About Compound

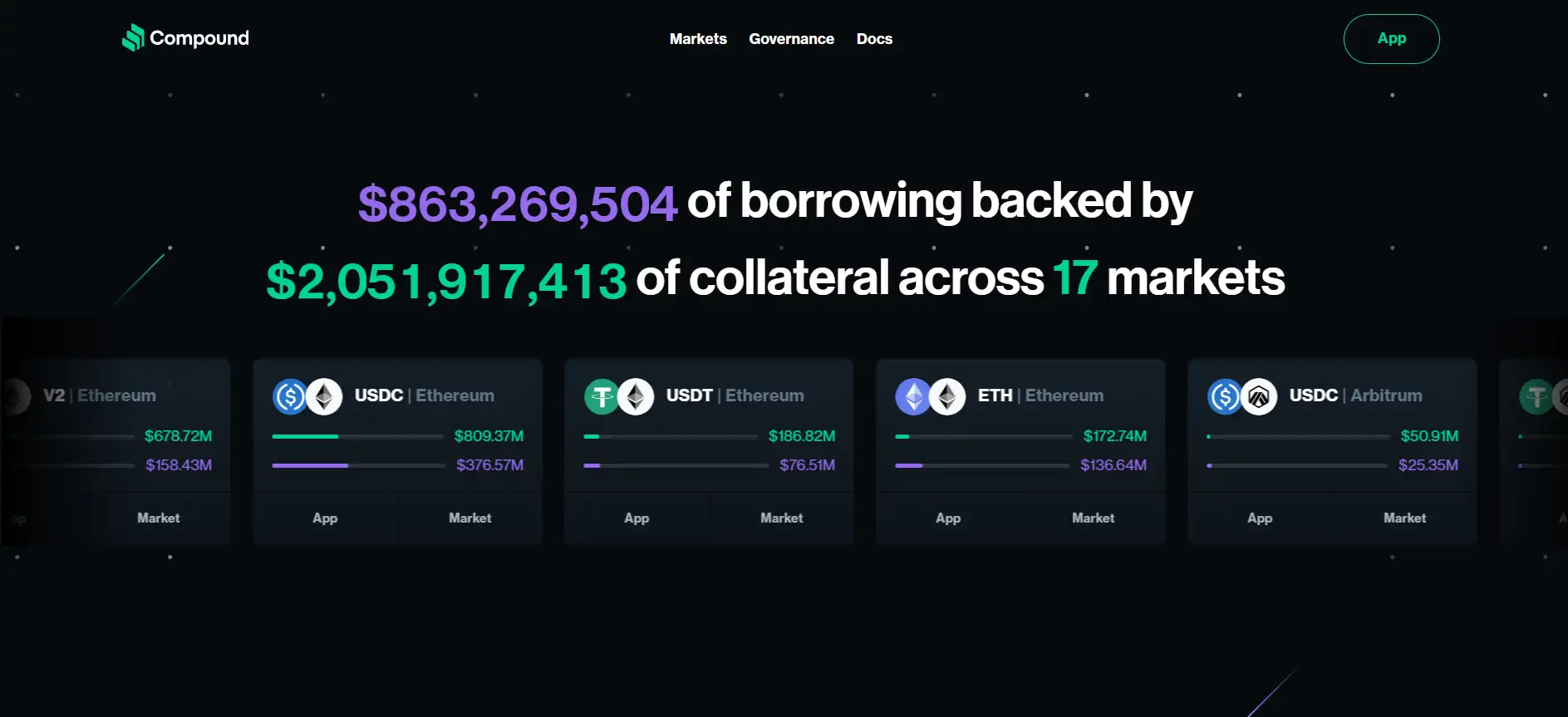

Compound Finance, available at Compound.finance, is a revolutionary decentralized finance (DeFi) protocol designed to enable users to lend and borrow cryptocurrencies in a secure, transparent, and automated manner. By leveraging the power of Ethereum-based smart contracts, the platform eliminates the need for intermediaries, offering a trustless and highly efficient system for financial transactions. With its focus on decentralization and accessibility, Compound empowers users to earn interest on their crypto holdings or access funds by borrowing against their collateral in a seamless and user-friendly way.

Since its launch in 2018, Compound Finance has emerged as a pioneer in the DeFi ecosystem, showcasing the transformative potential of blockchain technology in disrupting traditional financial systems. The platform’s innovative approach to dynamic interest rates, robust security, and decentralized governance via the COMP token has positioned it as a leader in the space. Trusted by both retail users and institutions, Compound has made decentralized lending and borrowing more accessible, scalable, and transparent than ever before, helping drive mass adoption of decentralized finance.

