About Benqi

BENQI is a leading DeFi (Decentralized Finance) protocol operating on the Avalanche blockchain. It provides users with a seamless experience for liquid staking, lending, and borrowing. By utilizing the high throughput and low latency of the Avalanche network, BENQI ensures scalable and efficient financial services for its users.

The protocol’s mission is to democratize access to decentralized financial tools while maintaining a high level of security and reliability. Whether you're a retail investor or an institutional player, BENQI offers solutions tailored to your needs, from maximizing yields to participating in governance through its QI token.

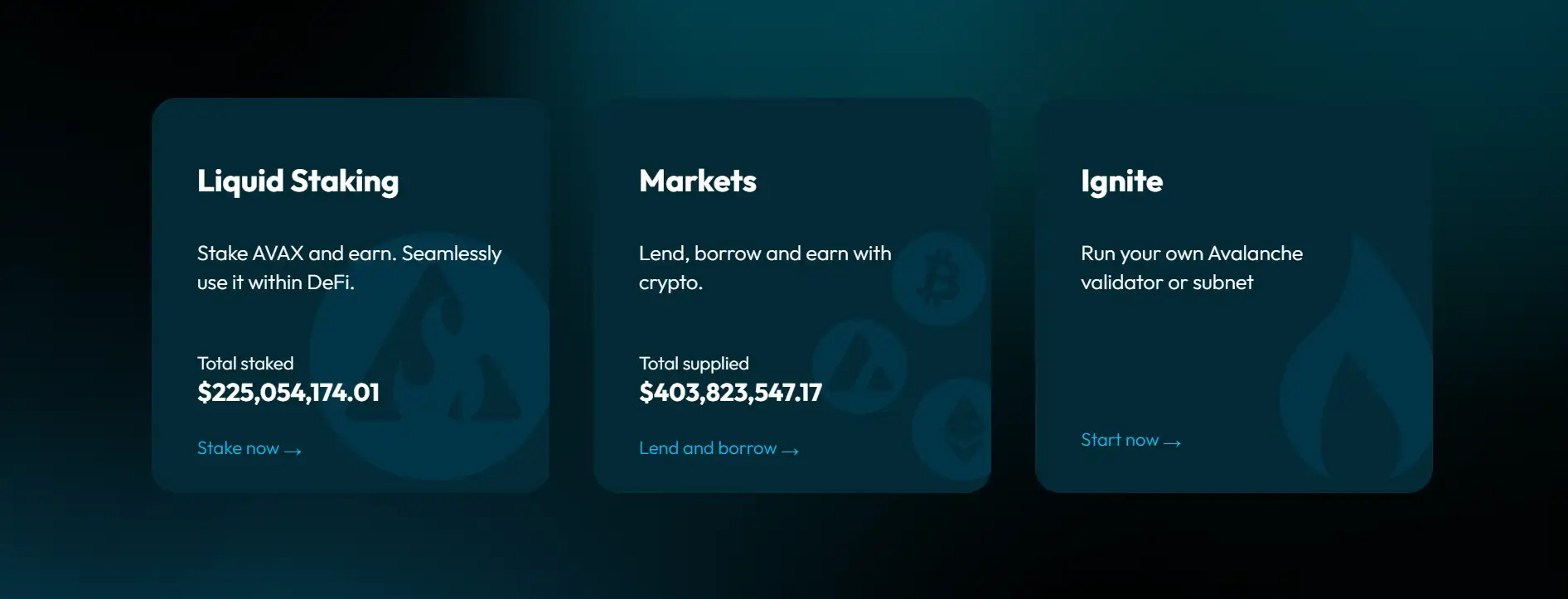

BENQI has established itself as a robust decentralized financial infrastructure with two main offerings: the BENQI Liquid Staking (BLS) and the BENQI Liquidity Market (BLM). These two components provide a comprehensive set of tools for users to grow and manage their digital assets.

The BENQI Liquid Staking (BLS) platform enables users to stake their AVAX tokens and receive sAVAX tokens in return. This process ensures that users continue earning staking rewards while maintaining liquidity. Unlike traditional staking, where funds are locked, sAVAX tokens can be used across various DeFi platforms for trading, lending, or yield farming. This not only optimizes asset utilization but also enhances the liquidity of staked assets.

