About Colend

Colend, available at Colend, is an innovative decentralized finance (DeFi) platform that is redefining the landscape of lending and borrowing. By leveraging blockchain technology, Colend connects lenders and borrowers directly, eliminating the need for traditional financial intermediaries. The platform is built on the principles of transparency, efficiency, and accessibility, making it a powerful tool for both individuals and businesses looking to maximize their financial potential. Its mission is to provide a secure, decentralized, and inclusive system that democratizes access to credit and lending opportunities for users worldwide.

Through its user-friendly interface and smart contract technology, Colend ensures seamless and secure transactions between participants. The platform empowers borrowers by removing barriers such as credit checks and approval delays while offering lenders higher returns compared to traditional savings or fixed-income investments. Additionally, Colend is dedicated to fostering financial inclusion, especially in regions where access to credit is limited or nonexistent. By prioritizing security, trustlessness, and ease of use, Colend is positioning itself as a leader in the growing DeFi ecosystem.

Colend, accessible at Colend, is an advanced DeFi lending and borrowing platform that offers secure and transparent financial services powered by blockchain technology. The platform was created to address inefficiencies in traditional finance, including high costs, lengthy processes, and limited accessibility for underbanked and unbanked populations. By eliminating intermediaries and relying on smart contracts, Colend ensures that all transactions are trustless, automated, and cost-efficient.

The project was developed by a team of experts with significant experience in blockchain, finance, and technology. Since its inception, Colend has made remarkable progress, expanding its ecosystem, enhancing its features, and establishing itself as a reliable solution for decentralized lending and borrowing. Unlike traditional systems, Colend enables borrowers to secure loans without credit checks and provides lenders with higher interest rates determined by supply and demand. This flexibility and efficiency make it a game-changer in the financial landscape.

Colend supports a wide range of cryptocurrencies, allowing users to lend and borrow in their preferred digital assets. Its intuitive interface makes it accessible to users with varying levels of experience in DeFi. Security remains a top priority for the platform, with advanced encryption and routine audits ensuring user funds are always protected. Moreover, the platform is designed to facilitate cross-border transactions, eliminating geographical barriers and enabling financial inclusion worldwide.

Colend competes with established DeFi platforms like Aave, Compound, and MakerDAO. However, it differentiates itself with a focus on inclusivity, competitive rates, and a commitment to making decentralized lending and borrowing accessible to users across the globe. Its growth trajectory and innovative approach highlight its potential to lead in the rapidly evolving DeFi ecosystem.

Colend offers a variety of benefits and features that make it stand out in the competitive DeFi landscape:

- Decentralized Lending and Borrowing: All transactions on Colend are governed by smart contracts, removing the need for intermediaries and ensuring transparency and security.

- Cross-Border Accessibility: The platform is accessible to anyone with an internet connection, making it an ideal solution for users in underbanked or unbanked regions.

