About DeFI Bank Wallet

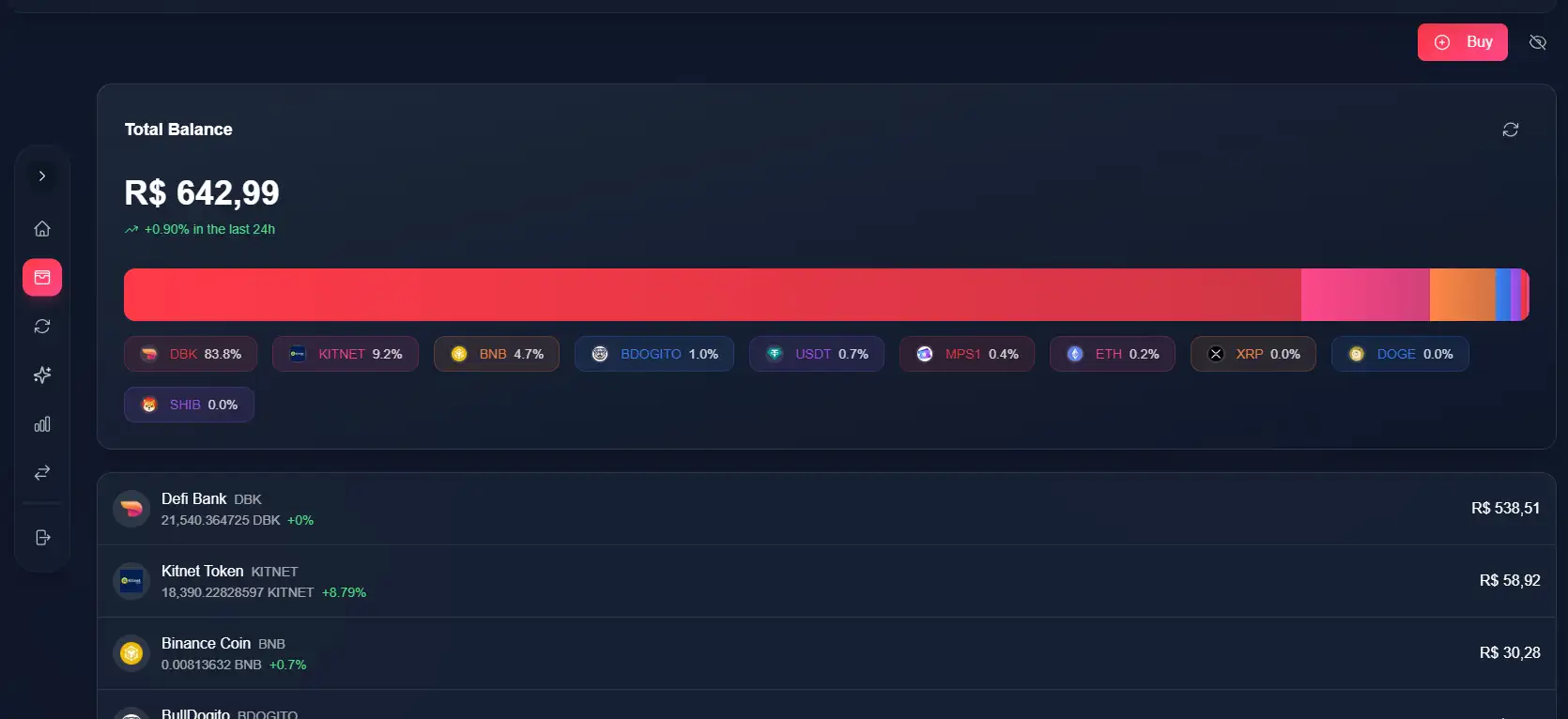

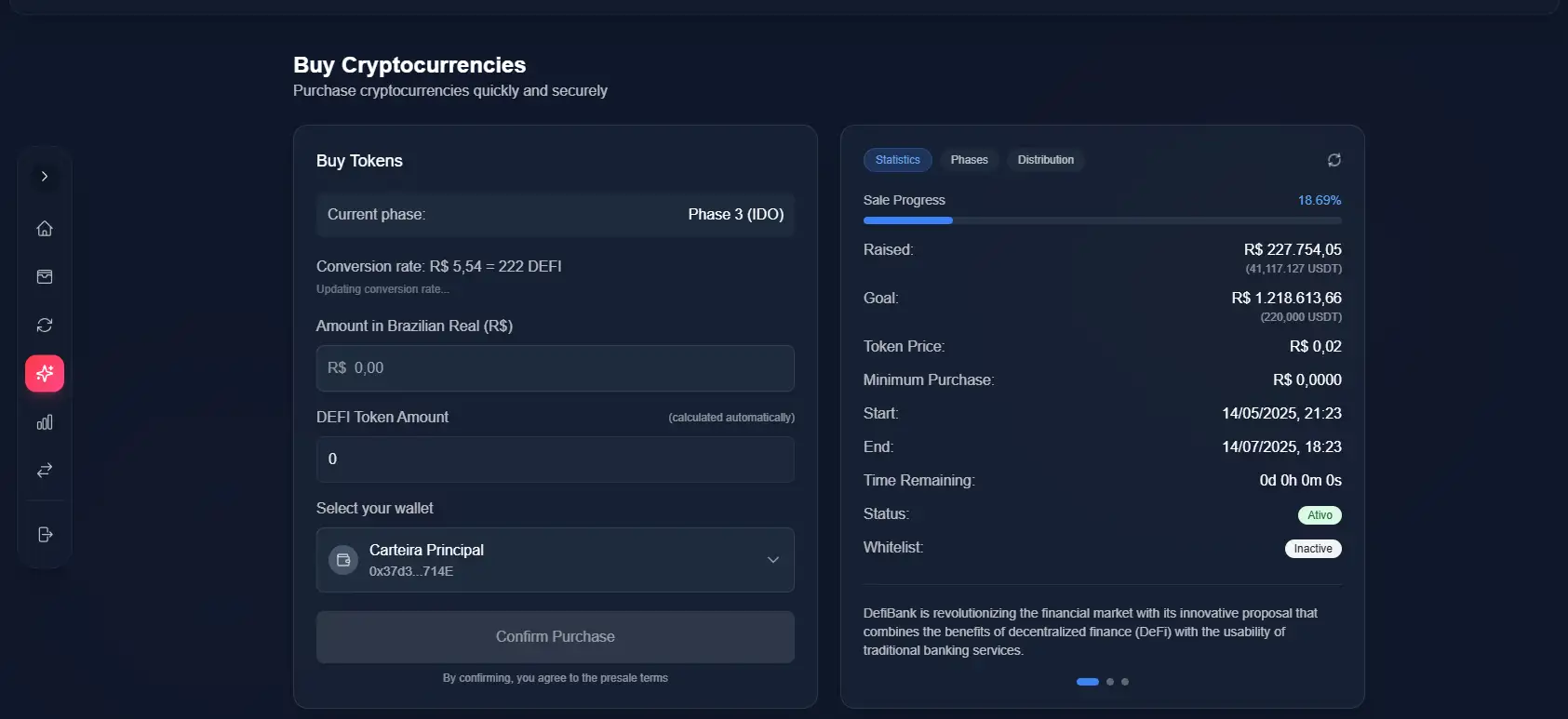

DeFi Bank Wallet is a next-generation Web3 banking ecosystem designed to bridge the gap between decentralized finance and traditional banking services. Users can buy crypto with fiat, spend USDT globally, earn from staking and usage-based rewards, and manage all assets from a single, easy-to-use wallet. The ecosystem is powered by the $DBK token, which is currently in presale, giving early adopters a chance to access the platform’s growing utilities at a discounted price.

Unlike many DeFi projects that launch before utility, DeFi Bank already offers a fully operational wallet, fiat on-ramp, and token functionalities. With its upcoming global crypto card, support for tokenized real-world assets, and a strong buyback model tied to platform revenues, DeFi Bank sets out to become the foundation of accessible, transparent, and rewarding digital banking.

DeFi Bank launched as a response to the fragmented, overly technical nature of modern crypto finance. The goal was simple: build a truly usable, inclusive, and benefit-rich ecosystem where users can interact with Web3 tools as easily as they do with online banking. Built on the BNB Chain, the platform combines speed, low fees, and reliability to support a growing user base seeking intuitive access to the DeFi economy.

