About Dextr

Dextr is a decentralized exchange (DEX) designed to optimize liquidity provision and safeguard liquidity providers (LPs) from risks like miner extractable value (MEV) exploits. By implementing an MEV-capturing AMM (automated market maker), Dextr allows users to trade securely while maximizing returns. The platform features advanced mechanisms such as liquidity abstraction and single-sided liquidity positions, which give LPs greater control and flexibility over their liquidity strategies.

The platform is designed for professional traders and LPs, offering features like 100% fee retention, meaning LPs can keep all trading fees they generate, and 0% slippage, ensuring that trades are executed at the quoted prices. Furthermore, Dextr is committed to user security, providing economic guarantees against any losses arising from MEV exploits, making it one of the most secure decentralized trading platforms available today.

To learn more, visit the official Dextr website.

Dextr aims to address the main pain points faced by liquidity providers in decentralized exchanges, particularly Loss-Versus-Rebalancing (LVR) and the inefficiencies of traditional AMM models. The platform’s vision is to enhance capital efficiency while simultaneously reducing risks such as slippage and MEV exploits. Inspired by the gaps in existing DEXs, Dextr's founders sought to create a next-gen solution that would maximize profitability and security for its users.

The innovative use of dynamic liquidity rotation and AI-powered strategy adapters sets Dextr apart. These features allow users to allocate liquidity across multiple pairs and market sectors dynamically, enhancing both flexibility and capital usage. Additionally, the platform supports conditional market-making, allowing users to define specific trading conditions for their liquidity, ensuring better control over trading outcomes.

Moreover, Dextr seeks to reduce gas costs by up to 25%, a critical improvement in DeFi ecosystems where transaction fees can significantly affect profitability. The platform also integrates advanced features like account abstraction for enhanced self-custody and smart contracts that support cross-chain functionality.

For further details, check the Dextr whitepaper.

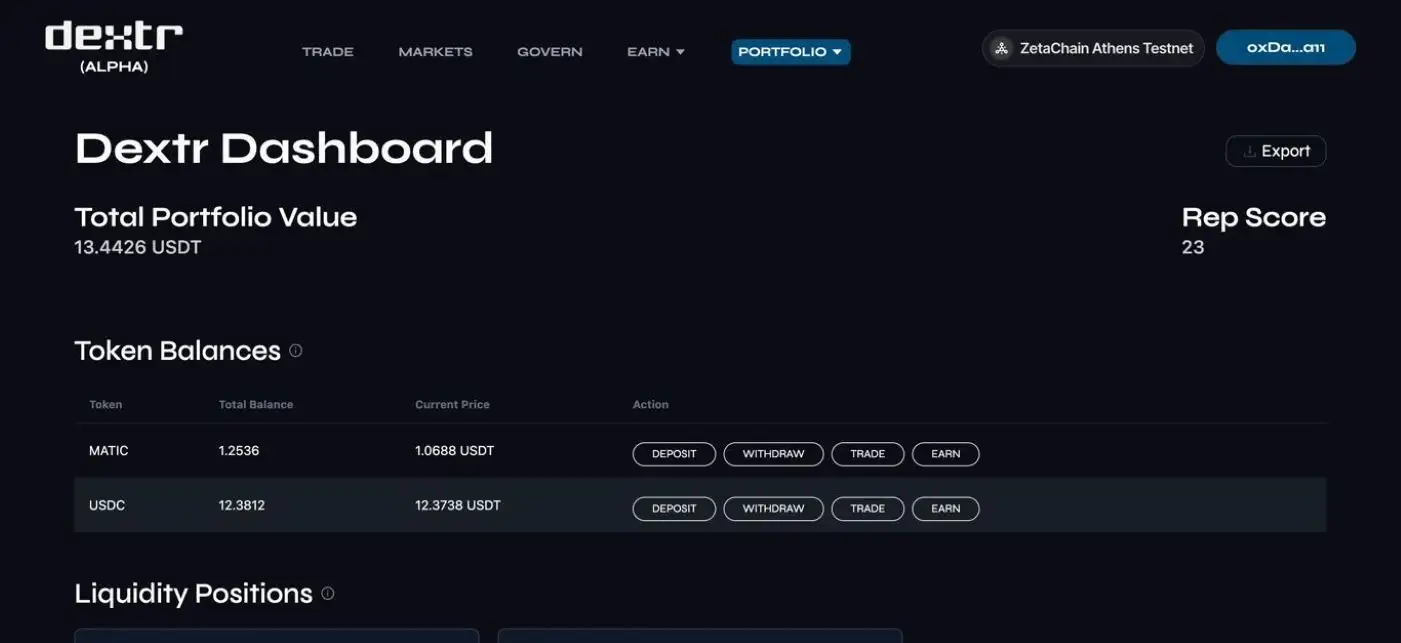

The Dextr testnet is already live, allowing users to explore the platform and earn rewards. In the testnet phase, participants can accumulate REP points, which can be used to prioritize liquidity or redeemed for DXTR tokens. The project roadmap includes expanding its liquidity provision features and eventually launching on the mainnet once ample feedback has been collected from early users.

