About Dinari

Dinari is a blockchain-powered platform that brings traditional equity and ETF exposure into the Web3 world through fully collateralized, tokenized real-world assets. With Dinari, users can buy and trade tokenized versions of public company stocks like Apple (AAPL.d), Amazon (AMZN.d), and Tesla (TSLA.d), all on-chain and with full asset backing. Each token represents a real share, fully verifiable and wrapped as a digital token for seamless DeFi integration.

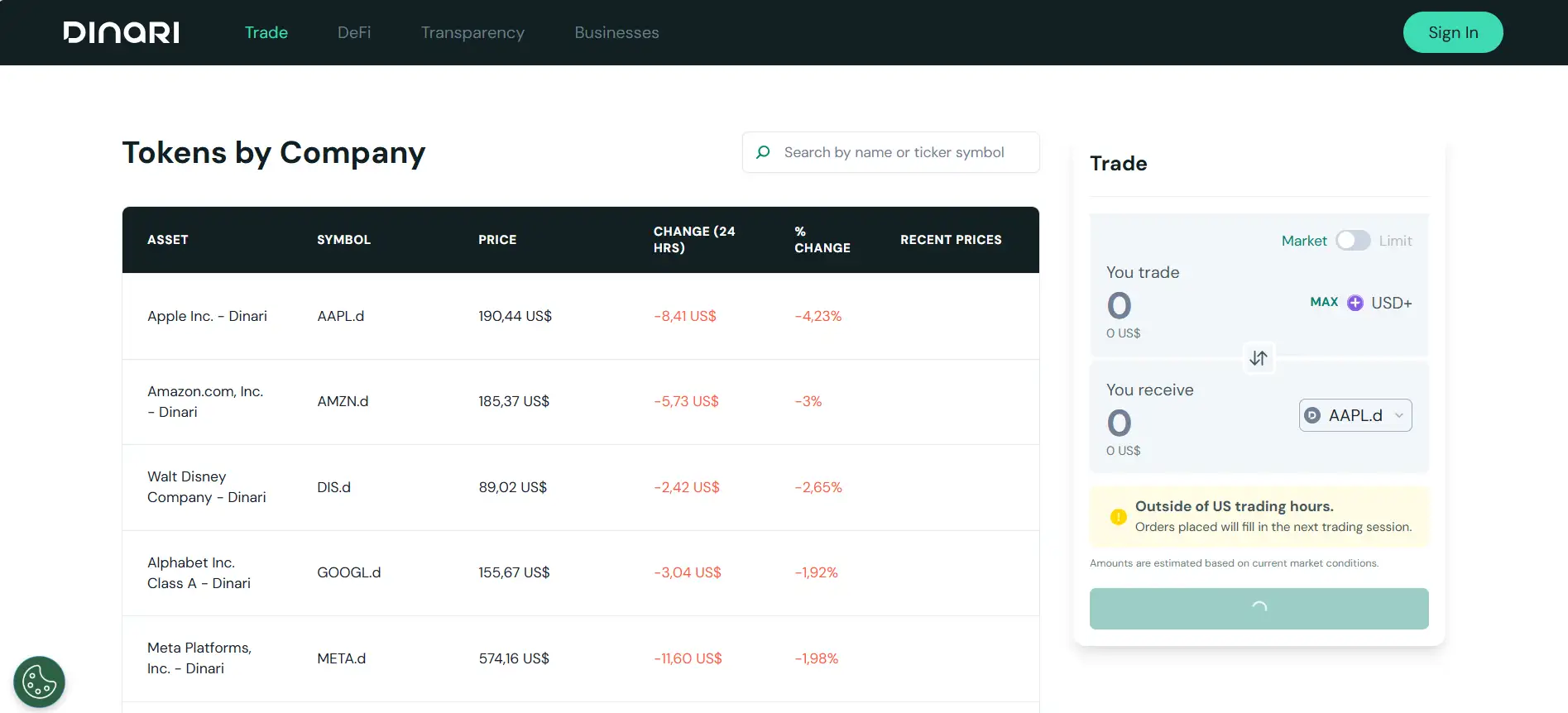

Via its intuitive interface and real-time pricing engine, Dinari enables users to trade dozens of tokenized stocks, ETFs, and Bitcoin-related assets such as Grayscale Bitcoin Trust (GBTC.d) and ARK 21Shares Bitcoin ETF (ARKB.d), without leaving the crypto ecosystem. These assets offer the benefits of decentralization, permissionless trading, and transparency, while remaining fully compliant with regulatory and financial protocols.