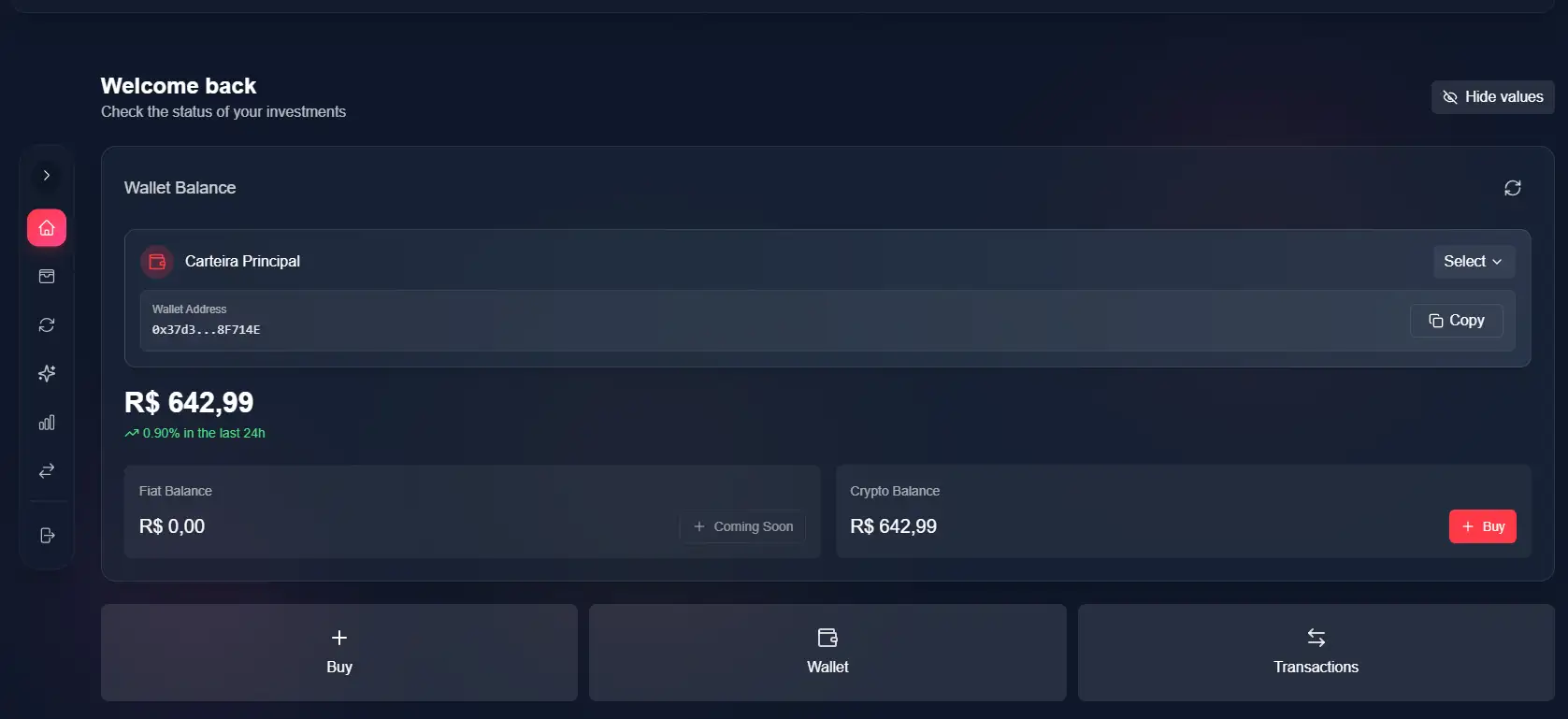

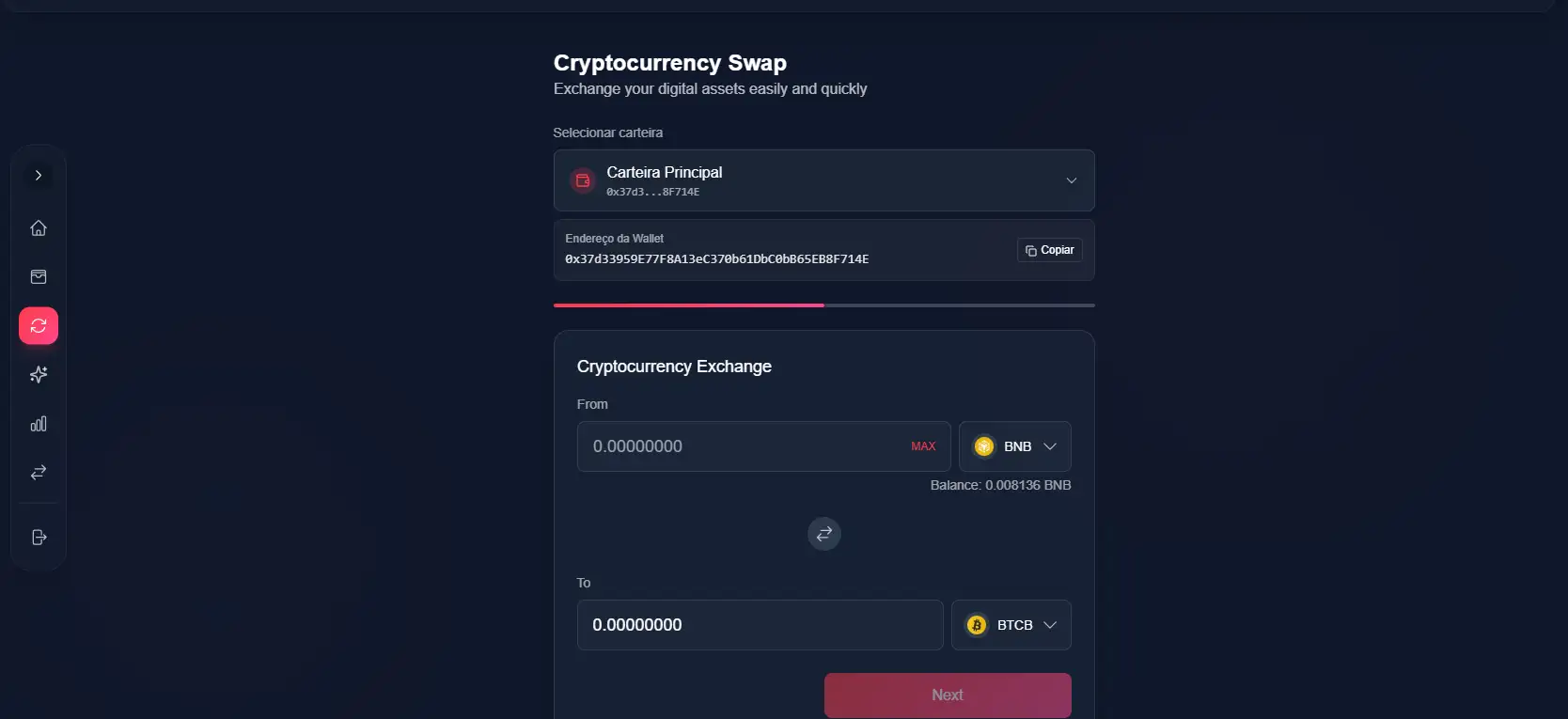

At the center of the ecosystem is the DeFi Bank Wallet — already live and operational. It allows users to manage assets, buy crypto via Pix and other fiat methods, and soon, spend crypto worldwide via the DeFi Bank Card. Unlike browser-based wallets like Metamask, this app is built to be non-custodial and user-friendly, with no gas fee surprises or extension installations. In just seconds, users can swap, stake, or move funds — all while maintaining full control over their private keys.

The upcoming DeFi Bank Card is one of the platform’s standout features. It will allow both virtual and physical card access to crypto balances, enabling spending at global merchants, cashback on purchases (with extra rewards for $DBK holders), and advanced security options like spend controls and geo-restrictions. No hidden fees, no bridge hassles — just real-world usability. This seamless integration of digital assets into everyday transactions sets DeFi Bank apart from many wallet-focused DeFi competitors.

