About CryptoTaxCalculator

Crypto Tax Calculator is a user-friendly tool designed to simplify cryptocurrency tax management and reporting. It caters to both individual and business needs by transforming complex blockchain data into CPA-approved tax reports. The platform supports integration with major exchanges and wallets, including Coinbase and MetaMask, making it a robust and versatile solution. Its mission is to alleviate the burden of crypto tax compliance, providing accurate and reliable tax calculations and reports, thereby helping users navigate the often confusing landscape of cryptocurrency taxation efficiently.

Crypto Tax Calculator was developed to address the burgeoning complexities of cryptocurrency taxation as the digital currency market continues to expand and diversify. Recognizing the challenges faced by crypto traders, investors, and businesses, the platform offers a comprehensive solution that supports a wide range of crypto activities, including trading, mining, staking, and participation in decentralized finance (DeFi) and non-fungible tokens (NFTs).

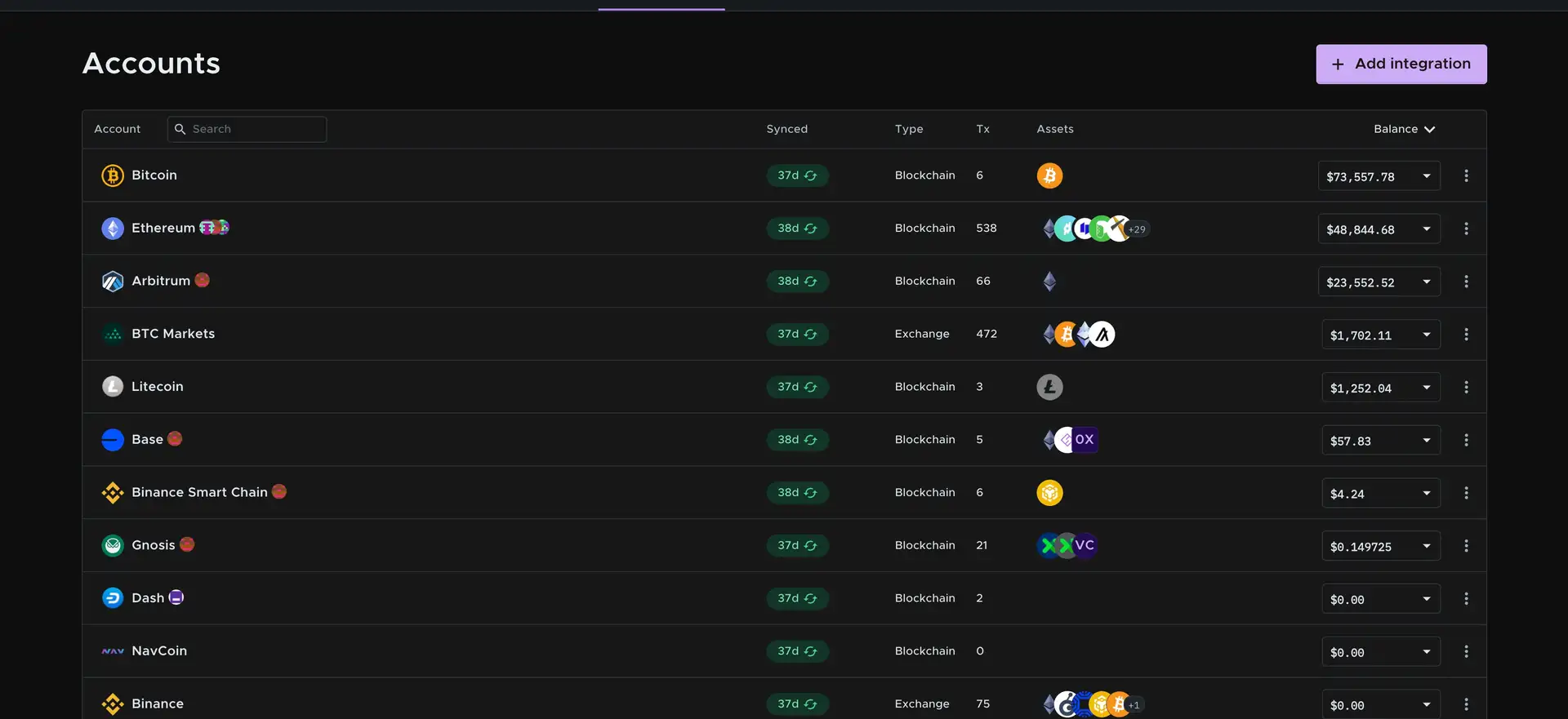

One of the platform’s significant strengths is its extensive integration capabilities. It supports over 1,000 different exchanges, wallets, and blockchains, ensuring users can easily import their transaction data without manual entry. This extensive network of integrations includes well-known names like Coinbase, Binance, Kraken, and many others, allowing for seamless data synchronization and accurate reporting.

