About BracketX

Bracket is an innovative platform in the Liquid Staked DeFi space, focusing on providing advanced financial tools and opportunities for Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs). The project’s mission is to unlock the full potential of staked assets by offering liquidity, leverage, and earning opportunities to users. By integrating these functionalities, Bracket aims to enhance the overall utility and productivity of staked assets within the decentralized finance ecosystem.

Bracket stands out in the industry due to its unique approach to handling staked assets. The platform supports various tokens such as $stETH, $eETH, $rETH, and more, ensuring that users have access to a wide range of options for staking and leveraging their assets. Bracket's focus on providing high-quality collateral and robust risk management protocols further differentiates it from other platforms in the market.

With a strong commitment to decentralization and community governance, Bracket empowers its users to participate in the decision-making process, ensuring that the platform evolves in a way that aligns with the interests of its community. The introduction of $brktETH as a core component of the ecosystem highlights Bracket’s dedication to innovation and enhancing the value proposition of staked assets in the DeFi space.

Bracket was developed to address the growing need for enhanced liquidity and utility in staked assets. The platform's history and development are marked by several key milestones that highlight its evolution and growth in the decentralized finance (DeFi) space. One of the major milestones is the launch of $brktETH, which plays a crucial role in providing liquidity and leveraged trading opportunities for staked assets.

The development of escrow staking mechanisms is another significant milestone for Bracket. These mechanisms ensure that staked assets are securely managed and utilized, providing users with confidence in the platform's ability to safeguard their investments. Additionally, Bracket has established robust risk management protocols to protect user investments and maintain the stability of the ecosystem.

Bracket's competitors include platforms like Lido and Rocket Pool, which also focus on providing liquidity and utility for staked assets. However, Bracket distinguishes itself by offering a comprehensive suite of financial tools that cater to the unique needs of Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs).

In terms of development, Bracket has continuously expanded its support for various tokens, including $stETH, $eETH, $rETH, and more. This expansion ensures that users have access to a diverse range of assets for staking and leveraging, enhancing the platform’s overall utility and appeal.

The future roadmap for Bracket includes plans to integrate advanced trading features and support additional assets. These planned developments aim to increase the token’s utility and adoption within the DeFi space. By focusing on continuous innovation and user-centric development, Bracket aims to maintain its position as a leading platform in the Liquid Staked DeFi space.

- Liquidity Solutions: Bracket provides liquidity for LSTs and LRTs, enabling users to maximize asset utility. This feature ensures that users can easily trade and stake their assets, contributing to the overall stability and efficiency of the DeFi ecosystem.

