About DeFi Protection

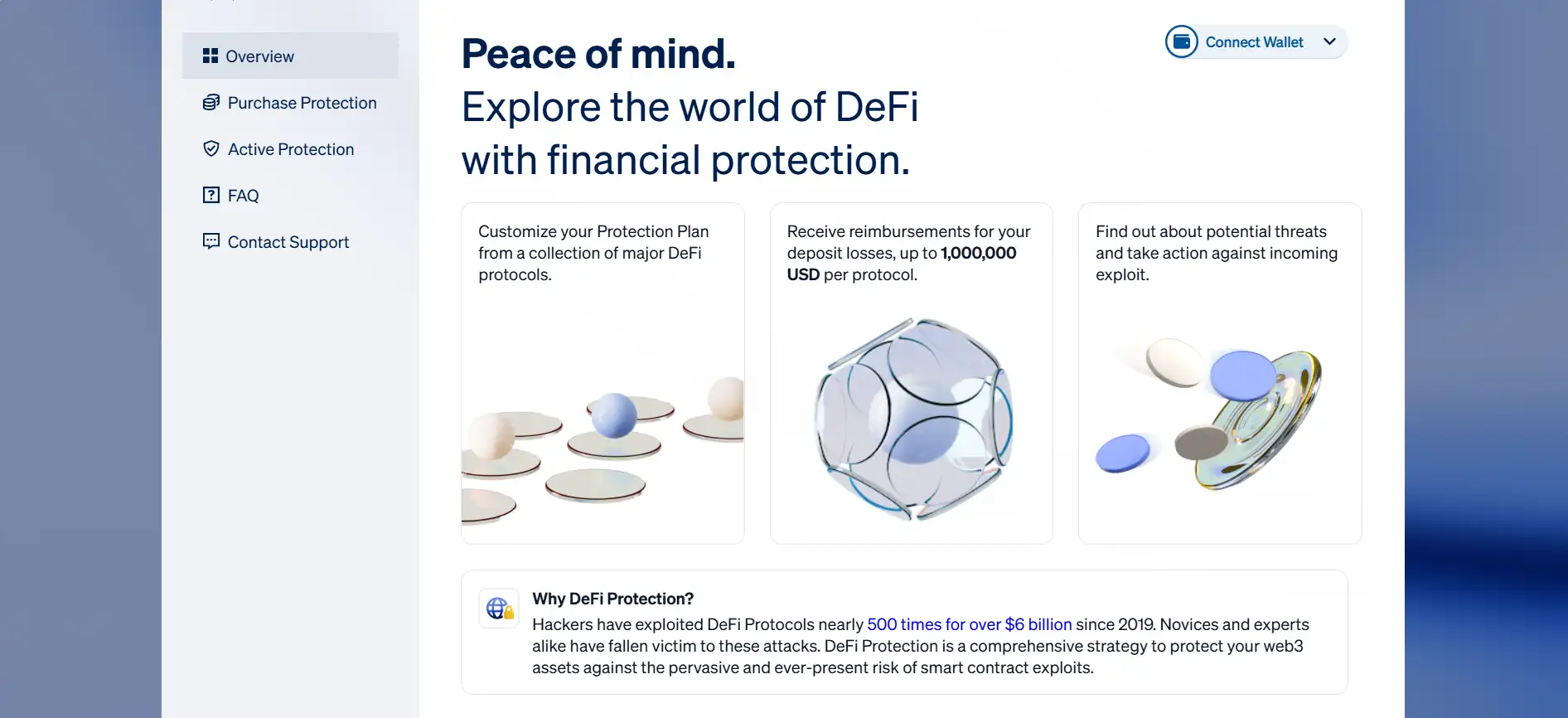

DeFi Protection is a next-generation financial security platform designed to safeguard users in the ever-evolving world of decentralized finance. Powered by Quantstamp, a leader in blockchain security, DeFi Protection offers customizable coverage plans to protect crypto assets from smart contract exploits, vulnerabilities, and undetected threats.

