About Cellana Finance

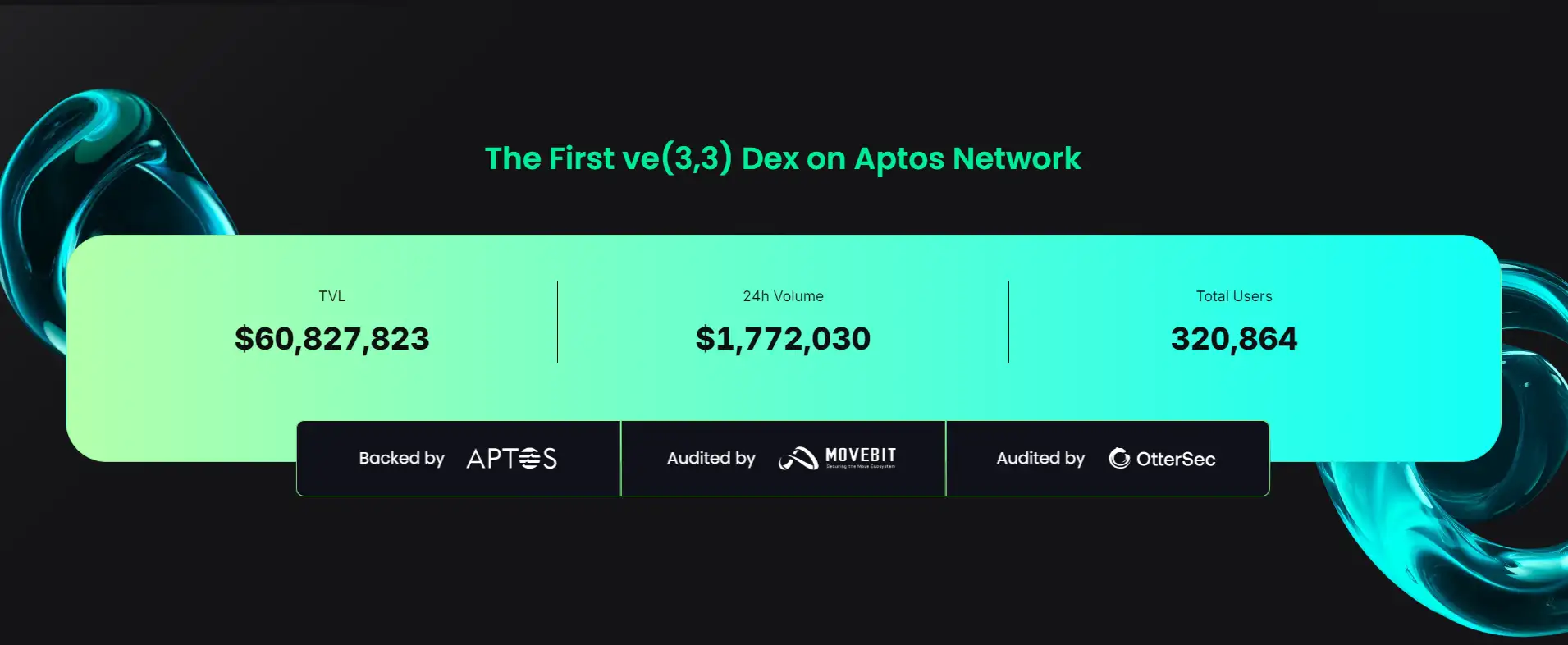

Cellana Finance is a groundbreaking decentralized exchange (DEX) built on the innovative Aptos blockchain. As one of the first platforms to adopt the revolutionary Ve (3,3) model, Cellana Finance is designed to deliver a more sustainable and community-centric approach to liquidity and governance. The platform offers users a seamless experience for trading, liquidity provision, and staking, aligning the interests of liquidity providers, token holders, and the broader Aptos ecosystem. This forward-thinking DEX aims to tackle challenges faced by traditional DeFi platforms, such as unsustainable token emissions and lack of community alignment, by leveraging advanced blockchain technology.

