like Peckshield, and all contracts are open-source, allowing for community scrutiny and transparency.

In terms of compliance, Bedrock is designed to meet the stringent requirements of institutional clients while remaining accessible to retail users. It balances regulatory standards with the anonymity desired by individual stakers, making it a versatile solution in the evolving regulatory landscape.

Bedrock's ecosystem includes partnerships with various DeFi platforms and protocols, enhancing its utility and integration within the broader blockchain space. For instance, Bedrock has collaborated with Babylon to enable Bitcoin holders to earn rewards through non-custodial staking, and with IoTeX to provide liquid staking solutions for the IoTeX blockchain.

Competitors in the liquid staking space include protocols like Lido, which offers liquid staking solutions for various assets, and Ankr, which provides staking and developer solutions across multiple blockchains. However, Bedrock differentiates itself through its focus on compliance, security, and integration with restaking technologies like EigenLayer, positioning it as a comprehensive solution for both institutional and retail users.

Overall, Bedrock represents a significant advancement in the liquid staking landscape, offering a secure, transparent, and compliant platform that enhances liquidity and yield potential for stakers across multiple blockchain networks.

Bedrock offers a range of benefits and features that distinguish it in the liquid staking ecosystem:

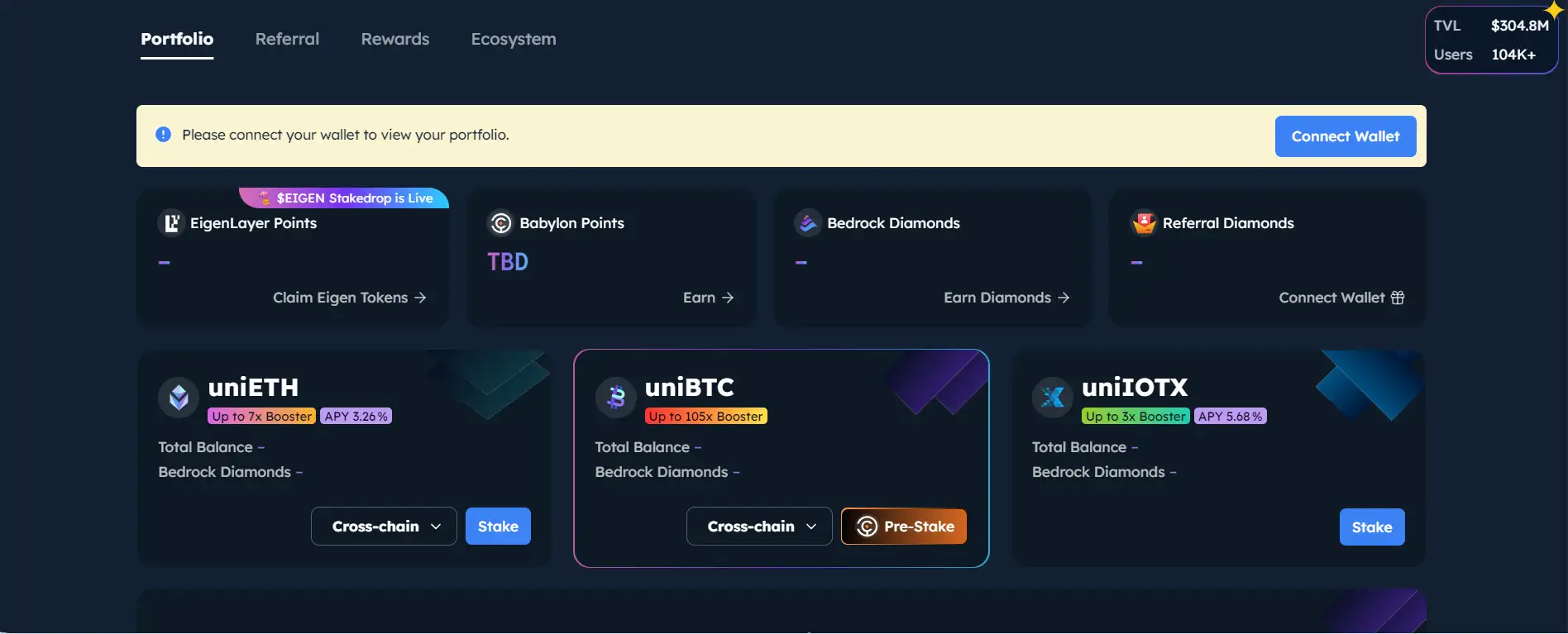

- Multi-Asset Support: Bedrock accommodates various digital assets, including ETH, wrapped BTC (uniBTC), and IoTeX (uniIOTX), providing users with flexibility in staking diverse cryptocurrencies.

- Integration with EigenLayer: By supporting restaking through EigenLayer, Bedrock enables users to earn additional rewards by extending cryptoeconomic security to new applications, enhancing the utility of staked assets.

- Enhanced Security: The protocol employs secret shared validator (SSV) technology, hybrid cloud architecture, and 24/7 monitoring systems to ensure robust security and continuous operation.

- Compliance and Transparency: Designed to meet institutional compliance standards, Bedrock maintains open-source smart contracts and has undergone thorough audits, ensuring transparency and reliability.

- Liquidity and Capital Efficiency: By issuing liquid staking tokens like uniETH, Bedrock unlocks liquidity for staked assets, allowing users to participate in DeFi activities while earning staking rewards.

- User-Friendly Interface: Bedrock provides an intuitive platform for both institutional and retail users, ensuring accessibility and ease of use.

Getting started with Bedrock is a straightforward process. Follow these steps:

