About Exa App

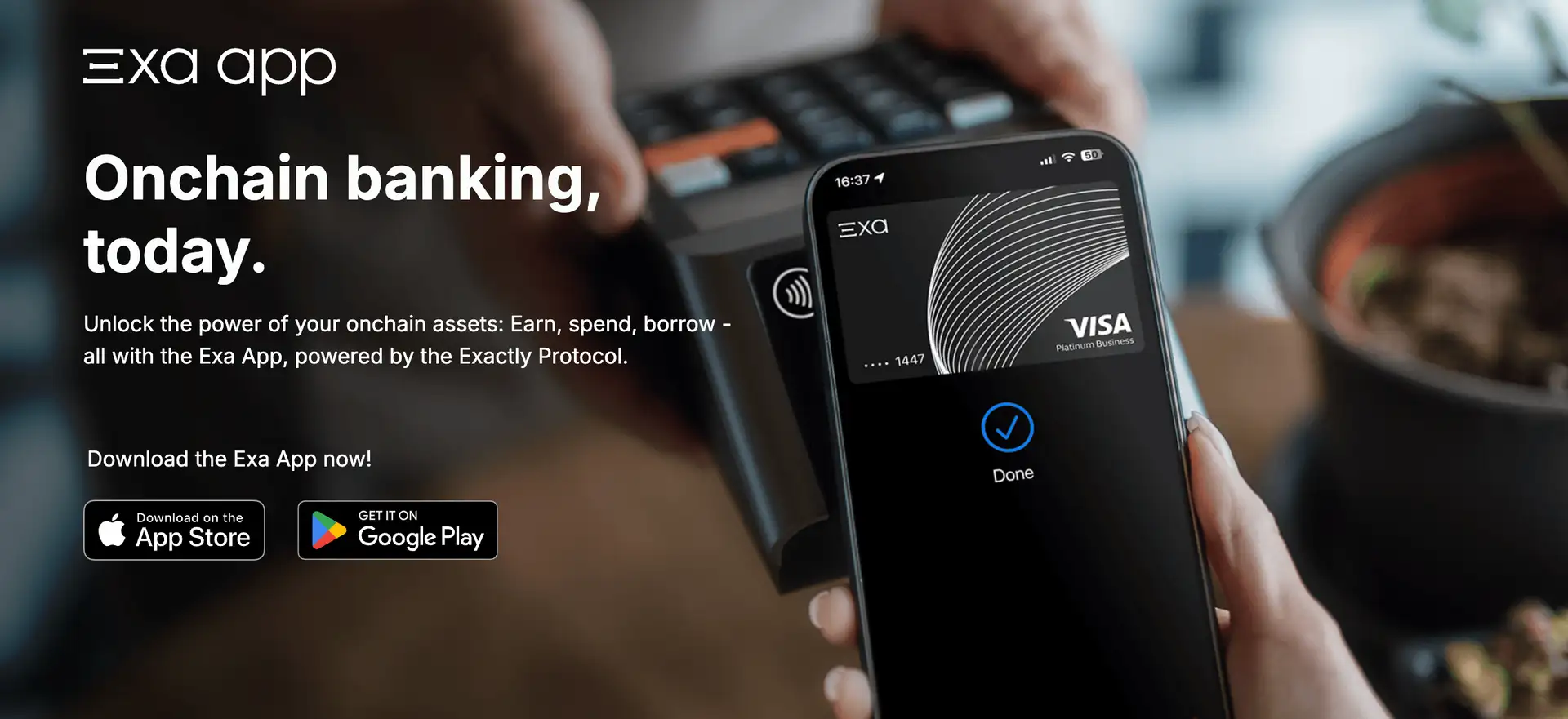

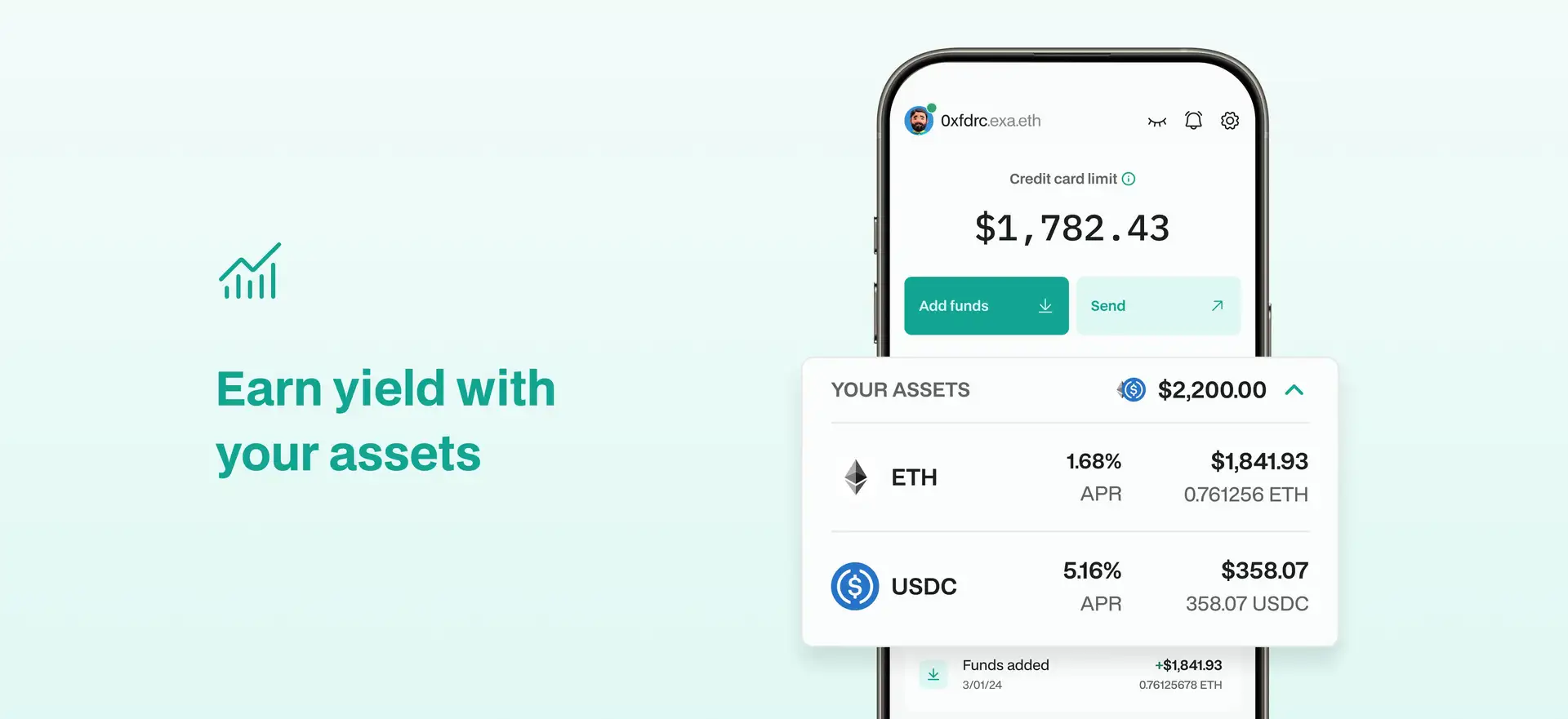

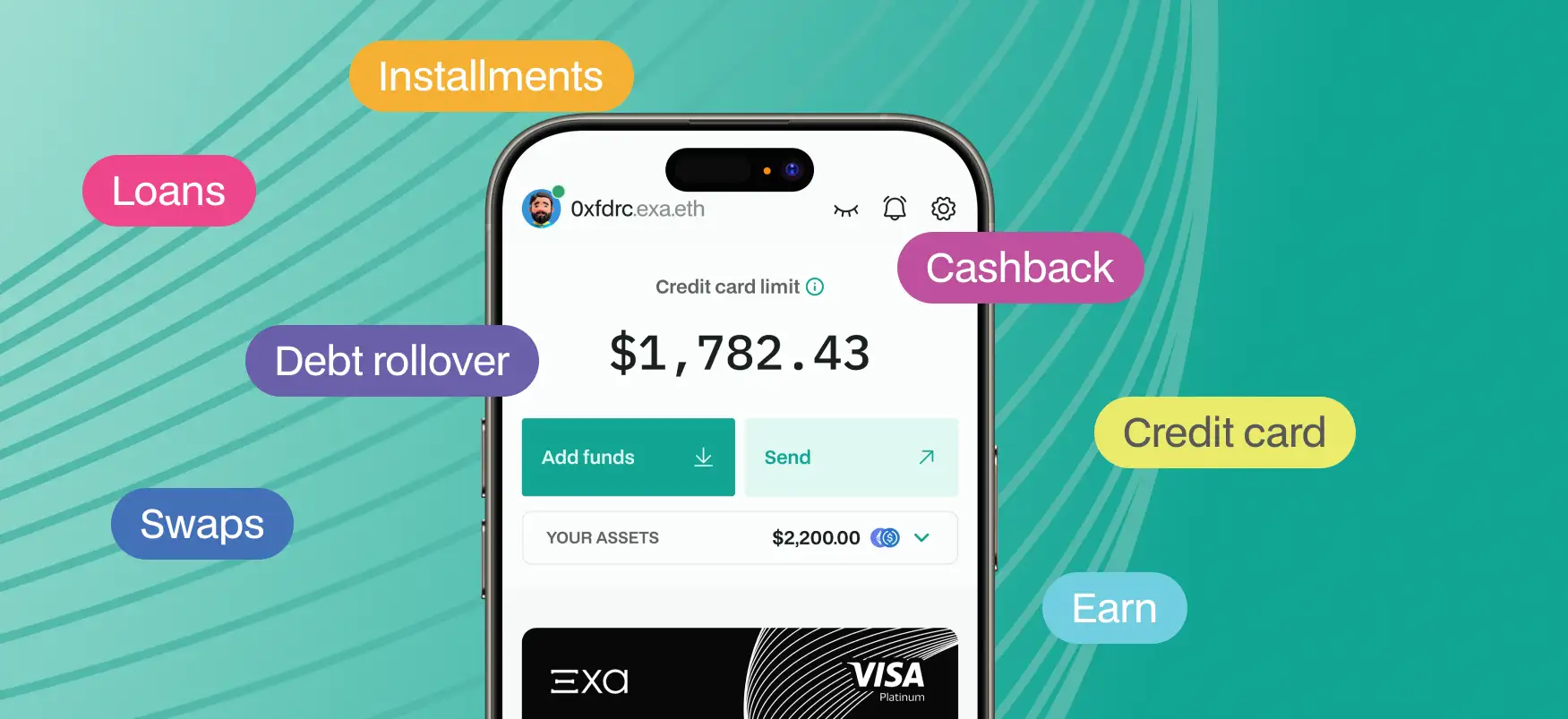

Exa App represents a pioneering leap into the future of onchain banking, empowering users to earn, spend, and borrow against their crypto assets effortlessly. Powered by the Exactly Protocol, Exa App delivers a self-custodial, secure, and decentralized financial experience through an intuitive mobile platform, allowing seamless interaction between crypto and real-world payments.

By using Exa App, users maintain full control over their assets via passkey-secured accounts while gaining access to innovative features like the Exa Card, enabling spending through Apple Pay and Google Pay without relying on traditional banks. Whether depositing to earn yield, splitting payments into six installments, or accessing instant onchain credit, Exa App redefines the DeFi user experience worldwide.

