About Defx

Defx is a next-generation decentralized exchange (DEX) designed to bring the performance and sophistication of centralized exchanges (CEXs) to the non-custodial world. Built with a central limit order book (CLOB) model, Defx enables users to enjoy fast, transparent, and highly secure trading across Arbitrum, Solana, Base, and other blockchains—without ever giving up custody of their assets.

Unlike traditional AMMs, Defx provides a true CEX-like experience with ultra-low latency (p95 at 0.591ms), support for advanced order types, real-time order matching, and upcoming features like cross-margin trading, spot markets, and a unified layer-1 for DEX infrastructure. Whether you’re a professional trader or a DeFi-native, Defx bridges the gap between performance and decentralization with unmatched flexibility and reliability.

Defx is redefining decentralized trading through its innovative hybrid CLOB architecture, combining the speed and UX of centralized exchanges with the trustless nature of DeFi. The platform is built on a custom Layer 1 and features native funding and settlement across major blockchains like Arbitrum, Base, Blast, and Solana. Its orderbook is currently supported by an off-chain sequencer, but upcoming developments will bring this functionality on-chain—enhancing transparency while retaining speed.

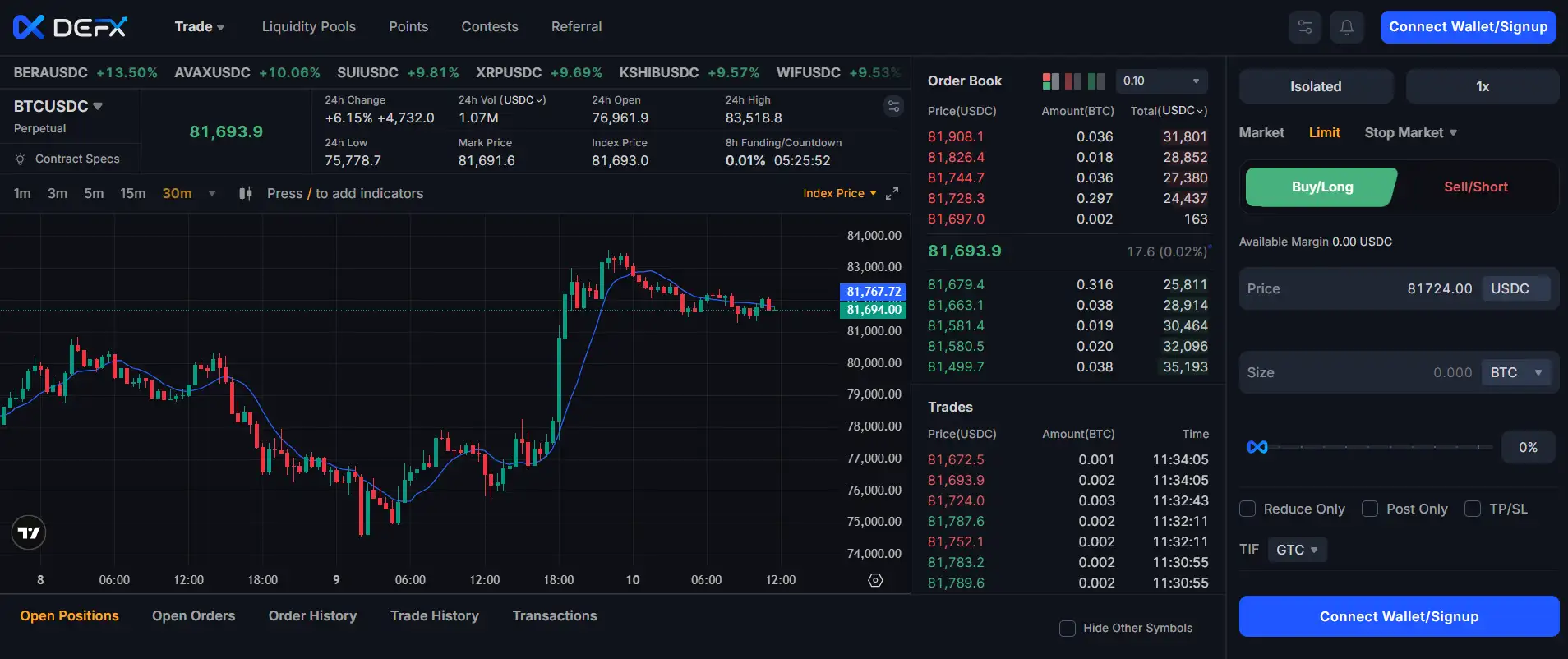

The current V1 supports Isolated Margin Perpetuals trading with future support for Cross Margin and Multi-Asset Collateral. Unlike AMM-based DEXs, Defx users get access to CEX-grade tools like Market, Limit, Stop Market, Stop Limit, Take Profit orders, and full support for Time in Force (TIF) configurations like GTC, IOC, and FOK. Defx stands out by giving its traders more than execution—they get full control over how, when, and with what margin their trades are placed.

A major innovation is the introduction of Just-in-Time (JIT) Funding, allowing users to keep assets in their wallets until the moment of trade execution. Combined with real-time settlement, self-custodial infrastructure, and cross-chain asset support, this makes Defx not only fast and capital-efficient, but also secure. The platform has already deployed sUSDe collateral support—letting traders earn 5% APY on their staked assets while using them as trading collateral.