With losses exceeding $6 billion due to DeFi hacks since 2019, both novice and experienced users face substantial risks. DeFi Protection offers a seamless, user-friendly platform where users can purchase tailored protection across multiple supported protocols—receiving coverage of up to $1,000,000 per protocol. If Quantstamp fails to detect a threat and a loss occurs, users are reimbursed, subject to the terms of the agreement.

DeFi Protection was created to bring peace of mind to Web3 users by offering financial guarantees against smart contract exploits. Unlike traditional insurance, which can be opaque or legally ambiguous in DeFi, DeFi Protection operates as a transparent, legally-binding protection plan under Quantstamp’s auditing and monitoring infrastructure. Users simply choose their desired protocol, amount of coverage (up to $1M), and time window—and the plan goes live once KYC is complete and fees are paid in USDC.

The system supports multiple L2 networks including Arbitrum, Optimism, Base, and Polygon, allowing cost-effective, on-chain interaction. Once a user connects their wallet and selects a protocol, Quantstamp’s live monitoring service continues to scan the protocol for vulnerabilities. If a major threat is detected, users are notified instantly. If a user suffers a loss and was not alerted, they can file a claim through the platform and receive reimbursement—making this a true “warranty-backed” protection layer.

This model differentiates DeFi Protection from both Nexus Mutual and InsurAce, which operate more like discretionary mutuals or parametric insurance models. DeFi Protection offers direct coverage and guaranteed payouts in specific breach scenarios—without dependency on DAO votes or insurer pools. It’s a modern approach for a modern risk landscape.

DeFi Protection offers unique benefits that provide an advanced layer of security for the DeFi space:

- Customizable Coverage: Select the protocol, protection amount (up to $1,000,000), and duration that fits your portfolio needs.

- Real-Time Threat Monitoring: Continuous scanning of supported DeFi protocols using Quantstamp’s audit technology.

- Guaranteed Reimbursement: If Quantstamp fails to alert and funds are lost, reimbursement is offered up to your plan’s max coverage.

- Layer-2 Integration: Purchase and manage coverage with low gas fees on Arbitrum, Polygon, Base, and Optimism.

- Transparent Terms: Fully documented and legally enforceable protection, not discretionary community-driven votes.

- Simple Claims Process: File a claim directly through your connected wallet using the “File a Case” interface.

- Fully Audited Protocols: Only protocols vetted and continuously monitored by Quantstamp are eligible for protection.