Cellana Finance's mission is to create a robust and fair ecosystem that supports decentralized finance (DeFi) on the Aptos network. By implementing the Ve (3,3) model—originally introduced by Andre Cronje—the platform promotes sustainability and long-term value for its participants. This model provides users with governance power through veCELL tokens, enabling them to influence liquidity pool rewards and token emissions. Backed by successful funding and a clear roadmap, Cellana Finance is poised to be a cornerstone of the Aptos DeFi landscape, fostering growth and innovation in the sector.

Established as a project under Ocean Floors Technology Ltd., Cellana Finance aims to redefine decentralized finance by addressing inefficiencies in traditional decentralized exchanges (DEXs). The platform capitalizes on the advanced capabilities of the Aptos blockchain, such as its scalability and low transaction costs, to deliver a superior trading experience.

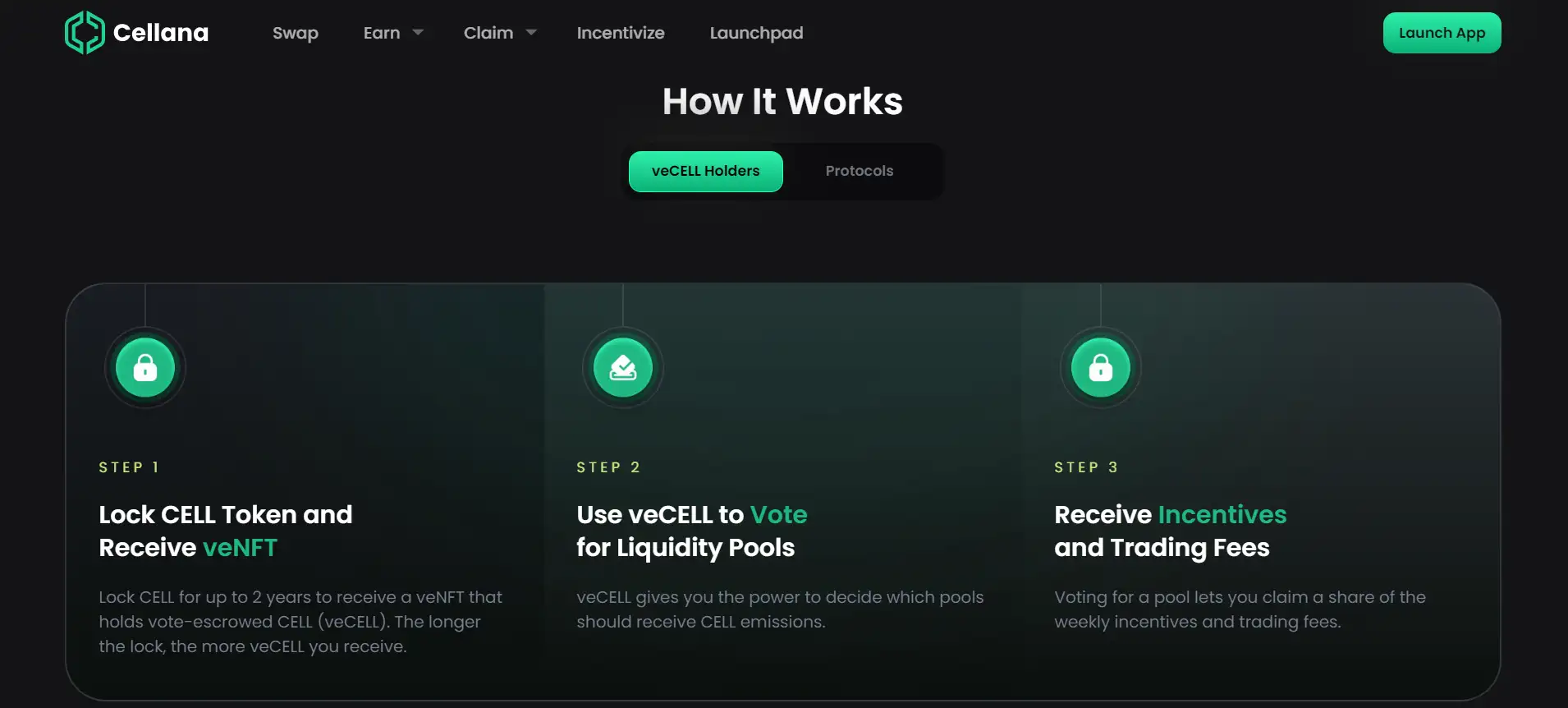

The central innovation of Cellana Finance is its adoption of the Ve (3,3) Model, which combines the best aspects of Curve’s ve-token model and OlympusDAO’s (3,3) game theory concept. Users who lock their tokens receive veNFTs, granting voting power and access to trading fee rewards. This governance model aligns incentives across stakeholders, from token holders to liquidity providers, creating a balanced and sustainable ecosystem.

