About EnsoFi

EnsoFi is a cross-chain decentralized finance (DeFi) platform designed to transform how users access and utilize DeFi services across blockchain networks. By consolidating liquidity and simplifying the user experience, EnsoFi aims to break down the barriers that typically hinder seamless financial activities in decentralized environments.

EnsoFi's mission revolves around creating an ecosystem where users can maximize yield opportunities, bridge liquidity across chains, and access a diverse range of financial services with minimal effort. By prioritizing ease of use and security, EnsoFi sets a new standard in the DeFi space, enabling users to navigate multiple blockchain ecosystems effortlessly.

EnsoFi is an innovative platform in the decentralized finance (DeFi) sector, addressing the critical challenges of fragmented liquidity and inefficient asset utilization across multiple blockchains. Established with a mission to unlock the full potential of cross-chain financial interactions, EnsoFi allows users to lend, borrow, and earn across various blockchain ecosystems seamlessly. The platform’s standout feature is its cross-chain lending mechanism, enabling users to collateralize assets on one blockchain while borrowing on another. This functionality eliminates the need for manual bridging of assets between chains, simplifying the user experience and reducing risks.

EnsoFi’s development has focused on three pillars: efficiency, accessibility, and security. By consolidating DeFi services into a unified platform, EnsoFi eliminates the need to navigate between multiple decentralized applications (dApps). Users can access liquidity pools, earn rewards through staking, and benefit from fixed interest rates on loans—all from a single interface. Moreover, the platform offers unique opportunities for leveraging liquid staking tokens (LSTs) to boost yield exposure up to 10x, further maximizing the value of user assets.

Security remains a top priority for EnsoFi, with robust measures in place to protect user assets and ensure safe cross-chain transactions. Recognizing the risks associated with bridging assets, EnsoFi employs advanced smart contract technologies to mitigate potential vulnerabilities. The platform also emphasizes user education, offering resources and guides to help users understand the intricacies of cross-chain lending and DeFi activities.

EnsoFi stands out in the competitive DeFi landscape by addressing challenges such as fragmented liquidity, high transaction costs, and complex multi-chain navigation. Competing platforms like Aave and Compound focus on single-chain lending, while EnsoFi provides seamless cross-chain interactions. By simplifying DeFi operations and offering predictable financial tools, EnsoFi positions itself as a leader in the cross-chain DeFi space.

EnsoFi offers a wide array of features and benefits that set it apart in the decentralized finance ecosystem:

- Cross-Chain Lending with Fixed Interest Rates: Users can collateralize assets on one blockchain and borrow on another, ensuring predictable financial stability. Learn more at EnsoFi's official website.

- Unified Platform for DeFi Activities: Consolidating lending, borrowing, staking, and yield farming into one interface saves time and reduces complexity.

- Enhanced Yield Opportunities: Users can leverage liquid staking tokens (LSTs) to boost yield exposure up to 10x while maintaining liquidity.

- Robust Security Measures: Advanced smart contracts ensure the safety of user assets during cross-chain transactions.

