About DeSyn Protocol

DeSyn Protocol is a cutting-edge decentralized liquidity infrastructure designed for the Web3 ecosystem. It empowers investors, projects, and security companies to seamlessly invest, build, and manage liquidity in a decentralized manner. By leveraging innovative financial models and structured liquidity pools (SLP), DeSyn Protocol aims to optimize yield opportunities while maintaining security and transparency.

With a mission to make liquidity fair and accessible, DeSyn is transforming decentralized finance (DeFi) by ensuring liquidity is not just a privilege for a select few but a common good available to all. Through its on-chain security modules, abstract accounts, and decentralized pool management, DeSyn provides a secure and efficient ecosystem for users seeking yield optimization, staking strategies, and automated asset management.

DeSyn Protocol is redefining decentralized asset management by introducing a novel approach to liquidity optimization. The platform is built on three core pillars:

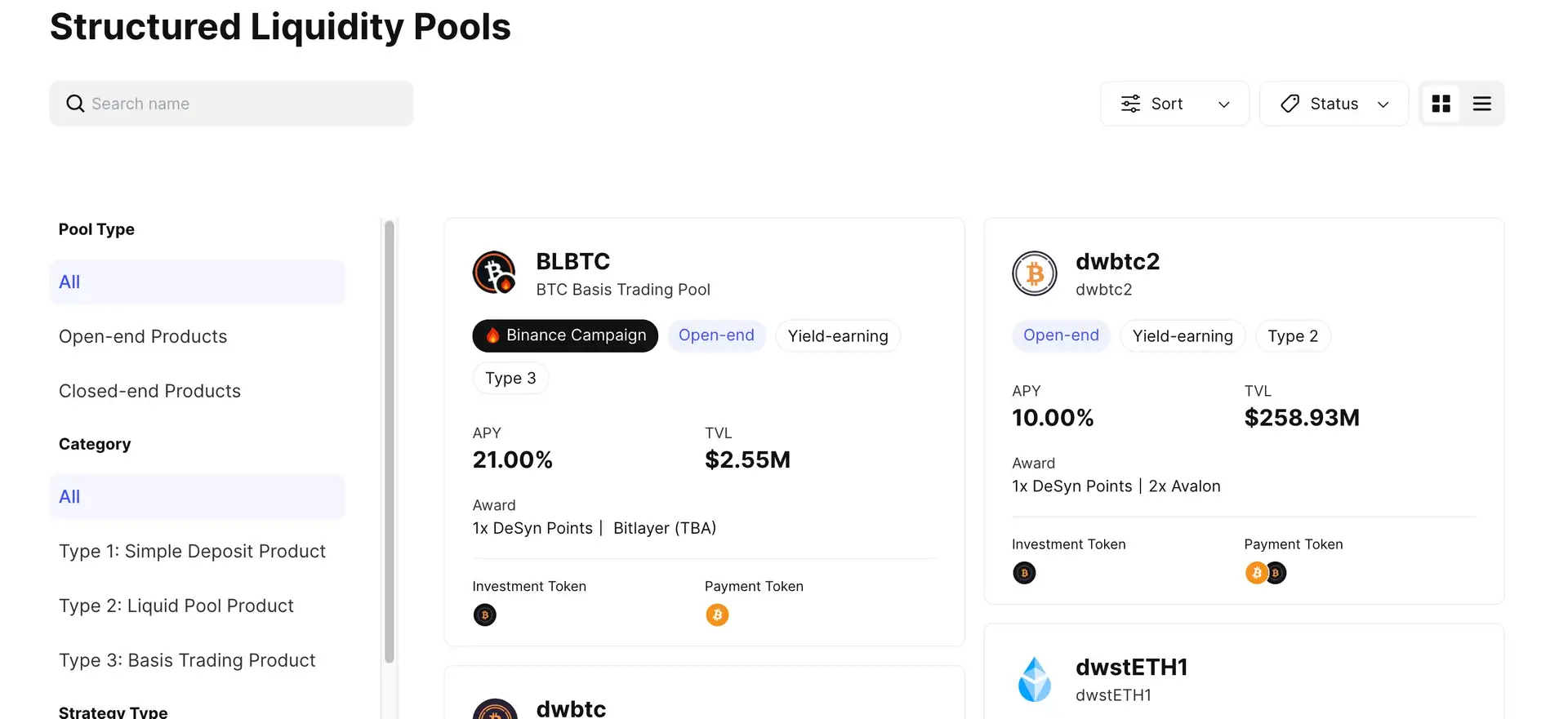

- Structured Liquidity Pools (SLP): DeSyn enables users to unlock optimized returns through cross-platform airdrops, high APR opportunities, and exclusive DeFi benefits.

