About Cryptoworth

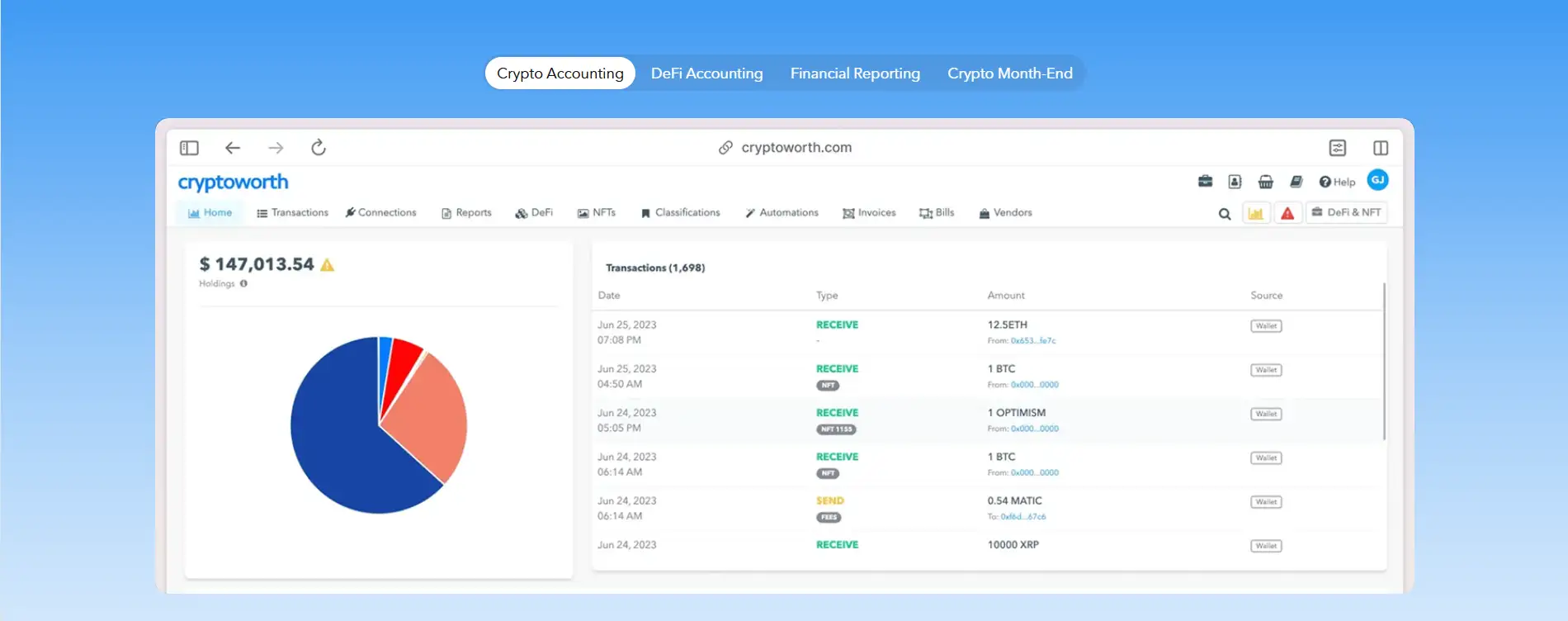

Cryptoworth is a professional-grade crypto accounting software tailored for businesses, accountants, and financial teams operating in the Web3 ecosystem. Since its founding in 2017, Cryptoworth has served as a robust subledger platform, designed to track, reconcile, and manage digital asset transactions across wallets, exchanges, and DeFi protocols. It offers audit-ready financial infrastructure that brings clarity and automation to blockchain finance operations. Cryptoworth addresses the gaps left by spreadsheets and general-purpose accounting tools by delivering purpose-built tools that simplify reporting and compliance for digital assets.

Built to meet enterprise-grade expectations, Cryptoworth ensures compatibility with major accounting standards like GAAP and IFRS, while also integrating smoothly with platforms such as QuickBooks, Xero, and NetSuite. From automated tax lot tracking to granular reconciliation across hundreds of chains and exchanges, the platform provides a scalable solution for handling complex on-chain activity. With its growing suite of integrations, real-time dashboards, and API-driven customization, Cryptoworth stands out as an essential back-office tool for Web3 organizations.

Cryptoworth is a powerful and highly specialized crypto accounting platform developed to help businesses reconcile, track, and report blockchain-based financial data with precision. Founded in 2017, the platform emerged as a response to the increasing complexity of managing digital asset records. As Web3 ecosystems evolved, so did the need for a secure, scalable, and intuitive financial reporting engine that supports crypto-native use cases. Cryptoworth meets this demand by supporting integrations with over 1,000 data connections, including 230+ blockchains, exchanges, DeFi protocols, wallets, and custodians.

The platform focuses on automating crucial accounting tasks like month-end closings, cost basis calculations, gain/loss reports, and tax tracking. It supports First-In-First-Out (FIFO), Last-In-First-Out (LIFO), and Weighted Average Cost (WAC) methods for flexible tax lot management. Additionally, Cryptoworth is capable of handling multi-entity structures, allowing large enterprises, DAOs, and foundations to segregate assets while still maintaining a centralized view.

