About Dollar Cost Average

Yoki Finance's Dollar Cost Average (DCA) app is an automated crypto investment tool tailored for the Web3 ecosystem. It provides users with the ability to regularly invest a fixed amount of funds in cryptocurrencies over a set time period. By leveraging the dollar-cost averaging strategy, the app helps users mitigate the risk of market volatility, smoothing out the average purchase cost of their chosen assets. The application operates on multiple EVM-compatible blockchains, offering non-custodial investment processes where funds remain fully under the user's control throughout the investment period.

The platform is designed to enhance the crypto investment experience by automating what is typically a manual and time-consuming process, making it easier for retail investors and crypto communities to maintain a consistent investment strategy without the hassle of continuously monitoring the market. This model is particularly effective in reducing the emotional stress that comes with price swings, allowing investors to focus on long-term growth. Visit Yoki Finance DCA to explore more.

Yoki Finance is redefining cryptocurrency investment strategies by bringing the proven benefits of Dollar-Cost Averaging (DCA) to the decentralized finance (DeFi) ecosystem. In traditional finance, DCA is commonly used to invest in stocks, mutual funds, and other assets by spreading purchases over time rather than making large, singular investments. This strategy minimizes the risks associated with market volatility by distributing the purchase cost across various market conditions, which can reduce the effects of short-term fluctuations. Yoki Finance has recognized the value of this approach in the volatile world of crypto, where timing the market is exceptionally challenging, especially for new investors. Yoki was developed as an exclusive platform focused on DCA, allowing users to seamlessly integrate this effective strategy into their crypto portfolio management.