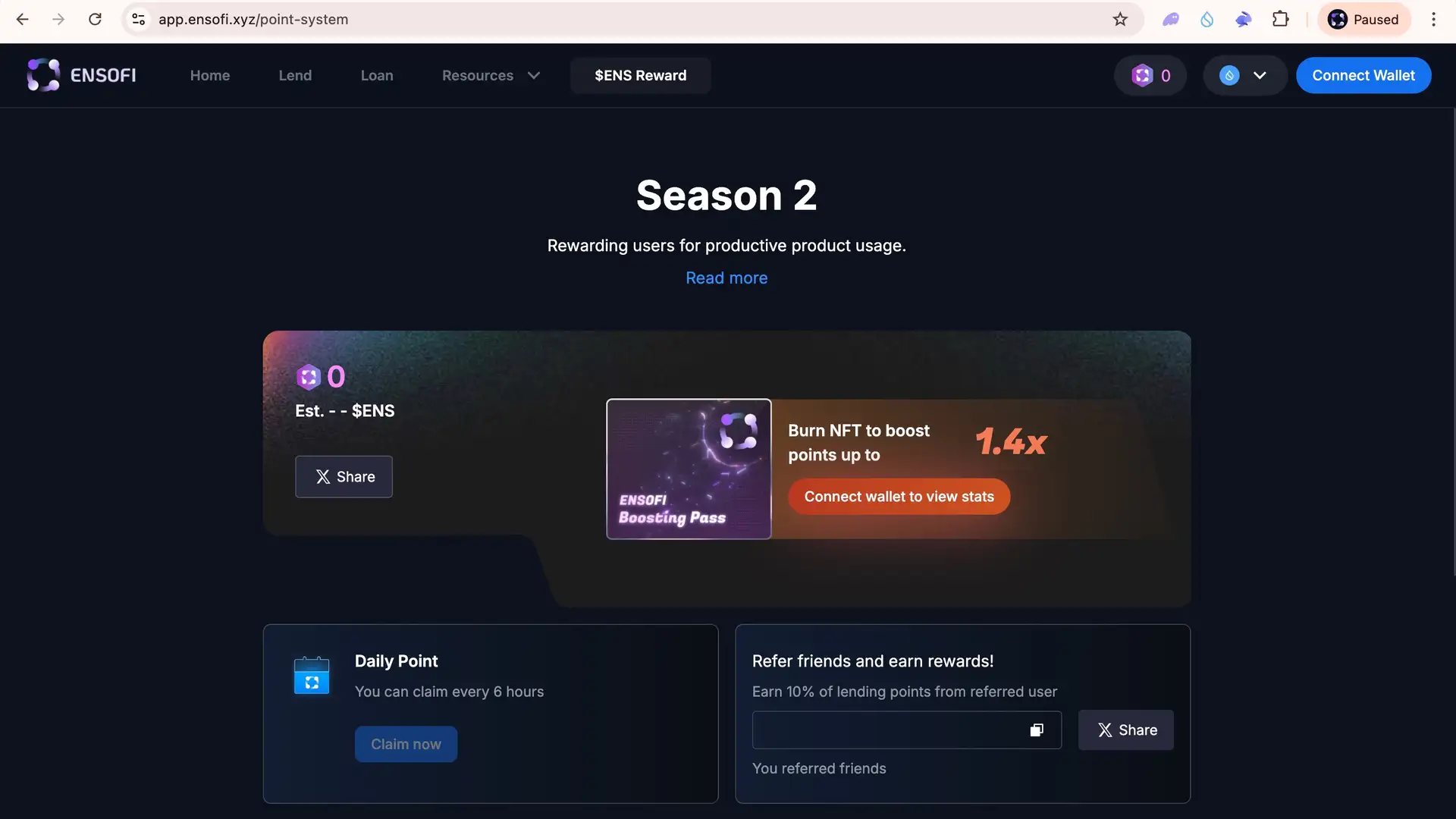

- Fee Rewards for Liquidity Providers: Users can earn rewards by supplying liquidity, making the platform attractive to various DeFi participants.

- Accessibility Across Multiple Blockchains: Supporting a variety of networks, EnsoFi ensures users access diverse financial opportunities. Learn more at EnsoFi's official website.

Getting started with EnsoFi is simple and straightforward. Follow these steps:

- Visit the official EnsoFi website and familiarize yourself with the platform.

- Connect your crypto wallet (e.g., MetaMask or WalletConnect) to access EnsoFi's features. Ensure your wallet is compatible with supported blockchains.