Dinari is on a mission to reshape traditional finance by enabling on-chain access to real-world assets. The platform focuses on the creation and trading of dShares — tokenized representations of publicly traded securities and ETFs. Each dShare is backed 1:1 with the underlying asset, stored and secured by regulated custodians, offering users the ability to own and trade real-world stocks directly from a Web3 wallet.

The protocol operates with transparency and security as its foundation. Users can track price movements of over 100 assets in real time, including major companies like Meta (META.d), Netflix (NFLX.d), and NVIDIA (NVDA.d), as well as ETFs like SPY.d and USFR.d. Price feeds are updated live, and trading is facilitated through intuitive Market and Limit orders. All trades are settled in USD+, a stablecoin medium that simplifies cross-asset execution.

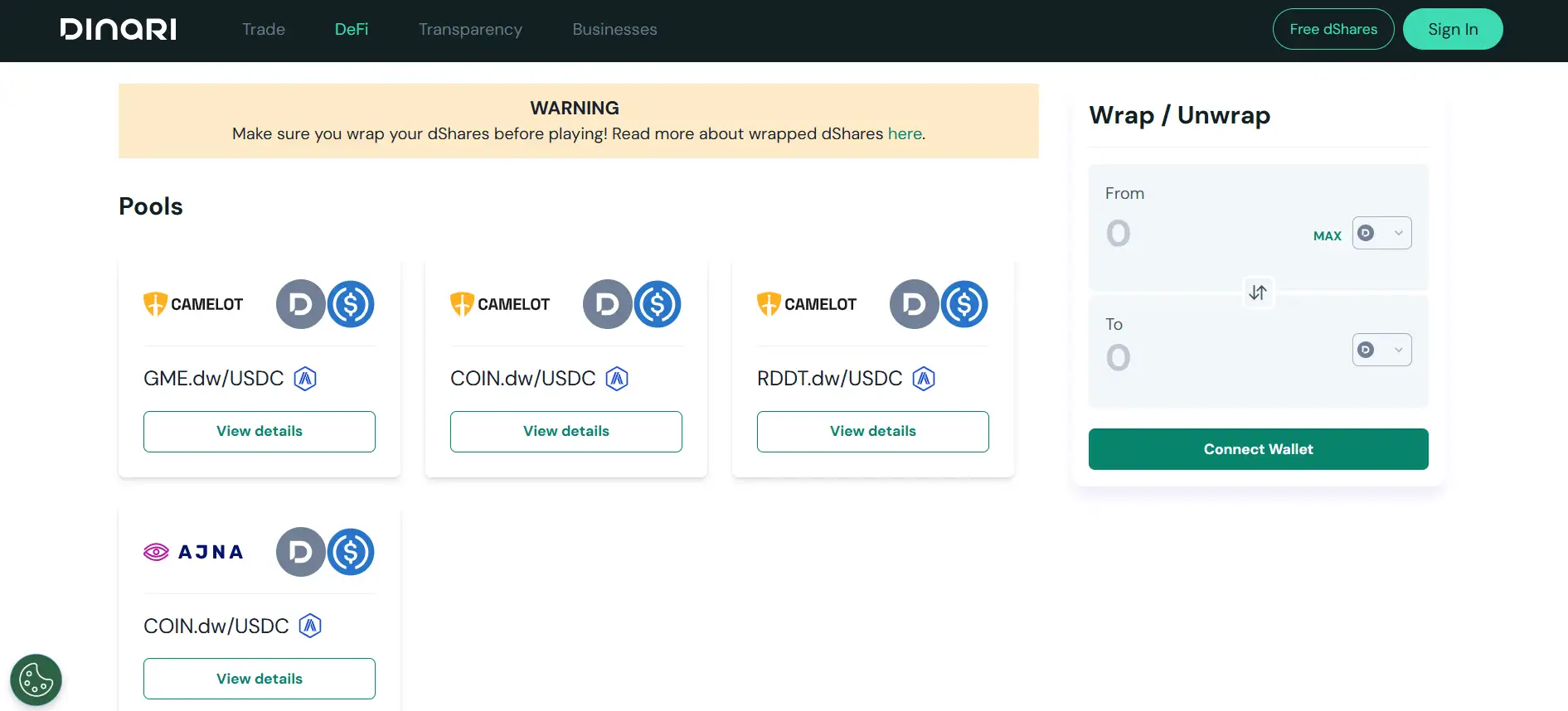

A key element of the Dinari experience is the Wrap/Unwrap system, which ensures that dShares can interact with DeFi applications without compromising asset integrity. By wrapping a dShare, users can enter liquidity pools and access yield opportunities, as seen with wrapped assets like GME.dw or COIN.dw. This bridge between traditional equities and decentralized finance is what makes Dinari uniquely powerful.