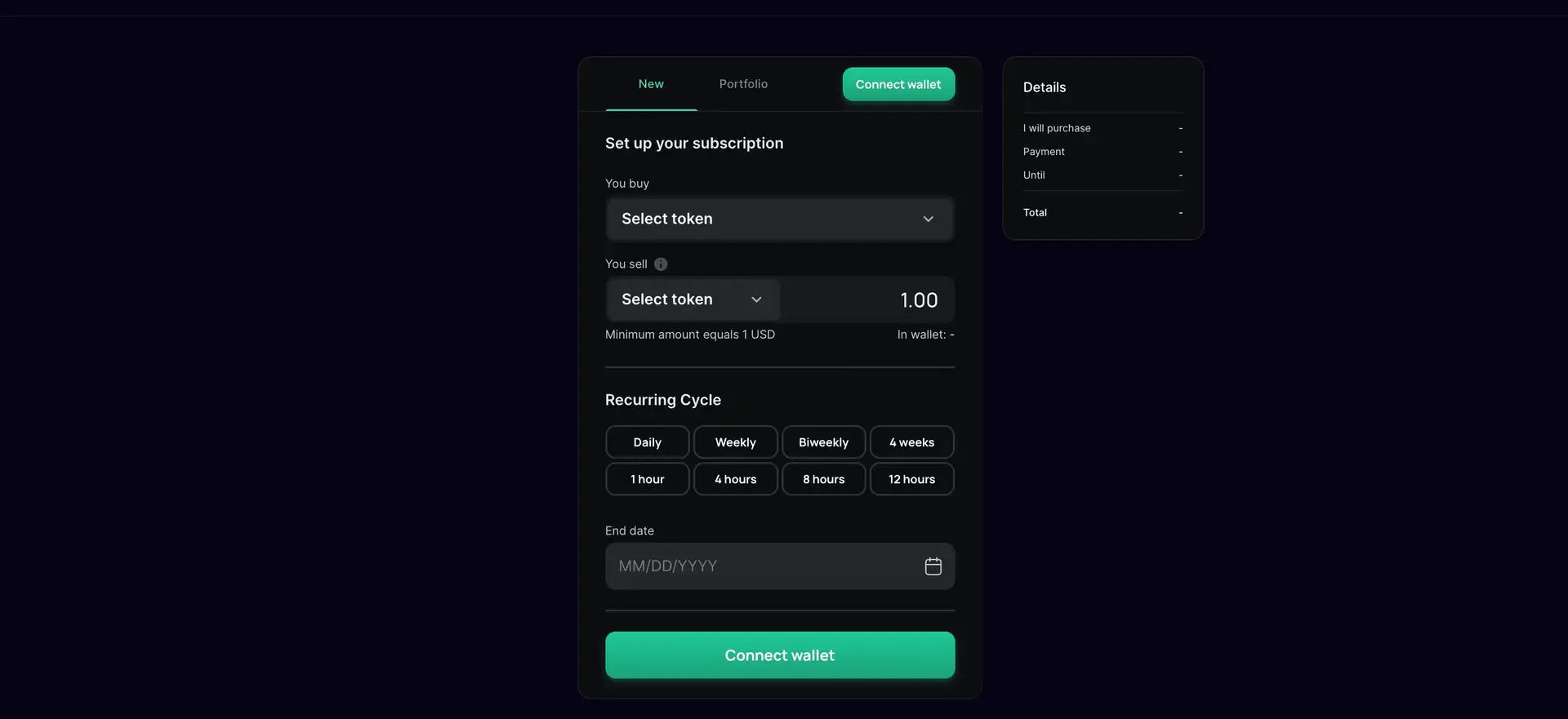

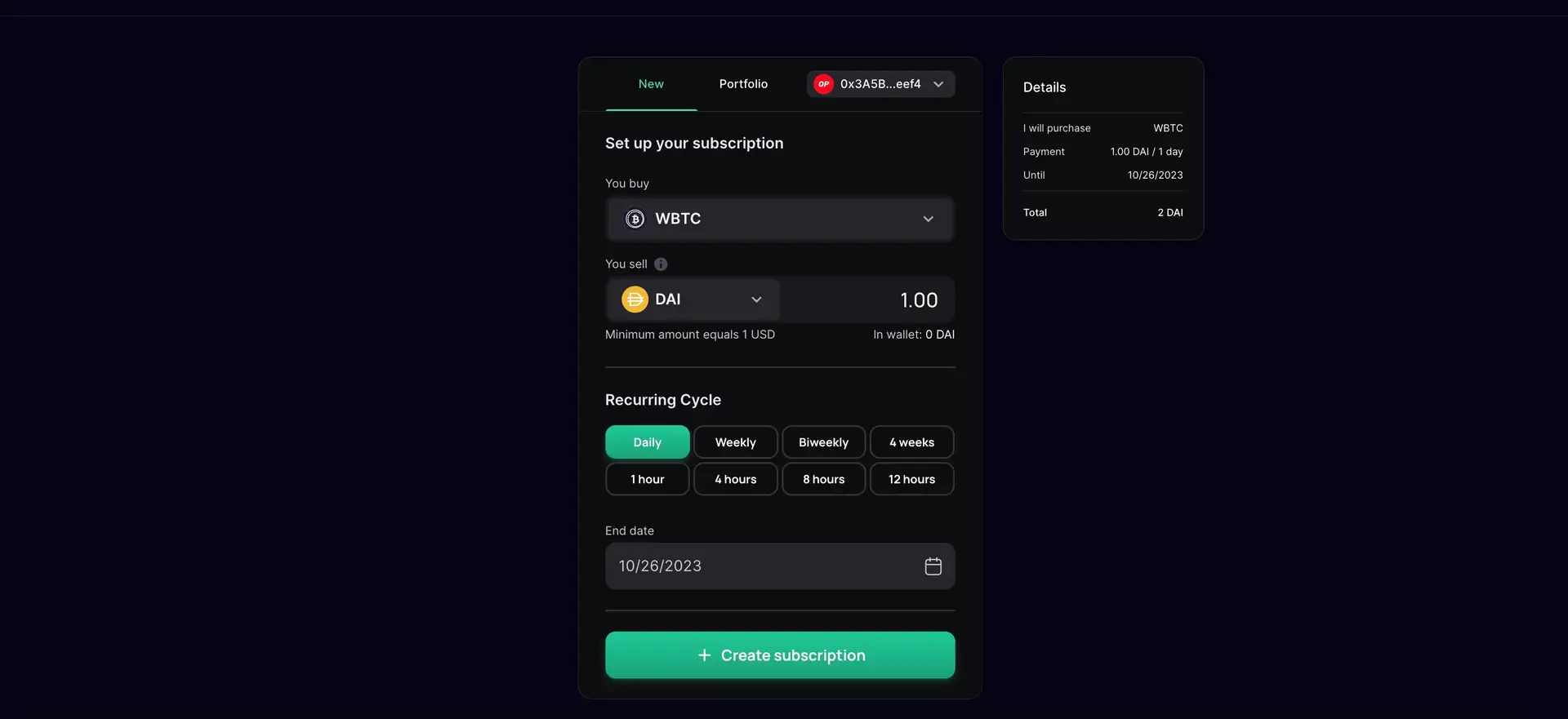

Yoki Finance emerged with the clear objective of making DCA accessible to everyone, regardless of their level of experience with cryptocurrencies. Unlike many DeFi applications that offer complex trading options, Yoki prioritizes simplicity, allowing users to set up automatic investment schedules with just a few clicks. Once users set the parameters for their DCA plan—choosing the asset, amount, and frequency—Yoki Finance takes over, executing transactions based on the predefined schedule. This hands-off approach removes the emotional burden of deciding when to buy in a market notorious for its volatility. Users benefit from a cost-averaging effect, as each purchase occurs at a different market price, which can result in a more favorable average purchase cost over time.

In terms of design and functionality, Yoki Finance stands out due to its user-friendly interface and seamless integration with popular Web3 wallets like MetaMask. This integration not only enhances accessibility but also ensures that users maintain custody of their assets, an essential aspect for those who prioritize decentralization. Through the platform’s dashboard, users can set up multiple DCA plans, each tailored to different assets or investment strategies. This flexibility allows investors to diversify their portfolios without the need for manual intervention or separate platforms for each asset.

Since its launch, Yoki Finance has focused on building a platform that prioritizes transparency, accessibility, and user empowerment. The team has achieved several key milestones, including the development of a straightforward user experience, integration with well-known Web3 wallets, and a robust system for handling periodic transactions with minimal fees. In contrast to other platforms that offer broad automation for trading, such as Coinrule and Ember Fund, Yoki’s exclusive focus on DCA makes it ideal for those seeking a more disciplined, consistent investment approach rather than speculative trading.

