About Bidask

Bidask is a next-generation decentralized exchange (DEX) built natively on the TON blockchain, delivering fast, efficient, and secure trading for the Web3 era. By embracing the principles of decentralization, Bidask empowers users to swap tokens, provide liquidity, and manage their assets without intermediaries, giving them full control over their financial strategies. Designed for both novice users and seasoned traders, the platform combines ease of use with technical depth.

With its cutting-edge Concentrated Liquidity Market Making (CLMM) model, Bidask allows liquidity providers to fine-tune their capital deployment by setting price ranges and liquidity shapes—reducing slippage and increasing potential earnings. Combined with features like spot and limit swaps, customizable fee reinvestment, and robust security through audited smart contracts, Bidask is redefining decentralized trading on TON.

Bidask is an innovative DeFi trading protocol operating on the TON blockchain, focused on delivering an advanced, high-performance DEX solution tailored for fast, low-fee, and permissionless trading. By integrating Concentrated Liquidity Market Making (CLMM)—an upgrade from traditional Automated Market Makers (AMMs)—Bidask empowers liquidity providers with granular control over how and where they allocate their assets. This innovation leads to enhanced capital efficiency, minimized slippage, and maximized fee earnings.

At its core, Bidask offers a seamless user experience for both token swapping and liquidity provision. Traders can perform spot swaps or place limit orders, depending on their strategy and market outlook. Meanwhile, liquidity providers (LPs) can supply liquidity to pools, define the exact price bins their assets should cover, and benefit from both pool fees and reward incentives. Through Safe Mode and partial execution options, Bidask ensures optimal trading experiences even in volatile market conditions.

The protocol also introduces several important technical innovations: auto-fee compounding for better yield optimization, custom liquidity shapes for strategic LP positioning, and user-centric interfaces that simplify order tracking and pool management. These features, combined with a secure and decentralized infrastructure, make Bidask a powerful trading hub for TON-based assets.

Bidask competes in a growing TON ecosystem alongside other platforms like STON.fi and Megaton Finance, yet stands out for its deep customization, high-speed execution, and intuitive UI. Its focus on efficiency, transparency, and decentralization makes it a standout solution for DeFi users looking to trade or earn yield on TON.

Bidask provides numerous benefits and features that make it a standout project in the TON DeFi ecosystem:

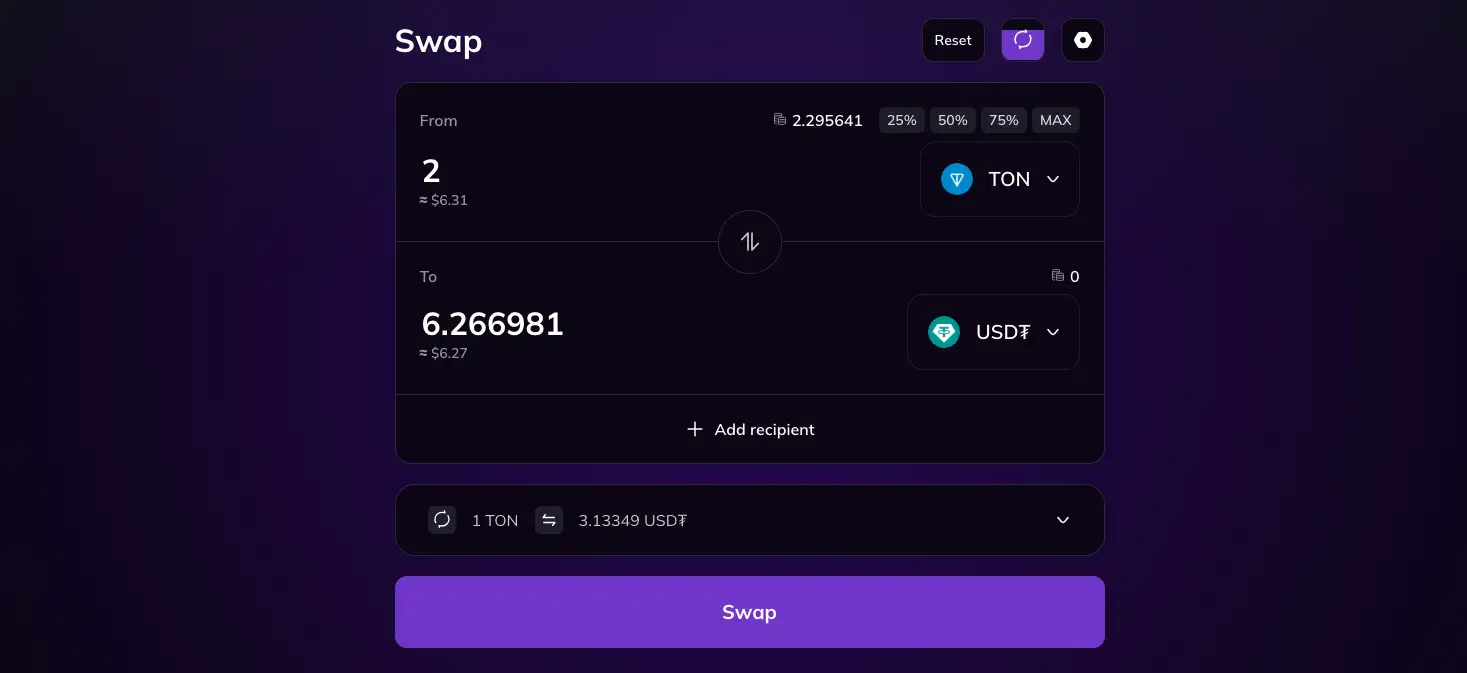

- Spot and Limit Swaps: Perform immediate swaps or set your desired price for execution with full control over your trades.

- Concentrated Liquidity Market Making (CLMM): Allocate capital within specific price ranges to maximize capital efficiency and fee generation.

- Liquidity Shapes: Customize how your assets are distributed across price bins to optimize risk/reward positioning.

- Auto Fee Compounding: Reinvest earned fees automatically to boost long-term yield without manual action.

- Partial Execution & Safe Mode: Enable flexible execution in volatile markets while protecting trades from extreme price swings.

- High-Speed Performance: Built on TON, Bidask ensures near-instant transaction speeds with extremely low fees.

- User-Centric Interface: Easily track orders, manage positions, and view pool stats from a clean and intuitive dashboard.

- Decentralized & Audited: Funds stay in your wallet until confirmed; contracts are audited to maximize trust and transparency.

Bidask makes it easy for anyone to start trading or earning yield on the TON blockchain. Follow these simple steps to begin:

- Step 1: Connect a Wallet: Use a compatible TON wallet such as Tonkeeper or TON Wallet to connect to Bidask.

- Step 2: Start Swapping: Navigate to the Swap section, select the tokens you want to exchange, input the amount, and confirm the transaction through your wallet.

- Step 3: Use Limit Orders (Optional): If you prefer specific pricing, place a Limit Order and define your ideal entry or exit price.