Exa App is purpose-built to seamlessly integrate decentralized finance into everyday life, allowing users to unlock the power of their crypto holdings. Unlike legacy fintech apps, which impose layers of intermediaries and hidden fees, Exa App provides direct access to Exactly Protocol's decentralized credit and yield markets. Every deposit instantly starts earning a variable APR, enhancing the financial efficiency of each user's assets while preserving full ownership.

The standout feature of Exa App is the Exa Card — the world's first onchain credit card. By depositing assets like USDC, ETH, or WBTC, users receive a spending line secured by their crypto, with the flexibility to pay purchases over time using the app’s Split Pay option. Unlike competitors such as Crypto.com Visa Card or Nexo Card, Exa App requires no credit score checks, charges zero issuance or maintenance fees, and keeps all transactions private and secure.

Moreover, Exa App enables real-time, frictionless conversion between crypto and local currencies, making it one of the few mobile apps combining full self-custody, global usability, and DeFi-based credit systems. Compared to apps like Revolut or Monzo, which rely on centralized banking rails, Exa App stands apart by putting users in full control of their funds at every step.

Exa App offers a powerful suite of benefits and features designed for the next generation of finance:

- Onchain Credit Line: Unlock spending power against your crypto without selling your assets.

- Virtual Card Integration: Instantly add your Exa Card to Apple Pay and Google Pay for worldwide payments.

- Split Pay Installments: Spread purchases over up to 6 fixed installments in USDC, directly through Exactly Protocol.

- Self-Custodial Security: Your assets are fully protected using device-based passkeys without centralized custodians.

- Earn Variable APR: Deposited assets automatically generate sustainable, real onchain yield.

- Fee-Free Spending: No card issuance fees, no transaction costs, and no hidden maintenance charges.

- Global Accessibility: Available in 160+ countries with no geographic restrictions.

Getting started with Exa App is simple and fast:

- Download the App: Install the Exa App from the App Store or Google Play.

- Create Your Account: Set up a self-custodial account using passkeys secured by your device's biometric systems.

- Enable Your Exa Card: Complete a quick KYC verification to activate your Exa Card instantly.

- Top Up Your Wallet: Deposit supported crypto assets to start earning APR and set your spending limit.

- Add to Mobile Wallet: Link your Exa Card to Apple Pay or Google Pay for contactless payments.

- Start Spending: Use your crypto globally for in-store or online purchases with seamless, secure transactions.

Exa App Reviews by Real Users

Exa App FAQ

The Exa Card allows users to make real-world purchases by using their deposited crypto assets as collateral instead of selling them. When a payment is made, Exactly Protocol borrows the required amount in USDC on behalf of the user at a fixed interest rate, preserving the user’s underlying crypto. This structure enables seamless transactions while keeping the assets earning yield within Exa App.

Exa App replaces traditional password and seed phrase authentication with device-stored biometric passkeys. These passkeys are linked to your fingerprint or facial recognition, never leave your device, and cannot be exposed online. Thanks to the integration with WebAuthn standards and Exactly Protocol's plugin, this method provides superior security and privacy compared to conventional Web3 wallets. Learn more at Exactly App.

Yes, your deposited crypto assets within the Exa App continuously generate variable yield through the Exactly Protocol’s lending markets, even while they are used as collateral for the Exa Card. Funds remain productive, earning APR until the exact moment they are used for a purchase, maximizing your financial efficiency. Discover more at Exactly App.

Split Pay in Exa App enables users to divide purchases into up to six fixed, low-interest installments directly through Exactly Protocol’s onchain credit system. Unlike typical BNPL services that depend on credit checks and centralized providers, Split Pay is powered by your deposited crypto and fixed lending pools, offering transparent rates and preserving your ownership. More info at Exactly App.

No, users maintain full ownership of their assets at all times in Exa App. Funds are stored in a self-custodial account protected by device-based passkeys, and payments are facilitated via onchain credit without transferring asset custody to third parties. Security and control remain in the user’s hands from deposit to payment. Find details at Exactly App.

You Might Also Like