About BendDAO

BendDAO is a modular, next-generation DeFi lending protocol designed to bring deep liquidity and advanced financial utility to both ERC20 tokens and NFT assets. By bridging the traditional DeFi space with the growing NFT ecosystem, BendDAO enables users to stake, borrow, lend, and leverage crypto assets with flexibility and speed, all while maintaining control over their collateral.

With the launch of BendDAO V2, the platform has evolved into a highly composable system, allowing developers, investors, and institutions to customize lending pools, manage risks, and participate in unique yield markets. Whether you're a lender seeking returns, a borrower maximizing asset efficiency, or a DeFi builder looking for smart contract modularity, BendDAO offers a comprehensive financial toolkit.

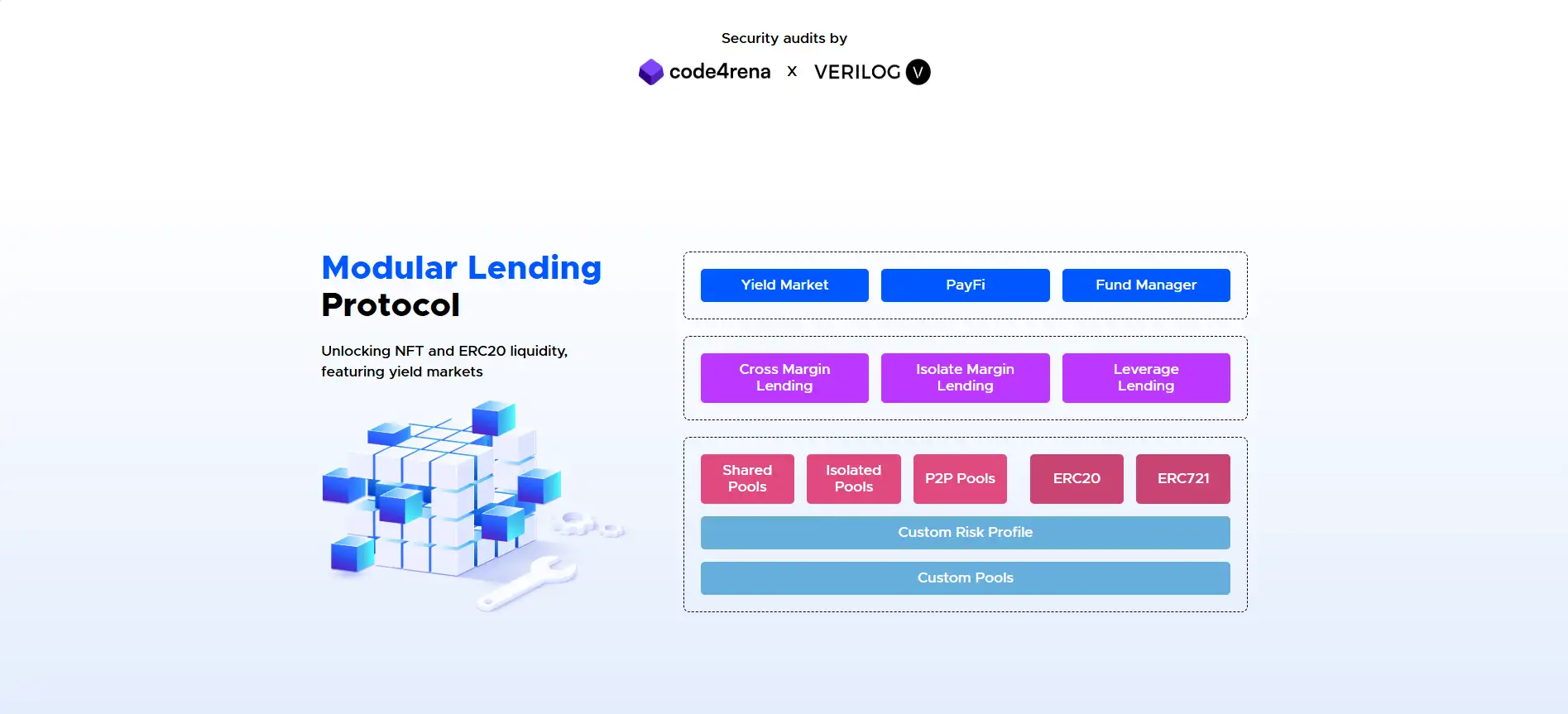

BendDAO V2 introduces a highly composable modular lending protocol that integrates NFT and ERC20 token liquidity into a single, interoperable framework. Unlike legacy DeFi models, BendDAO empowers users with multiple strategies to maximize the utility of their digital assets—whether for borrowing, yield farming, or cross-margin leverage.

One of the standout innovations in V2 is PayFi—a feature that bridges crypto and real-world payments. With PayFi, users can spend their crypto in everyday transactions, such as buying coffee or booking travel, using a forthcoming credit card backed by their digital assets. This extends the utility of crypto beyond the ecosystem and into mainstream commerce, all while maintaining on-chain security and control.