Unlike traditional DEXs such as PancakeSwap or Uniswap, which often struggle with token inflation and over-reliance on liquidity mining, Cellana Finance offers a more robust alternative. The Ve (3,3) Model ensures that all participants in the ecosystem are incentivized in ways that promote long-term growth and stability.

Since its launch, Cellana Finance has achieved key milestones, including over $400,000 raised from prominent investors such as Gui Inu and SwapGPT. The platform’s roadmap includes advanced trading tools, fiat on/off-ramp integration, and collaboration with DEX aggregators. By focusing on Aptos-based innovations, the project has established itself as a leader in sustainable DeFi development.

Cellana Finance offers a range of key benefits that set it apart in the decentralized finance (DeFi) ecosystem:

- Innovative Ve (3,3) Model: By utilizing the Ve (3,3) Model, Cellana Finance ensures a sustainable and community-driven approach to liquidity provision and token governance. This model aligns the interests of token holders and liquidity providers, creating a balanced and efficient ecosystem.

- Scalable Performance: Built on the Aptos blockchain, the platform delivers high-speed transactions, low fees, and enhanced scalability, making it ideal for a broad range of DeFi activities.

- Advanced Governance: veCELL holders can influence liquidity pool rewards through a transparent and user-driven governance model. This feature ensures that incentives are distributed equitably among the community.

- Diverse Trading Options: Cellana supports both stable and volatile asset pairs using specialized algorithms (sAMM for stable and vAMM for volatile). This dual functionality ensures optimized trading experiences for different asset types.

- Future Developments: The platform's roadmap includes the integration of fiat on/off ramps, advanced trading tools, and partnerships with DEX aggregators to expand its functionality and appeal.

To get started with Cellana Finance, follow these steps:

- Set Up a Wallet: Download and install an Aptos-compatible wallet, such as Petra Wallet or Martian Wallet. Configure the wallet to connect to the Aptos network.

- Fund Your Wallet: Purchase Aptos (APT) tokens from a supported exchange like Binance or Coinbase. Transfer the tokens to your wallet to cover transaction fees and participate in the ecosystem.

- Connect to Cellana Finance: Visit the Cellana Finance website and click "Connect Wallet." Follow the prompts to link your Aptos-compatible wallet to the platform.

- Explore Features: Start trading, providing liquidity, or staking tokens to earn rewards. Visit the official guidelines for detailed instructions on using the platform’s features.

- Participate in Governance: Lock CELL tokens to receive veNFTs, enabling governance rights and trading fee rewards.

Cellana Finance FAQ

The Ve (3,3) Model adopted by Cellana Finance incentivizes liquidity providers and token holders through a sustainable rewards mechanism. Users who lock their tokens receive veNFTs, which grant governance power and trading fee rewards. This ensures that liquidity providers earn incentives without diluting the ecosystem, while token holders influence liquidity pool emissions. Learn more about the model on the official documentation.

The Aptos blockchain provides the backbone for Cellana Finance, offering high-speed transactions, low fees, and scalability. By leveraging Aptos' advanced features, Cellana ensures a seamless user experience and reliable performance for traders, stakers, and liquidity providers.

Holders of veCELL tokens gain governance rights, allowing them to vote on liquidity pool emissions and reward distribution. Their votes directly determine which pools receive higher incentives, ensuring an equitable distribution of rewards aligned with the community's interests.

Yes, Cellana Finance plans to introduce fiat on/off ramps in its 2024 roadmap. This feature will make it easier for users to convert fiat currency into cryptocurrencies and vice versa, enhancing accessibility for newcomers. For updates, check the roadmap at https://docs.cellana.finance.

Cellana Finance caters to both stable and volatile asset pairs using specialized swap algorithms. The platform employs vAMM for volatile assets and sAMM for stable pairs, ensuring efficient and cost-effective trading.

You Might Also Like