In terms of ecosystem positioning, Dinari competes in the emerging sector of tokenized TradFi platforms alongside solutions like Synthetix, Mirror Protocol, and TokenTrove. However, Dinari’s unique approach to full collateralization and regulated custody makes it particularly attractive for institutions and compliance-focused users seeking real-world asset exposure on-chain.

Dinari offers a robust range of features and benefits that set it apart in the tokenized asset space:

- Tokenized Real-World Assets: Access over 100 fully collateralized dShares representing stocks, ETFs, and crypto-adjacent equities.

- On-Chain Transparency: Every dShare is traceable, and the backing asset is verifiably custodied, ensuring trust and auditability.

- Market & Limit Trading: Trade tokenized equities with ease using real-time pricing and intuitive trade execution.

- Wrap/Unwrap Functionality: Seamlessly move dShares into DeFi protocols for liquidity provision and staking via wrapped versions (e.g., COIN.dw).

- Multichain Accessibility: Dinari is optimized for EVM compatibility, enabling users across various blockchains to participate with their Web3 wallets.

- Fully Regulated Custody: Real assets backing dShares are managed by licensed custodians to ensure full compliance and asset protection.

Getting started with Dinari is quick and seamless, whether you're a crypto native or a TradFi investor exploring on-chain assets:

- Visit sbt.dinari.com and connect your preferred Web3 wallet such as MetaMask.

- Search by company name or ticker symbol to view available dShares. Example: AAPL.d for Apple, or TSLA.d for Tesla.

- Use the trading interface to place a Market or Limit order and receive your dShares instantly in your wallet.

- Explore DeFi use cases by wrapping your dShares into .dw tokens and joining supported liquidity pools like COIN.dw/USDC.

- Review the Wrap/Unwrap section to understand how to interact with yield opportunities while maintaining asset integrity.

- Follow Dinari's official channels for updates, market news, and community support.

Dinari FAQ

dShares are fully collateralized, tokenized versions of traditional financial instruments like stocks, ETFs, and funds. Each dShare (e.g., AAPL.d for Apple, TSLA.d for Tesla) is backed 1:1 by the corresponding real-world asset held with a regulated custodian. This ensures that every token on the Dinari platform represents a verifiable, legally-backed share that can be redeemed and tracked through secure custodial channels. Learn more at Dinari.

Dinari uses regulated custodians to manage and safeguard the real-world assets that back its dShares. Each dShare is issued only after verification and settlement of the underlying asset, and all activity is logged for full auditability. This model aligns with compliance standards and gives users confidence in the legitimacy of their on-chain holdings. Custodians are licensed and work under regulatory oversight to protect investor funds.

Wrapping dShares creates a new tokenized version (ending in .dw) that is compatible with DeFi protocols. For example, COIN.d can be wrapped into COIN.dw and used in liquidity pools or staking opportunities. Wrapping is necessary for dShares to participate in on-chain DeFi strategies while maintaining collateral integrity. Unwrapping returns the token to its original form, maintaining the 1:1 backing at all times. Explore this feature on the Dinari Wrap page.

Yes. Dinari allows you to buy and sell tokenized stocks like GOOGL.d, MSFT.d, and NFLX.d using your Web3 wallet—no brokerage account required. Trades are executed through the blockchain, settled in USD+, and your ownership is recorded on-chain. This removes traditional barriers and intermediaries, bringing equity trading directly to the crypto ecosystem via Dinari.

dShares on Dinari are synced with real-time market prices of their corresponding traditional assets. The platform pulls data continuously and reflects changes in USD pricing across all dShares. You’ll see live updates for price, daily change, and percentage fluctuation directly in the interface. This transparency allows traders to respond quickly to market moves, just like on conventional trading platforms—but with full on-chain settlement.

You Might Also Like