About E Money Network

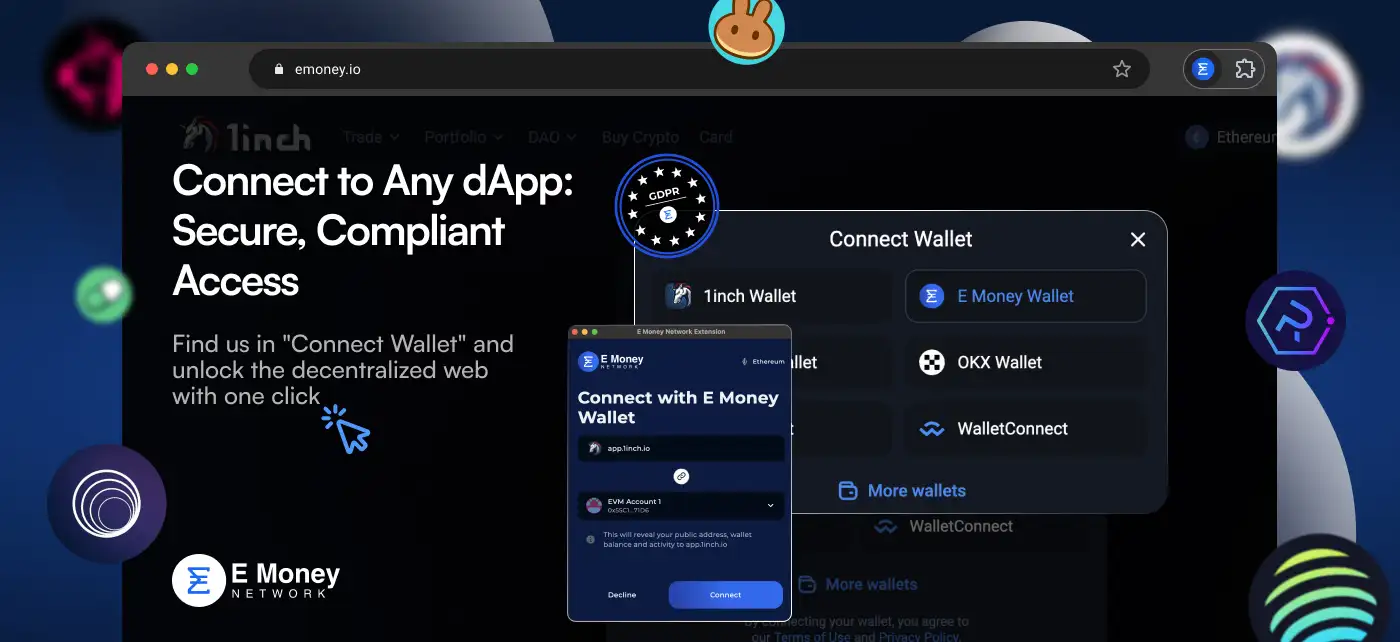

eMoney Network is the world’s first BankFi network, seamlessly integrating traditional banking with decentralized finance (DeFi). Built on a MiCA-compliant public blockchain, eMoney offers IBAN-linked wallets, real-world asset (RWA) tokenization, and crypto-compatible credit cards. By bridging the gap between CeFi and DeFi, it provides a regulatory-compliant ecosystem for businesses and individuals to transact securely and efficiently.

With features like on-chain KYC/AML, multi-currency support, and instant global payments, eMoney empowers users to manage their fiat and crypto assets within a unified, privacy-focused ecosystem. Whether you're an institution looking for a compliant blockchain infrastructure or an individual seeking a seamless way to spend crypto with a global credit card, eMoney provides an innovative, future-ready solution.

eMoney Network is a revolutionary blockchain financial platform designed to integrate banking services into the decentralized economy. Unlike traditional financial systems that rely on intermediaries, eMoney enables direct, peer-to-peer transactions with full compliance and security. Its innovative approach combines elements of CeFi and DeFi, allowing users to enjoy the best of both worlds.

One of the core strengths of eMoney is its support for IBAN-linked accounts, enabling users to send and receive crypto and fiat payments just like a traditional bank account. Additionally, real-time FX conversions allow seamless currency exchanges within the platform, making international payments more efficient than ever.