- Visit the official Bedrock website.

- Create an account by clicking on the "Sign Up" button and entering the required details.

- Connect your wallet. Supported wallets include MetaMask and WalletConnect-compatible wallets. Ensure your wallet contains supported digital assets like ETH.

- Select the asset you wish to stake and specify the amount. Confirm the transaction in your wallet to begin staking.

- Receive your liquid staking tokens (e.g., uniETH) in your connected wallet. These tokens can be used in DeFi applications for additional yield opportunities.

- To explore restaking options, visit EigenLayer through the provided integrations and follow the prompts to restake your tokens for additional rewards.

If you encounter any issues, refer to the Bedrock documentation or contact customer support for assistance. With Bedrock, you can maximize your staking rewards and liquidity efficiently.

Bedrock uniETH FAQ

Bedrock's liquid restaking protocol allows users to stake assets like ETH and receive liquid staking tokens (e.g., uniETH) that can be actively used in DeFi applications. This enables users to earn staking rewards while maintaining liquidity for other financial activities. Additionally, its integration with EigenLayer offers the ability to restake for enhanced rewards, making it more versatile than traditional staking.

Bedrock employs advanced technologies like Secret Shared Validator (SSV) to decentralize validator key management, ensuring no single point of failure. It also uses a hybrid cloud architecture with backup nodes and 24/7 monitoring systems for uninterrupted operations. All smart contracts are thoroughly audited by trusted firms like Peckshield, ensuring maximum security for users' staked assets.

EigenLayer is a restaking solution integrated into Bedrock. It allows users to opt-in to extend cryptoeconomic security to additional applications by restaking their liquid staking tokens. This enables users to earn extra rewards while enhancing the security and decentralization of the blockchain ecosystem. For more information, visit the Bedrock website.

Yes, Bedrock is designed with institutional use in mind. It adheres to strict compliance standards, ensuring secure and transparent staking processes. Its features, such as audited smart contracts and regulatory compatibility, make it an ideal choice for institutional clients. Retail users can also access these robust solutions via Bedrock.

To maximize rewards, users can stake their assets via Bedrock to receive liquid staking tokens, which can then be used in DeFi protocols. Additionally, users can opt to restake their tokens through EigenLayer for enhanced rewards. Visit the Bedrock website for a detailed guide on maximizing staking yields.

You Might Also Like