About cSigma Finance

cSigma Finance is redefining how on-chain capital interacts with the traditional economy by building the world’s largest on-chain RWA (Real World Asset) private credit marketplace. Built for stability-seeking crypto holders, cSigma Finance offers a trusted environment for generating yield from lending stablecoins to real-world businesses, without the volatility typically associated with crypto lending.

By blending AI-powered credit intelligence with smart contract transparency, cSigma Finance delivers an institutional-grade infrastructure where stablecoin holders can earn up to 18% APR through carefully underwritten private credit opportunities. The project’s core mission is to make sustainable, fixed-income yield accessible to everyone, using blockchain technology to streamline traditional lending models into the DeFi space.

cSigma Finance has rapidly emerged as a leading force in the Real World Asset (RWA) lending landscape, bridging the gap between institutional finance and DeFi through a secure, AI-driven ecosystem. The platform connects stablecoin lenders to vetted real-world businesses via an advanced credit engine that performs automated underwriting, risk evaluation, and ongoing loan monitoring. All loan data, performance, and repayment activity are recorded transparently on-chain, providing unparalleled access to yield-bearing private credit products.

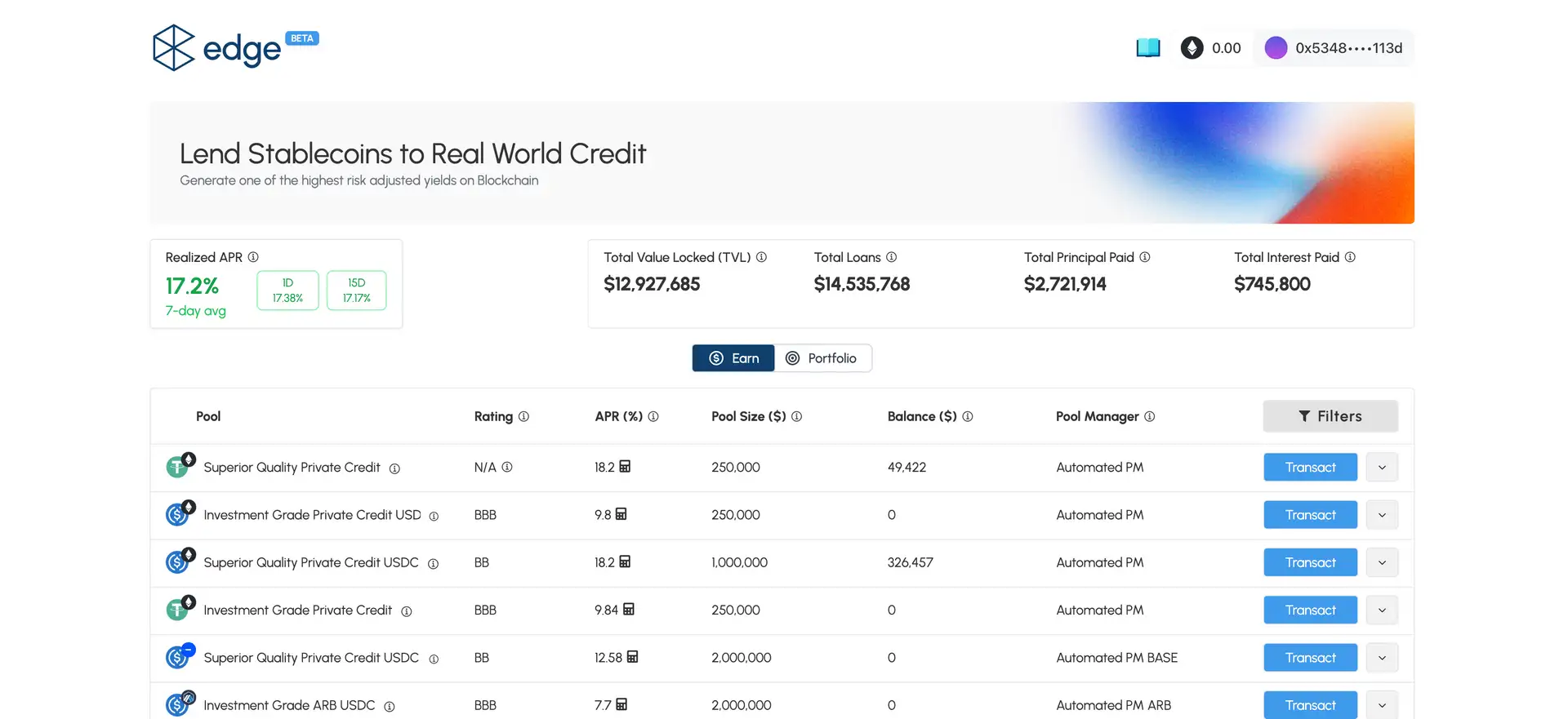

The project’s lending architecture includes curated credit pools, each with distinct risk-reward profiles, allowing users to lend USDC or USDT with ease. Every loan issued via cSigma Finance is backed by at least 3X collateral, creating multiple layers of protection against borrower default. Meanwhile, 24/7 AI risk monitoring tracks borrower health and adjusts strategies dynamically to safeguard capital. This intelligent layer brings a new level of security to on-chain lending, removing much of the uncertainty that traditionally deters risk-averse investors.