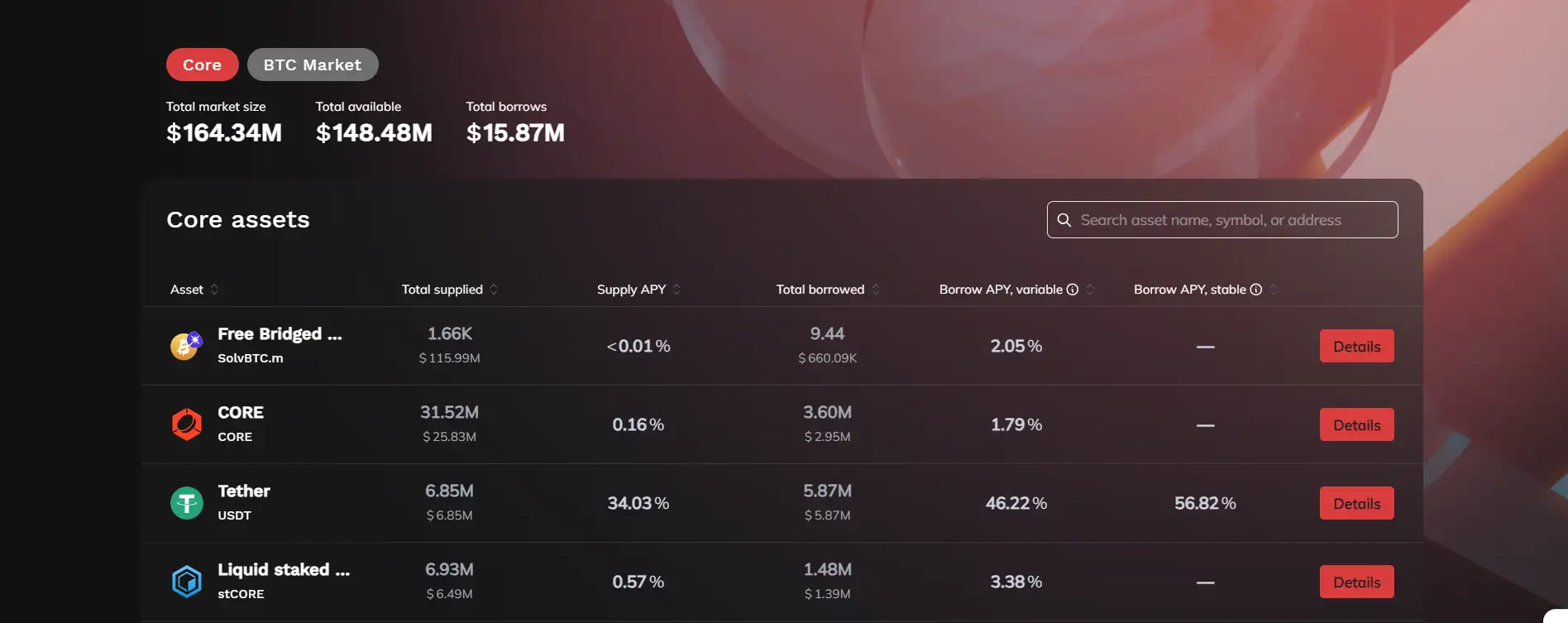

- Flexible Interest Rates: Interest rates are determined dynamically by supply and demand, benefiting both lenders and borrowers.

- Multi-Asset Support: Colend supports a wide range of digital assets, providing users with the flexibility to choose their preferred cryptocurrencies.

- Enhanced Security: The platform employs advanced security measures, including encryption and regular audits, to protect users' funds.

- User-Friendly Interface: The intuitive design ensures a seamless experience for both new and experienced users.

- No Credit Checks: Borrowers can access funds without undergoing credit checks, making Colend a viable option for individuals who may not qualify for traditional loans.

Getting started with Colend is a straightforward process. Follow these steps to begin your lending or borrowing journey:

- Visit the Official Website: Go to Colend's official website to access the platform.

- Create an Account: Click on the "Sign Up" button and provide the required information to create your account. If you already have an account, click "Log In."

- Connect Your Wallet: Colend supports popular crypto wallets such as MetaMask. Ensure your wallet is funded with supported digital assets.