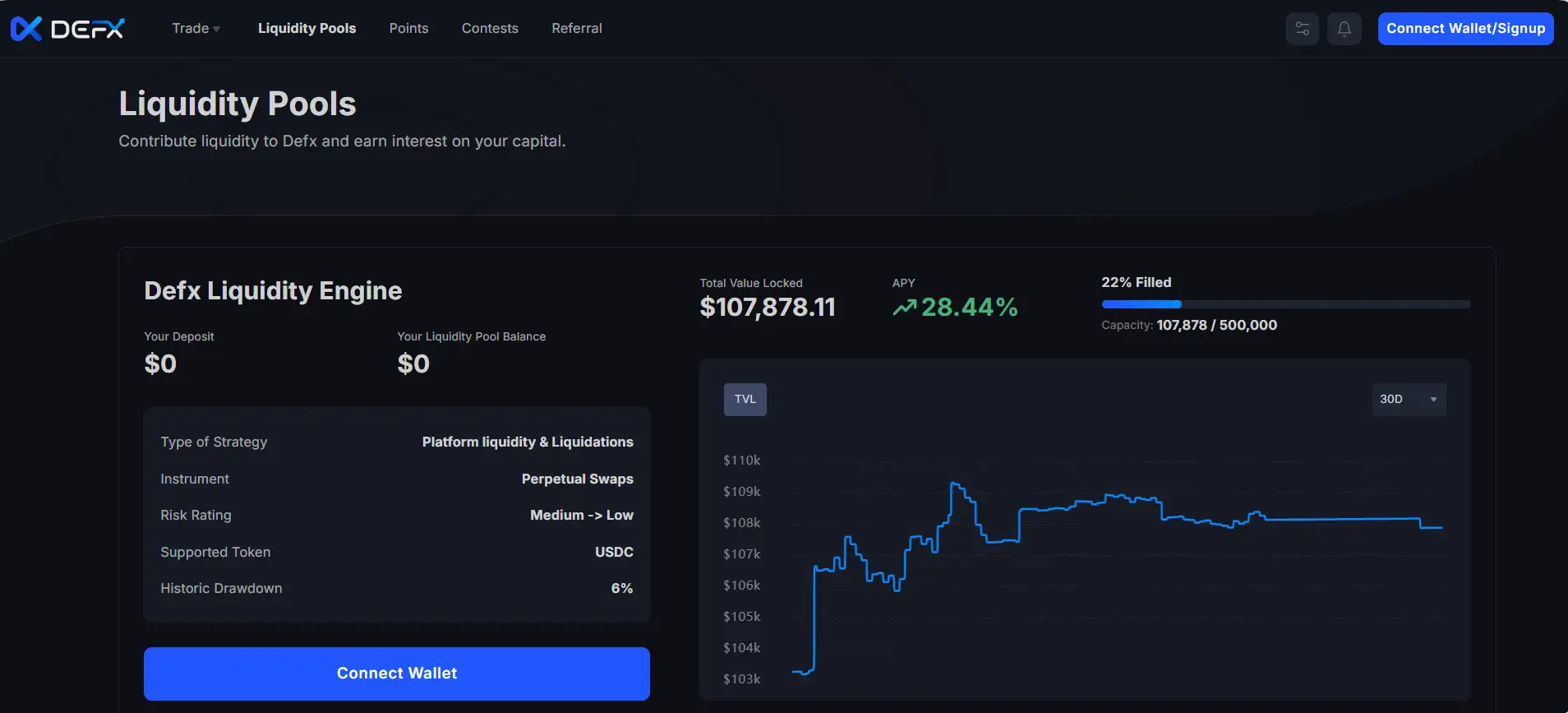

Defx is part of a new generation of DEXs competing with platforms like dYdX, Perpetual Protocol, and Vertex Protocol, offering professional tools without compromising on decentralization. But Defx differentiates itself by offering a plug-and-play CLOB infrastructure for other DEXs to build on—effectively becoming the "middleware layer" for the decentralized trading ecosystem.

Defx delivers a suite of powerful features that combine the performance of CEXs with the security of DeFi:

- True CLOB Experience: Built for traders, Defx uses a high-performance central limit order book—supporting advanced order types and fair matching.

- Self-Custody: Your assets stay in your wallet until execution. Just-in-Time (JIT) Funding gives you complete control and minimizes smart contract risk.

- Multi-Asset Collateral: Trade with sUSDe, wETH, wBTC, USDT, USDC, and more—across Arbitrum, Solana, and Ethereum—without converting to USDC first.

- Yield-Bearing Collateral: Use staked assets like sUSDe as collateral and continue earning ~5% APY while trading.

- Advanced Order Types: Supports Market, Limit, Stop-Loss, Take-Profit, Post-Only, Reduce-Only, and TIF settings (GTC, IOC, FOK).

- Pre-Launch Token Markets: Gain early exposure to assets before their official launch—no airdrop required.

- Auto-Deleveraging (ADL): Protects system integrity in high-volatility scenarios by selectively closing risky positions.

- Defx Points Program: Earn points weekly based on trading volume—designed for future rewards and potential token incentives.

Getting started on Defx is seamless, whether you’re new to DeFi or a seasoned pro:

- Step 1 – Visit the Platform: Go to defx.com and click "Connect Wallet."

- Step 2 – Choose a Network: Select from supported chains like Arbitrum, Solana, or Base. Ensure your wallet is configured for that network.

- Step 3 – Deposit Collateral: Deposit USDC or supported multi-chain assets like sUSDe, wETH, wBTC.

- Step 4 – Enable JIT Funding: Toggle this option to allow on-demand trade funding while keeping funds in your wallet.

- Step 5 – Start Trading: Use the pro trading UI to place Market, Limit, or Advanced Orders with full control over margin, TIF, and slippage.