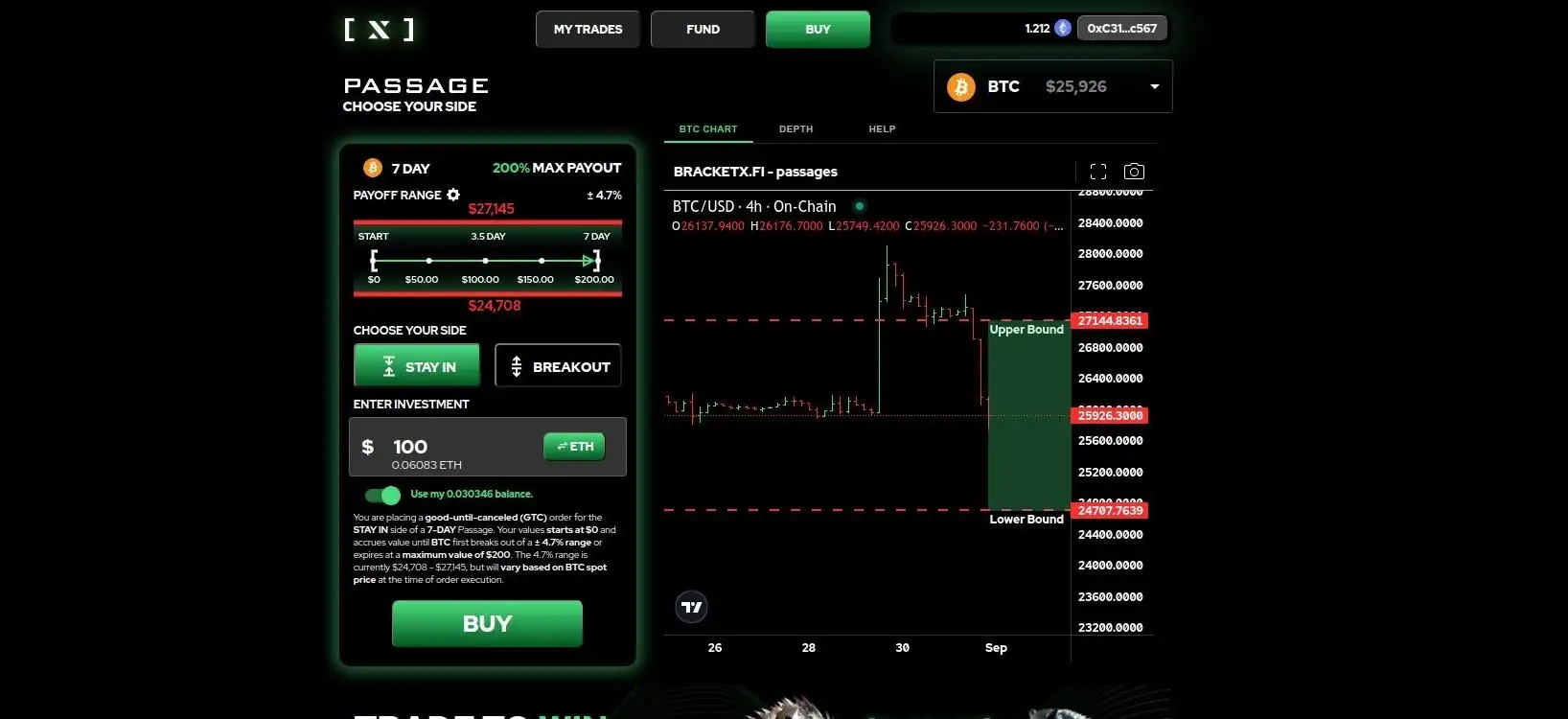

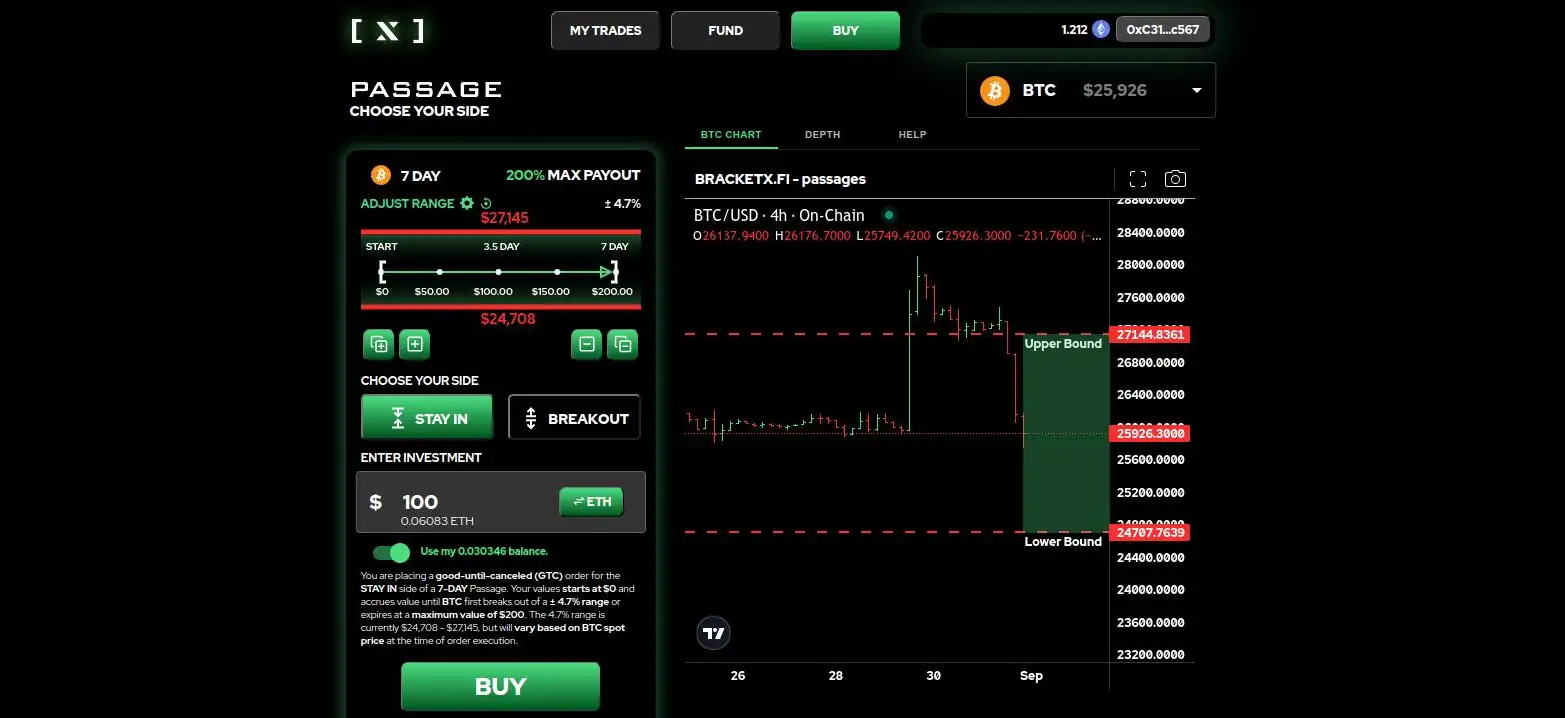

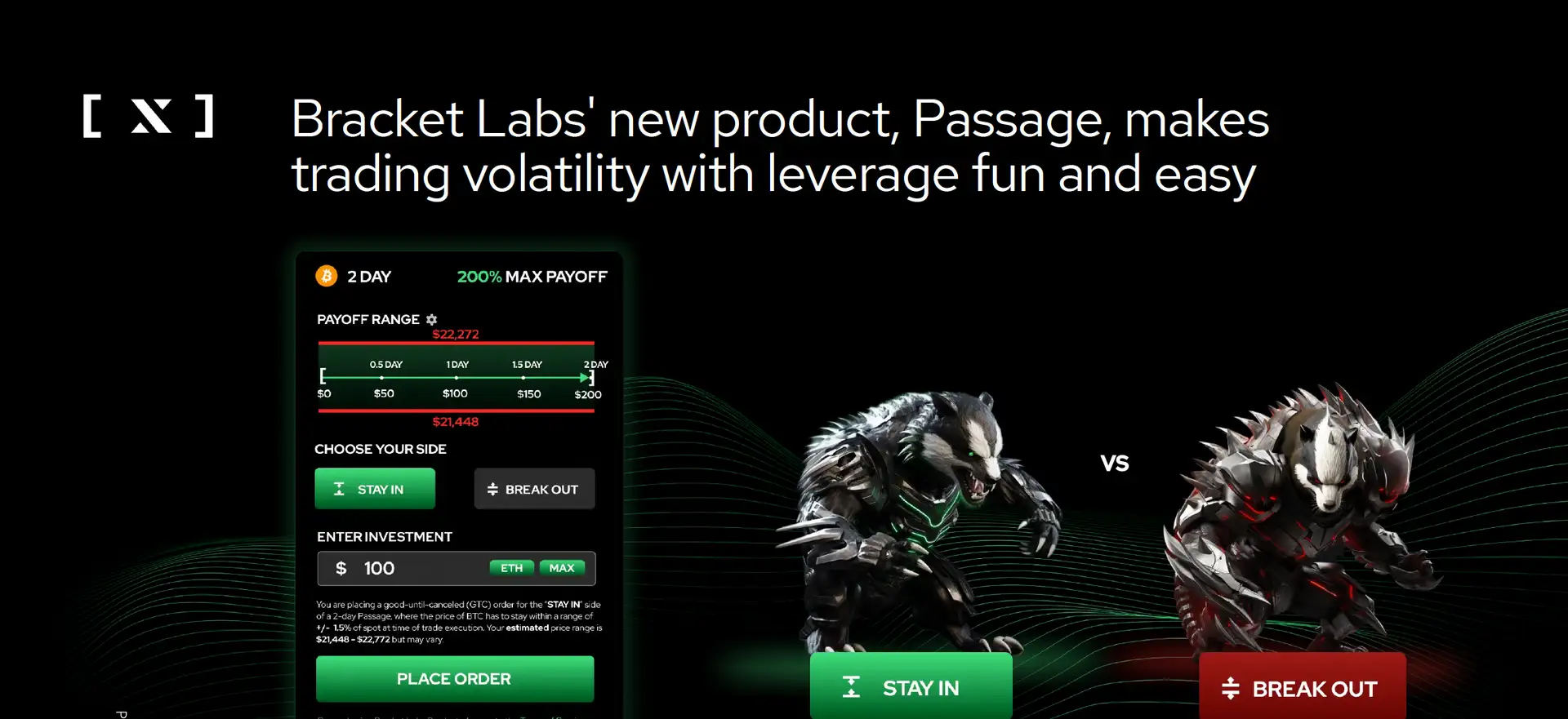

- Leveraged Opportunities: The platform facilitates leveraged trading, allowing users to amplify their potential returns on staked assets. This feature is particularly beneficial for users looking to maximize their yields without significantly increasing their initial investment.

- High-Quality Collateral: Bracket uses staked assets as reliable collateral in DeFi protocols, enhancing the overall utility and financial flexibility of these assets. This function provides users with additional opportunities to engage in various DeFi activities.

- Decentralized Governance: Bracket empowers token holders with voting rights to influence platform decisions. This governance model ensures that the ecosystem remains decentralized and community-driven, aligning the platform’s development with the interests of its users.

- Risk Management: The platform implements rigorous asset selection and risk management criteria to protect user investments. These protocols help maintain the stability and security of the Bracket ecosystem, providing users with confidence in the platform’s reliability.

- Integration with DeFi: Bracket is designed to integrate seamlessly with existing DeFi systems, optimizing liquidity and yield for users. This integration enhances the token’s overall utility and adoption within the broader DeFi landscape.

