About Binocs

Binocs is an AI-enabled portfolio tracking and workflow management system designed for private credit funds. The platform enhances operational efficiency and risk management through reliable data processing and advanced analytics. By integrating various financial data sources, it automates document management, cash flow monitoring, and covenant tracking. Binocs aims to streamline the entire workflow of asset managers, borrowers, and service providers, offering a centralized communication platform for all stakeholders involved. The mission of Binocs is to optimize the management of private credit portfolios by leveraging advanced AI technologies to provide accurate and timely insights, ensuring better decision-making and risk mitigation.

Binocs was founded to address inefficiencies in private credit portfolio management. It leverages AI to extract and standardize financial data from diverse sources, making it a crucial tool for asset managers. The platform supports its users by offering tools for risk assessment, financial modeling, and compliance tracking, ensuring comprehensive oversight of their portfolios. A key aspect of Binocs is its ability to integrate market intelligence platforms, providing users with up-to-date information essential for strategic planning and risk management.

One of the significant milestones in Binocs' development is the establishment of a robust early warning system for loan risk management. This system uses AI algorithms to detect potential risks early, enabling proactive measures to mitigate them. The platform also offers a centralized document management system, which digitizes and stores all relevant documents, making them easily accessible and searchable with metadata.

The development journey of Binocs has been marked by continuous improvement and adaptation to the evolving needs of the private credit market. By integrating features like automated cash flow monitoring and covenant tracking, it ensures that all financial activities are closely monitored and managed. These capabilities are essential for maintaining compliance and ensuring the financial health of the portfolios managed.

In the competitive landscape, Binocs stands out by offering a comprehensive solution tailored specifically for private credit funds. Its competitors include other financial management solutions like BlackRock's Aladdin and S&P Global Market Intelligence. These platforms also provide robust financial management tools but often cater to a broader range of financial services, whereas Binocs focuses on the specific needs of private credit fund management.

Moreover, Binocs incorporates ESG metrics into its monitoring system, enabling asset managers to track and report on environmental, social, and governance factors. This feature is increasingly important as investors demand greater transparency and accountability in these areas. By providing detailed insights into ESG performance, Binocs helps asset managers meet these expectations and align their investments with sustainable practices.

Overall, Binocs offers a unique blend of AI-driven data processing, comprehensive monitoring tools, and centralized communication, making it an indispensable tool for private credit fund managers looking to enhance efficiency, manage risks, and ensure compliance in their operations.

- High Integrity Financial Data Extraction: Automated extraction and standardization of financial data from multiple sources, ensuring data accuracy and reliability.

- Streamlined Monitoring: Automated tracking of cash flow, covenants, and ESG metrics with timely alerts and reminders to keep all stakeholders informed and proactive.

- Risk Management: AI-driven risk scoring and an early warning system for proactive portfolio management, enabling users to identify and mitigate potential risks before they escalate.

- Automated Document Management: Centralized storage and digitization of documents with searchable metadata, facilitating easy access and efficient document handling.

- Integrated Communication: A centralized platform for communication among lenders, borrowers, and other stakeholders, enhancing collaboration and information sharing.

- Calendar View: Comprehensive overview of all financial events and deadlines, helping users manage their schedules and ensure timely actions.