The platform also includes a robust RWA (Real-World Asset) tokenization system, allowing users to tokenize assets such as real estate, bonds, and commodities. This process enhances liquidity, enabling users to trade, stake, or collateralize physical assets within a blockchain-powered ecosystem.

Compared to traditional banking services like PayPal and Wise, eMoney offers faster transactions, lower fees, and enhanced transparency. Unlike fully decentralized solutions such as SkyMoney, eMoney ensures regulatory compliance while still providing users with self-custody and decentralized benefits.

eMoney offers numerous benefits and features that make it a pioneering BankFi network:

- IBAN-Linked Wallets: Manage fiat and crypto assets within an IBAN-supported account.

- Multi-Chain Compatibility: Access Ethereum, Solana, and other networks from a single wallet.

- Real-World Asset Tokenization: Tokenize and trade real estate, bonds, and commodities.

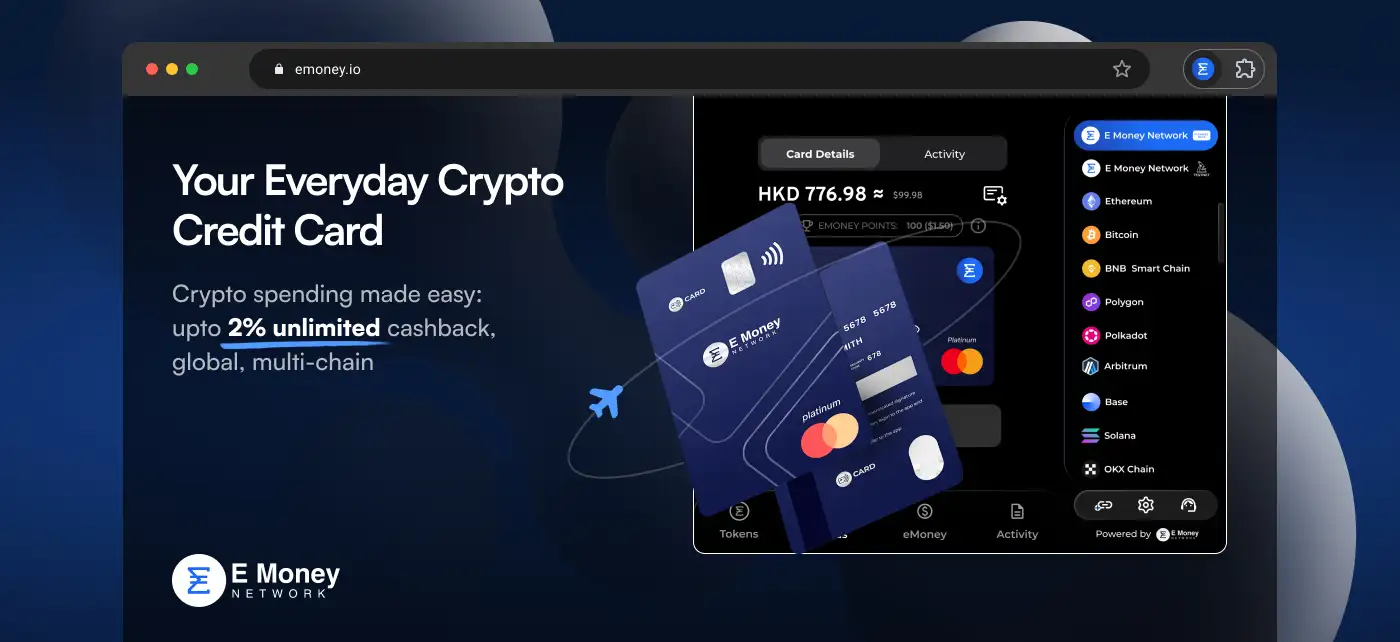

- Global Crypto Credit Cards: Spend crypto anywhere with internationally accepted crypto-compatible credit cards.

- Regulatory Compliance: Built on a MiCA-compliant blockchain with on-chain KYC & AML.

- Zero-Knowledge Proofs (ZKPs): Ensures privacy and secure biometric authentication.

Getting started with eMoney is easy. Follow these steps to begin using the world's first BankFi network:

- Download the Wallet: Get the official eMoney Wallet from the website.