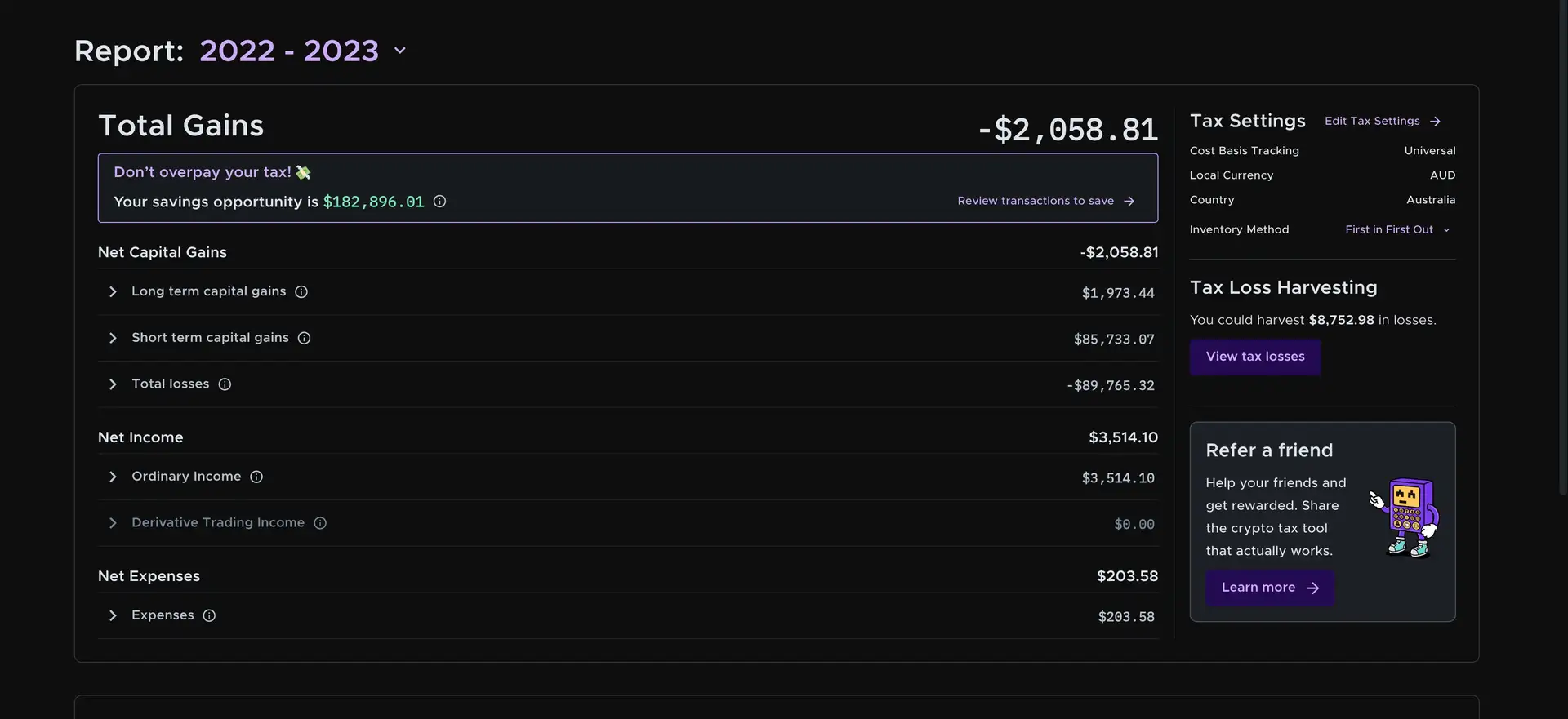

Crypto Tax Calculator employs sophisticated algorithms to automate and streamline the tax calculation process. These algorithms help in categorizing transactions, calculating capital gains and losses, and generating comprehensive tax reports that comply with IRS guidelines. The platform also supports various tax optimization strategies, such as Least Tax First Out (LTFO), to minimize users' tax liabilities legally and efficiently.

The project has achieved several key milestones since its inception. Notable partnerships with industry giants like Coinbase Ventures and MetaMask have bolstered its reputation and expanded its user base. These collaborations highlight the platform’s reliability and its commitment to providing top-notch services to its users.

Crypto Tax Calculator also stands out in the market for its user-friendly interface. Despite the complexity of crypto tax calculations, the platform’s intuitive design ensures that even users with limited technical knowledge can navigate the system with ease. It simplifies the entire tax reporting process, from data import to report generation, making it accessible for all types of users.

While competitors like Koinly, ZenLedger, and TokenTax offer similar services, Crypto Tax Calculator differentiates itself with its broad integration support, sophisticated algorithms, and focus on user experience. It is particularly noted for its comprehensive support for DeFi and NFT transactions, areas where other platforms may fall short.

Overall, Crypto Tax Calculator is a pioneering solution in the crypto tax software market, continually evolving to meet the needs of its users and stay ahead of industry trends.

- Extensive Integrations: Supports over 1,000 exchanges, wallets, and blockchains for seamless data import.

- Automated Tax Reports: Generate CPA-approved reports with minimal manual effort, ensuring compliance with IRS guidelines.

- DeFi and NFT Support: Comprehensive tracking and reporting for all DeFi protocols and NFT transactions.

- Optimization Algorithms: Uses exclusive algorithms like Least Tax First Out to minimize tax liabilities.

- User-Friendly Interface: Simplifies complex tax calculations with a clear, intuitive interface.