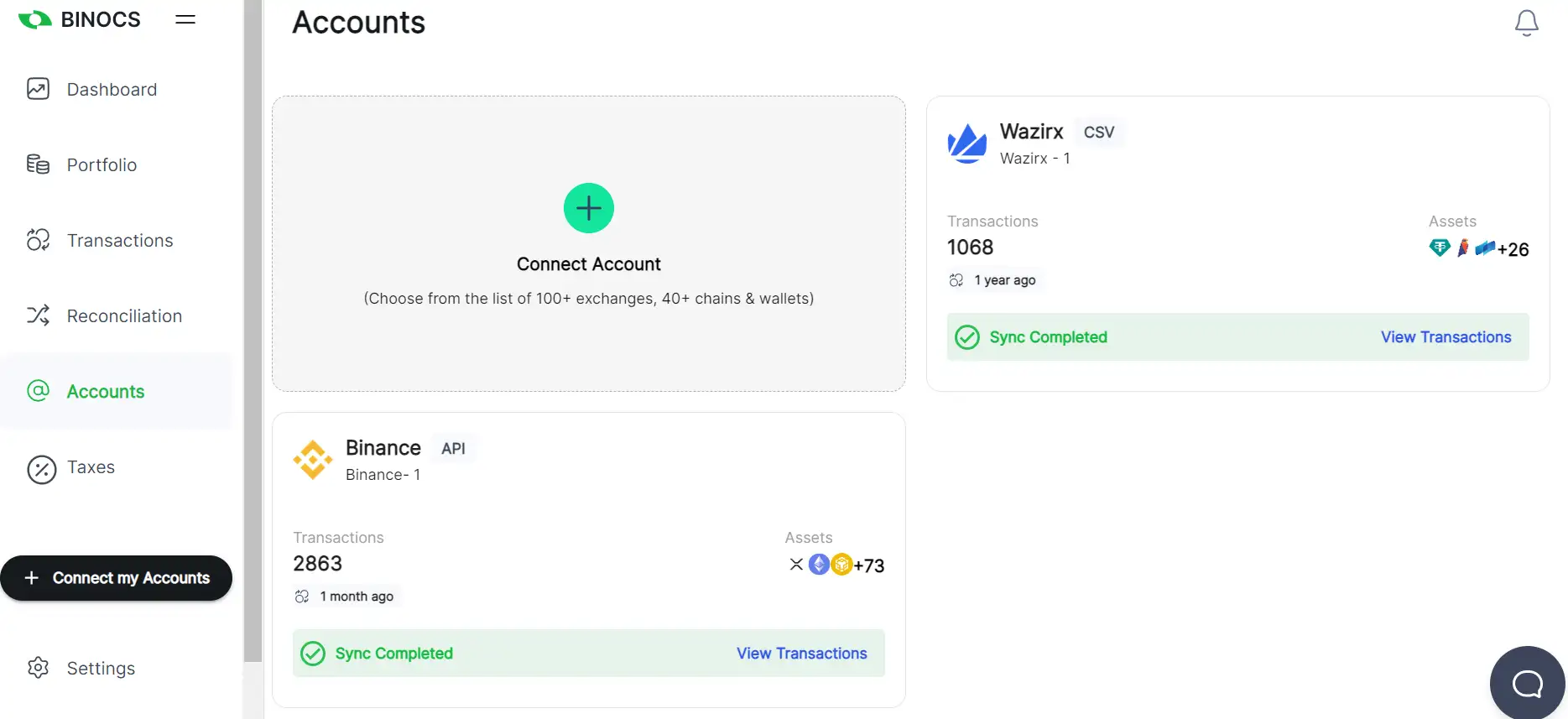

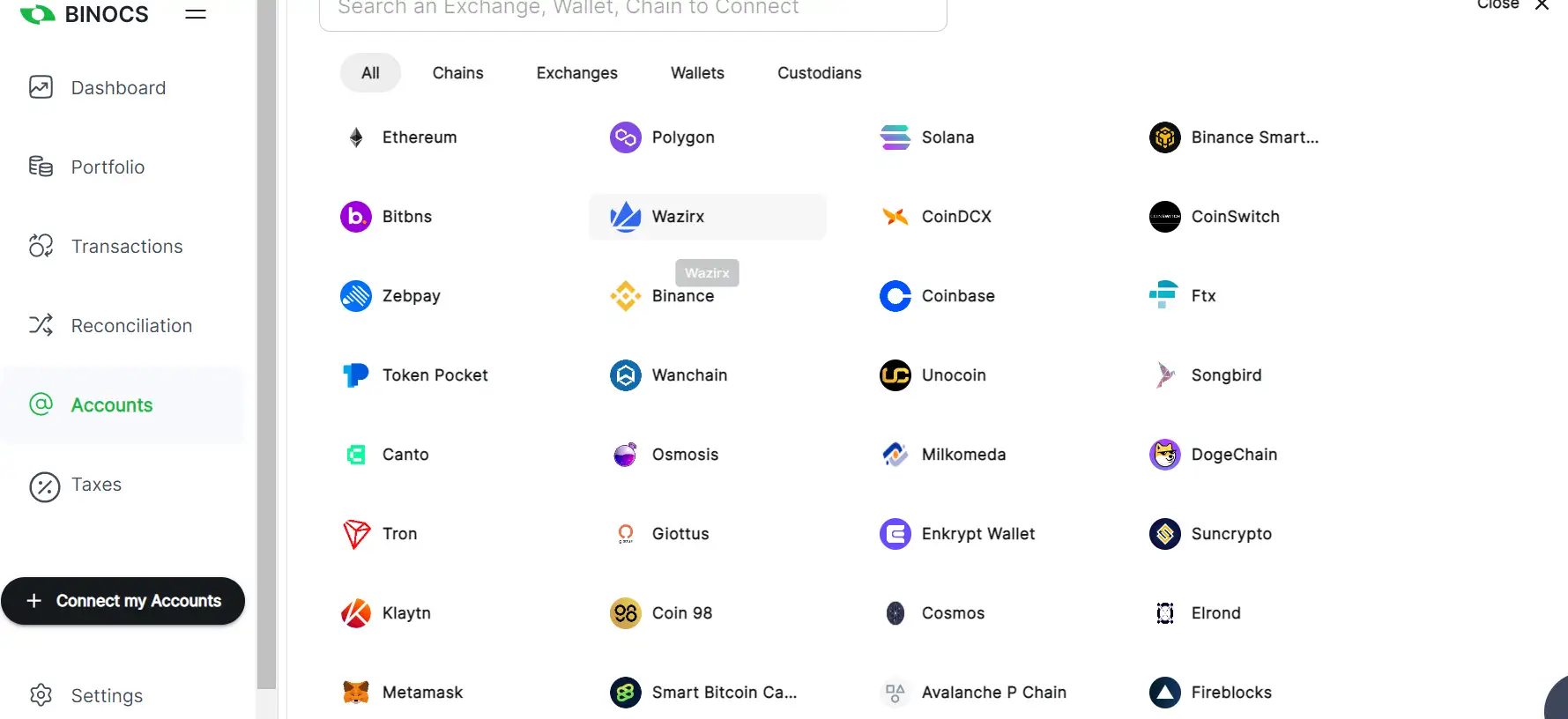

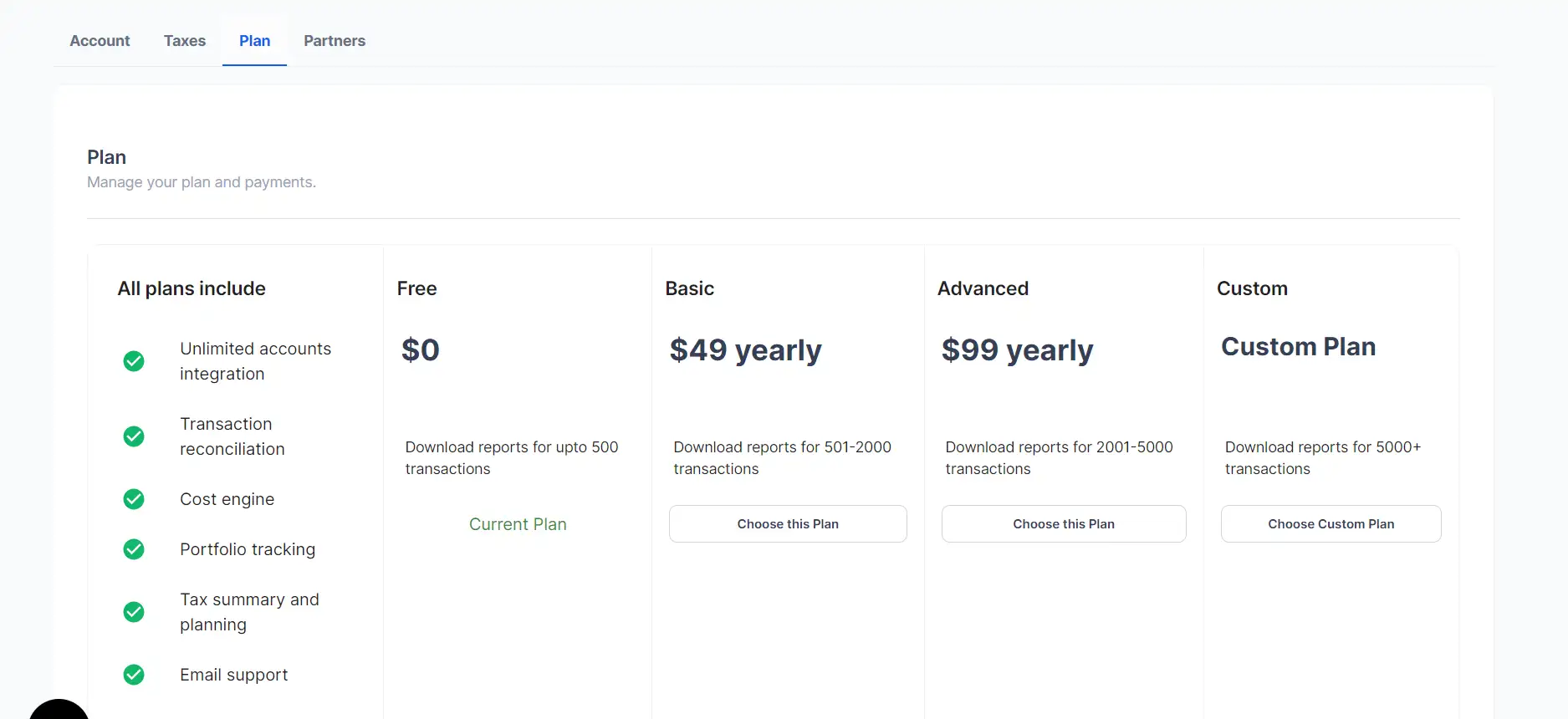

- Create an Account: Visit the Binocs website and sign up for an account by providing the necessary details.

- Initial Setup: Integrate your financial data sources into the platform and configure user roles and permissions according to your organizational structure.

- Access Features: Utilize the dashboard to monitor cash flows, covenants, and ESG metrics, gaining insights into your portfolio's performance and risks.

- Document Management: Upload and digitize relevant documents into the centralized document management system for easy access and retrieval.

- Notifications: Set up automated reminders and alerts for key financial events and deadlines, ensuring that you stay informed and take timely actions.