- Create an Account: Register and complete the on-chain KYC process to unlock full features.

- Deposit Crypto or Fiat: Link your IBAN for fiat deposits or transfer crypto to your wallet.

- Start Transacting: Send global payments, trade real-world assets, or use a crypto credit card.

- Secure Your Assets: Enable biometric authentication and zero-knowledge proofs for maximum security.

The vision of the E Money Network is to create an ecosystem that allows for seamless integration between traditional financial systems and decentralized networks. The project aims to provide a regulatory-friendly blockchain that can work within the global financial framework while maintaining security and privacy through advanced technologies such as ZK-Proofs.

Inspired by the growing need for decentralized financial solutions that comply with regulatory requirements, E Money Network sets out to balance innovation and compliance. By focusing on regulation-friendly solutions, the project aims to become a leading player in the compliant blockchain space.

Moreover, the project fosters financial inclusivity, ensuring its platform is accessible to both retail users and institutional investors. The network is designed to bridge the divide between traditional financial systems and the decentralized future. More about this vision can be found in the whitepaper.

The E Money Network roadmap outlines the development of its core products and services in a step-by-step manner. The first phase involved the successful launch of a secure and regulation-friendly blockchain. In subsequent phases, the project is focusing on expanding its suite of products, including the launch of the E Money Wallet, which allows secure transactions while maintaining compliance with AML/KYC regulations.

Another key milestone is the development of E Money Pay, a payment solution that allows businesses to accept transactions through the platform. The integration of regulated institutions is also a critical focus as the project works toward offering fully compliant services that meet both user and regulatory needs.

Additionally, the team is committed to continuous product improvement, including the development of innovative tools for both retail and institutional investors. The roadmap also includes partnerships with regulated financial institutions to ensure smooth adoption. Keep an eye on updates through the official website.

The E Money Network was founded by Raj Bagadi, who also serves as the CEO. Raj launched the project in 2019 with the vision of creating a MiCA-compliant blockchain that integrates traditional financial systems with Web3 technologies. His leadership has been instrumental in ensuring the network’s focus on regulatory compliance and secure RWA tokenization.

Regarding investors, E Money Network recently raised $3.3 million in a Series A round led by Animoca Brands. Other participants included Blockchain Founders Fund, GBV Capital, and KuCoin. These strategic investors support the project’s mission to develop the first fully compliant blockchain for real-world asset (RWA) tokenization.

As E Money Network continues to expand, more partnerships and team members will likely be announced. For the latest updates on the team and their vision, regularly check the official website.

The E Money Network offers a comprehensive testnet program, providing developers and early adopters the opportunity to test the platform’s core products. The testnet allows users to experiment with features such as the E Money Wallet and E Money Pay before the official public release. This testing environment ensures that the network is thoroughly vetted before wider deployment.

The project has also launched an exclusive beta program, where selected users gain early access to the platform’s features. This allows participants to provide valuable feedback, helping the team to fine-tune the products before the full-scale release. Those interested in joining the early access program are encouraged to visit the official platforms to stay informed.

By providing a dedicated testing environment, E Money Network aims to ensure a seamless and robust product release. The testnet serves as a sandbox for developers, allowing them to explore the network’s capabilities without any financial risks. More information about participation can be found on the official website.

E Money Network Token

E Money Network Reviews by Real Users

E Money Network FAQ

eMoney’s IBAN-linked wallet lets users send and receive fiat and crypto payments just like a traditional bank. By linking an IBAN, you can make global transactions while still accessing DeFi features. Get started by downloading the eMoney Wallet and completing on-chain KYC.

RWA tokenization on eMoney lets users convert real estate, bonds, and commodities into digital tokens. This enables fractional ownership and easy trading within the DeFi ecosystem while staying MiCA-compliant.

Yes! The eMoney Crypto Credit Card allows you to spend crypto for online and in-store purchases. Simply apply via the eMoney Wallet, link your assets, and use it wherever Visa or Mastercard is accepted.

eMoney follows MiCA regulations with on-chain KYC & AML. This ensures secure transactions while giving users full control over their assets within a decentralized ecosystem.

Zero-Knowledge Proofs (ZKPs) on eMoney allow identity and transaction verification without exposing personal data. This enhances privacy while maintaining regulatory compliance.

You Might Also Like