About Chainspot

Chainspot is an advanced omnichain DeFi protocol that enables seamless cross-chain swaps, yield farming, and liquidity management across EVM and non-EVM networks. Designed for both retail users and fintech projects, Chainspot offers a single-entry point to manage DeFi positions across 40+ blockchains with just one transaction signature. Through smart routing, gas abstraction, and built-in AML compliance, Chainspot simplifies complex DeFi operations into user-friendly flows.

With support for over 10,000 tokens, 540,000+ users, and integrations with 50+ liquidity protocols and 25+ bridges, Chainspot stands out as a powerful solution in the increasingly fragmented DeFi ecosystem. Its built-in Chainspot Family Loyalty Program adds an engaging layer of rewards, cashback, NFT memberships, and referral bonuses—making it one of the most complete Web3 platforms for both users and developers. Chainspot redefines the DeFi experience by merging convenience, security, and profitability.

Chainspot was designed to resolve one of DeFi’s biggest pain points: managing assets across multiple chains. Most users today navigate a disjointed multichain environment, often juggling wallets, gas fees, bridges, and liquidity pools across various ecosystems. These inefficient workflows lead to overspending, missed opportunities, and increased risk—especially for non-technical users and new entrants. Chainspot solves this through a robust, omnichain-native protocol architecture that abstracts the complexity and delivers real chain-agnostic DeFi.

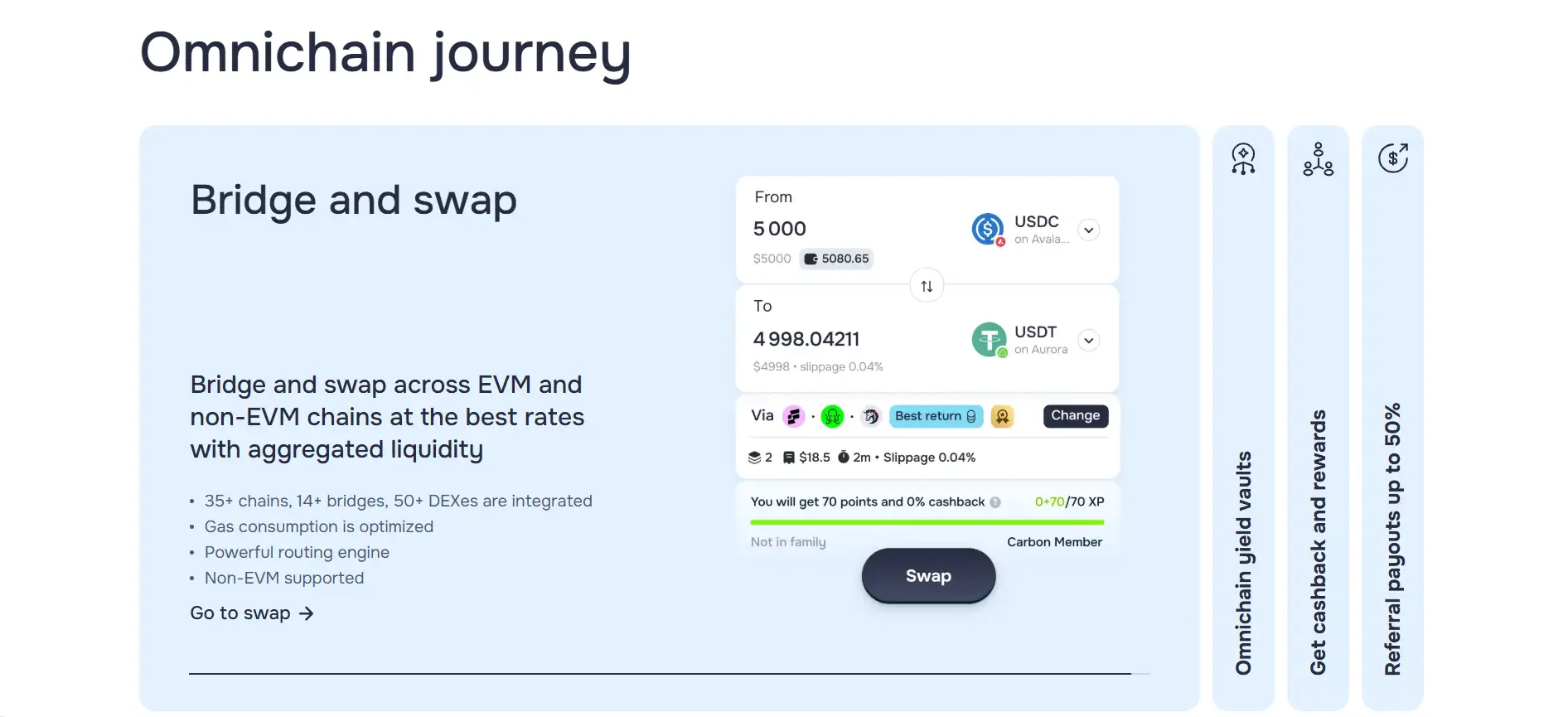

At its core, Chainspot integrates a smart liquidity routing engine, a cross-chain payload architecture, and on-chain protocol composability. This system enables users to swap tokens, bridge assets, top up wallets, or deposit into yield vaults—across different chains—all in a single transaction. Instead of requiring the user to create new wallets or manually manage native gas tokens, Chainspot handles all underlying processes and returns the user an omnichain LP token on the source chain.