BendDAO V2 supports both Cross Margin and Isolated Margin Lending, enabling users to choose between account-wide risk mitigation or asset-specific risk control. Lenders earn passive yield by depositing assets into shared or isolated pools. Borrowers can use both NFTs and ERC20s as collateral to access liquidity, while Leverage users can amplify positions across DeFi, NFTs, and Real-World Assets (RWA). The protocol's flexibility allows integration with platforms like MakerDAO, Lido, and EigenLayer, creating dynamic leverage strategies.

The architecture of BendDAO V2 is built on plug-and-play smart contract modules. Each component—lending, borrowing, yield, risk management, and oracle services—can evolve independently. This allows developers to launch custom lending pools with specific asset lists, LTV ratios, interest rate models, and risk parameters. Additionally, protocols can incorporate BendDAO V2's backend to offer leverage services natively to their users.

With over $18 million in total value locked and ongoing audits from Code4rena and Verilog, BendDAO continues to prove its robustness and innovation. It is governed by a strong community with Snapshot voting and supports features like veBEND escrow, NFT delegation via delegate.cash, and dual yield farming for BAYC/MAYC holders. Key alternatives in the space include NFTfi, and Arcade, but few offer the deep modularity and real-world payment integration that BendDAO delivers.

BendDAO delivers unique benefits and features for NFT and crypto lending participants across the DeFi ecosystem:

- Dual Collateral Support: Use both NFTs and ERC20 tokens as collateral for lending and borrowing.

- PayFi Integration: Use your crypto assets as real-world spending collateral via BendDAO’s upcoming crypto-backed credit card.

- Custom Lending Pools: Launch fully tailored pools with personalized risk parameters, assets, and interest models.

- Cross & Isolated Margin Options: Choose between full-account protection or asset-specific liquidation risk management.

- Yield Market for NFT Stakers: Stake BAYC, MAYC and other NFTs to earn dual yields—native and protocol incentives.

- Leverage Strategies: Leverage staking, restaking, and DeFi protocols like MakerDAO and EigenLayer directly through V2.

- Modular Smart Contracts: Plug-and-play protocol design allows continuous upgrades without compromising system cohesion.

- On-Chain Governance: Community-led governance via Snapshot voting and transparent protocol updates.

Getting started with BendDAO is simple, whether you’re a lender, borrower, NFT holder, or DeFi developer:

- Enter the App: Go to BendDAO V2 and connect your wallet to begin interacting with the protocol.

- Choose Your Role: Select whether you want to stake NFTs, lend ERC20 tokens, or borrow using collateral.

- Deposit Assets: Add your NFTs or ERC20 tokens to the pool of your choice. Shared and isolated pools are available depending on your risk profile.

- Access Yield & Leverage: Earn passive yield, borrow stablecoins, or enter leverage positions across DeFi, staking, and restaking protocols.

- Try PayFi (Coming Soon): Sign up for the upcoming Bend Card to spend your crypto assets anywhere Visa is accepted while retaining custody and control.

- Manage Risk: Use tools like health factor tracking and flexible margin options to monitor loan safety and avoid liquidations.

- Join the Community: Participate in governance via Snapshot, or connect on Discord and Twitter.

BendDAO FAQ

BendDAO V2 introduces PayFi, a feature that enables users to spend crypto assets directly in daily life. With the upcoming Bend Card, users can pay for goods and services using their crypto without liquidating their holdings. Assets are used as collateral, not cash, giving users flexibility while preserving upside. The card will work wherever Visa is accepted and operates on-chain, ensuring full user custody and transparency. Learn more at BendDAO.

Cross Margin allows users to borrow against the total value of all deposited assets, spreading risk across multiple collaterals. This helps maintain a healthier loan health factor and lowers liquidation chances. Isolated Margin, on the other hand, ties each loan to a specific NFT or asset. If that asset’s value drops, only it is subject to liquidation, providing more granular risk control. Both options are available in BendDAO V2.

Yes. BendDAO V2 supports NFT delegation via delegate.cash. This means users can stake their NFTs to earn yield while still assigning voting or utility rights to another wallet. It’s especially useful for BAYC or MAYC holders participating in other ecosystems while maximizing returns through staking.

BendDAO V2 features an auto-unstaking mechanism that helps avoid liquidation. If the value of a staked NFT drops to a critical threshold, the protocol automatically unstakes it before liquidation occurs. This ensures that assets are returned to the user’s wallet safely and without loss, providing a security buffer unique to BendDAO.

PayFi is a BendDAO product that turns your crypto into a usable spending tool. By backing a credit card with your on-chain assets as collateral, you can make everyday purchases without converting to fiat. The Bend Card will support global payments via Visa and offer features like crypto-backed credit, native yield repayment, and modular pool setup for issuers. Learn more via the PayFi section on BendDAO.

You Might Also Like