Dextr’s founding team includes notable figures in the DeFi space. One of the key founders is Madhur Prabhakar, who is listed as the CEO and founder of the platform. The team has collaborated with various strategic partners, such as zkMe, to ensure that Dextr integrates advanced privacy and compliance features.

Further team members and details are available on the official website.

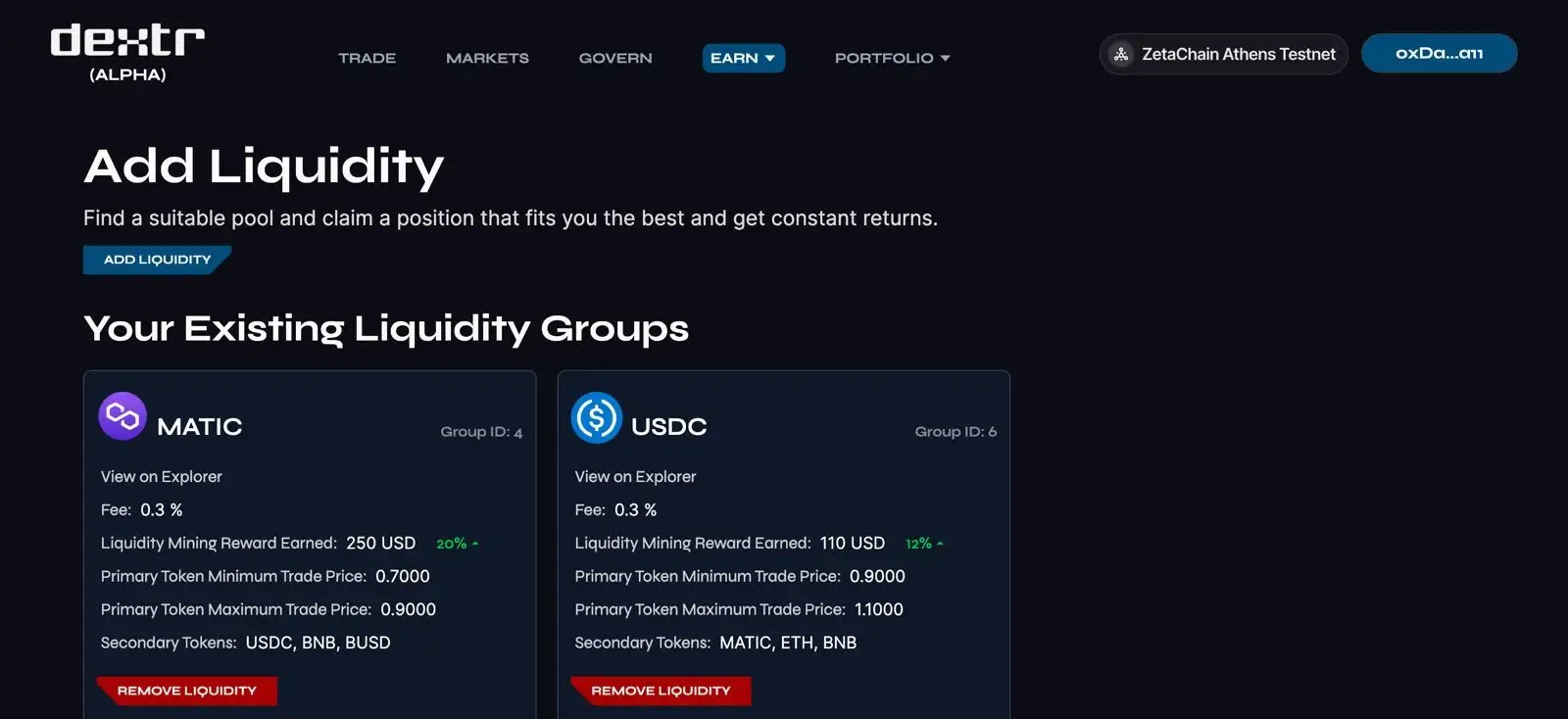

Dextr offers an open testnet and beta program where users can actively participate in testing the platform’s features. By joining the testnet, users can earn REP points through trading, staking, or providing liquidity. These points offer various benefits, such as redeeming for DXTR tokens or gaining priority in liquidity pools. To get early access, users can join the waitlist for the testnet program.

Dextr Suggestions by Real Users

Dextr FAQ

Dextr employs a unique MEV-capturing AMM that provides an economic guarantee to protect users from losses caused by MEV (miner extractable value) exploits. By implementing dynamic liquidity rotation and order flow identification, Dextr ensures that LPs can avoid rebalancing losses while benefiting from secure trades.

For further protection, the platform offers 100% compensation for any losses arising from these issues, ensuring a risk-mitigated experience. Learn more on the official Dextr website.

REP points are Dextr’s reputation-based rewards system that users can earn through trading, staking, and providing liquidity on the platform. These points allow users to gain priority in liquidity pools, redeem tokens, and even exchange them for other cryptocurrencies.

