About Cobo

Cobo is a leading digital asset custody and wallet infrastructure platform trusted by over 500 institutions worldwide. Designed for enterprises and developers, Cobo offers a unified interface for managing digital assets across custodial, MPC, smart contract, and exchange wallets. With over 3,000 supported tokens and 80+ blockchains, Cobo delivers institutional-grade security, seamless integrations, and unmatched operational flexibility for Web3 businesses.

From asset managers and DeFi protocols to trading platforms and payment providers, companies use Cobo’s infrastructure to automate wallet operations, scale cross-chain functionality, and enforce granular access policies. With SOC 2 Type II and ISO 27001 certifications, Cobo provides a regulatory-ready foundation for digital asset management in today’s high-risk environment.

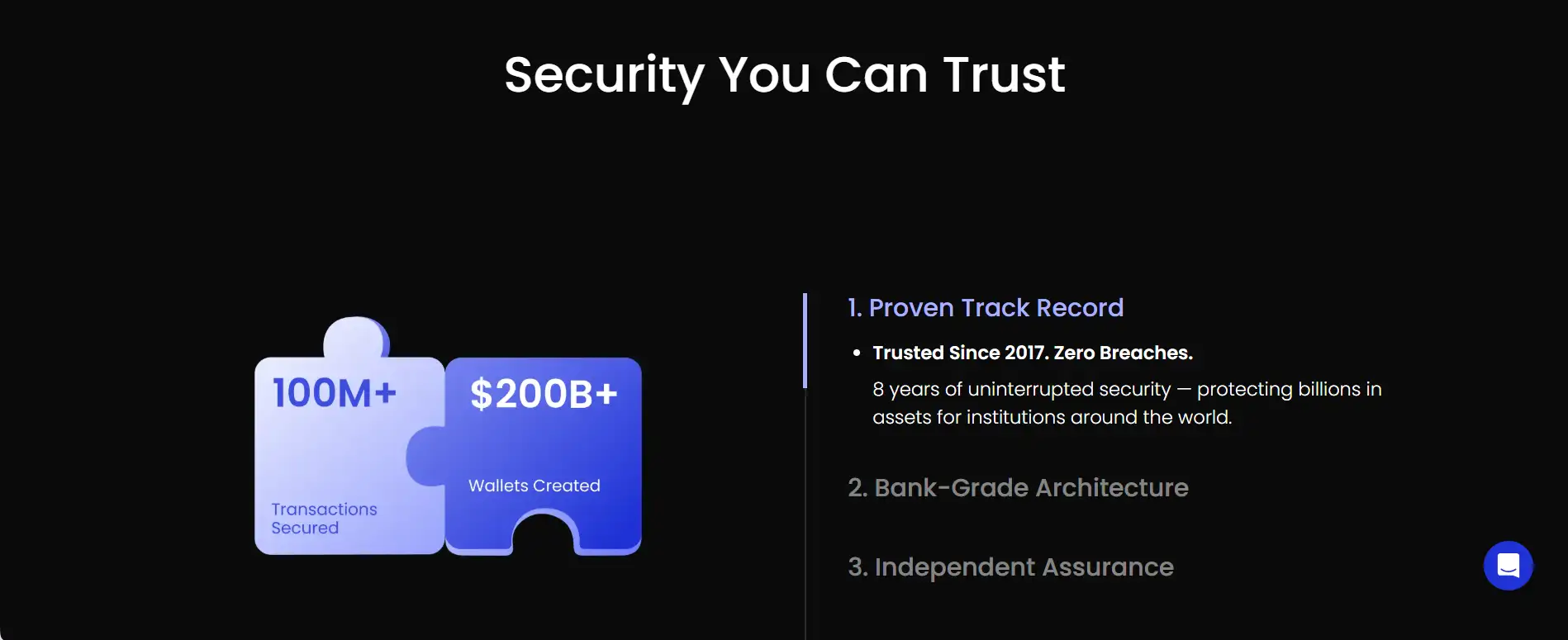

Cobo was founded in 2017 by industry veterans Discus Fish (of F2Pool) and Dr. Changhao Jiang (former Google/Facebook engineer). Their shared mission: to make digital assets safe and easy by removing complexity from crypto custody. Since then, Cobo has secured over $200B in transactions and created over 100 million wallets, empowering exchanges, institutions, and fintech platforms to build confidently on-chain.

