About Burrow

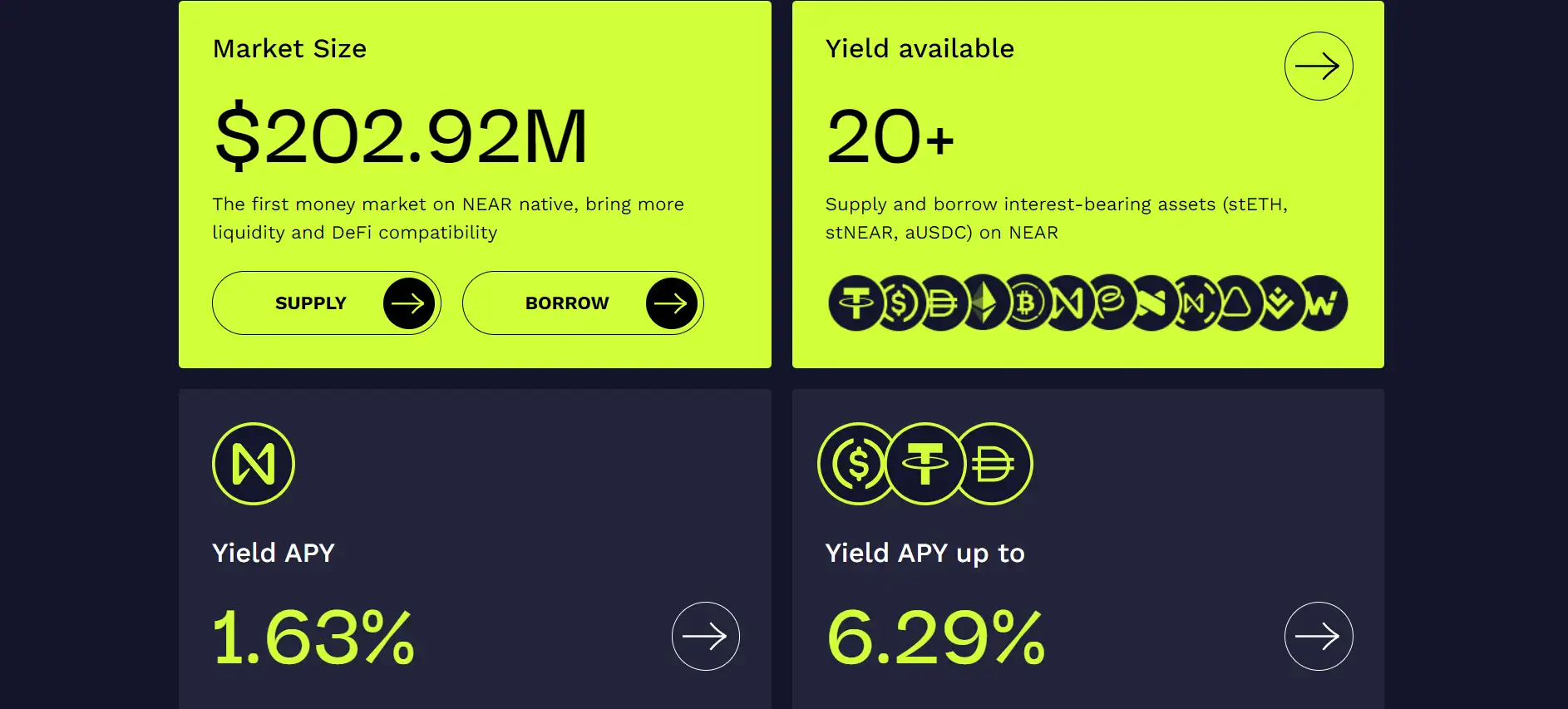

Burrow Finance is a cutting-edge, decentralized platform that revolutionizes the world of DeFi (Decentralized Finance) by offering a seamless way for users to earn interest on their digital assets and borrow against them. Built natively on the NEAR blockchain, a highly scalable and secure proof-of-stake network, Burrow Finance aims to unlock the liquidity of interest-bearing assets such as layer 1 staking derivatives like stNEAR and stETH. By focusing on these staking assets, the platform empowers users to maximize the utility of their holdings without sacrificing the rewards of staking.

Unlike traditional financial systems, Burrow Finance operates in a decentralized and non-custodial manner, ensuring users maintain complete ownership and control over their assets. Its intuitive interface and robust functionality enable users to supply assets for interest, leverage their holdings as collateral, and even participate in advanced trading strategies through features like margin trading. The platform is governed by the community-driven Burrow DAO, ensuring transparency and decentralization in decision-making. With comprehensive support for staking derivatives and Liquidity Provider (LP) tokens, Burrow is paving the way for a dynamic and interconnected DeFi ecosystem.

Burrow Finance is a transformative project in the decentralized lending and borrowing space, designed to address the challenges of liquidity within DeFi. Operating on the NEAR blockchain, it is specifically optimized for high throughput, low transaction fees, and eco-friendly operations, thanks to NEAR’s innovative proof-of-stake mechanism. The core mission of Burrow is to empower users by unlocking the liquidity of interest-bearing assets, particularly staking derivatives like stNEAR and stETH. By allowing users to supply these derivatives as collateral, Burrow enables a host of financial strategies, including leveraged staking, borrowing stablecoins, and creating self-repaying positions.