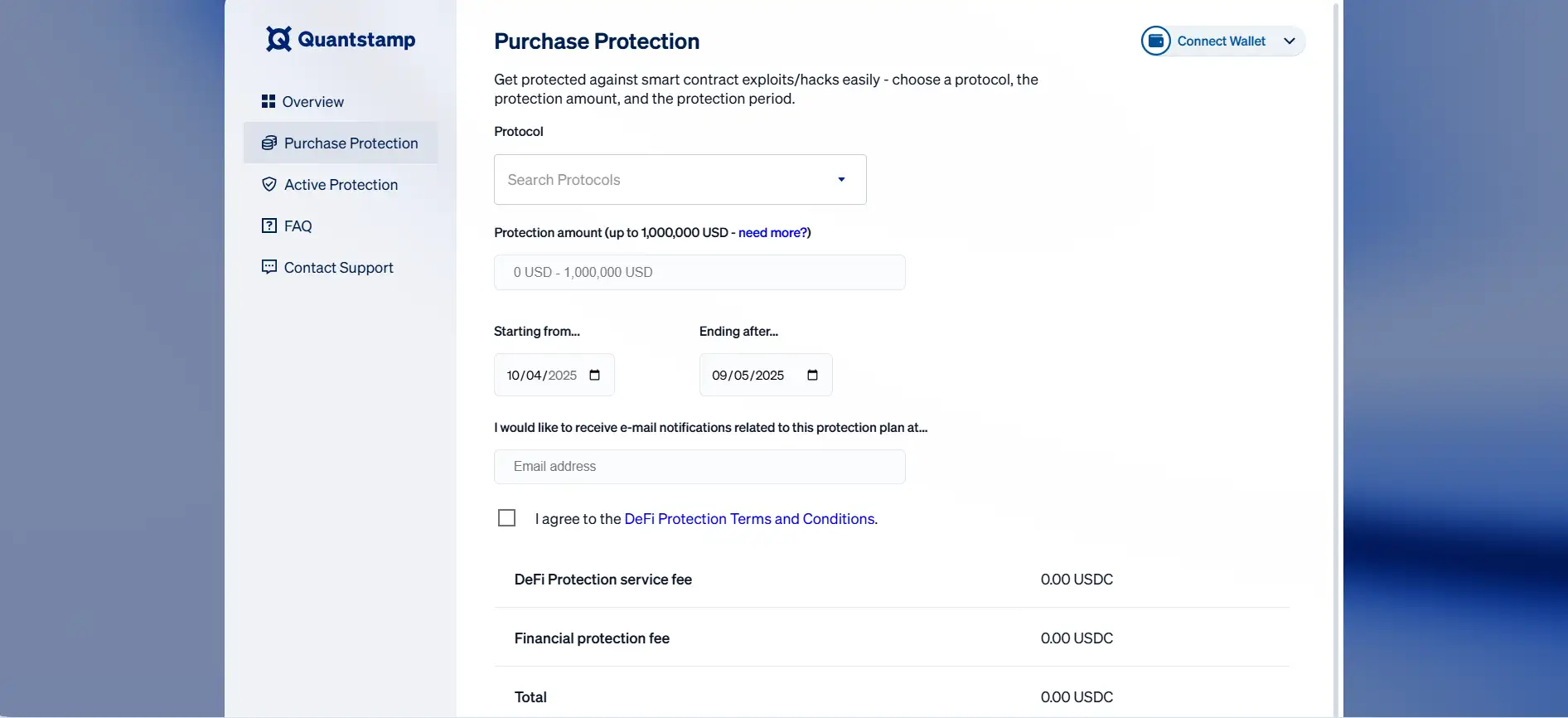

Getting started with DeFi Protection is simple and secure. Here's how to protect your DeFi portfolio in just a few steps:

- Visit the Website: Navigate to defiprotection.com and connect your wallet.

- Choose a Protocol: Select from the list of supported protocols. More protocols are regularly added based on audit completion.

- Select Protection Amount and Time: Choose your reimbursement cap (up to $1M) and duration (daily to monthly).

- Complete KYC: Users must pass identity verification due to compliance with U.S. and international regulations.

- Pay with USDC: Fees are clearly listed, split between a service fee and protection fee. Pay entirely in USDC.

- Activate Protection: Once payment is made, your protection begins. You will receive notifications if any risk is detected.

- File a Claim if Needed: In the event of a loss, go to the Active Protection tab, expand your plan, and click "File a Case" to submit.