At the core of Cobo’s platform is its support for four wallet types: Custodial Wallets for simplicity, MPC Wallets for enhanced resilience, Smart Contract Wallets for programmable control, and Exchange Wallets for multi-platform asset management. All of these are managed via a single API and SDK suite, making Cobo the industry’s most complete wallet-as-a-service solution.

Cobo’s infrastructure is designed to automate the most demanding operational workflows. It supports token sweeping, gas fee automation, role-based access controls, wallet address rotation, and volume-based settlement logic. Its built-in policy engine allows enterprises to create custom approval flows and governance rules to match their compliance standards.

Beyond security, Cobo provides full DeFi and Web3 access, portfolio tracking dashboards, and developer tools. Teams can monitor balances, transact on CeFi and DeFi protocols, and generate audit-ready compliance reports — all within a single portal. With deep integrations into AML and KYT providers like Chainalysis and Elliptic, it’s also fully equipped for financial and regulatory operations.

Compared to other platforms such as Fireblocks or BitGo, Cobo offers broader chain coverage, customizable wallet infrastructure, and an open developer ecosystem that encourages fast, secure innovation. Whether you’re launching a new protocol, managing billions in assets, or scaling Web3 payments, Cobo delivers the tools and trust you need to grow securely.

Cobo provides numerous benefits and features that make it a standout choice in the digital asset infrastructure space:

- Multi-Wallet Architecture: Access Custodial, MPC, Smart Contract, and Exchange Wallets from a single API.

- Widest Chain Coverage: Support for 80+ chains and 3,000+ tokens, with instant onboarding for new assets.

- Policy Engine: Set granular rules for transactions, spending limits, multi-sig approvals, and team permissions.

- Regulatory-Ready: Fully integrated AML/KYT checks via Chainalysis and Elliptic. SOC 2 and ISO certified.

- Developer Tools: RESTful APIs, SDKs in major languages, and a centralized developer console.

- DeFi Access: Secure access to dApps and DeFi protocols without leaving the platform.

- 24/7 Enterprise Support: Sub-5-minute response time with a dedicated success manager.

Cobo offers a robust onboarding experience for enterprises, exchanges, and developers:

- Step 1 – Book a Demo: Visit Cobo.com and book a demo to understand the right solution for your business.

- Step 2 – Access the Developer Hub: Use Cobo’s SDKs and APIs to integrate wallets across 80+ chains.

- Step 3 – Configure Your Wallets: Choose wallet types and set up governance, permissions, and security policies.

- Step 4 – Launch & Monitor: Use the Cobo Portal to transact, access DeFi, generate reports, and monitor your assets.

- Step 5 – Scale with Confidence: Automate treasury, staking, exchange transfers, and compliance operations from a single platform.

- Need Help? Reach out to the Cobo team or connect with the team on Twitter and LinkedIn.

Cobo FAQ

Cobo offers a unified platform with 4 wallet types — Custodial, MPC, Smart Contract, and Exchange — all accessible through one API and SDK stack. Compared to platforms like Fireblocks or BitGo, Cobo supports more blockchains (80+), offers instant token onboarding, and integrates 24/7 live support, making it a more versatile solution for rapidly scaling enterprises.

Cobo is SOC 2 Type II certified, ISO 27001 compliant, and licensed in multiple jurisdictions including the U.S., Hong Kong, and Lithuania. It integrates directly with Chainalysis and Elliptic for AML/KYT checks, ensuring that all transactions meet high regulatory standards without sacrificing operational speed.

Yes. Cobo unifies DeFi and CeFi operations via its wallet architecture, allowing users to manage exchange accounts, on-chain assets, and protocol interactions from one platform. With built-in access to dApps, customizable smart contract rules, and real-time transaction monitoring, Cobo makes it seamless to operate across decentralized and centralized finance environments.

Absolutely. Cobo offers automated workflows for token sweeping, gas fee management, wallet address rotation, and transaction routing. These features reduce manual overhead and allow developers and finance teams to scale securely while enforcing policy-based automation across wallets and user roles.

Cobo’s built-in policy engine allows organizations to configure custom rules for user roles, transaction approvals, spending limits, and compliance flows. This system ensures that every asset movement follows pre-approved security protocols, making it a critical component for mitigating internal risks and supporting secure, multi-party governance.

You Might Also Like