For example, if a user holds 100,000 USDT on BNB Chain and wants to stake in a Solana protocol, Chainspot handles bridging, conversion, staking, and gas—all in one click. The user receives a wrapped LP token on BNB Chain, while the entire transaction is executed in the background. This approach not only enhances security but saves up to 70% in gas fees and 1% on transaction volumes.

Chainspot’s architecture is also enterprise-ready. It includes an AML and accounting layer for B2B compliance, making it ideal for fintech projects seeking to integrate DeFi into their products. Features like transaction reporting, custom widgets, and a fintech-friendly API make integration easy. Supported business verticals include wallets, NFT platforms, Metaverse applications, GameFi protocols, and payment providers.

The protocol is backed by a network of decentralized liquidity providers and verified by leading audit firms such as HashEx and Decurity. With support for over 180+ chains, 120+ bridges, and 10M+ cross-chain routes, Chainspot is positioned to become the backbone of omnichain DeFi. It competes with solutions like Rubic, LI.FI, and Socket, but stands apart by offering chain abstraction, gamified loyalty, and protocol-level rewards in one unified ecosystem.

Chainspot provides a wide array of features and benefits that make it a standout platform in the omnichain DeFi space:

- Omnichain DeFi Position Management: Open and manage DeFi positions across EVM and non-EVM chains using just one transaction, eliminating the need to switch wallets or pay gas in multiple networks.

- Smart Liquidity Routing: Access optimal token exchange rates through intelligent aggregation of DEXes, bridges, and yield protocols across 40+ chains and $7B+ in total liquidity.

- Cross-Chain Yield Vaults: Deposit into yield-generating protocols directly from any chain, with automatic bridging, swapping, and gas coverage under the hood.

