About CREAM Finance

C.R.E.A.M. Finance is a decentralized finance (DeFi) platform offering a comprehensive suite of financial services, including lending, borrowing, and asset management. Operating on the Ethereum blockchain and other compatible networks, C.R.E.A.M. Finance empowers users to maximize the utility of their digital assets while promoting accessibility and efficiency. The platform caters to individuals, institutions, and developers, providing innovative tools to meet the diverse needs of the DeFi ecosystem.

C.R.E.A.M. Finance, which stands for "Crypto Rules Everything Around Me," is built to democratize financial services through blockchain technology. By eliminating intermediaries, C.R.E.A.M. Finance enables peer-to-peer transactions with lower fees, greater transparency, and enhanced user control. With a focus on interoperability, the platform supports a wide range of cryptocurrencies, allowing users to lend or borrow assets, stake for rewards, or participate in liquidity pools across multiple blockchain ecosystems.

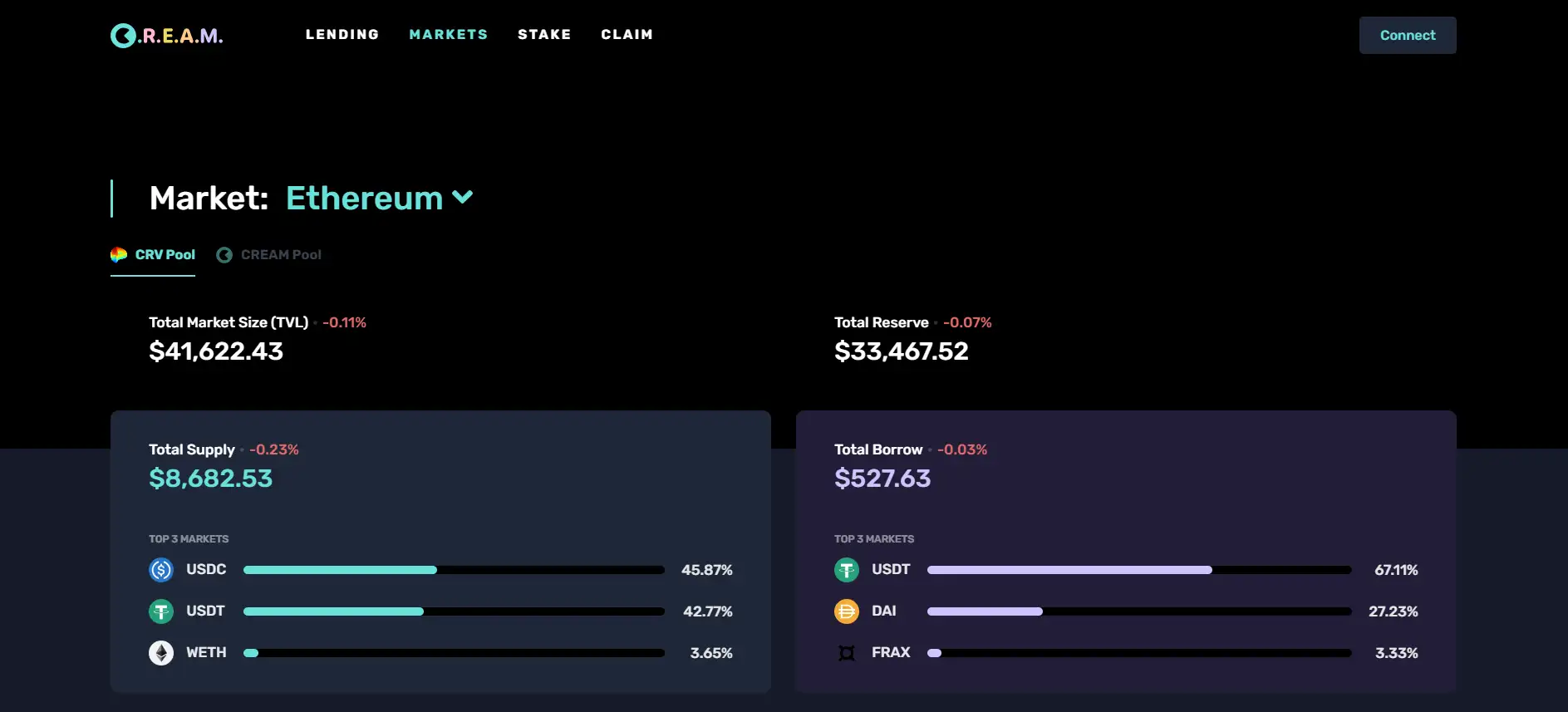

C.R.E.A.M. Finance is a decentralized finance platform designed to provide users with innovative financial solutions. Launched in 2020, the platform has established itself as a versatile tool for lending, borrowing, and yield farming. Operating on the Ethereum blockchain, Binance Smart Chain, and other compatible networks, C.R.E.A.M. Finance has emerged as a critical player in the DeFi sector by supporting a wide range of assets and offering high flexibility for users.