- Audit-Proof Reports: Provides detailed, audit-proof reports to ensure accuracy and compliance.

- Sign Up: Visit the Crypto Tax Calculator website and create a free account by providing your email address and setting a password.

- Connect Accounts: Import transaction data by connecting your exchanges, wallets, and blockchain accounts. The platform supports over 1,000 integrations, making it easy to sync your data.

- Review Transactions: Utilize the platform’s smart categorization tools to review and organize your transactions. This step ensures that all your activities are accurately accounted for.

- Generate Reports: Once your transactions are categorized, generate your tax reports. The platform provides various report formats, including capital gains reports, Form 8949, and more, all of which are CPA-approved.

- File Taxes: Export the generated reports for filing your taxes or share them directly with your accountant. The detailed, audit-proof reports ensure compliance with IRS guidelines.

For additional guidance, tutorials, and support, visit the Crypto Tax Calculator Help Center.

CryptoTaxCalculator Reviews by Real Users

CryptoTaxCalculator FAQ

Crypto Tax Calculator employs advanced encryption methods to secure user data. Additionally, the platform uses secure API connections for data imports and does not store user data longer than necessary.

Yes, Crypto Tax Calculator supports a wide range of DeFi transactions, including staking, lending, and liquidity pool activities. It provides accurate tracking and reporting for these complex transactions.

Crypto Tax Calculator is regularly updated to comply with the latest tax regulations and guidelines. The development team closely monitors changes in tax laws to ensure the platform remains current.

Yes, Crypto Tax Calculator supports tax calculations for multiple countries, making it suitable for international users. It includes specific tax rules and forms for various jurisdictions.

Yes, you can import and manage multiple years of transaction data with Crypto Tax Calculator. This feature is especially useful for users who need to amend previous tax returns or report historical transactions.

You Might Also Like