In addition, REP points contribute to enhancing the user’s rank within the system, granting benefits like discounted fees and higher liquidity allocation. To start earning, visit the Dextr testnet.

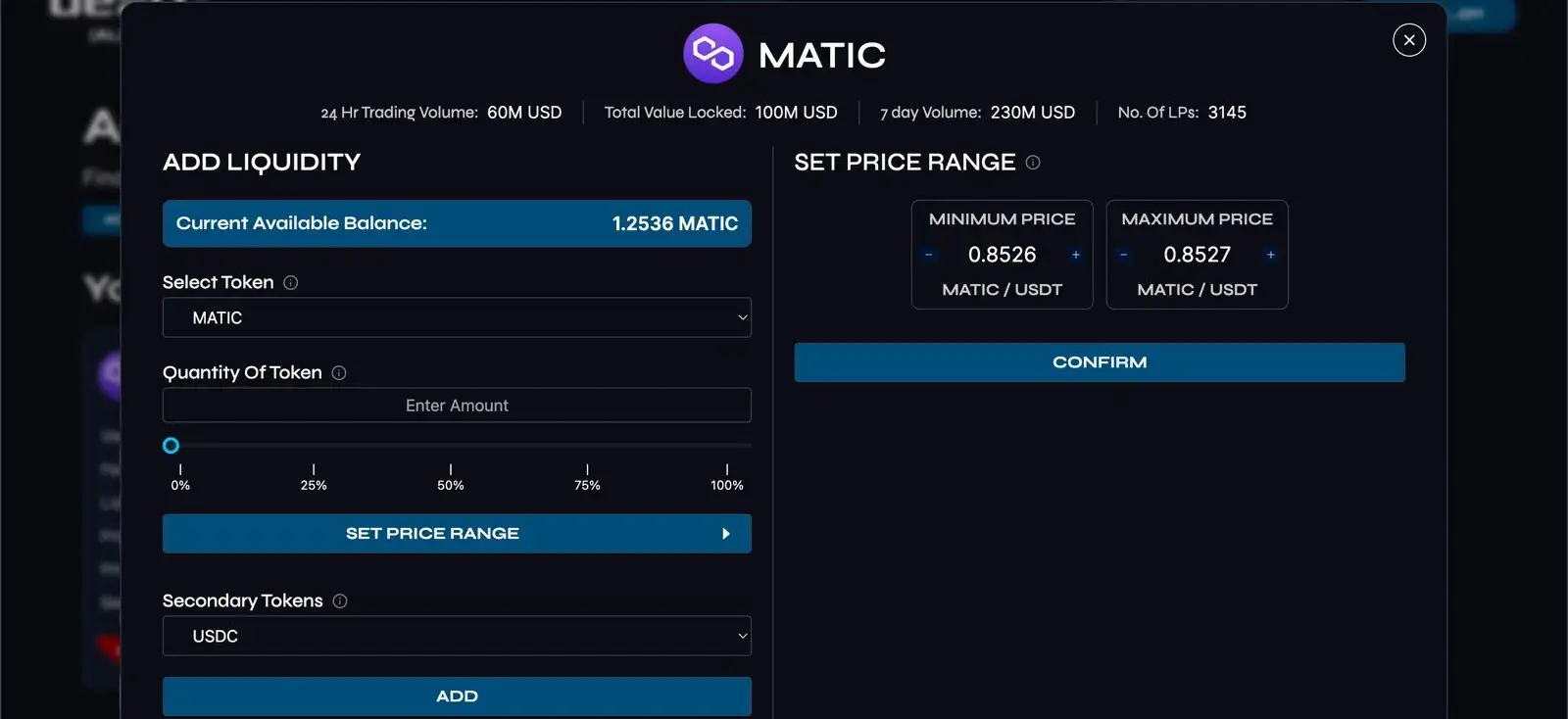

Yes, Dextr allows users to set up highly customized trading and liquidity strategies through its strategy adapters and universal hooks. These tools enable you to define specific price conditions and liquidity pairings, such as providing liquidity for an ETH/BTC pair only when a certain price level is reached.

This flexibility is part of Dextr’s vision to empower users with advanced, automated decision-making tools. To explore more, head over to the whitepaper.

Dextr integrates optimized smart contracts that reduce gas consumption by up to 25%. These contracts are designed to execute trades and liquidity management more efficiently, ensuring that users can save on fees while transacting on the platform.

This reduction is particularly beneficial in DeFi environments where gas fees can significantly impact profitability. For more information, check out the official website.

Dextr introduces features like single-sided liquidity positions and multi-market revolving liquidity, allowing LPs to allocate liquidity across multiple pairs using just one token. Unlike conventional AMMs, this method reduces capital inefficiency and maximizes return potential.

The platform also enables price source selection from oracles or external exchanges, offering greater flexibility in liquidity management. For a deep dive into how it works, visit the Dextr whitepaper.

You Might Also Like