cSigma also powers Edge, its lending interface for stablecoin strategies, allowing users to select between single-asset exposure via Edge Pools or diversified yield-bearing tokens like csUSD. The inclusion of both ERC-4626 and ERC-7575 token standards enables flexible risk management and portfolio simplicity.

Competitors like Goldfinch, Credix, and Maple Finance have explored the RWA sector, but cSigma differentiates itself through real-time AI automation, over-collateralization standards, and zero reliance on crypto volatility. With over $80M in active loans and a growing TVL, cSigma has proven its ability to scale and serve both crypto and institutional markets, positioning itself as a sustainable engine for DeFi-native yield generation.

cSigma Finance provides numerous benefits and features that set it apart in the DeFi lending ecosystem:

- AI-Powered Credit Intelligence: Leverages real-time AI analysis to underwrite, monitor, and adjust credit pools automatically.

- Real-World Yield: Generates returns from real business activity, not speculative crypto assets, delivering consistent income.

- Multi-Layered Collateral: Each loan is protected by 3X collateral and credit risk barriers to protect lender capital.

- Simple & Fast Lending: Lend in under two minutes by connecting your wallet and selecting a credit pool that fits your strategy.

- Stablecoin Diversification: Choose between individual lending pools or invest via the csUSD vault for diversified stablecoin exposure.

- Institutional-Grade Due Diligence: Every borrower undergoes KYB, AML, and financial vetting before being accepted.

- Global Reach: Partners with vetted traditional businesses worldwide, unlocking access to new yield markets.

Getting started with cSigma Finance is simple and designed for both new and experienced DeFi users:

- Visit the platform: Head over to cSigma Finance and click “Start Lending” or “Explore Pools.”