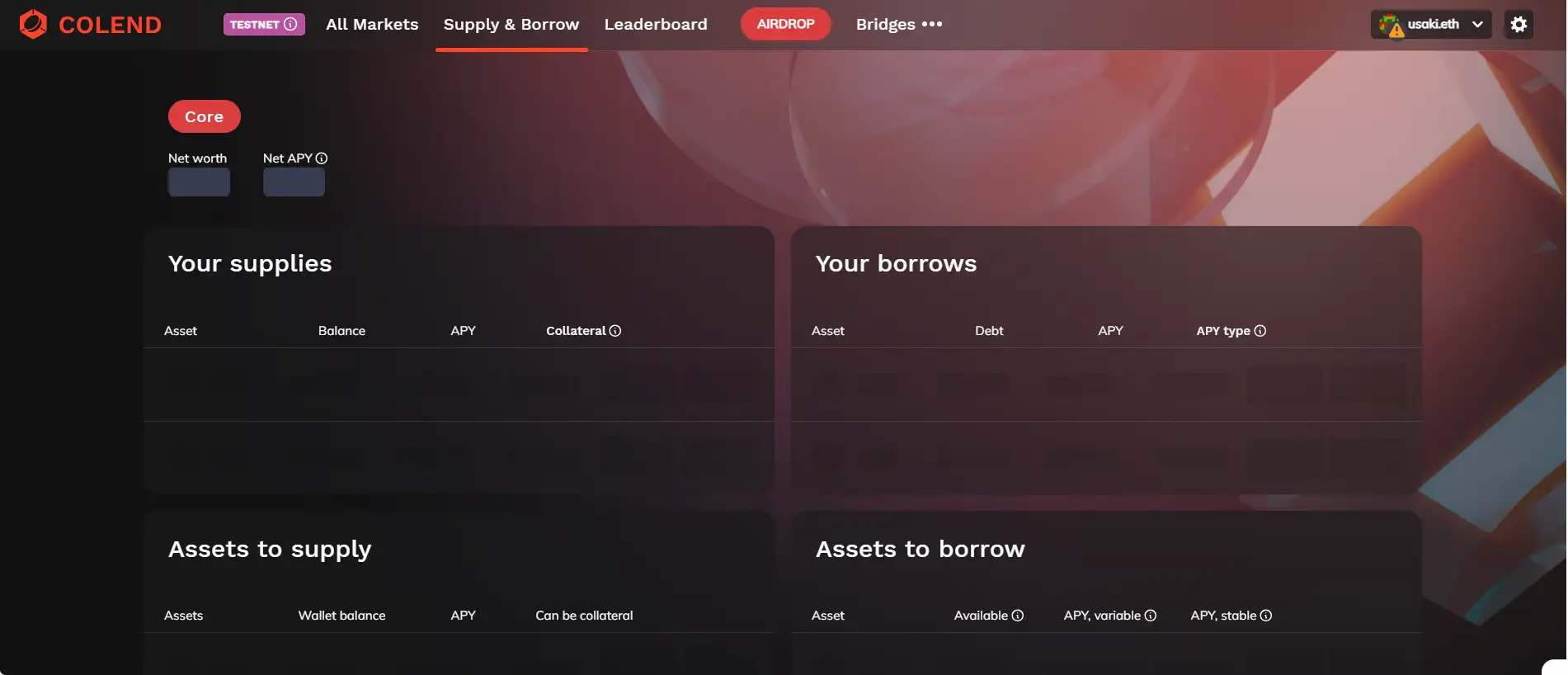

- Explore Lending and Borrowing Options: Navigate to the lending or borrowing section of the platform. Select the asset and amount you wish to lend or borrow.

- Confirm Transactions: Review the terms and confirm the transaction via your connected wallet. Smart contracts will handle the rest securely.

- Manage Your Portfolio: Monitor your active loans or borrowings through the user dashboard, where you can track interest rates, repayment schedules, and more.

Colend FAQ

Colend, available at Colend, ensures the security of your funds by utilizing blockchain-based smart contracts, which automate and safeguard all transactions on the platform. These contracts are publicly auditable and designed to eliminate the risk of tampering or manipulation. Additionally, Colend implements advanced encryption technologies and undergoes regular security audits to protect user data and assets from potential threats.

Colend, accessible at Colend, primarily operates as a collateralized lending platform to ensure lenders' security. Borrowers must deposit supported digital assets as collateral to access loans. However, the platform is exploring innovative approaches to offer under-collateralized or reputation-based loans in future updates, further enhancing financial accessibility.

On Colend, users can lend and borrow a variety of popular digital assets, including stablecoins, major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), and other tokens supported by the platform. The list of supported assets is continuously expanding to meet the needs of the growing user base.

Interest rates on Colend are dynamically determined by the supply and demand of each supported asset. This market-driven approach ensures that both lenders and borrowers receive competitive rates. Users can view real-time rates on the platform's dashboard before initiating any transactions, allowing for full transparency.

Colend, available at Colend, mitigates risk for lenders through an over-collateralized system. If a borrower cannot repay their loan, the collateral they provided is liquidated to cover the outstanding amount. This ensures that lenders are protected, while borrowers are aware of the terms and risks before borrowing.

You Might Also Like