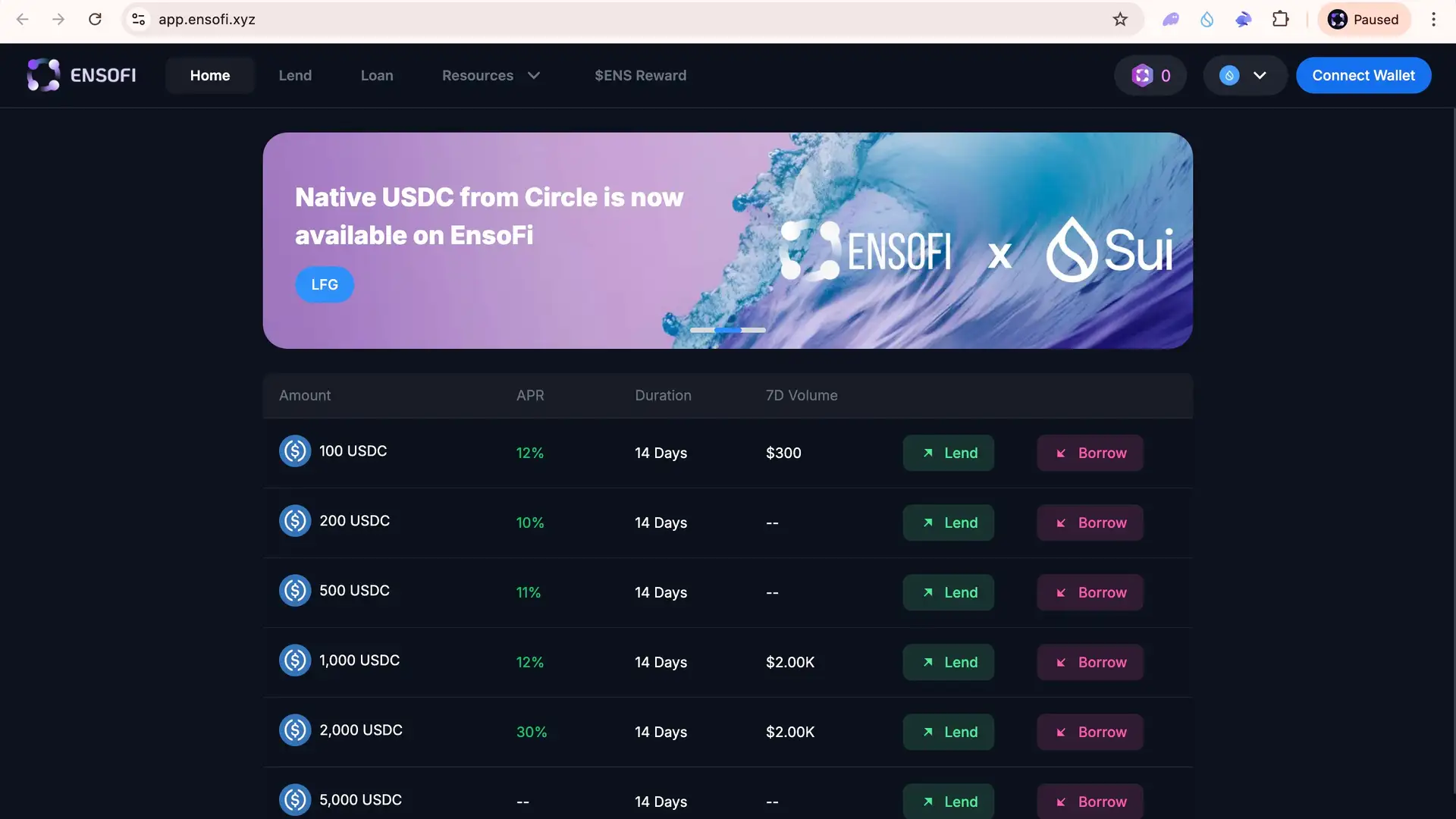

- Explore lending, borrowing, and staking features. Review the terms and interest rates before proceeding.

- Supply assets to liquidity pools or collateralize them for borrowing. Leverage liquid staking tokens for increased yields.

- Monitor your activities via the dashboard and adjust strategies based on market conditions.

- Access educational resources and FAQs on the EnsoFi GitBook for in-depth guidance.

By following these steps, you can unlock the full potential of EnsoFi and explore its robust cross-chain DeFi ecosystem. Start now at EnsoFi's official website.

EnsoFi Reviews by Real Users

EnsoFi FAQ

EnsoFi stands out as a truly cross-chain platform, allowing users to access DeFi services seamlessly across multiple blockchains. Unlike competitors like Aave or Compound, which are limited to single-chain ecosystems, EnsoFi empowers users to collateralize assets on one chain and borrow on another with fixed interest rates.

The cross-chain lending mechanism on EnsoFi allows users to supply collateral on one blockchain and borrow assets on another. This is achieved through advanced interoperability protocols that eliminate the need for manual bridging. For instance, a user could supply ETH on Ethereum and borrow USDT on Binance Smart Chain, ensuring seamless liquidity movement across networks. Learn more about this unique feature at EnsoFi's official website.

EnsoFi employs state-of-the-art smart contract technology to mitigate vulnerabilities and protect user assets during cross-chain transactions. Additional security layers include thorough contract audits, transaction monitoring, and contingency protocols to prevent exploits. These measures ensure that users can interact confidently across chains. Learn more about security on EnsoFi's official website.

EnsoFi allows users to utilize liquid staking tokens (LSTs) to boost yield exposure up to 10x. By staking assets through supported networks and receiving LSTs in return, users can re-deploy these tokens into EnsoFi’s ecosystem to earn additional rewards, without losing access to the original staked assets. This enables enhanced yield generation while maintaining liquidity.

EnsoFi supports a wide range of blockchains, including Ethereum, Binance Smart Chain, and Polygon, among others. This multi-chain compatibility ensures users can interact with diverse financial ecosystems, optimize liquidity, and access a broad array of yield opportunities. The flexibility to navigate various blockchains makes EnsoFi a versatile solution for modern DeFi needs.

You Might Also Like