About Entendre Finance

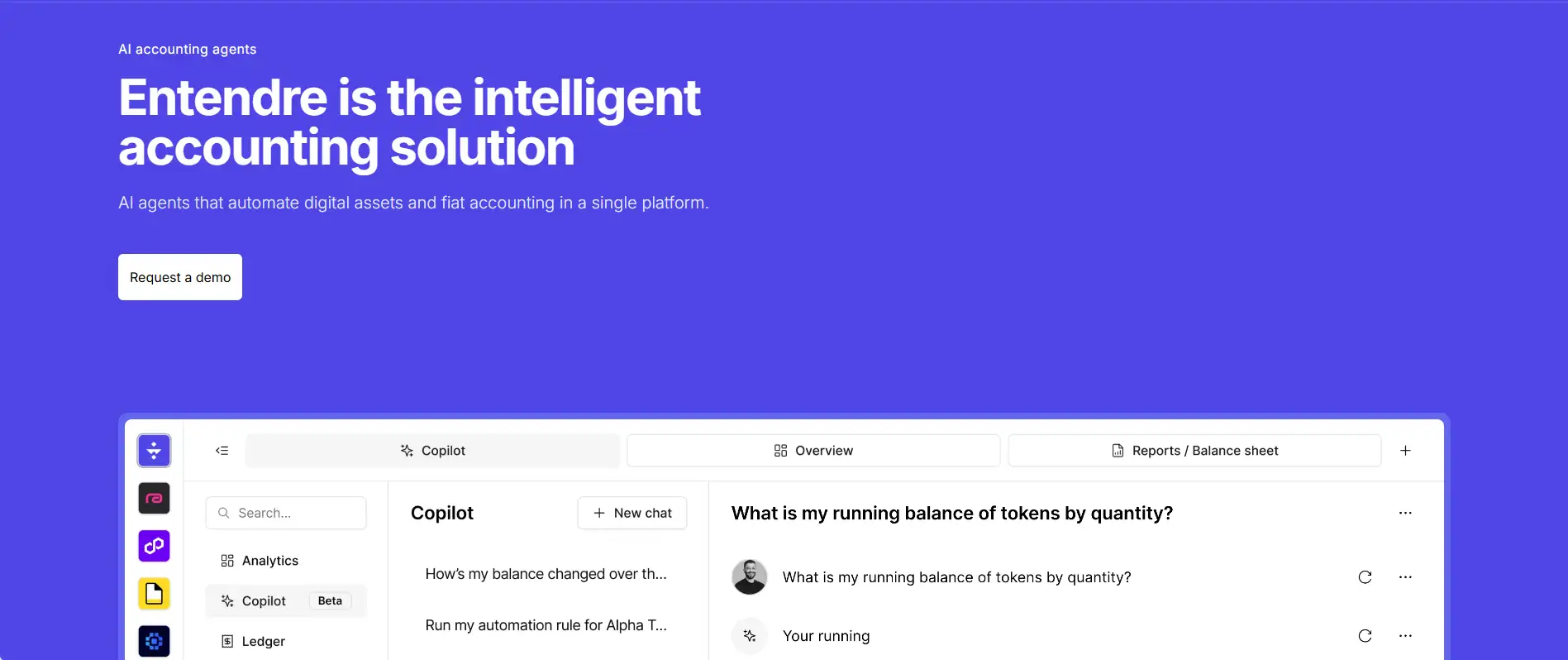

Entendre Finance is an AI-powered crypto accounting platform designed to transform how businesses manage both fiat and digital assets. Built for the Web3 era, it introduces intelligent AI agents that automate accounting processes such as reconciliation, bookkeeping, and financial reporting across multiple blockchains and traditional systems. Entendre Finance empowers organizations to maintain accurate, real-time financial records while reducing manual effort and compliance risk.