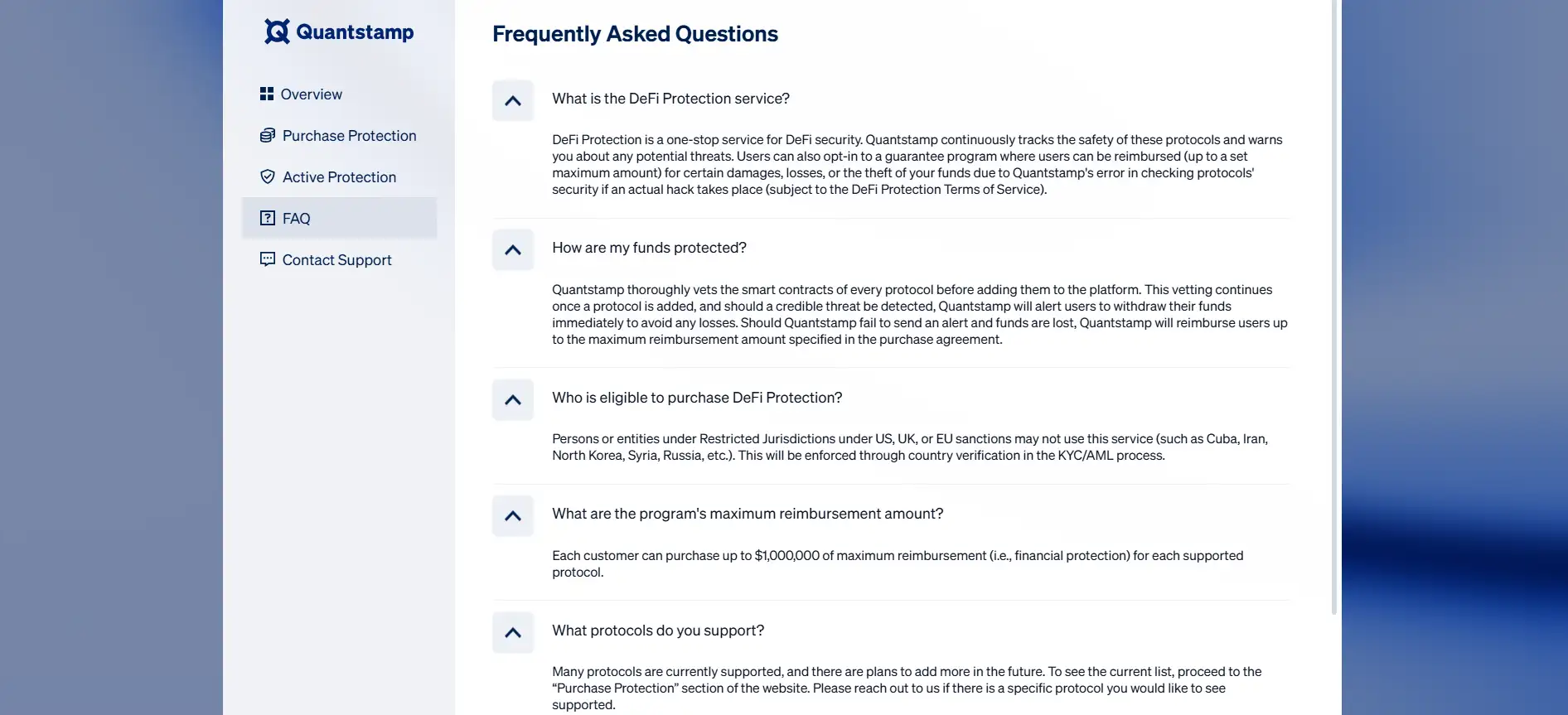

DeFi Protection FAQ

DeFi Protection is not an insurance product but a security service with contractual reimbursement. Unlike discretionary mutual models like Nexus Mutual, DeFi Protection guarantees reimbursement up to $1M if Quantstamp fails to detect a threat that results in a loss. This provides stronger accountability and transparency for users seeking proactive coverage.

If a supported protocol is hacked and you suffer losses without prior alert from Quantstamp, you can file a claim via the “Active Protection” dashboard. After verification, DeFi Protection will reimburse you up to your selected protection amount. It’s a direct process designed to minimize friction and delay.

Yes. DeFi Protection is designed for multi-protocol portfolios. You can customize protection plans for individual protocols, each with independent coverage limits (up to $1M). Whether you’re yield farming, lending, or staking, DeFi Protection helps you mitigate risk across your entire strategy.

KYC is mandatory to comply with U.S., UK, and EU financial regulations. Since DeFi Protection is not an insurance policy but a contractual agreement involving fiat-equivalent payments and reimbursements, identity verification ensures legal enforceability and prevents fraud. The process is handled securely via the platform's KYC/AML provider.

Absolutely. DeFi Protection supports Layer 2 networks including Arbitrum, Optimism, Base, and Polygon. This means you can purchase protection affordably with minimal gas fees, and manage plans across ecosystems without needing to bridge funds to Ethereum mainnet.

You Might Also Like