- Support: Access the guides and tutorials provided on the Binocs website for detailed instructions and best practices to maximize the platform's capabilities.

Binocs Reviews by Real Users

Binocs FAQ

Binocs ensures high integrity in financial data extraction by utilizing advanced AI algorithms to automatically extract and standardize financial data from multiple sources. This process minimizes human error and ensures that the data is accurate and reliable for analysis and decision-making.

Binocs offers several features for streamlined monitoring, including automated tracking of cash flows, covenants, and ESG metrics. Timely alerts and reminders keep stakeholders informed, while the centralized dashboard provides a comprehensive view of all financial activities, ensuring efficient portfolio management.

The AI-driven risk management system in Binocs uses advanced algorithms to assess risk factors and score potential risks. It features an early warning system that alerts asset managers to potential issues, enabling proactive measures to mitigate risks and protect the portfolio's financial health.

The automated document management system in Binocs centralizes storage and digitization of documents, making them easily accessible and searchable with metadata. This feature enhances efficiency in document handling, reduces manual errors, and ensures that all necessary documents are readily available for compliance and auditing purposes.

Binocs integrates communication through its centralized platform, which facilitates seamless interaction among lenders, borrowers, and other stakeholders. This feature ensures that all parties are on the same page, improving collaboration, transparency, and the overall efficiency of managing private credit portfolios.

You Might Also Like