With this DCA-exclusive focus, Yoki Finance appeals to a broad audience: from beginners who may feel overwhelmed by the complexities of crypto trading to seasoned investors looking for a reliable, low-stress way to build their holdings. The platform not only provides the tools necessary for automated investing but also empowers users to engage in DeFi confidently. Yoki Finance’s commitment to decentralized principles and its dedication to building a user-friendly DCA platform make it a notable player in the DeFi space, catering to those who value steady growth over speculative gains.

- Automated Dollar-Cost Averaging (DCA): Yoki Finance is purpose-built for DCA, a tried-and-true investment method that spreads purchases over time. This automation allows users to avoid making high-stakes, one-time investments, promoting steady and disciplined investment practices in the crypto market.

- Mitigation of Volatility Risks: In the crypto market, volatility is inevitable. Yoki’s DCA model enables users to mitigate these risks by investing at regular intervals rather than all at once, helping to create a “smoothing” effect that may be beneficial during market downturns.

- Flexible Investment Customization: Users can choose their preferred investment frequency and amounts, aligning their DCA plans with personal financial goals, whether they want to invest weekly, bi-weekly, or monthly.

- Streamlined, User-Centric Interface: Yoki Finance offers an intuitive interface for setting up and managing DCA plans, viewing ongoing investments, and monitoring performance without needing advanced technical knowledge.

- Decentralization and Wallet Integration: Integrated with Web3 wallets like MetaMask, Yoki ensures users retain complete control over their funds, staying true to the decentralized nature of blockchain.