- Abstract Accounts: The platform allows seamless cross-chain interactions while maintaining high-security standards and usability.

- Security Module: Powered by its proprietary SDT model, DeSyn ensures asset safety and mitigates risks associated with decentralized asset management.

The core innovation of DeSyn Protocol lies in its SLP Model, which enables investors to achieve multiple financial goals within a single strategy. This includes:

- Multiple DeFi Strategies: Users can deploy their funds in various high-yield DeFi protocols, leveraging automated strategies for optimized returns.

- Multiple Airdrop Opportunities: By participating in DeSyn pools, investors can maximize potential rewards through strategic partnerships and new chain integrations.

- Capital Preservation: The core investment remains protected while benefiting from diversified yield generation.

The platform supports different types of investment strategies, such as:

- Simple Deposit Products: Designed for low-risk investors, these pools focus on stable staking rewards and protocol airdrops.

- Liquid Fund Products: Medium-risk pools that leverage cross-platform DeFi opportunities, including lending, staking, and automated yield strategies.

- Basis Trading Products: These pools utilize arbitrage strategies on centralized and decentralized exchanges for steady, low-risk returns.

The decentralized management approach of DeSyn ensures that all pool operations, including fund issuance, withdrawal, and management, are executed transparently via smart contracts. The platform also integrates a robust on-chain security model to ensure protection against potential risks, including fraudulent asset management and misappropriation of funds.

Some of DeSyn’s key competitors in the decentralized asset management space include:

- Enzyme Finance – A decentralized asset management protocol offering customizable investment strategies.

- dHEDGE – A non-custodial asset management platform focusing on synthetic assets and DeFi strategies.

- Balancer – A decentralized trading and liquidity protocol with automated portfolio rebalancing.

DeSyn Protocol offers a wide range of benefits and features that distinguish it from other decentralized liquidity solutions:

- Optimized Yield Strategies: The SLP Model allows investors to access multiple DeFi rewards, maximizing their earning potential.

- Decentralized Pool Management: All asset pools are managed through transparent smart contracts, ensuring security and fairness.

- Cross-Chain Compatibility: DeSyn’s abstract accounts allow seamless interaction with multiple blockchain networks.

- Security Module: The platform’s proprietary SDT Model provides advanced security measures to mitigate smart contract risks.

- Automated Fund Management: Users can select from multiple investment strategies, reducing the need for active management.

- Flexible Vault Solutions: Investors can choose between public vaults or self-custody solutions for greater control over assets.