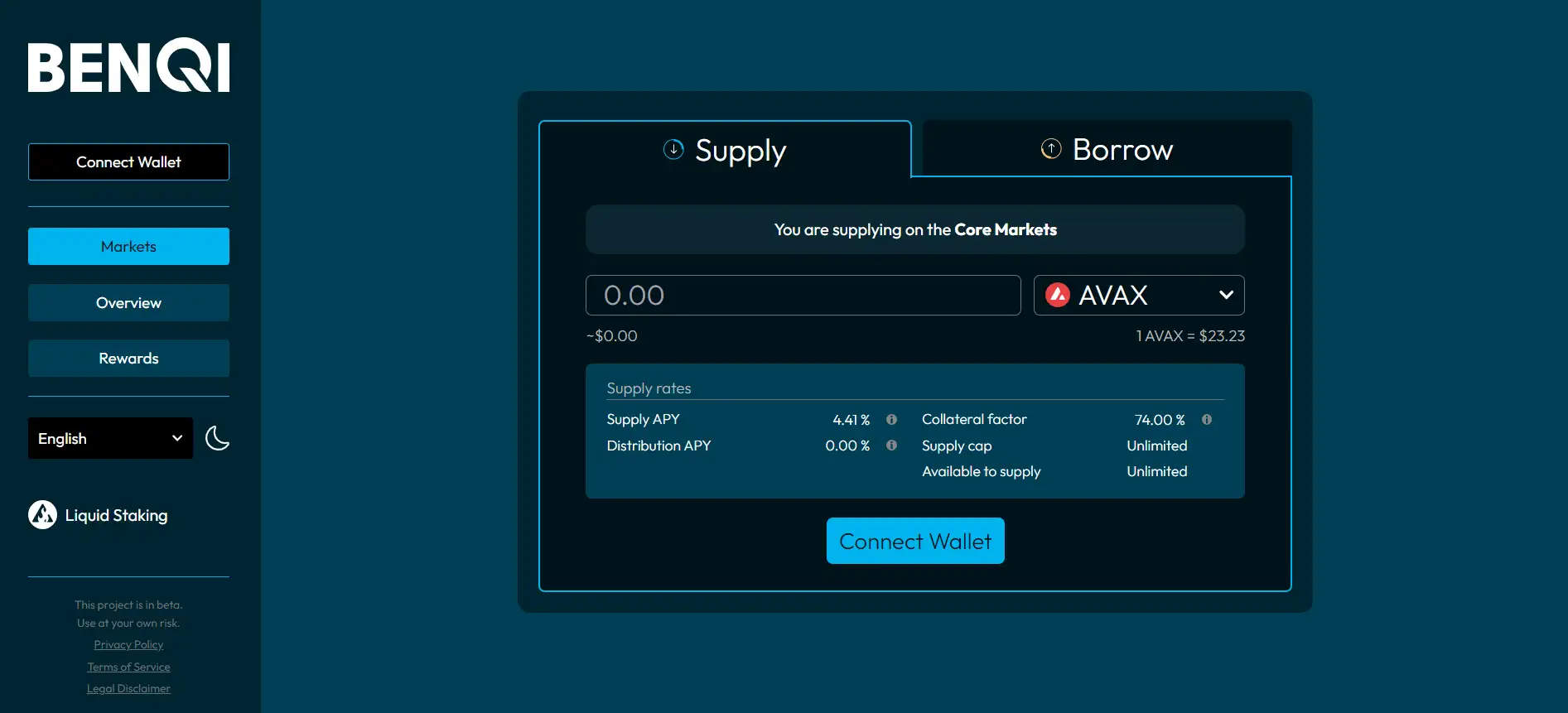

Meanwhile, the BENQI Liquidity Market (BLM) serves as a decentralized lending and borrowing platform. Users can lend their crypto assets to earn interest or borrow against their holdings in an over-collateralized manner. The protocol supports popular assets such as wBTC, wETH, AVAX, and stablecoins like BUSD. Its smart contract-driven architecture ensures a secure and transparent system without intermediaries.

The governance of BENQI is community-driven through the QI token. Token holders can vote on proposals that shape the future of the protocol, ensuring decentralization and active participation from its user base. Additionally, the integration of staking rewards with veQI tokens allows for advanced staking capabilities, further enhancing user benefits.

Competitors such as Aave, Compound, and Lido provide similar services in the decentralized finance ecosystem. However, BENQI distinguishes itself with its seamless integration into Avalanche's scalable network and its focus on user-centric tools.

The BENQI protocol provides several key benefits to its users:

- High Liquidity: With its liquid staking service, users can stake AVAX while retaining liquidity through sAVAX.

- Decentralized Governance: Through the QI token, users actively shape the protocol’s future by participating in voting and governance decisions.

- Scalability: Built on the Avalanche blockchain, BENQI ensures low fees, high speed, and excellent network efficiency.

- Yield Optimization: Users can combine staking rewards with other DeFi opportunities to maximize their earnings.

- Wide Asset Support: From wBTC and wETH to stablecoins like BUSD, the platform supports a variety of digital assets.

Getting started with BENQI is simple and intuitive. Follow these steps to begin your journey:

- Visit the official website: Navigate to https://benqi.fi to explore all available services.

- Set up your wallet: Ensure you have an Avalanche-compatible wallet like MetaMask or Avalanche Wallet.

- Bridge your assets: Use the Avalanche Bridge to transfer your assets to the Avalanche network.

- Choose a service: Access the Liquid Staking or Liquidity Market to start staking, lending, or borrowing assets.

- Start earning: Stake your AVAX tokens, earn sAVAX, or lend your assets to earn interest.

Benqi FAQ

BENQI Liquid Staking (BLS) stands out by allowing users to stake AVAX tokens and receive a yield-bearing token called sAVAX. This enables users to maintain liquidity and maximize their capital efficiency. Unlike traditional staking, sAVAX can be utilized across various DeFi platforms for lending, trading, and farming opportunities, creating a dual benefit of staking rewards and active asset utilization.

BENQI is built entirely on smart contracts deployed on the Avalanche blockchain. This ensures full transparency, as all transactions and operations are recorded on the blockchain and can be audited by anyone. Additionally, the protocol undergoes regular security audits by top-tier blockchain security firms, ensuring a secure and reliable environment for users.

Yes, sAVAX is designed to integrate seamlessly with the broader DeFi ecosystem. Once you stake AVAX through the BENQI Liquid Staking platform, you can use sAVAX for lending, borrowing, or trading on various DeFi platforms that support Avalanche assets. Check the compatibility and opportunities with platforms like Trader Joe or other Avalanche-based applications.

The QI token is the governance token of the BENQI protocol. It allows holders to participate in governance by voting on key proposals, such as upgrades, new integrations, and operational decisions. Additionally, QI tokens can be staked to earn veQI, which provides further benefits such as enhanced staking delegations and access to exclusive protocol features.

To get started with the BENQI Liquidity Market, first ensure you have an Avalanche-compatible wallet such as MetaMask. Next, transfer your assets to the Avalanche network using the Avalanche Bridge. Once your wallet is connected, you can deposit supported assets like wBTC, wETH, or stablecoins to start earning interest or borrow against your holdings in a few simple clicks.

You Might Also Like