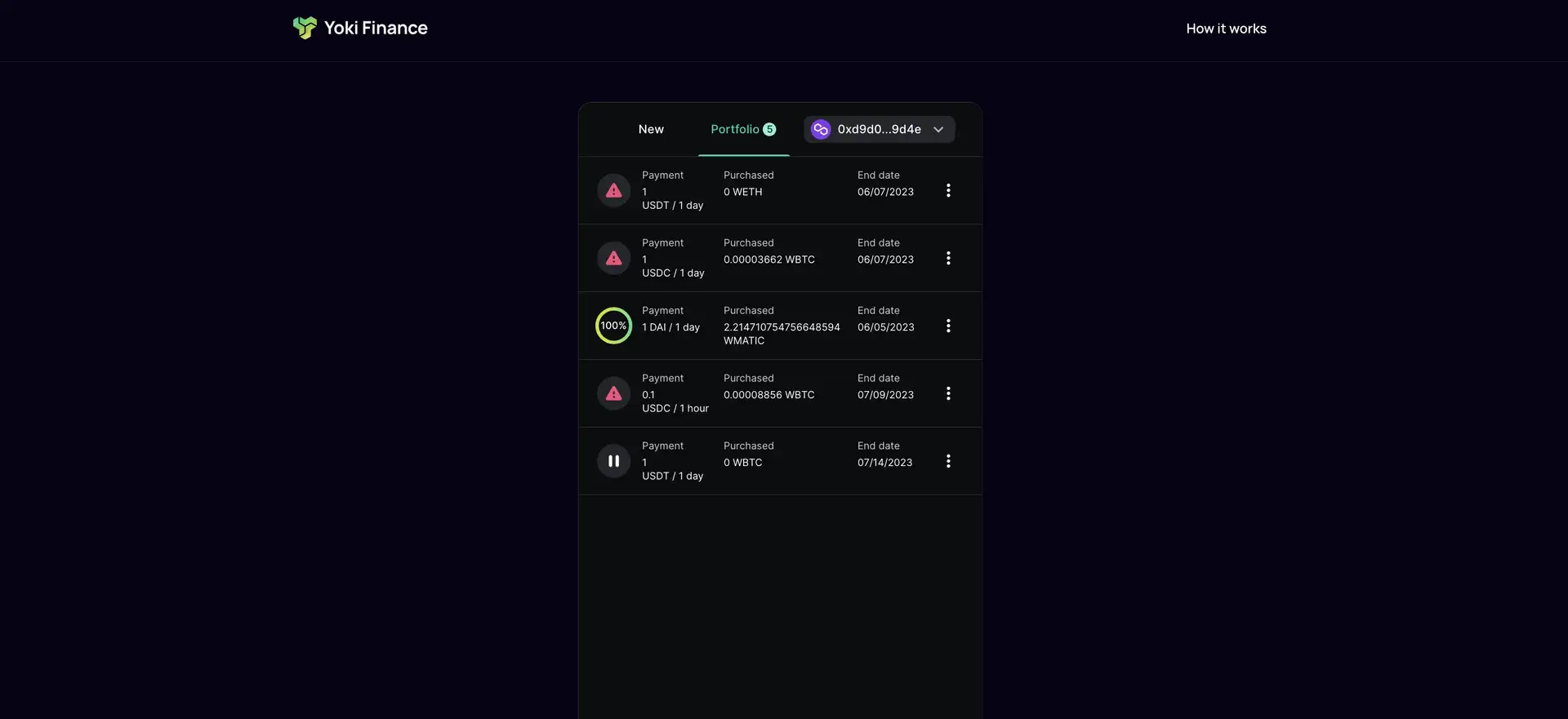

- Portfolio Diversification Made Easy: The platform supports multiple DCA plans, allowing users to diversify their portfolios across various cryptocurrencies without using multiple tools or platforms.

- Connect Your Web3 Wallet: Visit Yoki Finance and connect a Web3 wallet like MetaMask. Make sure your wallet is funded with the crypto asset you plan to invest in, as well as enough ETH (or another network gas token) to cover transaction fees.

- Choose Your DCA Parameters: Select the cryptocurrency asset you want to invest in and set the parameters for your DCA plan. Decide on the investment amount for each transaction and the frequency, such as weekly, bi-weekly, or monthly. Yoki Finance offers flexibility to match your plan with your financial goals and cash flow.

- Confirm and Review Your DCA Setup: After selecting your DCA parameters, carefully review the setup details, including the estimated total cost and investment timeline. Once you confirm, Yoki Finance will handle the recurring purchases automatically.

- Track and Adjust Your Investments: Yoki’s dashboard provides an accessible view of all active DCA plans. You can monitor your investment progress, view transaction details, and make any necessary adjustments to the frequency or amount through Yoki Finance directly.

- Explore Support Resources: Yoki Finance offers guides, FAQs, and customer support to assist new users in navigating the platform. These resources are especially helpful for those new to crypto investing and looking to understand how to use DCA effectively.

Yoki Finance's vision with the Dollar-Cost Averaging (DCA) app is to make decentralized crypto investments more accessible, reliable, and seamless. The core mission is to automate recurring purchases while ensuring users maintain full control of their assets, addressing a key issue in traditional investment platforms where control is often surrendered to centralized entities. By combining smart contracts with self-custody, Yoki Finance empowers users to create personalized and automated strategies that align with their investment goals.