In addition, DeFi Bank is introducing tokenized real-world assets (RWAs) and a transparent revenue-sharing model. Every six months, 30% of net platform profit is used to buy back $DBK tokens from the market and redistribute them into staking pools. This creates a cyclical reward loop where platform growth leads to token scarcity and higher passive income potential. Few ecosystems tie usage directly to token benefits as effectively as DeFi Bank.

As it develops, DeFi Bank will release enhanced governance, global fiat onboarding, and deeper integrations with third-party apps. Competitors like Crypto.com, Revolut, and Monolith offer similar card or wallet functionality, but DeFi Bank’s approach — rewarding real usage, simplifying on-ramps, and creating token incentives from every transaction — gives it a unique, integrated edge in the sector.

DeFi Bank Wallet provides numerous benefits and features that make it a standout project in the Web3 banking landscape:

- Live & User-Friendly Wallet: The DeFi Bank Wallet is already live and functional, requiring no extensions or Metamask. Users can manage assets, swap tokens, and access DeFi features with ease.

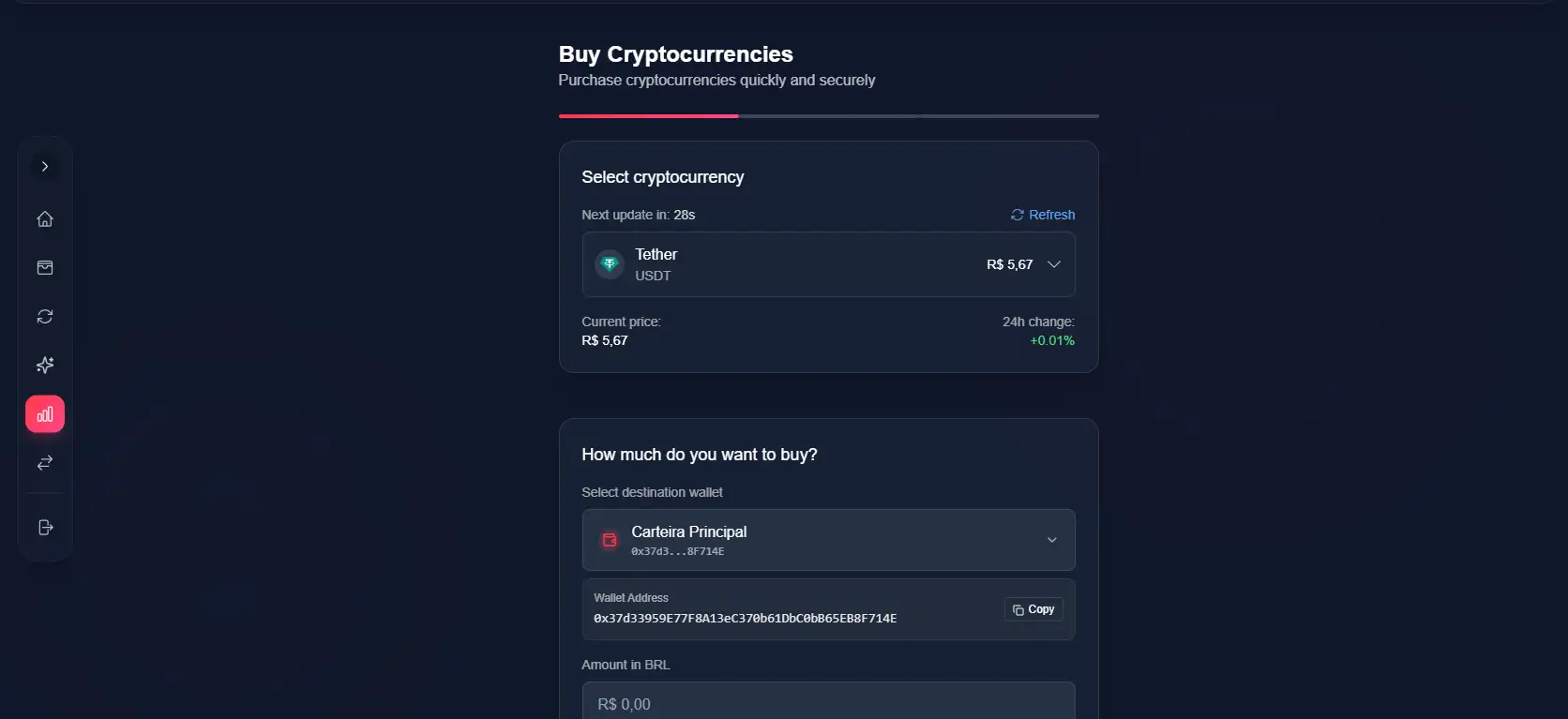

- Buy Crypto with Fiat: Fiat on-ramp support through Pix (BRL) and global fiat gateways makes crypto onboarding fast and accessible for new users.

- DeFi Bank Card: The upcoming crypto card allows users to spend USDT globally with cashback, security controls, and both virtual and physical card options.

- Real Usage = Real Rewards: Platform-generated fees flow back into the ecosystem through staking rewards and a recurring buyback mechanism powered by $DBK.

- Staking & Governance: Earn passive income and participate in key governance decisions by staking your $DBK tokens.

- Tokenized Real-World Assets (RWA): Future updates will include early access to exclusive RWA deals for $DBK holders.

- No Custody Risk: A truly non-custodial wallet experience — your private keys remain with you, ensuring full asset ownership.

- Transparent Tokenomics: A fixed total supply, vesting schedule for the team, and strategic allocation give $DBK a sustainable growth model.

DeFi Bank Wallet makes it simple for anyone to begin exploring the Web3 finance ecosystem:

- Step 1 – Visit the Website: Go to the official site at defibank.digital to access the wallet and token presale platform.

- Step 2 – Create a Wallet: Click on the wallet section and follow the on-screen instructions to generate a new non-custodial wallet in seconds.

- Step 3 – Fund with Fiat or Crypto: Use Pix (for BRL) or connect an external wallet to fund your account and prepare for your first swap or stake.