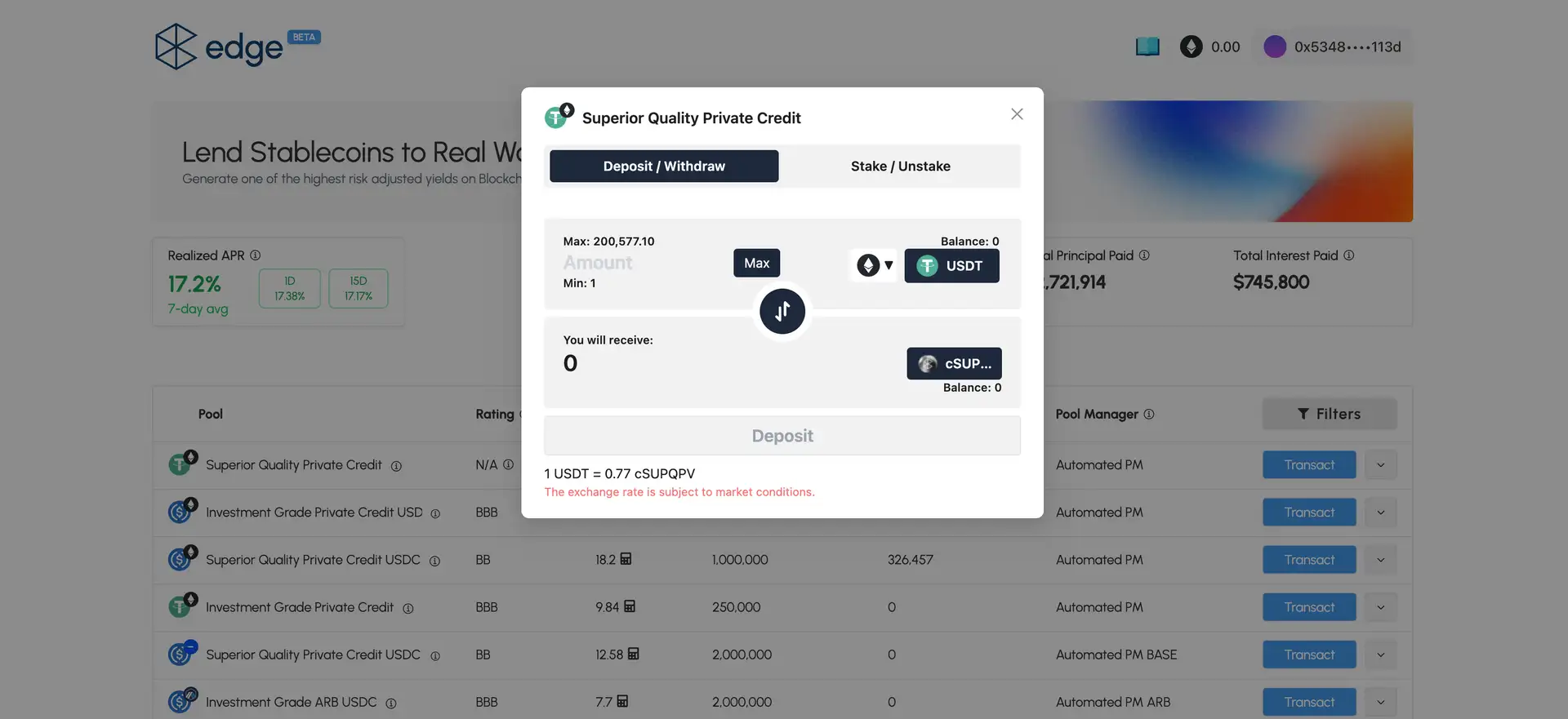

- Connect your wallet: Use your preferred Web3 wallet (such as MetaMask) to securely connect to the dApp. Supported chains and stablecoins include USDC and USDT.

- Choose a credit pool: Select a lending pool that aligns with your yield expectations and risk tolerance. Each pool includes detailed metrics like APR, credit rating, and duration.

- Deposit funds: Confirm the transaction in your wallet to lend your stablecoins. You'll receive an LP token or csUSD in return, depending on the pool type.