The platform aims to not only support retail investors but also serve the needs of crypto projects. By embedding the DCA widget on their own websites, crypto projects can drive engagement, stimulate stable token purchases, and strengthen loyalty within their communities. This dual benefit ensures both users and token issuers gain from the consistent and automatic purchasing that the widget offers. The system also enhances transparency and security through the decentralized execution of trades using liquidity aggregators such as 1inch.

Yoki Finance envisions a future where Web3 payments and subscription services are common, blending the power of decentralized finance (DeFi) with predictable investment models. The success of this model could significantly contribute to the wider adoption of crypto investment strategies, helping to make digital assets a more integral part of financial planning for businesses and individuals alike.

The development of Yoki Finance's DCA app follows a structured roadmap. The platform's early stages involved the creation and deployment of smart contracts on Ethereum, Polygon, and other chains like BNB Chain. Key milestones include integrating the DCA widget into crypto projects and transitioning from centralized execution to decentralized systems using the automation tools provided by partners like Gelato.

Yoki Finance has completed the first phase of their roadmap by launching their beta version, allowing users to access gasless transactions without fees. This is expected to continue through the beta phase, after which a modest fee structure will be introduced. Looking forward, Yoki aims to onboard new blockchain ecosystems, conduct smart contract audits, and offer even more advanced features for crypto automation.

The leadership team behind Yoki Finance consists of experienced professionals with deep expertise in blockchain and fintech. The CEO, Konstantin Shirokov, brings extensive experience in the Web3 space, having previously held leadership roles at companies like PrimeXBT and Fringe Finance. The CTO, Georgii Savchenko, has over a decade of technical expertise in leading Web3 projects, ensuring the platform's technological robustness. Other key team members include Stanislav Osipenko (Head of Design), Sergey Okishev (Full Stack Developer), and Stepan Bubnov (Backend Developer).

The team is further supported by investors and partners, including accelerators such as DATASH. Their combined efforts have propelled Yoki Finance to the forefront of Web3 innovation, particularly in the space of recurring crypto transactions and decentralized automation. You can learn more about their journey and the broader mission by visiting their official website: Yoki Finance.

Yoki Finance is currently in its beta stage, offering users a unique opportunity to use the DCA app with zero fees. During this period, all subscriptions created will remain free of charge. Early adopters benefit from a gasless transaction process, making it more cost-effective to set up and manage recurring investments without worrying about high transaction fees. Users can participate in the beta through the platform's private launch, which targeted the first 100 users. To sign up, you can visit Yoki's DCA page.

Dollar Cost Average Reviews by Real Users

Dollar Cost Average FAQ

Yoki Finance leverages non-custodial smart contracts, meaning your assets never leave your control during any transaction. Unlike centralized platforms, funds are not stored on a third-party wallet. Instead, your recurring investments are managed directly through smart contracts on blockchain networks like Ethereum and Polygon, ensuring full transparency and ownership at every step.

Yes, the Dollar-Cost Averaging (DCA) app supports investments across various tokens on multiple blockchains such as Ethereum, BNB Chain, and Polygon. You can easily set up recurring investments for multiple tokens, all managed from one streamlined interface, providing flexibility and scalability to your investment strategy.

Integrating the DCA widget into your crypto project’s website allows your community to automate token purchases, thereby driving consistent demand for your token. This fosters long-term loyalty and engagement, as users can set up automated investments while reducing the risks associated with market fluctuations. It also creates a seamless, gasless transaction experience for your users. Learn more about integration on the Yoki Finance website.

During the beta stage of the DCA app, Yoki Finance covers all gas fees for users, offering a gasless transaction experience. This incentive is in place for all subscriptions created during the beta, allowing users to focus solely on their investment strategy without worrying about extra costs. Post-beta, a small fee will be introduced to cover gas costs. For more details, visit Yoki Finance.

Yoki Finance partners with key decentralized technologies to ensure smooth operations. These include Gelato for automating smart contract execution and 1inch for liquidity aggregation. By integrating these tools, the platform ensures decentralized, secure, and efficient execution of recurring investments. Learn more about our partners on the Yoki Finance website.

You Might Also Like