Compound Finance, available at Compound.finance, is a leading decentralized protocol in the DeFi sector, enabling users to lend and borrow cryptocurrencies efficiently and securely. Launched in 2018 by Robert Leshner and Geoffrey Hayes, the platform was designed to eliminate intermediaries in financial transactions by leveraging Ethereum-based smart contracts. Through these automated contracts, users can supply cryptocurrencies to liquidity pools to earn interest or borrow assets by providing collateral, all in a seamless and trustless manner.

The protocol operates using an innovative concept of cTokens, which users receive in exchange for supplying their assets to the platform. These cTokens not only represent the user’s contribution to the liquidity pool but also automatically accrue interest over time. For borrowers, the system allows access to funds while requiring collateral to ensure financial stability. The interest rates for both lending and borrowing are dynamically determined by market demand and supply, ensuring fairness and transparency in all transactions.

In 2020, Compound Finance introduced its governance token, COMP, marking a significant milestone in its evolution. The COMP token enables users to actively participate in the protocol's decision-making process by voting on proposals for upgrades, fee structures, and market additions. This decentralized governance system ensures that the platform remains community-driven and transparent. The introduction of governance has further solidified Compound as a pioneer in the decentralized finance ecosystem.

In the highly competitive DeFi market, Compound Finance distinguishes itself through its simplicity, security, and focus on user empowerment. Its main competitors include Aave, which offers unique features like flash loans and credit delegation; MakerDAO, known for its decentralized stablecoin DAI; and Curve Finance, a platform specializing in stablecoin and low-slippage liquidity pools. Despite these strong competitors, Compound remains one of the most trusted and widely used platforms, with billions of dollars locked in its protocol, underscoring its reliability and market leadership.

Compound Finance offers several compelling benefits and features that distinguish it in the competitive DeFi ecosystem:

- Decentralized and Transparent: As a protocol built on Ethereum, all transactions on Compound are executed through smart contracts, ensuring transparency and security without relying on centralized intermediaries.

- Dynamic Interest Rates: Interest rates for lenders and borrowers are algorithmically determined based on real-time supply and demand, ensuring market efficiency.

- cTokens for Liquidity: When users deposit funds, they receive cTokens, which accrue interest over time and can be redeemed for the underlying asset at any time.

- Wide Range of Supported Assets: Compound supports popular cryptocurrencies, including ETH, DAI, USDC, and others, enabling users to diversify their portfolios.

- Non-Custodial: Users maintain full control over their funds, as the protocol does not require them to transfer ownership of their assets.

- Governance Model: Community governance via the COMP token allows stakeholders to influence the platform’s future by voting on proposals.