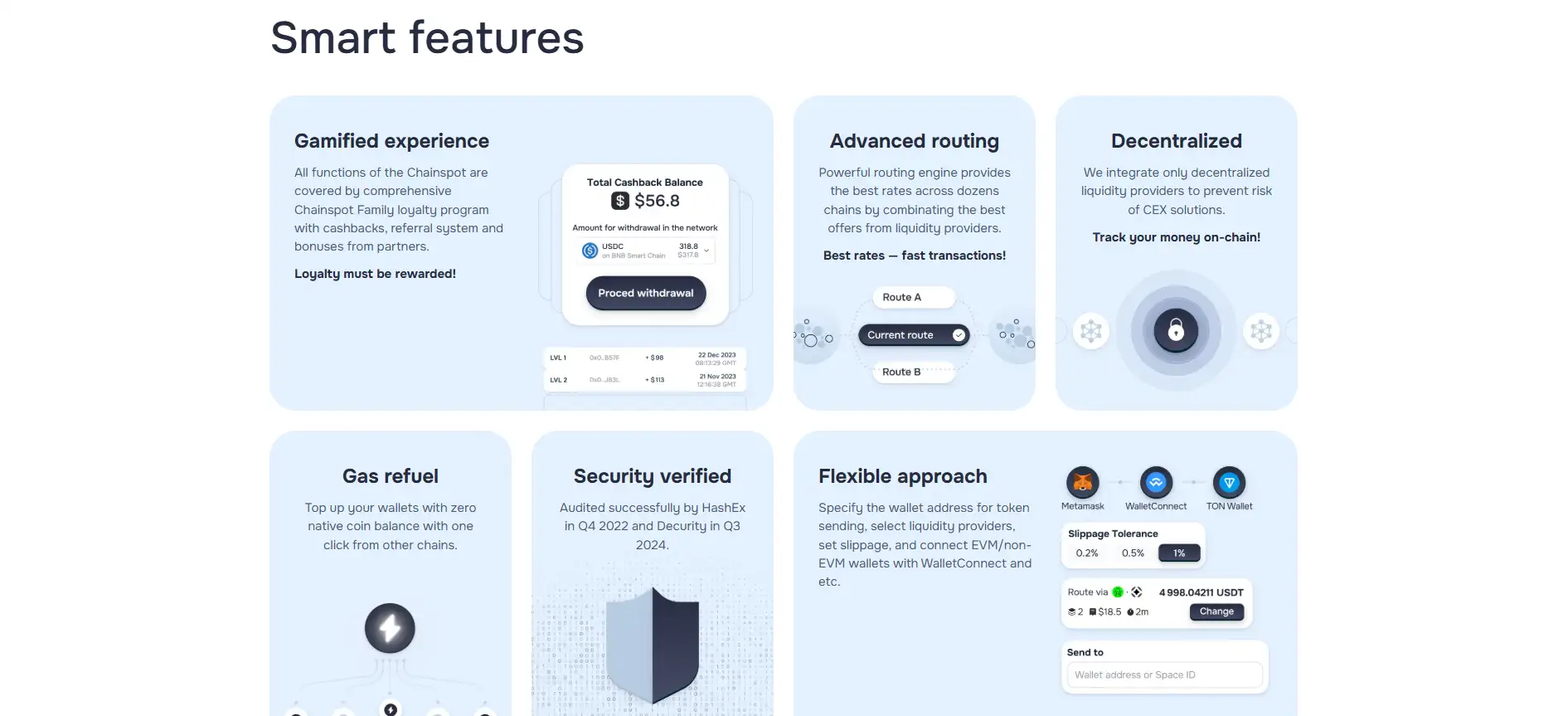

- Loyalty Program with On-Chain Rewards: Earn stablecoin cashback, referral payouts up to 50%, and unlock tradable NFT memberships with increasing levels and bonuses.

- Gas Refuel System: Seamlessly top up wallets that have zero native token balance with cross-chain transactions—never get stuck without gas.

- Full Decentralization: All integrated services are from decentralized liquidity providers, minimizing centralized risk.

- B2B API & Widget Integrations: Wallets, DEXes, NFT platforms, and fintech apps can integrate with Chainspot’s high-speed API or widget to enable cross-chain functionality and revenue generation.

Getting started with Chainspot is a smooth and intuitive experience for both individual users and Web3/fintech teams:

- Connect Your Wallet: Visit chainspot.io and launch the dApp. Connect your preferred wallet via WalletConnect, MetaMask, or any supported wallet.

- Make Your First Swap or Deposit: Choose a token and network to send from, and select your desired destination. Execute a swap, bridge, or vault deposit in one click with the best route suggested automatically.

- Join Chainspot Family: After your first transaction, you’ll start earning XP. This XP unlocks cashback, bonuses, and your first NFT membership—giving access to higher loyalty levels and passive referral income.

- Track and Boost Your Rewards: Access the Chainspot Dashboard to monitor your XP, referral earnings, and membership NFTs. Use the dashboard to boost your level and receive enhanced benefits.

- Invite and Earn: Share your referral link found in “My Referrals.” Earn up to 50% in cashback from every transaction your invitees make.

- Integrate Chainspot: If you’re a developer or fintech builder, explore the Chainspot Docs to integrate the protocol via API, widget, or custom partner onboarding. Contact the team directly for advanced integrations.

Chainspot FAQ

Chainspot uses a chain abstraction layer that wraps all swap, bridge, and vault deposit actions into one seamless transaction. The protocol’s routing engine fetches the best route, executes all required steps (including gas coverage and token conversion), and delivers the final omnichain LP token to the user’s wallet on the source chain. This turns multi-step operations into a single, efficient signature.

Chainspot’s NFT membership system is tied to user activity and loyalty. As users accumulate XP through swaps and deposits, they unlock Carbon, Bronze, Silver, Gold, or Platinum NFTs. These NFTs provide increasing levels of cashback, referral payouts, and even access to Web3 VPN services. They are also tradable, allowing users to cash out or level up within the loyalty ecosystem.

B2B partners—wallets, NFT platforms, fintech apps—can integrate Chainspot using an API or widget. They can generate new revenue streams by enabling cross-chain swaps and yield vault deposits with a transactional or success-fee model. Chainspot allows partners to keep up to 95% of fees while offering support for AML checks, gas abstraction, and customizable payout models.

Chainspot reduces phishing risk by allowing users to manage all DeFi positions from one dashboard and through one trusted dApp. Instead of visiting multiple unfamiliar DEXes, bridges, and wallets, users execute actions in one click. This limits exposure to malicious sites and minimizes the need to connect wallets across unknown interfaces, which is a common vector for phishing attacks.

Chainspot offers full chain abstraction, not just multichain routing. It combines liquidity aggregation, vault integration, gas refueling, and on-chain loyalty rewards in one platform. Unlike competitors, Chainspot also supports non-EVM chains and enables both retail and B2B users to access DeFi positions across 40+ networks in a single transaction—secured, optimized, and gamified.

You Might Also Like