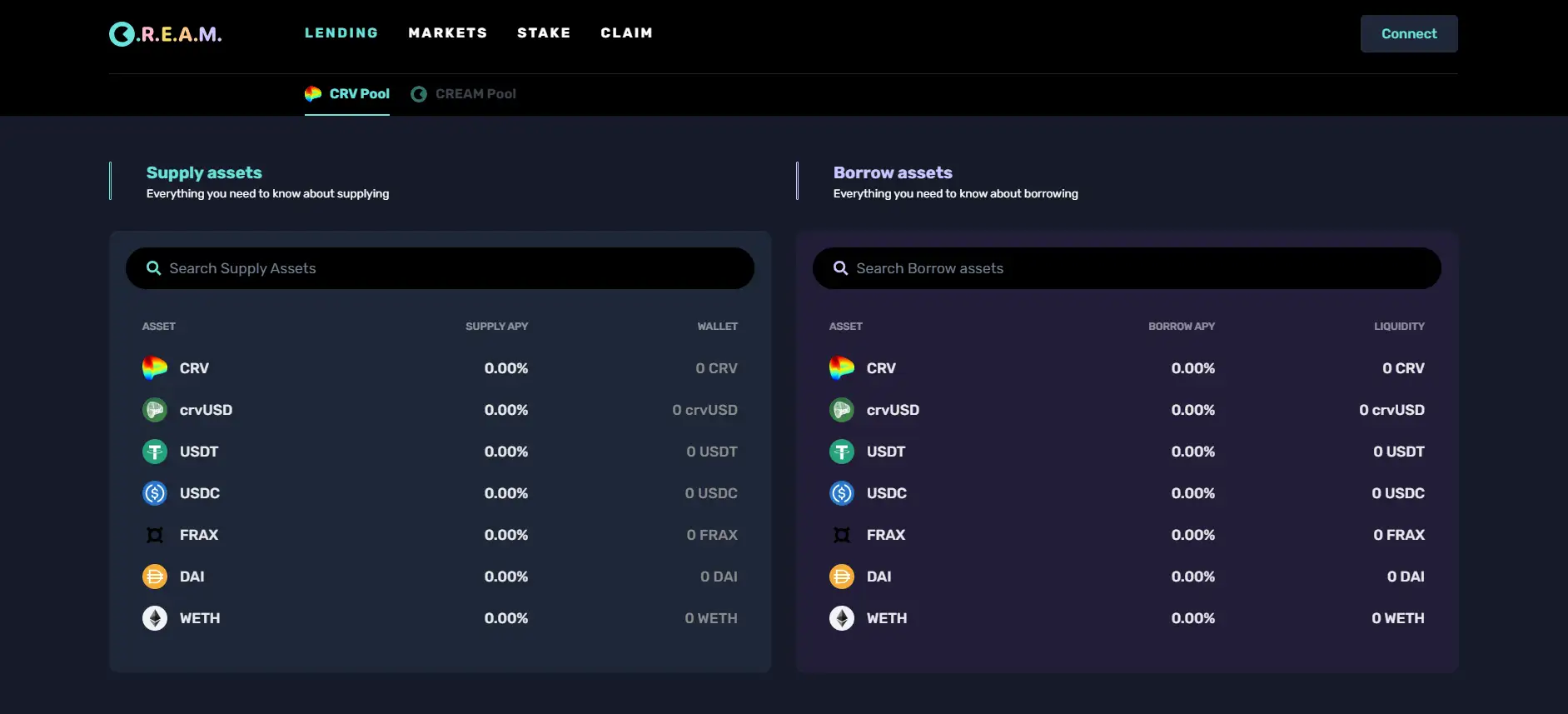

The platform's lending and borrowing protocol operates similarly to traditional financial systems but without intermediaries. Users can deposit their cryptocurrency assets into lending pools to earn interest or borrow against their deposits. C.R.E.A.M. Finance also allows users to participate in liquidity mining and yield farming, enabling them to maximize their returns by providing liquidity to decentralized exchanges.

Over the years, the platform has achieved several milestones, including integrating with multiple blockchains and introducing advanced features such as collateralized loans and flash loans. Its commitment to interoperability ensures that users can interact seamlessly across networks, giving C.R.E.A.M. Finance an edge over competitors.

