About Coinalyze

Coinalyze is a professional-grade cryptocurrency analytics platform offering powerful insights into the futures market, including open interest, funding rates, and liquidation data. Known for its speed, clarity, and interface flexibility, it equips both novice and advanced traders with actionable metrics to assess market sentiment and make better-informed trading decisions. As a fully independently owned service, it is committed to transparency and neutrality in the volatile world of crypto trading. Explore the platform at Coinalyze.

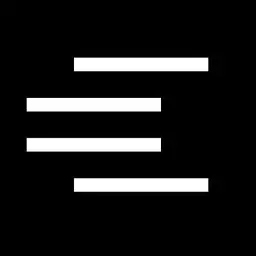

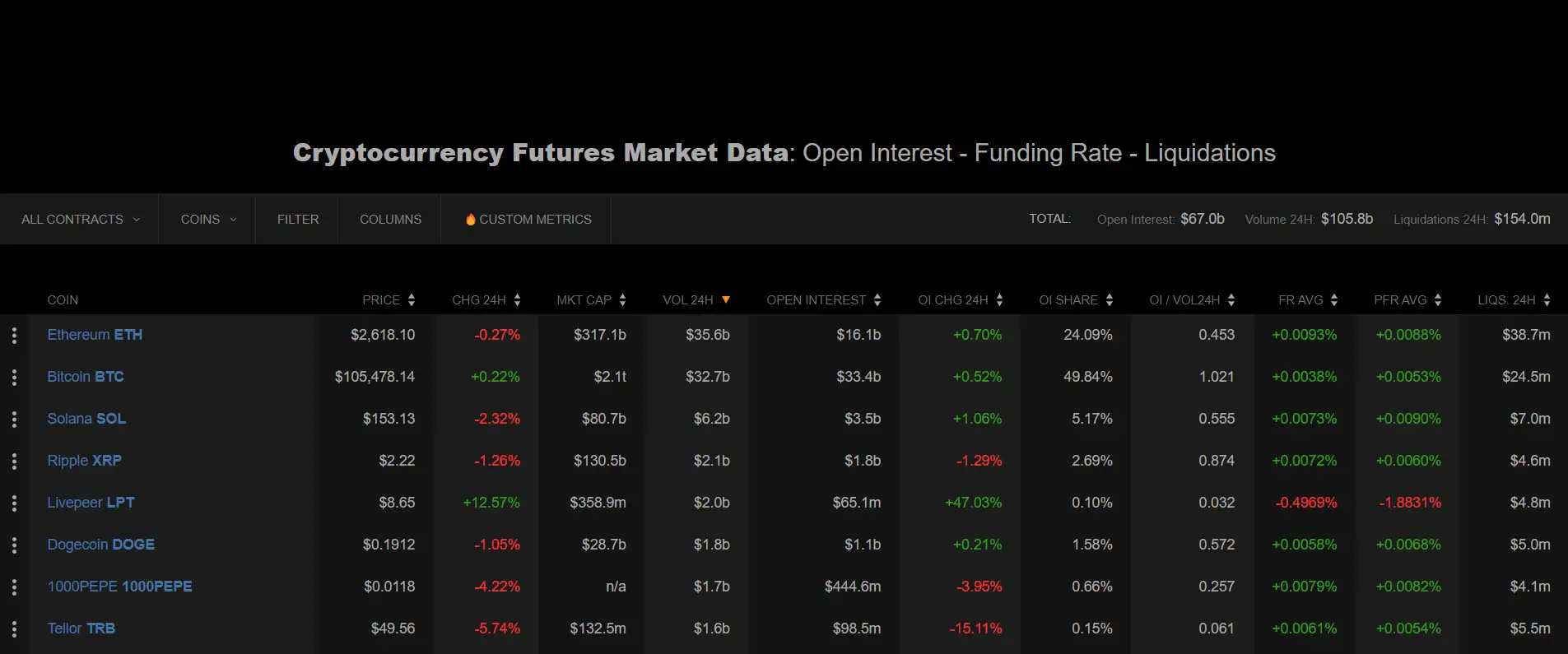

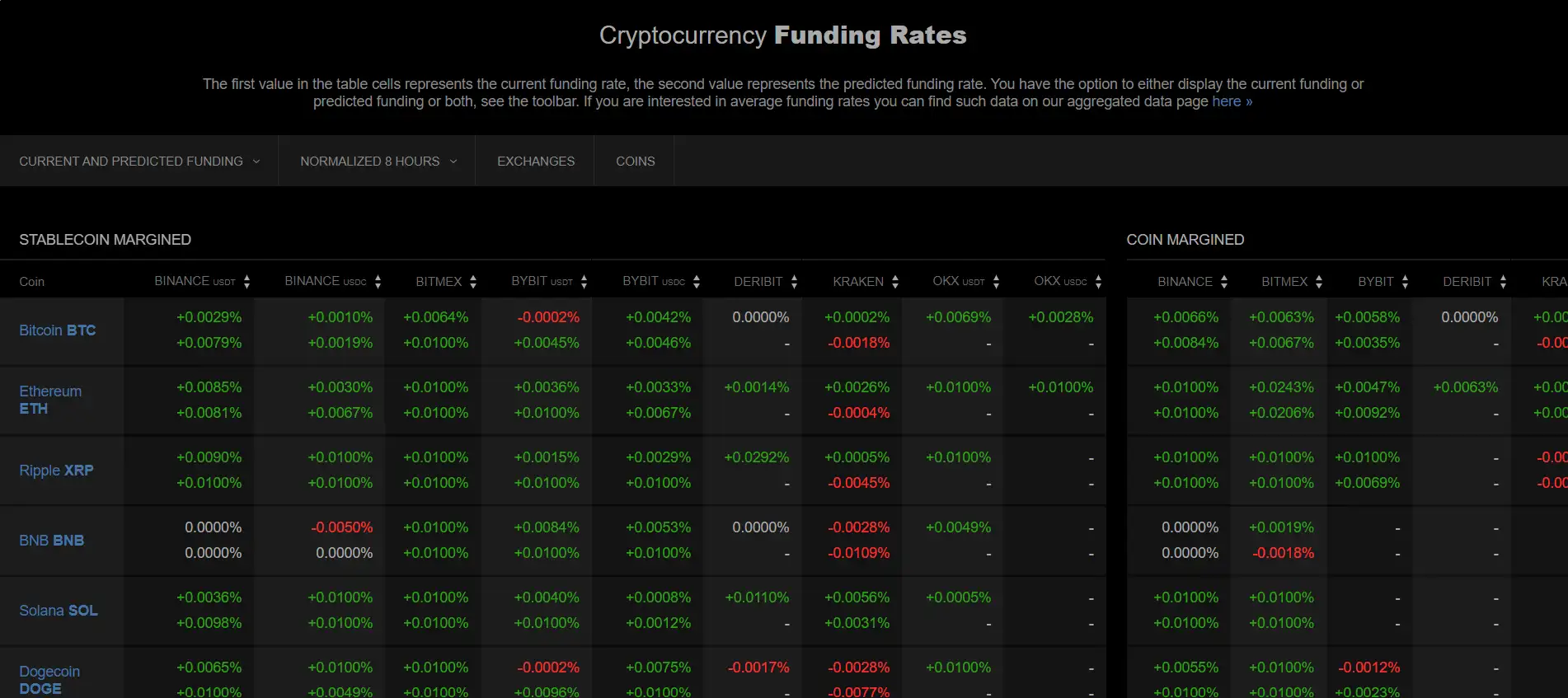

With real-time data feeds and a clean UI, Coinalyze tracks market movements across hundreds of the most traded digital assets, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and many altcoins. The platform's unique metrics—such as the OI/VOL24H ratio and predicted funding rate averages—give traders a competitive edge, whether they are hedging positions or hunting for new entries in derivatives markets.

Coinalyze was created with a sharp focus on providing deep analytics for crypto traders, particularly in the ever-evolving futures market. It has rapidly become a trusted resource for traders who rely on precision and up-to-the-minute insights. The platform’s primary strength lies in how it simplifies complex financial data—such as open interest changes, 24-hour funding rates, and liquidation heatmaps—making them understandable and usable across experience levels.