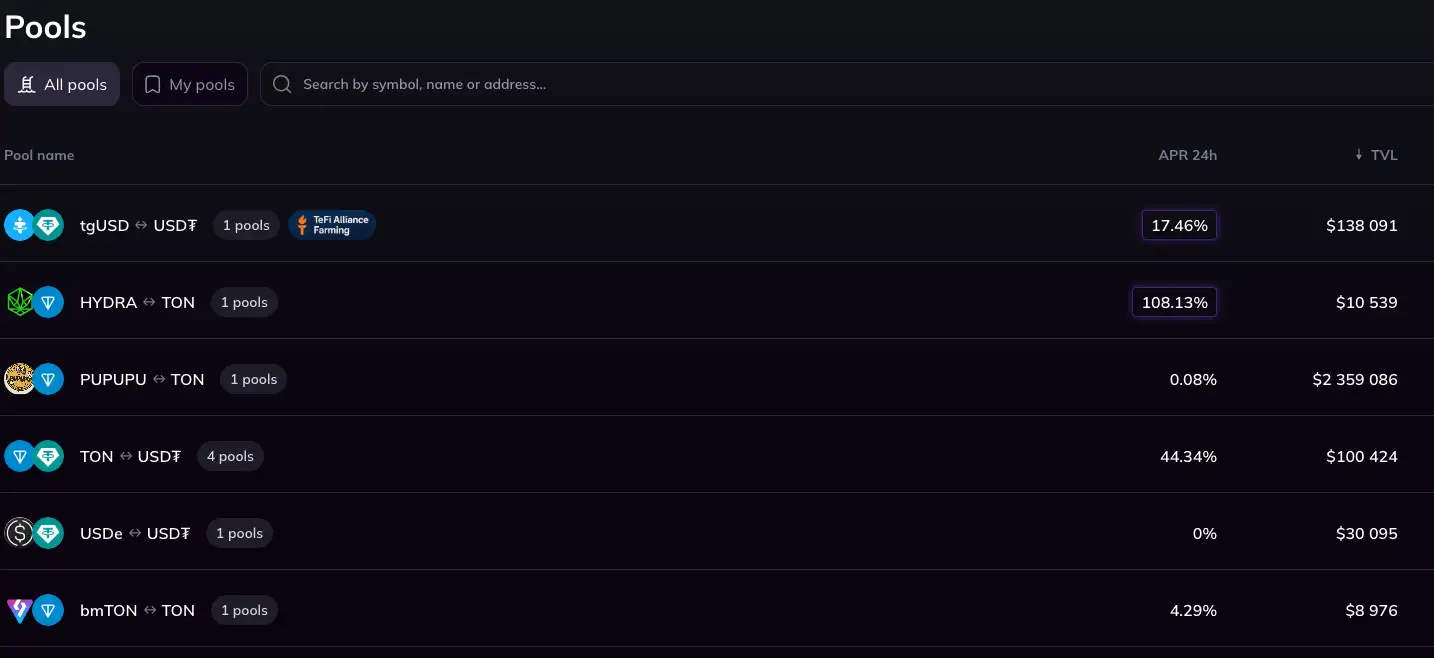

- Step 4: Add Liquidity: Visit the Pools tab and select a pool or create a new one. Choose your liquidity shape and price bins, input token amounts, and confirm.

- Step 5: Manage Positions: Track and manage all your trades and liquidity via the "My Pools" and "Active Orders" sections.

- Step 6: Learn & Optimize: For advanced usage, explore the Documentation to dive into concepts like partial execution, fee settings, and price bin selection.

Bidask Reviews by Real Users

Bidask FAQ

Bidask utilizes a Concentrated Liquidity Market Making (CLMM) model, unlike traditional AMMs like Uniswap V2 where liquidity is spread uniformly across the price curve. With CLMM, liquidity providers on Bidask can choose precise price ranges for deploying capital, which leads to lower slippage and higher capital efficiency. This means more trading fees earned for the same amount of capital.

The Safe Mode feature on Bidask helps traders execute swaps with added protection against extreme price volatility. When enabled, this mode prevents your trade from completing if price impact exceeds your defined slippage tolerance. It ensures a more secure and predictable trading experience, especially during volatile market conditions.

Yes, users can earn passive income by providing liquidity to pools on Bidask. Liquidity providers receive a share of trading fees proportional to their contribution. Additionally, auto-compounding features reinvest earned fees automatically, boosting yield over time without requiring active management.

When a swap is executed on Bidask, a 0.25% fee is applied. This fee is distributed proportionally to all liquidity providers whose funds were used in the transaction, based on their position in the selected price bins. The protocol also supports automatic fee reinvestment, further enhancing LP earnings.

In the event of a partially filled limit order on Bidask, the filled portion is settled, and the remaining order stays active until it’s fully executed, canceled, or expired. Users can view and manage open orders from the “Active Orders” tab, and any unused rewards or reserved gas will be refunded when the order expires or is canceled.

You Might Also Like