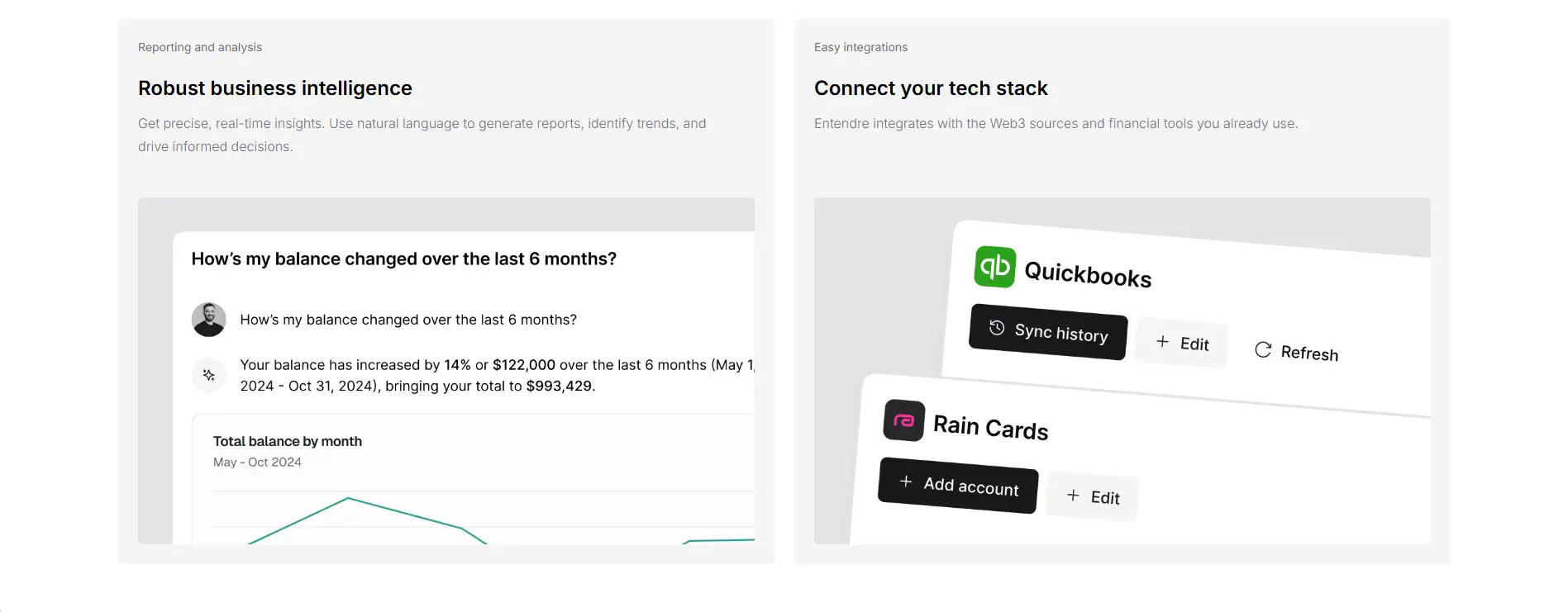

With seamless integration into over 50 blockchains, exchanges, and leading accounting software like QuickBooks and Xero, Entendre Finance ensures a single source of truth for every transaction. Designed for scale, whether for startups or multi-entity enterprises, Entendre adapts to evolving business needs through modular automation, personalized onboarding, and intelligent reporting—all without compromising accounting standards like GAAP or IFRS.

Entendre Finance was created to solve one of the most urgent problems in modern finance: the overwhelming complexity of managing digital and fiat assets in parallel. As blockchain technology grows and crypto adoption accelerates, traditional accounting tools fall short. The company was founded with a mission to address this gap, combining the capabilities of advanced AI agents with deep accounting logic to automate and unify digital financial operations. Entendre Finance serves clients ranging from DeFi protocols to NFT marketplaces, Web3-native startups, and global enterprises, enabling them to focus on innovation while automating their back office.

Entendre’s platform offers comprehensive features like automated journal entries, GAAP/IFRS-compliant financial reports, real-time dashboards, and multi-entity, multi-currency support. With over $979 billion in accounting volume automated, more than 1 million journal entries posted, and nearly 40,000 hours of human labor saved, it is setting a new standard for crypto finance infrastructure. The platform supports use cases across the entire spectrum of Web3 including DeFi tracking, NFT sales, DAO treasury accounting, enterprise reporting, and more.

Trusted by major players like Polygon, Celestia, Premia Finance, and Fuel3, Entendre is built for scale and audit readiness. The company is backed by leading investors including MoonPay, Basis Set, and Valhalla Ventures, and has also partnered with Maple Finance to support institutional DeFi automation. Unlike competitors such as Cryptio and Bitwave, Entendre uniquely combines AI automation with full-spectrum accounting to support everything from basic bookkeeping to full audit and compliance workflows.

Entendre Finance offers numerous benefits and features that make it the most robust AI accounting platform in the Web3 finance space:

- AI-Powered Automation: Replace manual entries and reconciliations with autonomous accounting agents capable of handling complex on-chain and off-chain data.

- Multi-Asset Accounting: Track every transaction across fiat, crypto, NFTs, DeFi protocols, DAOs, and tokens in a single unified ledger.

- Audit-Ready Financials: Generate GAAP and IFRS-compliant financial statements in real time with full audit trails.

- Dynamic Reporting: Use natural language queries to instantly generate financial reports and business insights.

- Enterprise-Grade Scalability: Entendre supports multiple legal entities, currencies, and user roles with unlimited agents and customized workflows.

- Easy Integration: Seamlessly integrates with top Web3 platforms and traditional tools like QuickBooks, Xero, and Netsuite.

- Regulatory Compliance: Includes tools for mark-to-market tax treatment, balance validation, and audit reconciliation across jurisdictions.

