About Clearpool

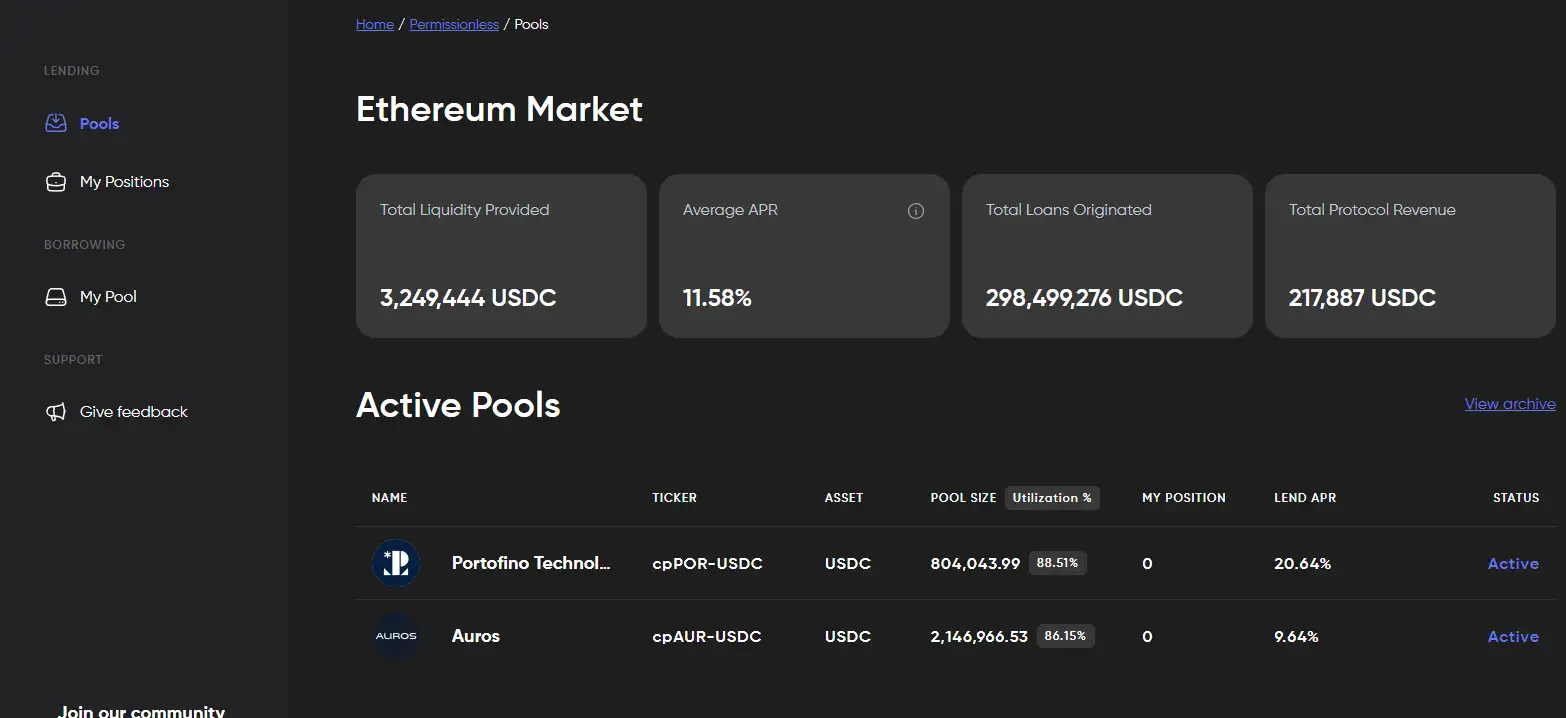

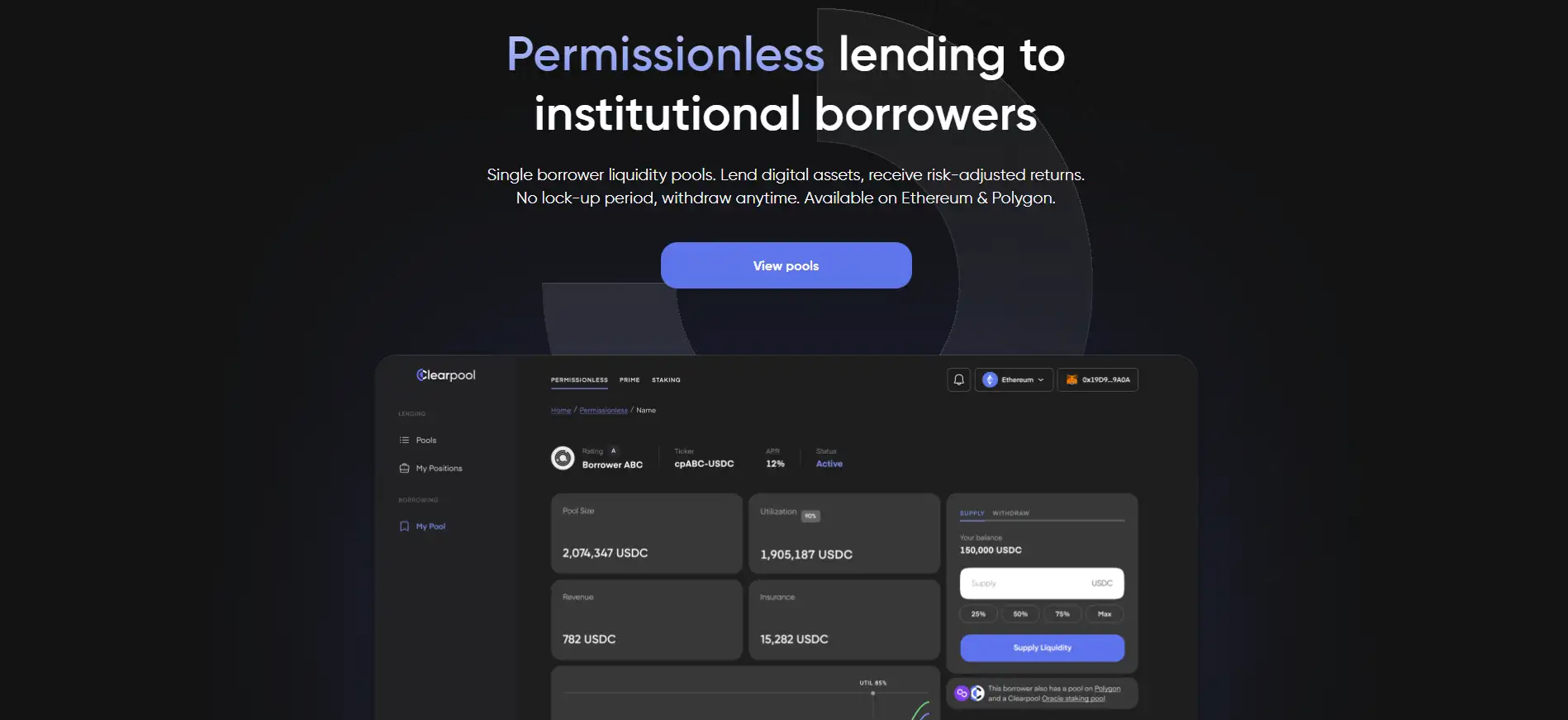

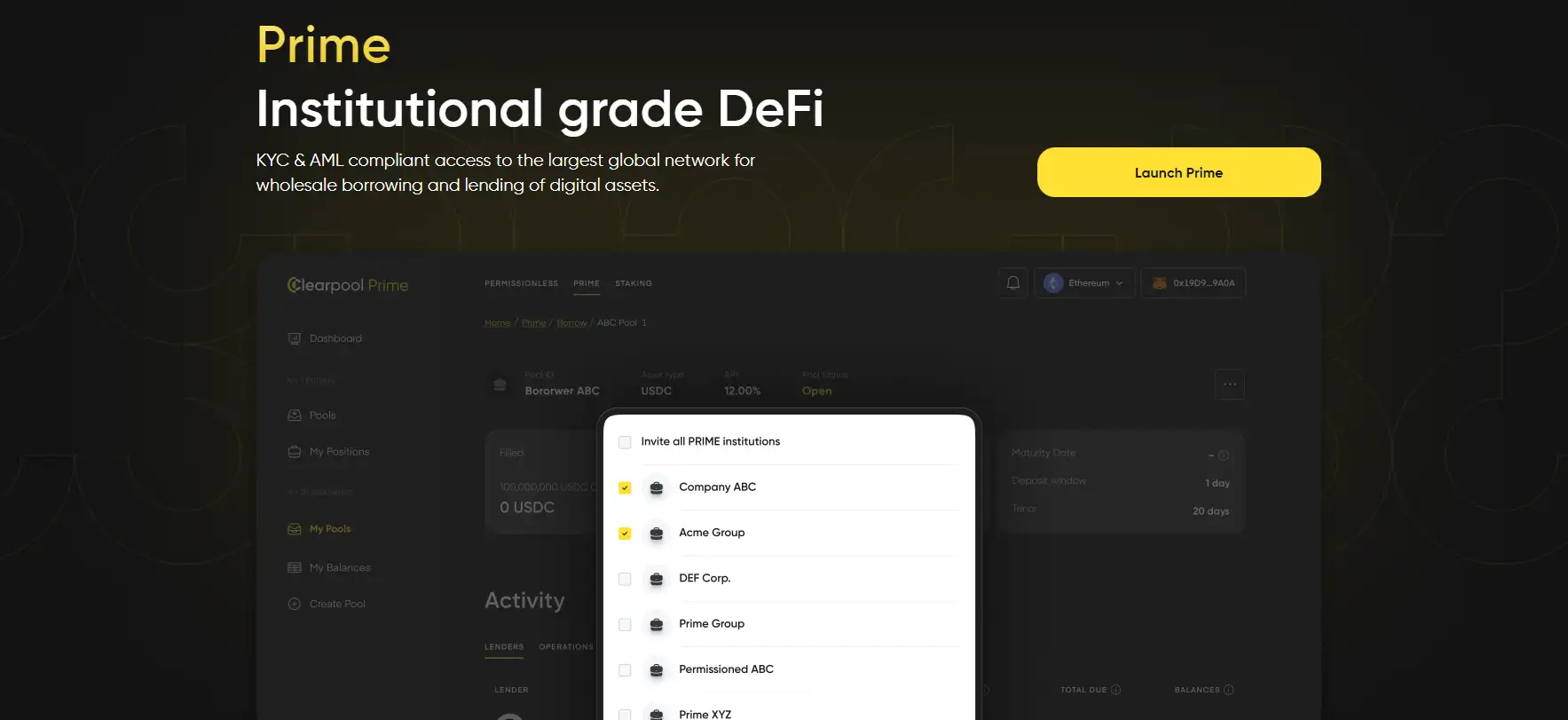

Clearpool is a decentralized capital markets platform designed to provide institutional borrowers with access to uncollateralized liquidity from a decentralized network of lenders. By bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi), Clearpool aims to create a more efficient and inclusive financial ecosystem. The platform offers a unique value proposition by enabling institutions to access liquidity without the need for over-collateralization, which is a common requirement in many DeFi platforms.

The mission of Clearpool is to democratize access to capital markets by leveraging the transparency, efficiency, and security of blockchain technology. This mission is driven by the belief that decentralized finance has the potential to transform the global financial system, making it more accessible and fair for all participants. By providing a platform where institutional borrowers can interact directly with lenders, Clearpool aims to eliminate the inefficiencies and barriers that exist in traditional financial markets.

Clearpool was launched with the vision of transforming the traditional capital markets by introducing a decentralized alternative that operates on the principles of transparency, efficiency, and accessibility. The project is built on the foundation of decentralized finance (DeFi), which seeks to disrupt the traditional financial system by offering financial services that are open, permissionless, and transparent.

The development of Clearpool has been marked by several key milestones, starting with the successful launch of its initial platform in 2021. Since then, the platform has undergone continuous improvements and expansions, with the introduction of new features and services aimed at enhancing the user experience and broadening the platform's capabilities. One of the most significant developments in Clearpool's history was the integration of its Oracle network, which plays a crucial role in pricing interest rates and ensuring the accuracy of financial data used on the platform.