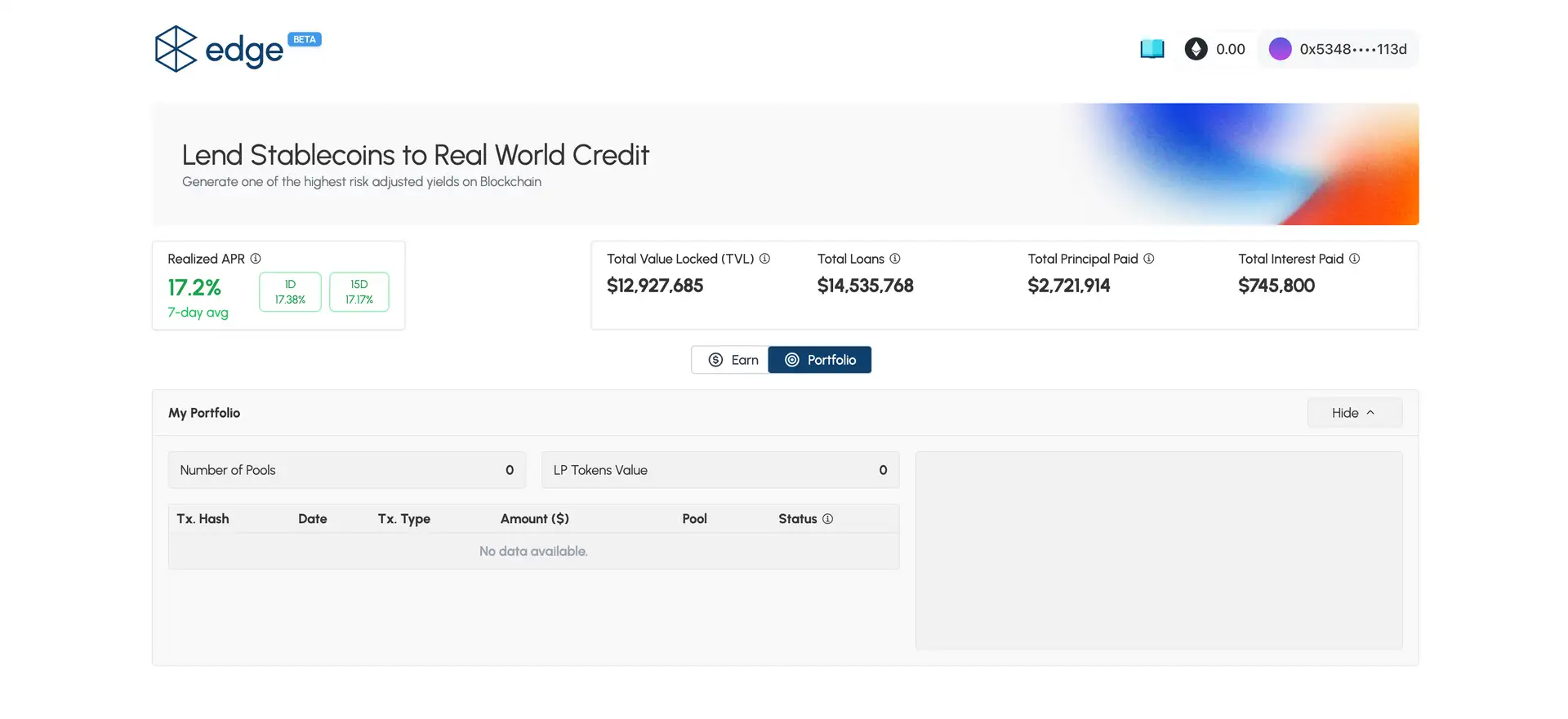

- Track your returns: Monitor repayments, APY, and risk metrics through your personalized dashboard. Withdraw or reinvest as desired.

cSigma Finance Reviews by Real Users

cSigma Finance FAQ

cSigma Finance partners exclusively with vetted borrowers who pass rigorous KYB, AML, and financial audits. Every loan undergoes deep analysis by the platform’s AI Credit Engine, which assesses borrower health in real-time. By focusing on income-generating businesses and maintaining 3X collateral coverage, cSigma Finance minimizes risk and ensures capital safety for lenders.

csUSD offers automated diversification across stablecoin pools while maintaining institutional-grade yields. Instead of juggling multiple LP tokens, users receive a single, yield-bearing token backed by multiple high-quality credit pools. This dramatically reduces risk and user overhead. cSigma Finance created csUSD to offer yield without complexity or volatility.

cSigma’s AI credit engine actively monitors every borrower’s financial behavior, repayment trends, and external data to trigger protective measures if any deviation from credit terms is detected. This includes adjusting exposure or initiating recovery protocols. These AI-driven risk tools make lending through cSigma Finance significantly safer than traditional DeFi protocols relying on passive metrics.

Yes. By lending USDC or USDT into cSigma credit pools, you earn up to 18% APR backed by real-world business activity. Whether you choose Edge Pools or the csUSD Vault, your stablecoins start working immediately. cSigma Finance provides a frictionless, non-volatile path to passive income with on-chain transparency.

cSigma Finance structures every loan with a minimum of 3X collateralization, layered protections, and real-time risk surveillance. In case of repayment failure, smart contracts enforce recovery actions, including collateral seizure. This multi-tier defense system significantly reduces downside risk and ensures lenders are protected from unexpected losses.

You Might Also Like