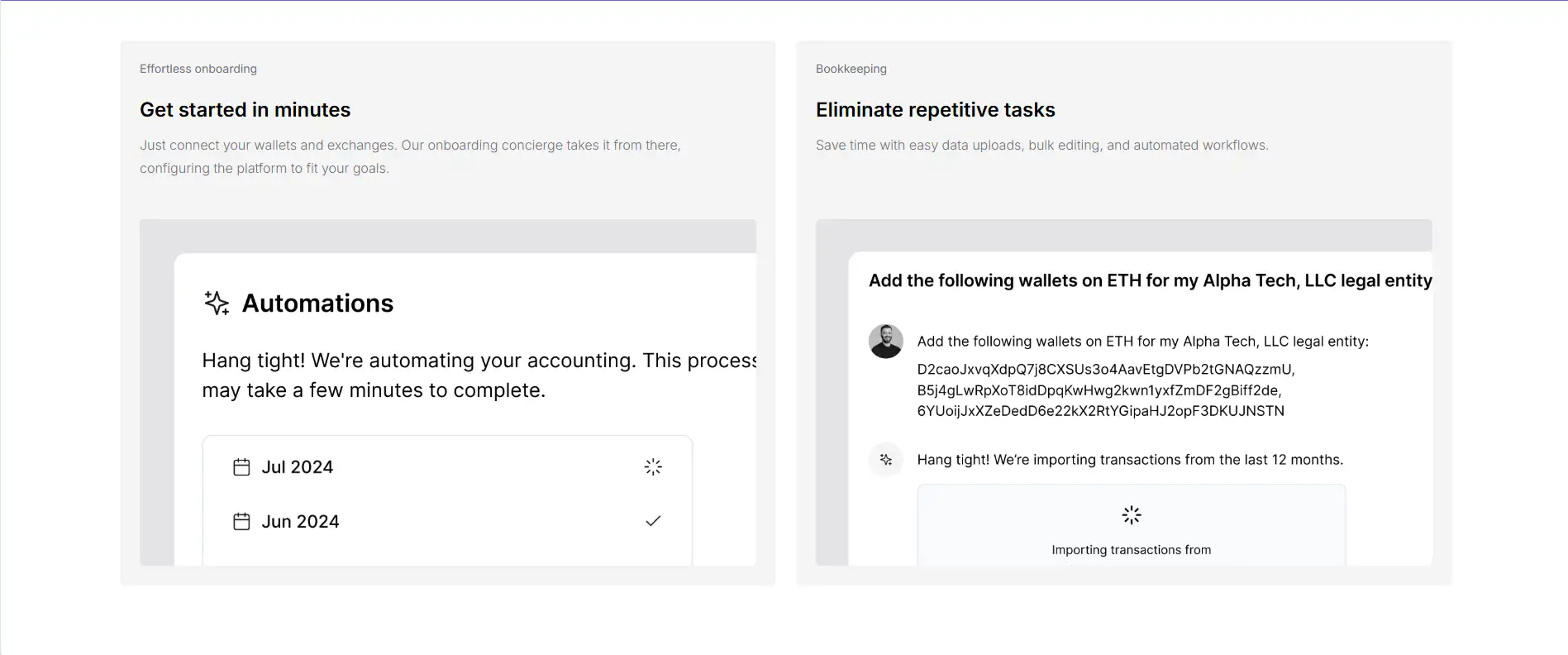

Getting started with Entendre Finance is streamlined and designed for both speed and customization:

- Request a Demo: Visit entendre.finance and click “Request a Demo” to speak with their onboarding team.

- Connect Wallets & Tools: Sync your wallets, exchanges, and accounting tools like QuickBooks or Xero in just a few clicks.

- Custom Setup: Let the AI concierge configure rules, tagging systems, templates, and integrations tailored to your business.

- Choose a Plan: Start with the Launch plan ($500/mo), or contact sales for custom pricing tiers (Growth and Scale) depending on your volume and complexity.

- Explore Use Cases: Whether you're a DeFi protocol, NFT marketplace, or enterprise CFO, Entendre adapts to your specific accounting needs.

Entendre Finance FAQ

Yes—Entendre Finance was built precisely for this purpose. Its intelligent AI accounting agents automate workflows such as journal entry creation, reconciliation, tagging, and audit preparation—reducing reliance on large accounting teams. Entendre Finance allows lean teams to operate with the same efficiency and precision as a full back office, giving crypto-native organizations a significant operational edge.

Entendre Finance offers automated NFT accounting features that continuously pull live market data to update asset valuations and cost basis in real time. Whether tracking individual NFTs or large collections, the system calculates unrealized gains/losses and organizes data into tax-compliant formats. You can view your entire NFT portfolio’s financial impact directly within the unified dashboard at entendre.finance.

Entendre’s AI system is built to handle gaps and discrepancies in blockchain data. If smart contract output is missing or malformed, the platform flags those entries, allowing you to make manual adjustments or apply override rules. With integrations to partners like Maple Finance, backfill options are often available to restore accurate data integrity across your books.

Yes, Entendre Finance was architected to support multi-entity accounting across both fiat and crypto. Users can configure each entity independently and then generate consolidated reports across chains, currencies, and business units. Whether you manage a DAO with multiple treasuries or a multi-country fund, Entendre provides unified visibility in one real-time interface.

Entendre’s AI engine uses configurable templates and posting logic to ensure every entry aligns with GAAP and IFRS standards. Each journal includes audit trails, metadata, and traceable logic that supports compliance. Users can customize account mapping, tagging, and rule-based logic for different asset classes. Every transaction processed through entendre.finance maintains full transparency and audit readiness.

You Might Also Like