- Step 4 – Join the Presale: Head to the Presale section and use USDT to buy $DBK tokens at the current discounted rate.

- Step 5 – Stake and Explore: Stake your $DBK, manage assets, and explore future features like the crypto card, RWAs, and governance tools.

- Step 6 – Get the DeFi Bank Card: Once launched, request your DeFi Bank Card to start spending crypto globally — with enhanced rewards for $DBK holders.

- Step 7 – Join the Community: Follow DeFi Bank on social media to stay up to date on launches, integrations, and promotions.

DeFI Bank Wallet Reviews by Real Users

DeFI Bank Wallet FAQ

DeFi Bank Wallet was built with mass adoption in mind, offering a non-custodial interface that requires no extensions, no browser plugins, and no prior crypto experience. Users can set up a wallet in seconds, manage assets with a clean UI, and convert fiat to crypto without needing to understand wallets like Metamask or complex seed phrases. Everything happens inside a guided and mobile-friendly dashboard at defibank.digital.

Every six months, 30% of DeFi Bank’s net platform profit is used to buy back $DBK tokens from the open market, reducing circulating supply. These tokens are then redistributed to staking pools, rewarding active participants with greater returns over time. This creates a cyclical economy where real-world usage of the wallet, card, and on-ramp tools directly feeds value back into the $DBK token economy.

Yes, one of the key innovations of the DeFi Bank Card is that users can load the card with USDT directly from the wallet without having to manually bridge, convert, or move funds to another provider. Once loaded, the card can be used globally with automatic fiat conversion at the point of sale, giving users a seamless crypto-to-real-life spending experience.

DeFi Bank Wallet is 100% non-custodial, meaning users are the sole owners of their private keys. During wallet setup, users are prompted to safely store their seed phrase. If the phrase is lost, the platform cannot recover access due to its commitment to decentralization. This ensures full security and ownership, but it also places responsibility on the user. Instructions and security tips are provided at defibank.digital.

Yes, $DBK holders receive priority access to tokenized real-world asset opportunities as the feature rolls out. This includes pre-launch access to exclusive deals, reduced entry thresholds, and boosted yield when participating via the wallet’s RWA integration. These benefits are tied to wallet activity and staking levels, reinforcing ecosystem participation as a core value driver.

You Might Also Like