In the DeFi space, C.R.E.A.M. Finance competes with projects like Aave, Compound, and MakerDAO. However, its focus on multi-chain interoperability and support for niche tokens helps it carve out a unique position in the market. With a commitment to innovation and community-driven development, C.R.E.A.M. Finance continues to grow as a trusted platform for decentralized financial solutions.

C.R.E.A.M. Finance offers a range of benefits that make it a standout platform in the decentralized finance space. These advantages are designed to cater to the needs of both individual users and institutions seeking innovative financial solutions.

- Comprehensive DeFi Services: C.R.E.A.M. Finance provides lending, borrowing, yield farming, and liquidity mining, all in one platform. This one-stop-shop approach ensures users can access diverse financial tools without switching between platforms.

- Multi-Chain Support: The platform operates on multiple blockchains, including Ethereum, Binance Smart Chain, and Fantom, allowing users to interact seamlessly across networks and access a broader range of assets.

- Wide Asset Availability: Unlike many competitors, C.R.E.A.M. Finance supports a large number of cryptocurrencies, including niche tokens. This inclusivity ensures users can utilize their preferred digital assets within the ecosystem.

- Dynamic Interest Rates: Interest rates on the platform are determined algorithmically based on supply and demand. This ensures fair and competitive rates for both lenders and borrowers.

- Flash Loans: C.R.E.A.M. Finance supports flash loans, enabling users to borrow funds without collateral, provided they repay the loan within a single transaction. This feature is ideal for advanced DeFi strategies like arbitrage and refinancing.

- Transparent and Secure: The platform operates on audited smart contracts, ensuring transactions are transparent, reliable, and resistant to tampering. Users can engage confidently with the platform without concerns about intermediaries.

- Rewards and Incentives: By participating in liquidity mining or staking, users can earn rewards in the form of CREAM tokens or other supported assets, enhancing the earning potential for participants.

- Community-Driven Development: C.R.E.A.M. Finance actively involves its community in governance decisions, giving users a voice in shaping the platform's future.

Getting started with C.R.E.A.M. Finance is straightforward. Follow these steps to begin using the platform and access its wide range of DeFi services:

- Set Up a Wallet: Ensure you have a compatible cryptocurrency wallet, such as MetaMask, that supports Ethereum and other compatible blockchains.

- Connect Your Wallet: Visit the official C.R.E.A.M. Finance website and connect your wallet to the platform. Ensure you’re on the correct network (e.g., Ethereum or Binance Smart Chain).

- Deposit Assets: Select the asset you want to deposit into a lending pool. Once deposited, you will start earning interest based on the pool’s rates.

- Borrow Funds: If you need liquidity, you can use your deposited assets as collateral to borrow cryptocurrencies directly from the platform.

- Participate in Yield Farming: Explore the platform’s liquidity pools and staking opportunities to maximize your returns through yield farming and liquidity mining.

- Monitor and Manage: Track your deposits, earnings, and borrowed funds through the platform’s user-friendly dashboard. Adjust your strategies as needed to optimize your results.

CREAM Finance FAQ

C.R.E.A.M. Finance employs several mechanisms to mitigate risks in its lending and borrowing ecosystem. The platform uses over-collateralization, meaning borrowers must deposit more collateral than the value they borrow, reducing the risk of default. Additionally, loans are managed through audited smart contracts, ensuring transparent and automated liquidation processes if collateral values fall below required thresholds. Learn more at C.R.E.A.M. Finance.

To participate in liquidity mining on C.R.E.A.M. Finance, users must deposit supported cryptocurrencies into specific liquidity pools. These pools allow users to earn rewards in the form of platform tokens like CREAM. The rewards vary depending on the pool's activity and the amount of liquidity provided. A compatible wallet, such as MetaMask, is also required to interact with the platform.

Yes, C.R.E.A.M. Finance supports a wide range of cryptocurrencies, including niche and emerging tokens. This inclusivity allows users to access DeFi services for assets that may not be available on other platforms. The platform's multi-chain support further enhances this flexibility by enabling transactions across Ethereum, Binance Smart Chain, and Fantom networks.

Yes, governance participants on C.R.E.A.M. Finance can earn rewards. By staking CREAM tokens and voting on proposals, users contribute to shaping the platform’s future and receive incentives for their involvement. This mechanism ensures that the community plays an active role in decision-making while benefiting financially.

C.R.E.A.M. Finance operates using audited smart contracts that provide full transparency and security for all transactions. These contracts are publicly available on blockchain explorers, allowing users to verify the code and transaction histories. Additionally, regular third-party audits ensure that vulnerabilities are identified and resolved promptly. Visit C.R.E.A.M. Finance for more details.

You Might Also Like