- Escrow Staking: Ensures the secure management and utilization of staked assets, giving users confidence in the platform's ability to safeguard their investments.

- Diverse Asset Support: Bracket supports a wide range of tokens like $stETH, $eETH, $rETH, and more, providing users with multiple options for staking and leveraging their assets.

- Continuous Innovation: The platform's future roadmap includes plans to integrate advanced trading features and support additional assets, ensuring ongoing growth and development.

- Create an Account: Visit the Bracket platform and sign up by providing the necessary information. Follow the verification steps to secure your account.

- Stake Assets: Deposit your LSTs or LRTs into the platform. Follow the guidelines provided to ensure that your assets are staked correctly and securely.

- Utilize $brktETH: Access earning and leveraged opportunities with $brktETH. Explore the various financial tools and features available on the platform to maximize the utility of your staked assets.

- Explore Features: Engage in margin trading, liquidity provisioning, and other DeFi activities. Utilize the tools provided to optimize your asset's performance and returns.

- Follow Guides: Use the detailed user guides available on the Bracket website for step-by-step instructions on various features and functionalities. These guides will help you navigate the platform efficiently and make the most of its offerings.

- Stay Informed: Keep up with the latest updates and developments by following Bracket's official channels. Stay informed about new features, upcoming integrations, and community governance proposals.

For more information, visit the Bracket GitBook.

BracketX Reviews by Real Users

BracketX FAQ

Using Bracket provides multiple benefits, including enhanced liquidity, leveraged trading opportunities, and the ability to use staked assets as high-quality collateral in DeFi protocols. The platform also offers decentralized governance, allowing users to participate in decision-making processes.

Bracket employs escrow staking mechanisms to securely manage and utilize staked assets. These mechanisms ensure that assets are safely stored and efficiently used, providing users with confidence in the platform's security measures.

$brktETH enables the creation of liquidity pools that support the trading and staking of Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs). This liquidity is crucial for maintaining stability and efficiency in the DeFi ecosystem, allowing users to maximize their asset utility.

Bracket's leveraged trading opportunities allow users to amplify their potential returns on staked assets. This feature is beneficial for users looking to maximize their yields without significantly increasing their initial investment, providing a unique advantage in the DeFi space.

Bracket empowers token holders with voting rights on key platform decisions. This decentralized governance model ensures that the ecosystem remains community-driven, aligning the platform's development with the interests of its users and maintaining transparency.

You Might Also Like