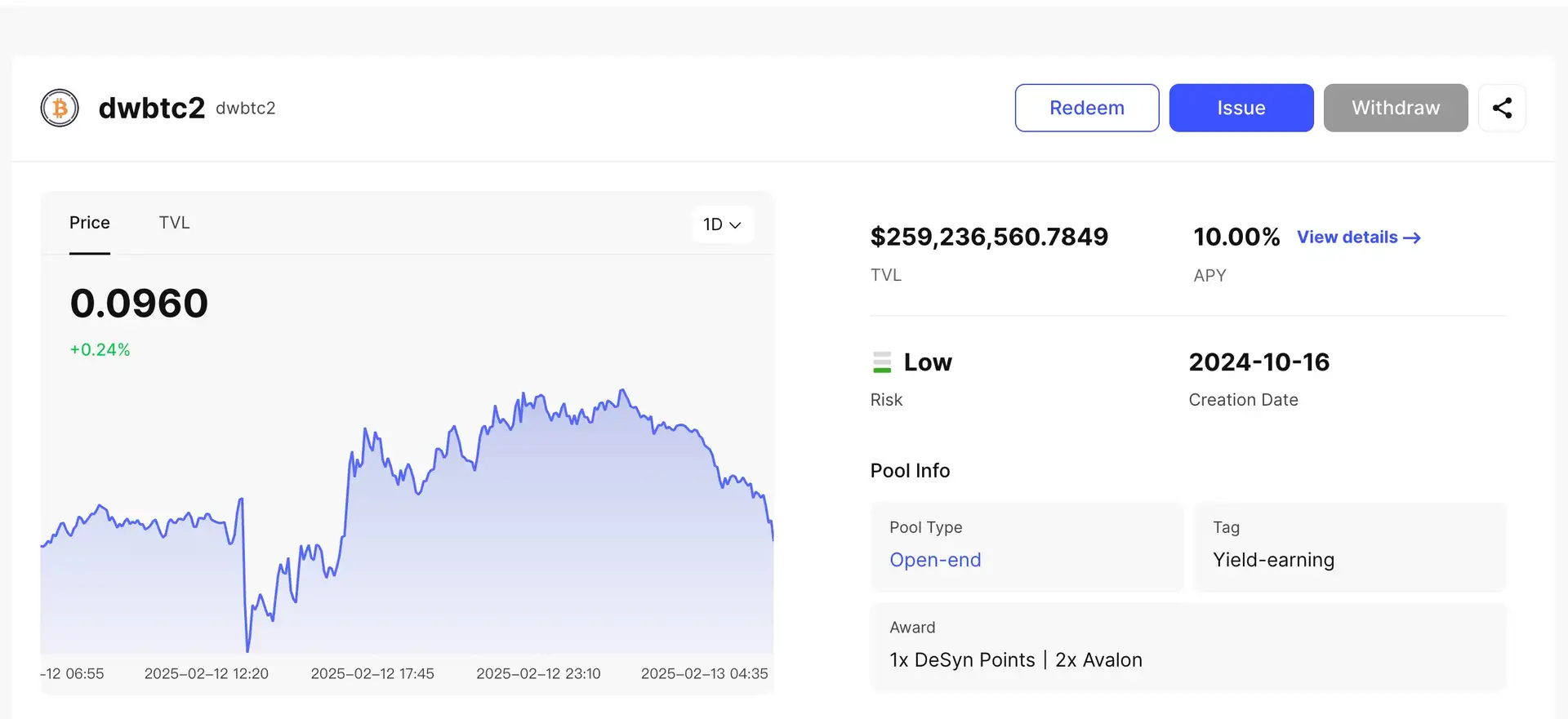

Getting started with DeSyn Protocol is a straightforward process:

- Visit the Platform: Go to DeSyn Protocol and connect your wallet.

- Choose Your Investment Strategy: Select from Simple Deposit, Liquid Fund, or Basis Trading products based on your risk tolerance.

- Deposit Funds: Allocate assets into a preferred investment pool and confirm transactions through your wallet.

- Monitor Your Returns: Track your earnings, airdrop rewards, and pool performance via the DeSyn dashboard.

- Withdraw or Reinvest: Redeem your assets at any time (for open-end products) or after the investment period (for closed-end products).

For more details, explore the official DeSyn Protocol website or check their Documentation for in-depth insights.

DeSyn Protocol Reviews by Real Users

DeSyn Protocol FAQ

DeSyn Protocol introduces a unique Structured Liquidity Pools (SLP) Model, allowing users to earn rewards from multiple sources simultaneously. Unlike traditional DeFi staking, which often locks assets into a single protocol, DeSyn enables users to participate in multi-platform yield farming, cross-chain airdrops, and automated rebalancing strategies. This ensures that each dollar invested is optimized for the highest possible returns while maintaining capital protection.

DeSyn Protocol offers two types of investment pools: Open-end Pools, where users can deposit and withdraw anytime, and Closed-end Pools, which require funds to remain locked until the cycle ends. If you're part of an open-end pool, withdrawals can be processed instantly via smart contracts. However, for closed-end pools, assets are only redeemable at the end of the investment period. This structure ensures that fund managers can execute planned strategies without unexpected liquidity disruptions.

The Security Module in DeSyn operates on a self-custody model, ensuring that only investors—not fund managers—can withdraw assets. This eliminates the risk of rug pulls since pool managers can only execute pre-set investment strategies without direct control over funds. Additionally, all transactions and asset movements are governed by smart contracts, with real-time on-chain visibility, making unauthorized transfers impossible.

Abstract Accounts allow users to seamlessly interact with multiple blockchain networks without manually bridging assets. Through DeSyn's cross-chain integration, investors can access liquidity across different DeFi platforms while maintaining a unified account structure. This enhances user experience by reducing transaction friction and minimizing gas fees, making it easier to diversify investments across various ecosystems.

Yes! DeSyn Protocol empowers users to create fully customizable liquidity pools with tailored management rules. Users can define investment strategies, set asset allocation ratios, whitelist specific tokens, and even establish automated rebalancing mechanisms. Whether you’re a retail investor or a professional fund manager, DeSyn’s ecosystem provides the flexibility to design pools that match your financial goals. To get started, visit DeSyn’s official website and follow the pool creation process.

You Might Also Like