Clearpool's growth and success can be attributed to its innovative approach to uncollateralized lending, which differentiates it from other DeFi platforms. By allowing institutional borrowers to access liquidity without over-collateralization, Clearpool provides a more flexible and attractive option for these borrowers, who may find the collateral requirements of other platforms to be restrictive. This unique value proposition has helped Clearpool attract a growing number of institutional participants, positioning it as a leading player in the DeFi space.

In terms of competition, Clearpool faces competition from other DeFi lending platforms such as Aave, and Compound. However, Clearpool sets itself apart by focusing specifically on uncollateralized lending for institutional borrowers, a niche that is not as widely covered by its competitors.

Looking ahead, Clearpool plans to expand its platform by introducing new products and services, such as tokenized credit lines and decentralized credit scoring. These innovations are expected to further enhance the platform's appeal to institutional borrowers and solidify its position as a leader in the decentralized capital markets space.

Clearpool offers several key benefits and features that distinguish it in the DeFi space:

- Uncollateralized Lending: Clearpool allows institutional borrowers to access liquidity without requiring over-collateralization, offering more flexibility compared to traditional DeFi platforms. This is particularly beneficial for institutions with strong credit histories, as it reduces the capital requirements for borrowing.

- Decentralized Governance: Users have the power to influence the platform’s decisions through the CPOOL token. This decentralized governance model ensures that the platform evolves in a way that aligns with the community’s interests, promoting transparency and user engagement.

- Staking & Liquidity Mining: Clearpool offers a robust staking and liquidity mining program. By staking CPOOL tokens, users can earn rewards while helping to secure the network and validate critical financial data. The liquidity mining program further enhances platform liquidity, making it an attractive option for borrowers and lenders alike.

- Oracle Network Integration: Clearpool integrates a secure and reliable Oracle network to ensure accurate pricing of interest rates and other financial metrics. This helps maintain the stability and reliability of the platform’s lending and borrowing operations, making it a trustworthy option for institutional and individual participants.

- Cross-Platform Accessibility: Clearpool is designed to be accessible across multiple platforms, allowing users to interact with the ecosystem via web and mobile interfaces. This accessibility broadens the user base and ensures that participants can engage with the platform from anywhere.

- Community-Driven Development: The platform’s development is guided by its community, with proposals and updates often originating from user feedback. This approach fosters a sense of ownership among users and encourages active participation in the platform’s growth and evolution.

Getting started with Clearpool is straightforward:

- Create an Account: Visit the Clearpool website and sign up for an account using your email or a supported wallet.

- Set Up Your Wallet: Ensure you have a compatible wallet, such as MetaMask, and connect it to your Clearpool account.

- Acquire CPOOL Tokens: Purchase CPOOL tokens from a supported exchange and transfer them to your connected wallet.

- Start Staking or Lending: Navigate to the staking or lending sections on the platform, select the amount of CPOOL you wish to stake or lend, and follow the on-screen instructions.

- Participate in Governance: Use your staked tokens to participate in governance decisions and help shape the future of Clearpool.

For more detailed guides and support, visit the Clearpool documentation.

Clearpool Token

Clearpool Reviews by Real Users

Clearpool FAQ

Staking CPOOL tokens allows users to earn rewards while contributing to the platform’s security and governance. By staking, you also participate in the decision-making process, influencing key protocol changes and improvements on Clearpool.

Unlike traditional DeFi platforms that require over-collateralization, Clearpool offers uncollateralized lending specifically designed for institutional borrowers. This provides more flexibility and better capital efficiency, making it a unique option in the DeFi space.

Yes, individual investors can participate in Clearpool’s liquidity pools. By providing liquidity, they earn rewards and help maintain the platform’s liquidity, which is essential for supporting institutional borrowing.

CPOOL token holders can propose and vote on key protocol decisions, including fee structures, platform upgrades, and new feature integrations. This gives the community a significant role in shaping the future of Clearpool.

The Oracle network on Clearpool ensures accurate and reliable pricing of interest rates by sourcing and validating data from multiple decentralized sources, thus enhancing the transparency and trustworthiness of lending operations.

You Might Also Like