Since its inception, Burrow Finance has achieved significant milestones in expanding the scope of DeFi. The launch of its V2 update in July 2024 introduced major enhancements, including margin trading capabilities and support for Liquidity Provider (LP) tokens as collateral. These features cater to both novice and advanced users, opening up diverse opportunities within the NEAR ecosystem. Additionally, Burrow is actively working on implementing cross-chain functionalities using Chain Abstraction technology, which will allow users to interact with other blockchain networks seamlessly. Competitors like Aave and Compound offer similar decentralized lending services, but Burrow differentiates itself by its focus on staking derivatives and its integration within the NEAR ecosystem.

Burrow Finance's governance framework, the Burrow DAO, plays a critical role in ensuring the platform remains decentralized and user-focused. Built on the SputnikDAO/AstroDAO framework, the DAO handles treasury management, asset onboarding, and risk control while allowing community members to actively participate in the decision-making process. Additionally, Burrow emphasizes security, having undergone third-party audits and offering up to $250,000 in bug bounties to safeguard the platform.

While traditional DeFi platforms like Aave and Compound serve as competitors, Burrow's unique approach, particularly its focus on unlocking the potential of interest-bearing staking assets, sets it apart in the competitive DeFi landscape. By leveraging the capabilities of the NEAR blockchain, Burrow ensures an efficient, scalable, and secure environment for decentralized financial activities.

Burrow Finance stands out in the DeFi ecosystem with its unique set of features and benefits that empower users to fully utilize their assets:

- Decentralized and Non-Custodial: Users retain full ownership and control of their assets, ensuring maximum security and eliminating the need for intermediaries.

- Interest-Earning Opportunities: Supply assets to earn competitive interest rates, creating a passive income stream while retaining ownership of your holdings.

- Collateralized Borrowing: Unlock liquidity without liquidating assets by borrowing against them. This enables flexible financial strategies for users to manage their portfolios.

- Staking Derivatives: Specialized support for assets like stNEAR and stETH, allowing users to use staking rewards as collateral and amplify returns.

- Margin Trading: Take advantage of leveraged positions to boost potential profits, catering to more advanced trading strategies.

- Liquidity Provider Tokens as Collateral: Enhance capital efficiency by using LP tokens from various decentralized exchanges as collateral.

- Cross-Chain Functionality: Upcoming Chain Abstraction features will enable interactions with multiple blockchains, expanding the scope of financial possibilities.

- Community Governance: Governed by the Burrow DAO, users can participate in decisions regarding treasury management, risk parameters, and more.

- Robust Security: The platform has undergone thorough audits and offers bug bounties up to $250,000, demonstrating a strong commitment to safeguarding user assets.

- Low Transaction Fees: Built on the NEAR blockchain, users benefit from low transaction costs and a highly scalable architecture.

Getting started with Burrow Finance is a straightforward process, allowing both new and experienced users to engage in DeFi activities easily:

- Visit the Platform: Start by navigating to the official Burrow Finance website: https://burrow.finance/.

- Set Up a Wallet: Ensure you have a NEAR-compatible wallet such as NEAR Wallet or a hardware wallet like Ledger. Connect your wallet to the platform.

- Deposit Assets: Supply digital assets to the platform. This step allows you to earn interest while keeping your assets available for further use.

- Enable Collateral: If you plan to borrow against your holdings, enable the “Use as Collateral” option for the assets you’ve supplied.

- Borrow Funds: Visit the ‘Borrow’ section to access the desired amount of funds. Ensure your Health Factor is above 100% to prevent liquidation.

- Track Your Portfolio: Monitor your supplied and borrowed assets directly from the dashboard to manage your financial strategies effectively.

- Participate in Governance: Engage in platform governance by joining the Burrow DAO. You can contribute to decision-making and influence the platform’s future.

Burrow FAQ

Burrow Finance enables users to utilize their staked assets, such as stNEAR and stETH, as collateral while retaining their staking rewards. This means you can borrow assets or create leveraged positions without losing access to staking benefits. By doing so, Burrow provides a solution to the otherwise illiquid nature of staking derivatives. Learn more on their official website: https://burrow.finance/.

Yes, Burrow Finance supports the use of Liquidity Provider (LP) tokens as collateral. This feature allows users to maximize the utility of their LP tokens, enabling them to unlock liquidity without withdrawing from their liquidity pools. This approach helps users maintain their staking rewards or trading fee income while accessing additional funds.

The governance of Burrow Finance is conducted through the Burrow DAO, which empowers the community to make decisions about treasury management, risk parameters, and asset onboarding. This decentralized approach ensures that users have a say in the platform’s development and growth.

Burrow Finance places a strong emphasis on security by undergoing comprehensive audits and offering bug bounties of up to $250,000 to encourage responsible disclosure of vulnerabilities. The platform’s smart contracts are built with robust mechanisms to minimize risks, ensuring a safe environment for users. Explore more about security measures at https://burrow.finance/.

Burrow is actively working on implementing cross-chain functionality using Chain Abstraction, which will allow users to interact with multiple blockchains seamlessly. This will enable lending, borrowing, and trading activities across various ecosystems, greatly expanding the opportunities for users. Stay updated on their progress at https://burrow.finance/.

You Might Also Like