Security and compliance are top priorities. Cryptoworth runs entirely on AWS infrastructure with SOC 2 Type I and II certifications, TLS 1.2 encryption, and secure data protocols for safeguarding enterprise data. It aligns with evolving global regulations such as VASP, VARA, MiCA, and MAS. Through its robust audit logs, portfolio segregation features, and sanity checks, the platform helps ensure data reliability during internal and external audits.

Some of the leading alternatives to Cryptoworth include Koinly, Cryptio, Bitwave, Integral, and Tres Finance. However, where Cryptoworth stands out is in its comprehensive subledger capabilities, advanced API coverage, and real-time reconciliation dashboards, which are especially beneficial to high-volume or regulatory-heavy organizations. Its performance has been validated by G2’s Software Rankings, where it has received multiple awards for support and innovation.

As Web3 and digital finance continue to evolve, Cryptoworth remains committed to simplifying complex crypto operations. Its ability to streamline workflows, ensure data accuracy, and remain adaptable makes it a core component in the infrastructure of serious blockchain-enabled enterprises. Cryptoworth continues to innovate with its API-driven engine, helping clients transition smoothly from legacy tools to modern crypto-native financial management systems.

Cryptoworth provides numerous benefits and features that make it a standout project in the crypto accounting landscape:

- Comprehensive Integrations: Connect with over 1,000 sources including 230+ blockchains, exchanges, wallets, and DeFi protocols, all consolidated in one platform.

- Enterprise-Level Reporting: Generate audit-ready reports, trial balances, PnL statements, and asset roll-forwards with full GAAP/IFRS compliance.

- Real-Time Dashboards: View up-to-date crypto portfolio insights with support for multi-entity structures and roll-up reporting.

- Automated Tax Compliance: Run cost basis calculations and tax lot tracking using FIFO, LIFO, or WAC methods.

- Security and Compliance: End-to-end encryption, SOC 2 certification, and full regulatory alignment with VASP, VARA, MiCA, and MAS.

- API-Driven Infrastructure: Developers can build custom workflows and syncs using Cryptoworth’s headless API engine.

- Award-Winning Support: Recognized on G2 for best-in-class support across all tiers, including sandbox users.

Cryptoworth offers a simple yet scalable onboarding process for teams looking to integrate crypto accounting software into their financial systems:

- Create an Entity or Portfolio: Sign up on Cryptoworth and set up your workspace by choosing your fiat base currency and initial chart of accounts.

- Connect Wallets and Exchanges: Use API keys or wallet addresses to securely connect with supported platforms like Binance, Coinbase, Kraken, and more.

- Run Sanity Checks: Automatically validate on-chain transactions for completeness and accuracy using Cryptoworth’s built-in tools.

- Configure General Ledger Mapping: Sync transactions to QuickBooks, Xero, or NetSuite by mapping your digital asset accounts to your GL accounts.

- Run Reports and Automate Rules: Generate detailed reports for tax, gain/loss, and PnL, and set classification rules for recurring transactions and spam tokens.

- Collaborate with Your Team: Share access with your finance team or external auditors for real-time collaboration and attestation.

- Try Sandbox First: Explore Cryptoworth’s features risk-free with the sandbox tier, including 5 wallet connections and 2,000 transactions.

Cryptoworth FAQ

Cryptoworth offers robust support for decentralized autonomous organizations (DAOs) by enabling full-spectrum tracking of token issuance, distribution, staking, and governance payouts. Its system supports unique tokenomics models, allowing accountants to classify DAO-based smart contract interactions using custom automation rules. With over 1,000+ data integrations, including DAO-managed wallets and DeFi protocols, Cryptoworth ensures accurate categorization of activity and generates audit-ready reports aligned with GAAP and IFRS. Learn more at Cryptoworth.

Cryptoworth is designed with built-in compliance architecture that addresses evolving crypto regulations, including MiCA (EU), VARA (UAE), and ADGM (Abu Dhabi). It offers proof-of-funds attestations, signature matching, and connection-level audit trails that allow financial controllers and auditors to validate entries in real-time. Each transaction can be mapped to accounting standards using customizable chart of accounts. For firms operating across jurisdictions, Cryptoworth enables entity-specific rule sets and local standards, ensuring seamless global financial reporting. Explore it at Cryptoworth.

Cryptoworth simplifies month-end closings by automating reconciliation workflows across subsidiaries, wallets, and exchanges. Teams can run sanity checks to verify data completeness, categorize digital assets using automation rules, and sync journal entries directly into ERP tools like QuickBooks or NetSuite. The platform's multi-entity support allows each portfolio to maintain separate cost-basis settings, currencies, and charts of accounts, speeding up the closing process by up to 10x. Visit Cryptoworth for more details.

The API-first architecture of Cryptoworth enables businesses to integrate it with any ERP system seamlessly. Whether syncing data into legacy accounting software or building real-time dashboards, users gain access to configurable endpoints for transaction ingestion, report generation, and entity-level mappings. This makes it ideal for high-frequency data environments like CEXs, DeFi protocols, and Layer 1 ecosystems. Developers can use Cryptoworth's documentation to deploy automated reporting pipelines with minimal configuration.

Cryptoworth employs advanced filtering and validation tools to prevent inaccuracies common in crypto accounting. Its platform can automatically exclude spam tokens, flag duplicate entries, and cross-check data integrity between blockchain records and wallet APIs. Using automation rules and data completeness checks, users can classify transactions properly before syncing with a general ledger. This ensures that financial reports reflect true, realized and unrealized positions. Explore these features at Cryptoworth.

You Might Also Like