- Step 6 – Monitor Your Position: View real-time liquidation prices, adjust margin, and manage risk directly from the dashboard.

- Step 7 – Earn Points: The more you trade, the more points you earn. These may convert into rewards in future token launches.

Defx FAQ

Defx uses a central limit order book (CLOB) architecture rather than an automated market maker (AMM). This provides professional-grade trade execution with better price discovery, tighter spreads, and support for advanced order types. Unlike AMMs, which use bonding curves and LPs, Defx matches buy and sell orders directly, enabling faster and more capital-efficient trading experiences.

JIT Funding allows your funds to remain in your wallet until they’re actually needed for a trade or settlement. This minimizes the time your capital is exposed to potential smart contract vulnerabilities. When a trade executes, funds are transferred instantly and returned after settlement. With JIT enabled, Defx maximizes both security and control by giving users full custody until execution.

Yes, Defx supports sUSDe as a trading collateral. This means you can use your staked yield-bearing assets as margin while continuing to earn approximately 5% APY. This double-duty mechanism lets your capital work harder—earning yield while backing trades. Defx offers a seamless way to optimize both trading and passive income strategies simultaneously.

Absolutely. Defx was built for professional traders and supports a wide range of order types including Market, Limit, Stop Market, Stop Limit, Take Profit, as well as options like Reduce-Only, Post-Only, and Time-in-Force (GTC, IOC, FOK). This makes Defx ideal for strategy-driven execution and high-volume trading workflows.

The Defx Points Program rewards users weekly based on their trading activity. Points accumulate over time and are expected to play a major role in upcoming platform incentives, possibly including airdrops or token rewards. The more you trade, the more points you earn. Defx is building for long-term community value—and points are your key to future benefits.

You Might Also Like