The homepage of Coinalyze features aggregated data including total Open Interest (OI), 24-hour volume, and liquidation totals, all updated in real time. This snapshot gives traders immediate situational awareness. Coinalyze covers a vast number of assets with detailed analytics per token: metrics like OI share percentage, predicted funding rates (PFR), and open interest changes provide granular insights into trader positioning and market volatility.

The platform also supports a customizable interface where users can adjust columns and filters, allowing them to tailor their dashboards to specific strategies or market segments. Whether someone is monitoring Ethereum's funding shifts or watching Dogecoin liquidations, Coinalyze ensures that the data is clear, structured, and updated live. It even includes unique pairs and meme tokens like Fartcoin and 1000PEPE, reflecting its coverage of both mainstream and emerging assets.

Beyond just numbers, Coinalyze integrates charting technology from TradingView, allowing traders to visually correlate price actions with funding rates, OI shifts, and liquidation spikes. This hybrid model of visual analytics and metric depth makes Coinalyze an ideal companion to both discretionary and algorithmic trading.

Competitors in the space include Coinglass, CryptoRank, and CoinMarketCap. However, Coinalyze sets itself apart by being ad-light, fully transparent, and focused exclusively on trader-centric derivatives data rather than general news or portfolio tracking.

Coinalyze provides numerous benefits and features that make it a go-to resource for crypto futures traders:

- Real-Time Futures Data: Track open interest, liquidations, and funding rates across hundreds of tokens in real time.

- Unique Trading Metrics: Utilize custom metrics like OI/VOL24H and PFR AVG to assess market momentum and risk.

- Ad-Free Mode: Upgrade to a premium version for a completely distraction-free experience and advanced filtering.

- Custom Dashboard Filters: Create personalized tables using filters and columns to focus on assets or metrics that matter most to your trading strategy.

- TradingView Charts Integration: Access professional-grade charting tools right inside the platform for technical analysis.

- Wide Asset Coverage: From BTC and ETH to meme coins and obscure derivatives, Coinalyze tracks them all.

- No Login Needed: Use the site with full data access—no account or personal info required.

Getting started with Coinalyze is fast and effortless, whether you're a casual trader or a derivatives specialist:

- Step 1: Visit the website — Navigate to coinalyze.net on desktop or mobile.

- Step 2: Explore Market Metrics — Begin by reviewing aggregated futures data on the homepage, including Open Interest, Funding Rates, and Liquidations.

- Step 3: Customize your dashboard — Use the filter and column options to tailor the interface to your specific analysis needs.

- Step 4: Use Charts — Launch TradingView-powered charts for detailed TA overlays on asset-specific pages.

- Step 5: Go Ad-Free (Optional) — Create an account for premium tools and an ad-free trading environment.

Coinalyze FAQ

Coinalyze includes the OI/VOL24H ratio to help traders understand market leverage versus actual trading activity. A high ratio may indicate over-leveraged positions, while a lower ratio may suggest organic spot-driven movement. It's a powerful indicator for judging the strength or fragility of ongoing trends.

By monitoring Open Interest spikes and rapid changes in Funding Rates on Coinalyze, traders can anticipate zones of likely mass liquidations. These insights are especially useful during volatility spikes or news-based events, helping traders prepare or capitalize on large market moves.

Yes, Coinalyze offers futures data and analytics on a wide range of assets including trending tokens like 1000PEPE, Fartcoin, and dogwifhat. This makes it ideal not only for BTC or ETH traders, but also for those diving into niche and speculative markets.

Coinalyze believes in open access to market data. Traders can view all charts, metrics, and analytics without logging in, which supports fast research, privacy-first browsing, and a seamless user experience for all levels of traders.

The PFR AVG (Predicted Funding Rate Average) shown on Coinalyze helps anticipate short-term sentiment shifts in perpetual swaps. This is critical for scalpers or swing traders aiming to exploit imbalances between long and short positions before they manifest in price.

You Might Also Like