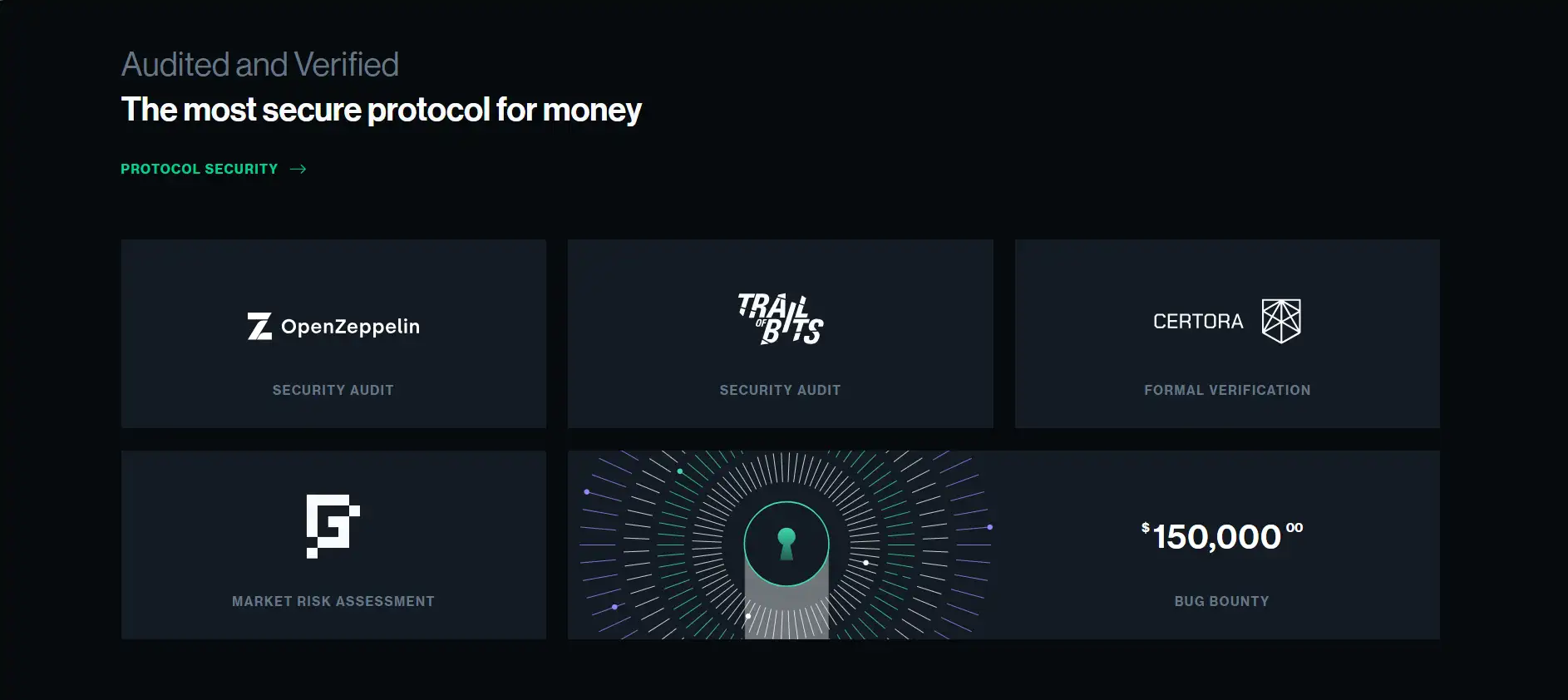

- Secure and Audited: The protocol undergoes regular security audits to ensure the safety of user funds.

Getting started with Compound Finance is simple and straightforward. Follow these steps to begin:

- Set Up a Wallet: To interact with Compound, you need a compatible cryptocurrency wallet, such as MetaMask, which can connect to Ethereum-based decentralized applications (dApps).

- Deposit Funds: Transfer supported assets (like ETH, DAI, or USDC) into your wallet. Then, visit the Compound Finance platform and connect your wallet.

- Supply Assets: Choose an asset to deposit into the liquidity pool. Once deposited, you will receive cTokens in return, which represent your share in the pool and accrue interest over time.

- Borrow Funds: If needed, you can borrow funds by providing collateral in the form of cryptocurrencies. The amount you can borrow depends on the collateral’s value and the protocol’s collateralization ratio.

- Track and Manage: Monitor your supplied assets, accrued interest, and borrowed funds directly on the Compound dashboard.

- Withdraw or Repay: You can withdraw your assets (plus interest) at any time or repay any borrowed amount through the platform.

For more detailed instructions, visit the official Compound Finance documentation.

Compound FAQ

Interest rates on Compound Finance are dynamically calculated using an algorithm that considers the real-time supply and demand for each asset in the protocol. When the demand to borrow a particular asset increases, its interest rate rises, encouraging more users to supply it. Conversely, if an asset is oversupplied, the interest rate decreases to balance the market. This mechanism ensures an efficient and transparent financial system without manual intervention.

cTokens are tokenized representations of assets supplied to the Compound Finance protocol. For example, when you deposit DAI into Compound, you receive cDAI in return. These tokens not only represent your share of the liquidity pool but also automatically accrue interest over time. cTokens can be redeemed at any time for the underlying asset, plus the interest earned. This system ensures that users can maintain liquidity while earning yield on their deposits.

Yes, you can! Compound Finance allows users to borrow cryptocurrencies without selling their existing holdings by providing collateral. For instance, if you own ETH and want to borrow USDC, you can deposit ETH as collateral. The protocol uses a collateralization ratio to determine how much you can borrow, ensuring that the system remains secure and over-collateralized to prevent losses.

Governance on Compound Finance is managed through the COMP token. Anyone holding COMP can propose changes to the protocol or vote on existing proposals. These changes might include adding new assets, adjusting interest rate models, or upgrading the protocol. Governance ensures that the community drives the development of the platform, making it decentralized and responsive to user needs.

When borrowing on Compound Finance, the protocol monitors your collateralization ratio in real-time. If the value of your collateral drops below the required threshold, your loan becomes under-collateralized, and a liquidation process may occur. This means that a portion of your collateral is sold to repay the loan, ensuring the protocol remains solvent. To avoid this, users can add more collateral or repay part of the loan before their collateralization ratio reaches a critical level.

You Might Also Like